What Is KYB Verification?

Know Your Business (KYB) is the process where the legitimacy of a firm is confirmed during onboarding. The company’s registration details, ownership structure, and risk profile is taken into account during KYB. KYB uncovers Ultimate Beneficial Owners (UBOs) of firms. It also helps prevent shell companies from registering, and finally, detect companies that are related to sanctions breaches and money laundering schemes. In this blog post, we’ll be giving details about KYB verification and how your company might benefit from using the process.

Why Is KYB Verification Important for Businesses?

Your business needs KYB verification since it allows you to be in compliance with anti money laundering (AML) regulations. The process will help you align your company with FATF recommendations and the Sixth Anti-Money Laundering Directive (6AMLD) of the EU. More than that, the process will ensure that you’re blocking fraudulent and sanctioned companies from collaborating with your firm. Since you’re verifying companies beforehand, the act promotes transparency and trust.

What Information Is Collected During KYB Checks?

Since your company needs to verify collaborators, there are some information you need to demand and collect during KYC checks. One of the first things you should ask for is the business registration certificate. Afterwards, you need documents that verify the UBO of the said company. Some regulators also demand that you acquire the tax identification number and registered company address with articles of incorporation. These all help outline the firm’s structure. Our KYB module provides a comprehensive company detail page for verifying businesses and their key stakeholders. KYB checks also need results of sanctions, politically exposed persons (PEP), and adverse media screenings. Having safe results will make sure you’re not doing business with firms who are suspicious.

Why KYB Verification Should Be a Priority

Your company should be placing KYB verification at the top of your to-do list. KYB checks reduce the risk of money laundering and terrorist financing. Your company will be safer thanks to KYB checks. These checks are there to help you stay compliant with international regulations and you can avoid fines and criminal charges. Your company will be able to avoid reputational damage since you’re not involved with suspicious firms. In 2024, Sweden’s financial supervisory authority, Finansinspektionen, issued Klarna a fine of $44.8 million for violating AML regulations. The investigation revealed significant deficiencies in Klarna’s compliance with key AML requirements, especially in regards to its customer due diligence procedures. This shows the importance of KYB verification in avoiding fines and more serious penalties.

How Does the KYB Verification Process Work?

There are several steps to the KYB verification. The first action you need to take is identifying the business. You will need to have registry data and official documents to make sure the company is legitimate. Afterwards, you’re ready to figure out the UBO. The ownership structure needs to be mapped out since knowing the owner is crucial to ensure there is no illegal activity going on. Next comes risk screening against sanctions lists, PEP databases, and adverse media sources. Ongoing monitoring is the final step of the verification to make sure things are smooth sailing and there isn’t any negative changes about your customer.

What Is the Difference Between KYB and KYC?

Know Your Customer (KYC) is the individual level version of the KYB checks. That’s not all, there are more differences to these processes. KYB is dealing with companies and verifying them by collecting their registry and licensing documents and figuring out who their UBO is. KYC does the same verification but it demands details like ID, proof of address, and other identity documents if needed. KYB is an important step in vendor due diligence, and the same can be said about KYC and customer onboarding.

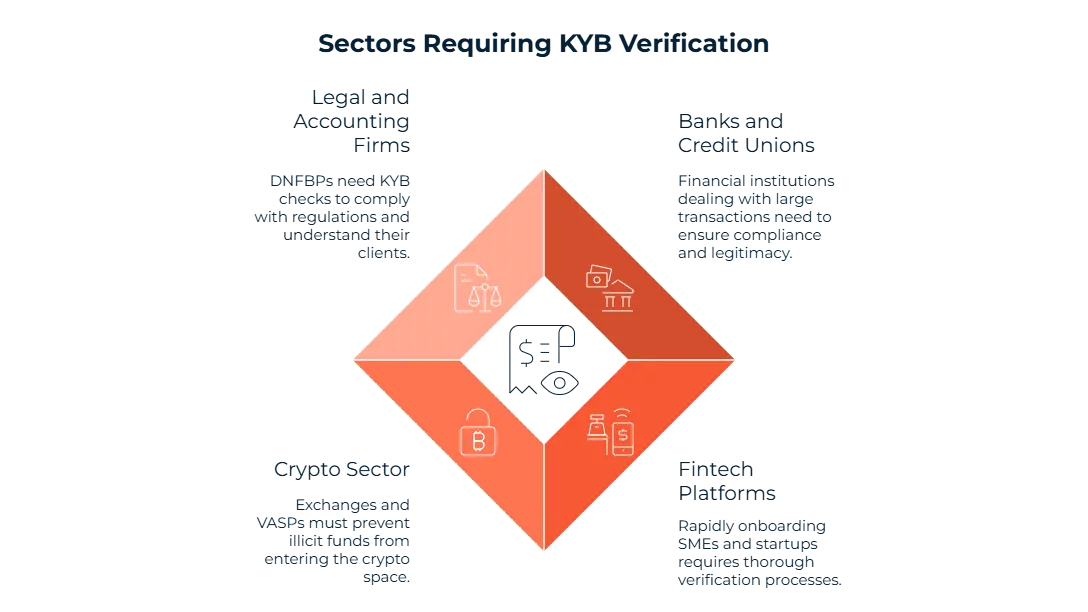

Who Needs to Perform KYB Verification?

We’ll now talk about our recommendations for sectors who need to use KYB the most. The first sector is banks and credit unions. Since they’re dealing with large sums of money, the companies they work with need to be compliant and actually real. This is also true for fintech platforms, where SMEs and startups are being onboarded each year in an increasing manner. The crypto sector is not exempt from this verification. Exchanges and Virtual Asset Service Providers (VASPs) are obligated to conduct these checks to not allow illicit funds from companies enter into the newer sector. Legal and accounting firms, and more included in Designated Non-Financial Businesses and Professions (DNFBPs), should also know that KYB checks will help them adhere to regulations. These firms help set up new companies and heavily deal with large transactions. Knowing who they’re up against will help these companies.

What Are the Common Challenges in KYB Verification?

KYB verification may have its own difficulties. One example we can give is the incomplete UBO data you may face. Companies sometimes hide their true owners knowingly or unknowingly, and this can prolong your verification process. Manual document collection is another burden your company may face. Getting physical documents from the collaborator and verifying them later slows down the onboarding process. Since you’ll be supporting KYB checks with ongoing monitoring, the difficulties pop up here, also. Frequent changes in ownership structures will make it harder for you to keep track and records of what’s occurring. Jurisdictional inconsistency when it comes to customers from different areas is another real challenge. Your company should be aware of different compliance rules regarding that specific jurisdiction, but if the said jurisdiction offers little for transparency regulations, your work will be a bit more tedious. Our customer from Tom Bank, Arda Akay (Chief Compliance Officer) has said that our tool helped their company create a fast, easy, and secure onboarding process.

How Can KYB Software Help?

Investing in a KYB software can help ease your company’s manual work. Since automated registry lookups can be done using KYB softwares, you won’t be wasting time looking for proof by yourself. Sanctions and PEP screenings will also help you ensure who you’re about to work with is safe and not involved in suspicious activities. Risk scoring tools use these data to divide companies that are your customers into risk levels. This will help you focus more on and watch closely higher-risk customers. Real-time monitoring will also help you keep watch on customers to make sure all of their details are updated accordingly after changes are made. Our Sanction Scanner tool is updated every 15 minutes to make sure you miss nothing. It is said that manual onboarding takes around 6 to 14 days. Our KYB software will help you reduce the onboarding process to mere minutes.

Is KYB Compliance Required by Law?

KYB compliance is legally required in many regions since it helps strenghten AML and counter-terrorism financing (CTF) compliance. Internationally, the Financial Action Task Force (FATF) recommendations is taking the biggest part setting compliance standards. The 6AMLD in Europe is mandating KYB for businesses. When it comes to the U.S., the Bank Secrecy Act and the FinCEN Customer Due Diligence (CDD) Rule is setting obligations for firms to follow. In Singapore, MAS guidelines are the most important for companies looking to reach compliance. Our Sanction Scanner tool supports compliance teams in over 70 countries.

FAQ's Blog Post

KYB verification is the process of checking a business’s identity, ownership, and registration details for compliance.

Companies need KYB to prevent fraud, uncover shell firms, and meet AML regulations.

KYB checks require company registration data, beneficial owners, directors, and financial records.

Banks, fintechs, crypto firms, and payment providers must perform KYB on business clients.

KYB supports AML compliance by revealing ultimate beneficial owners and screening businesses against sanction lists.

Sanction Scanner provides automated KYB checks with real-time company data, UBO discovery, and compliance reporting.