In this blog post, we’ll be talking more about and explaining the details of AML software. Anti money laundering (AML) software is what companies use when they in search of a solution for ensuring they reach AML compliance. This software will detect and report suspicious financial activities that are maybe related to money laundering, terrorist financing or other financial crimes of the similar nature.

Why Is AML Software Important in 2025?

Since AML compliance is what companies should always aspire to reach, AML softwares will always be important. In 2025, since there are more creative ways of money laundering, the FATF and FinCEN regulations have become stricter to fights against these techniques that are used by fraudsters. Another reason is because of digital transactions; with the rise of digital banking, there are more areas to check and regulate. This in turn means that digital transactions give fraudsters more area to launder money. Because of this, AML software is needed.

There are high penalties for those who are not acting accordingly with AML regulations. For this reason, making sure you are reaching AML compliance with AML software is important. Finally, your company may be operating in riskier markets that are on the rise in 2025; some examples are virtual asset and decentralised finance (DeFi) markets. Since these are on the newer side, compliance is more important than ever. AML software is good for adapting to these new sectors and risks they bring along with.

A top Wall Street regulator told Bank of America to fix its programme that should prevent criminals from laundering money through; this occurred since the regulator found deficiencies and “systemic failure” in how BoA handles transactions that appear suspicious. This shows that even the most popular entities can get hit from failing to comply with AML compliance.

.webp)

What Are the Features of AML Software?

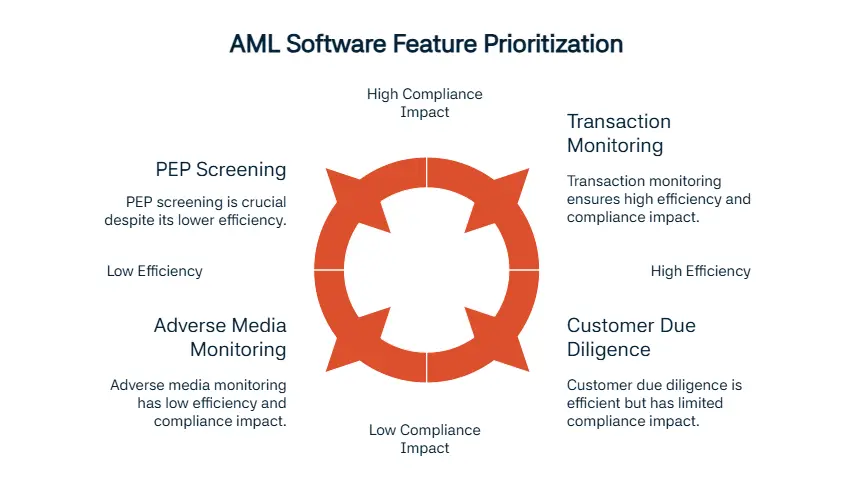

Let’s talk more about AML software features to further enlighten our readers. The first feature is customer due diligence (CDD). AML software helps you in the process of reaching CDD compliance by verifying customer identity, address, and ultimate beneficial ownership (UBO) to ensure that the entity you’re about to enter a partnership in legitimate.

Another feature is transaction monitoring; AML software has ongoing monitoring to help analyse transactions. While doing so, it can identify odd transactions that might be laundering money. One other item is sanctions screening; the software helps by checking customers and transactions, it uses global sanctions lists like OFAC, UN, and EU lists and completing this process using a software ensures speed and efficiency.

The next feature we’ll talk about is PEP screening. You need to be careful when working with politically exposed persons (PEPs) so this software helps you flag and pay more attention to these customers. Another feature is adverse media. The AML software monitors negative news and presents these to your company for you to act accordingly.

One other example is risk scoring. The software uses a risk based approach (RBA) to help you categorise your customers according to their risk levels. It then helps you pay more attention to higher risk customers, ensuring AML compliance. Finally, case management is offered by the software to help you track and report suspicious cases to the authorities.

Types of AML Solutions

There are several types of AML solutions and we’ll explain them to our readers now. The first type is on-premise, meaning this software is on your company’s own servers. This type helps you reach internal control and more protected data. Another type is cloud-based solutions. These AML solutions are on the cloud as the name suggests, providing scalable and faster deployment for those who are looking for a solution that is ready for your growing company reach efficiency.

One other type is modular, meaning you can pick and choose what feature you desire to implement. Modular type helps you customise your own AML software solution. Finally, our last type is end-to-end. This type gives you the whole package, full protection from CDD to SARs. This type is for those who are looking for full compliance coverage.

How AML Tool Works?

In this part, we’ll walk you through the process of a AML tool working. The first feature is data integration. The tool tasked with collecting and keeping customer data, past transaction information, and other information like sanctions and PEP databases which help with RBA. Another feature is real time screening that ensures transactions and profiles of customers are in an ongoing screening process. One other feature is behavioural analysis; this is done by using algorithms and machine learning to analyse past transactions and figure out any irregularities or odd activities.

Another feature we’ll talk about is alert generation. Since the tool is continuously monitoring transactions and checking for suspicious activity, the system also has a feature that helps with creating alerts to compliance teams when something odd actually occurs. The final feature is case management and reporting. These alerts are in a centralised system that helps track investigations, records and creates reports like SARs when needed.

.webp)

Key Benefits of AML Software

There are many benefits to using AML software to automate activities that help ensure AML compliance. The first benefit, like we mentioned before, is that the software helps you with reaching regulatory compliance. This is crucial for your company and we advise our readers to act accordingly. Another benefit is that rather than using a traditional way with a huge team, the software helps you reach compliance in a more cost efficient way. The costs of using manual labor for AML compliance is rising every year worldwide. Bringing your company’s cost down is what the software does.

One other benefit is that the software is really quick during the customer onboarding process with its checks. This creates a safe and comfortable environment for both your company and your potential customer. Another benefit we’ll mention is risk based monitoring that is enables thanks to AML software. This approach will help you operate in a more efficient way since it divides your customers according to their risk levels.

Another feature is that the software simplifies audits and it does this in a way that doesn’t compromise with ensuring your company’s compliance. Finally, the software offers transparency and efficiency, helping you feel more at ease during your operations. FinCEN announced a resolution with BGS USA after their failure to meet AML compliance requirements; the result was a $37 million civil monetary penalty and a total payment of $42 million over three years. Making sure that you use the benefits of AML software will prevent you from facing similar fines.

Which Industries Need AML Software?

Several industries are in need of AML software since it helps reach compliance. The first industry is banks and fintechs. Since these companies deal with a high volume of transactions, there is a likelihood of money laundering occurring more. These firms are also in a sector that is heavily regulated, highlighting the need of AML software once again. Another category is crypto firms. These firms are newer and therefore of higher risk currently. Since this is a volatile sector, an AML software will benefit them greatly. Insurance firms are also another sector that requires AML software. These firms are in need of risk based policy management to help them during their operations and an AML software can complete this task easily.

One other industry is real estate. Since this industry involved large transactions and it is constantly cash heavy, it is in need of AML software to help regulate these transactions more easily. Another sector is money service businesses (MSBs). These firms are dealing with transactions and currency exchanges, so it would be a mistake to not implement AML software solutions in their company. One other sector is investment platforms. These platforms are digitally-led and are heavily regulated. An AML software will help you during this process since you need to be serious about regulations if you are in the investment sector.

Finally, online gambling platforms are in need of AML software since they are really prone to fraud because of their online nature. Since lots of financial crimes occur in this sector, it is especially important to reach compliance.

Which Regulators Require AML Compliance?

There are several regulators around the world updating their regulations according to the ever-changing nature of transactions and financial activities. FATF is a regulator that operates globally. In the US, FinCEN is the first and most important regulatory body you should think about when speaking of compliance. In the UK, FCA deals with reaching AML compliance and more. Singapore is using MAS to figure our their regulations and compliance needs. In Australia, AUSTRAC is the regulatory body that deals with implementing regulations and regulating companies to make sure they reach comliance. Finally, EU AML Directives are for those who are operating in the EU.

How to Choose the Best AML Software?

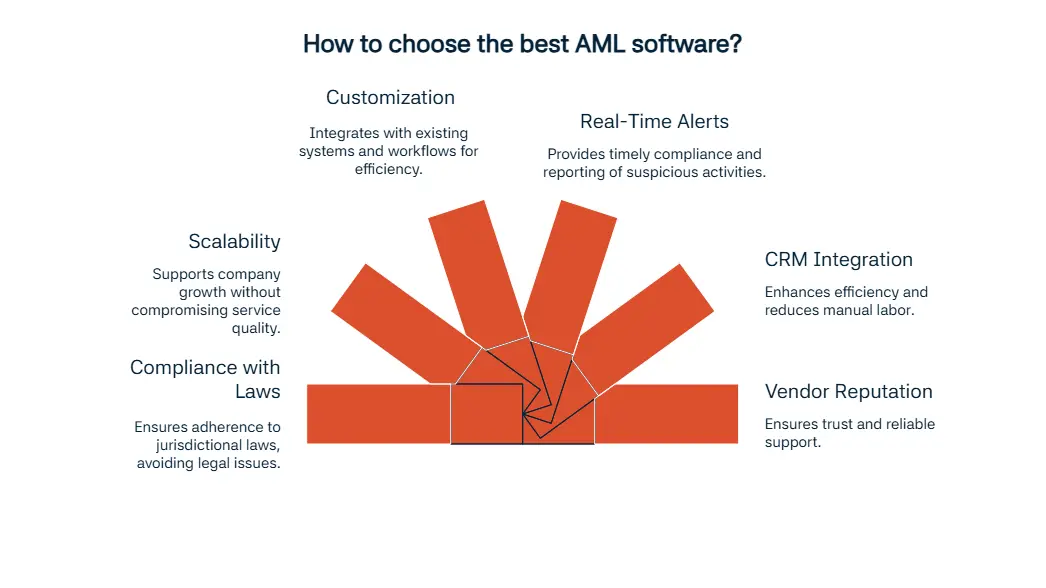

There are options to choose from when thinking of AML softwares. First thing to look out for is making sure that the AML software you’re looking to use meets your jurisdiction’s laws. Since different jurisdictions use different laws, this is important. Another thing to figure out is knowing that this software ensures scalability. In the case of your company growing, the AML software should be able to provide the same quality of service accordingly regardless of size. One other thing that you should want in your AML software is its ability to be customisable to your workflows. Making sure that the AML software is capable to integrating to your already existing systems is crucial.

Another thing our readers should pay more attention to is the AML software offering real time alerts. These alerts make sure you are in AML compliance and reporting odd activities whatever the case may be. One other thing to look out for is integration with CRM and core banking. This helps your company become more efficient and reduces manual labor. Finally, choosing an AML software where its vendor - provider is reputable and well-supported is the most important part. You should be able to trust the company you’re working with.

We at Sanction Scanner provide you with all that is mentioned and more while making sure you are reaching compliance without struggling. Let's request a demo now to see how we can contribute to your anti money laundering requirements.

FAQ's Blog Post

AML software reduces compliance costs, prevents money laundering, and protects reputation, and we suggest seeing it as a long-term investment.

AML software ensures adherence to FATF, EU, and local AML directives, and we recommend choosing tools that adapt quickly to new regulations.

AML software includes name screening, transaction monitoring, risk scoring, and reporting, and we advise selecting solutions with automated alerts.

Banks, fintechs, crypto firms, and payment providers should use AML software, and we suggest every regulated industry integrate it into operations.

AML software screens customer data, monitors transactions, and flags suspicious behavior, and we recommend real-time monitoring for maximum protection.

Companies need AML software to comply with laws, reduce risks, and avoid penalties, and we suggest adopting it early for stronger compliance.

Anti-Money Laundering software is a compliance tool that detects, prevents, and reports suspicious activities, and we recommend using it to align with global AML standards.