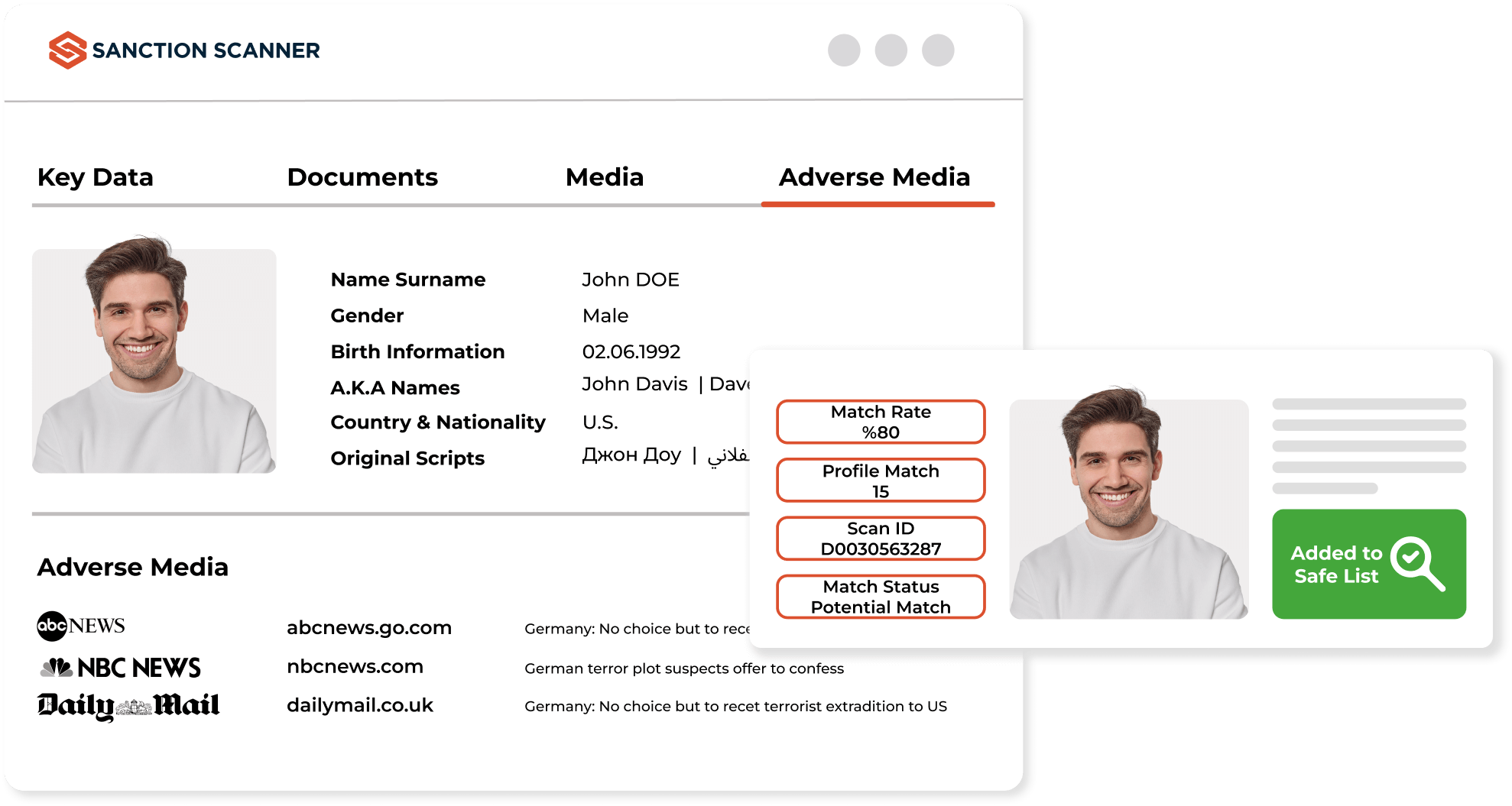

Adverse Media

Screening & Monitoring

Strengthen AML Compliance With Global Comprehensive Adverse Media Data

Navigating the media maze with 800+ companies, uncovering risks before they unfold.

Adverse Media Screening in Customer Onboarding

You can perform Adverse Media controls via API, batch files, or the web using our Adverse Media softwares.

Detect and Avoid Risks

Using Adverse Media Screening and Monitoring, you can identify and protect yourself from financial crimes such as money laundering, terrorist financing, corruption, bribery, fraud, human trafficking, smuggling, or tax evasion.

Features

Full Data Coverage

Masked Query

Up-To-Date Data

Batch Screening

Reliable Data Sources

Translate do Scan Results

Multiple Search Options

You can perform Adverse Media checks using our Adverse Media software via API, batch files, or the web.

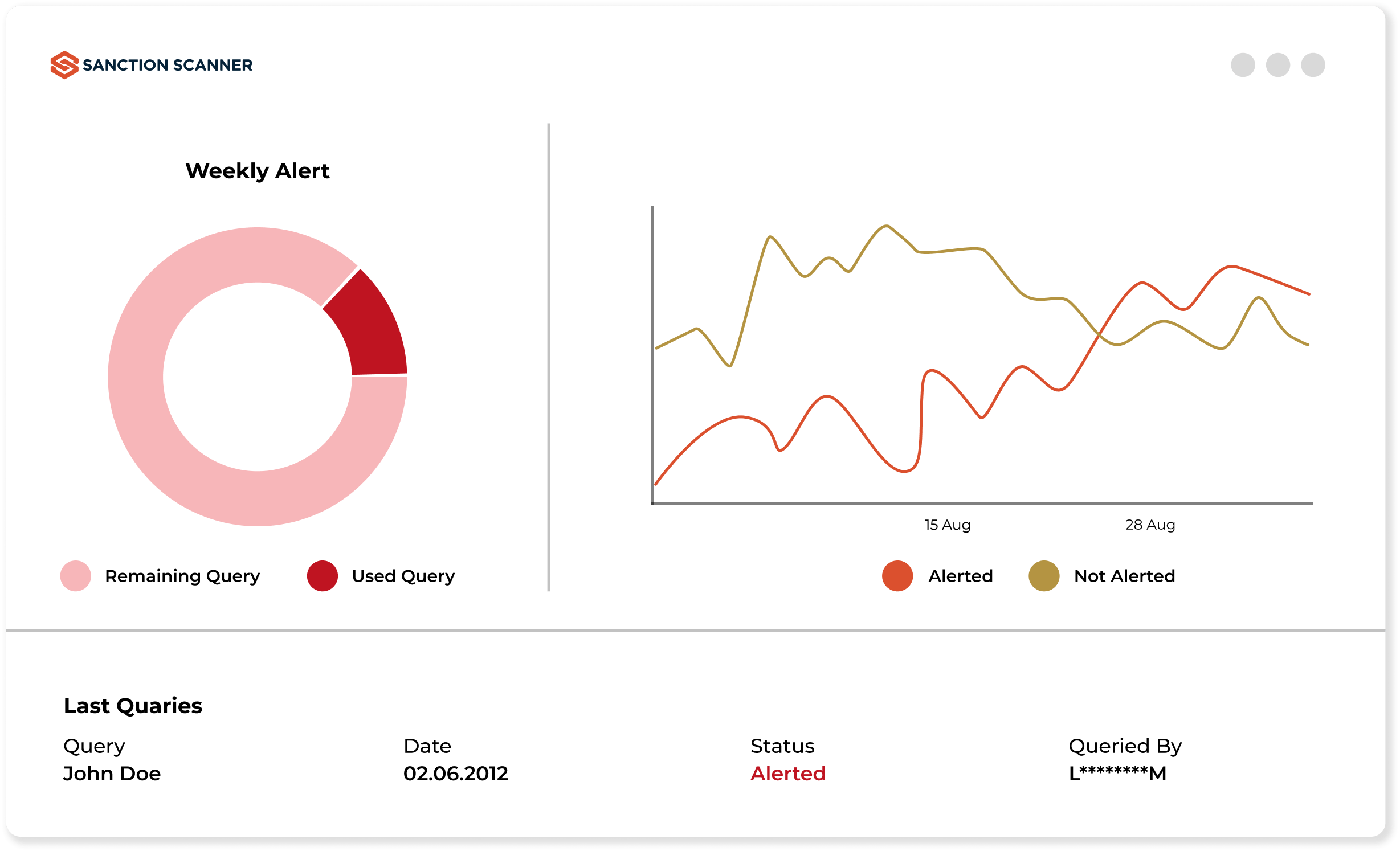

Automate the Control Process

You can check the global Sanctions, PEPs, and Adverse Media data by the risk levels of your customers while performing your Automated Daily Ongoing Monitoring process to reduce your workload.

“Sanction Scanner's software is easy to use, and we enjoy working with it. Since implementing its solution, we have significantly reduced false positives. The time and effort we previously spent on false positive alarms can now be directed towards other aspects of the business, which contributes to its growth.”

Guy Shaked

Legal Counsel at ironSource

“What I like best about Sanction Scanner is its real-time screening capability and automated alerts. It helps us detect potential matches instantly and take immediate action, which is critical for our AML compliance.”

Tolgahan Kapanci

Head of Compliance at PeP

“With Sanction Scanner, we offer a fast, easy, and secure customer onboarding process. Thanks to its enhanced scanning tool, we focus on real risks, not false positives. Thus, we can meet our AML obligations and our customers' expectations.”

Arda Akay

Chief Compliance Officer at Tom Bank

“Sanction Scanner provided us the most comprehensive database to screen our clients. It includes lists from all over the world and is always up-to-date.”

Gulnihal Akartepe

Global Vice President at TPAY

“With Sanction Scanner, we reduce the risks of money laundering and terrorist financing by controlling on local and international lists also to avoid risks during our onboarding process.”

Oğuzhan Akın

Experienced Banking & Expansion Manager (MEA) at WİSE

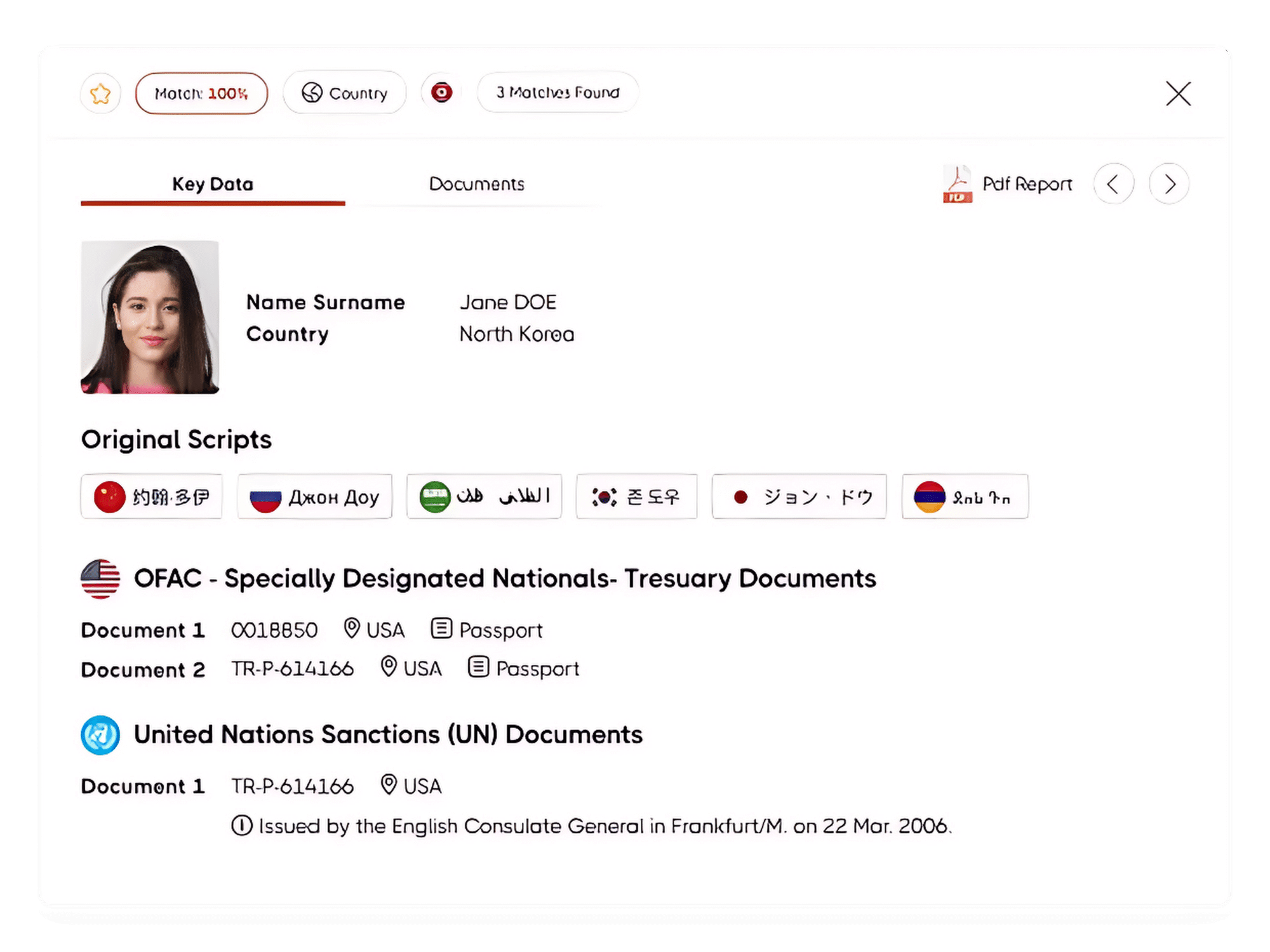

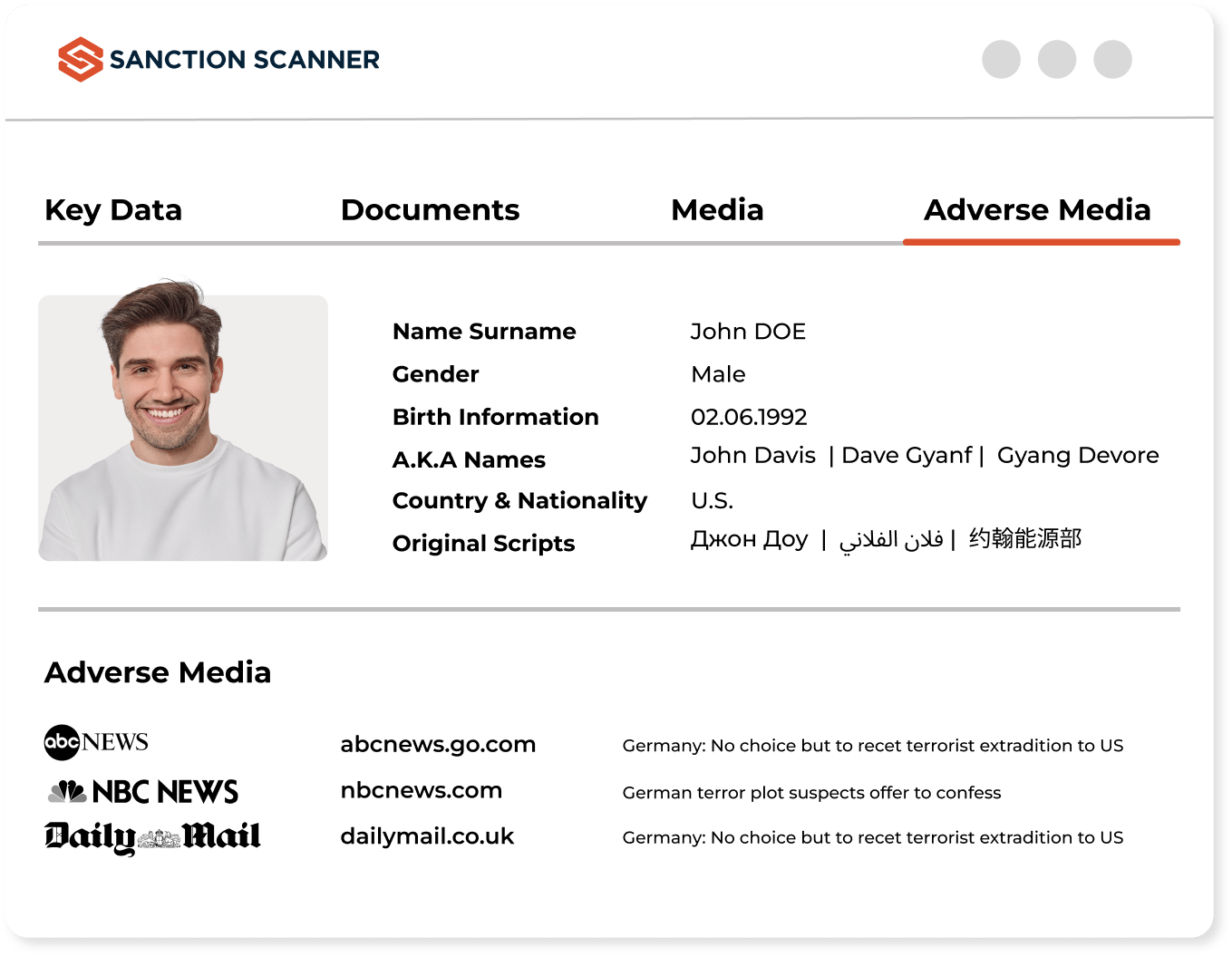

Adverse Media Screening & Monitoring

Adverse media screening is monitoring worldwide news, blogs and reports to discover negative information on a person or organization that may be linked to financial crime.

Sanction Scanner does this automatically by monitoring thousands of worldwide sources in real-time to help business stay on its toes against hidden risks.

Adverse media screening helps banks meet FATF, FinCEN and EU AML laws by alerting on reputational and criminal risk at the early stage.

Sanction Scanner is a reputational risk radar that helps compliance teams detect and report problems before they result in regulatory problems.

It continuously tracks global sources such as news sites, blogs, and public databases for identifying negative coverage regarding specific entities or individuals.

Sanction Scanner works on an artificial intelligence engine that checks more than 400 reliable sources and provides real-time risk profiles with automated notifications.

PEP and sanctions screening screen lists in a systematic way, while adverse media screening identifies true content that reveals exposures before they are on any official list.

Sanction Scanner encompasses all three modules to give an end-to-end view of risk and allow businesses to detect possible threats earlier.

Adverse media detects possible associations with fraud, corruption, money laundering, terror and other crimes against reputation.

Sanction Scanner categorizes every alert by risk level and severity, so teams only work on the most urgent cases.

Yes. Ongoing Monitoring will automatically notify your team when new negative news emerges about an individual or business.

The Ongoing Monitoring feature of Sanction Scanner provides real-time alerts and minimizes the requirement for manual checks.

Checks should be performed when customers are being onboarded and then on a recurring basis to determine new risks.

Sanction Scanner allows you to automatically re-screen so your information is always up to date and compliant.

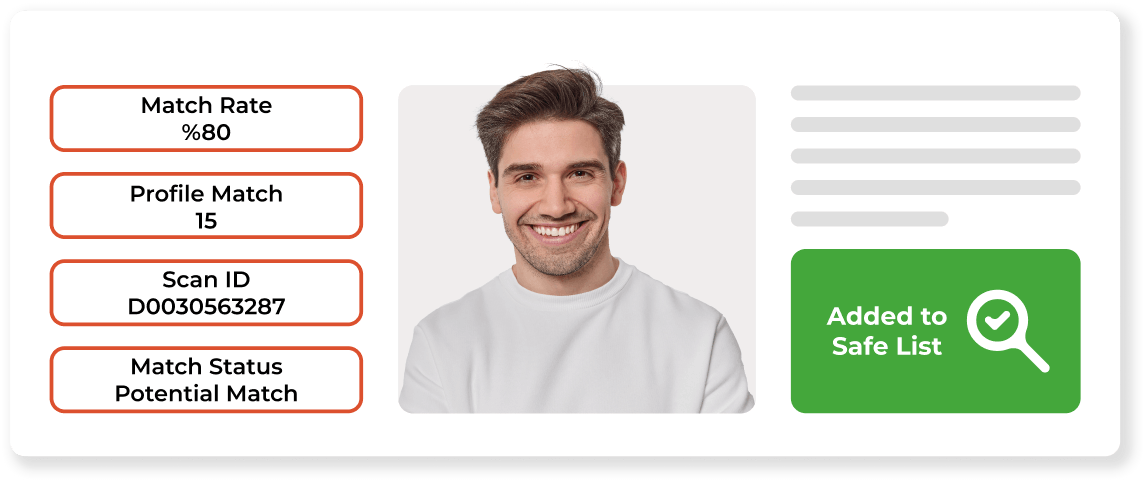

False positives occur when the incorrect unrelated names are matched. AI filters use sophisticated identifiers such as date of birth, nationality and document numbers to make it more accurate.

Sanction Scanner reduces false positives by more than 96.99% through context-aware name matching and multi-layered identity verification.

Banks, fintech companies, crypto exchanges and insurers use adverse media screening to find high-risk individuals and entities.

More than a decade of industries use Sanction Scanner to reveal hidden risks, build customer trust and implement strong compliance programs.

Sanction Scanner's single-platform AML platform includes adverse media screening in conjunction with sanctions, watchlist and PEP screening.

Each module communicates with the others inside a single system to provide complete automation and global coverage.

Integration allows compliance departments to start using adverse media screening without changing their existing processes.

Sanction Scanner's API-first approach can connect seamlessly with CRM, core banking and case management systems for seamless automation.