AML Solutions for Lending

Advanced Anti-Money Laundering Solutions for the Lending Industry.

TRUSTED BY OVER 800+ CLIENTS

We make it easy for our customers to comply with AML Regulations.

AML Challenges in Lending Industry

Credit Unions, Lenders, Digital Lenders, Invoice Finance Firms, and Lending Firms face challenges in customer onboarding processes, customer transactions, and monitoring ongoing customer behavior. To overcome these challenges, meet Sanction Scanner AI-Driven AML/CFT software.

Growing Risks in the Lending Industry

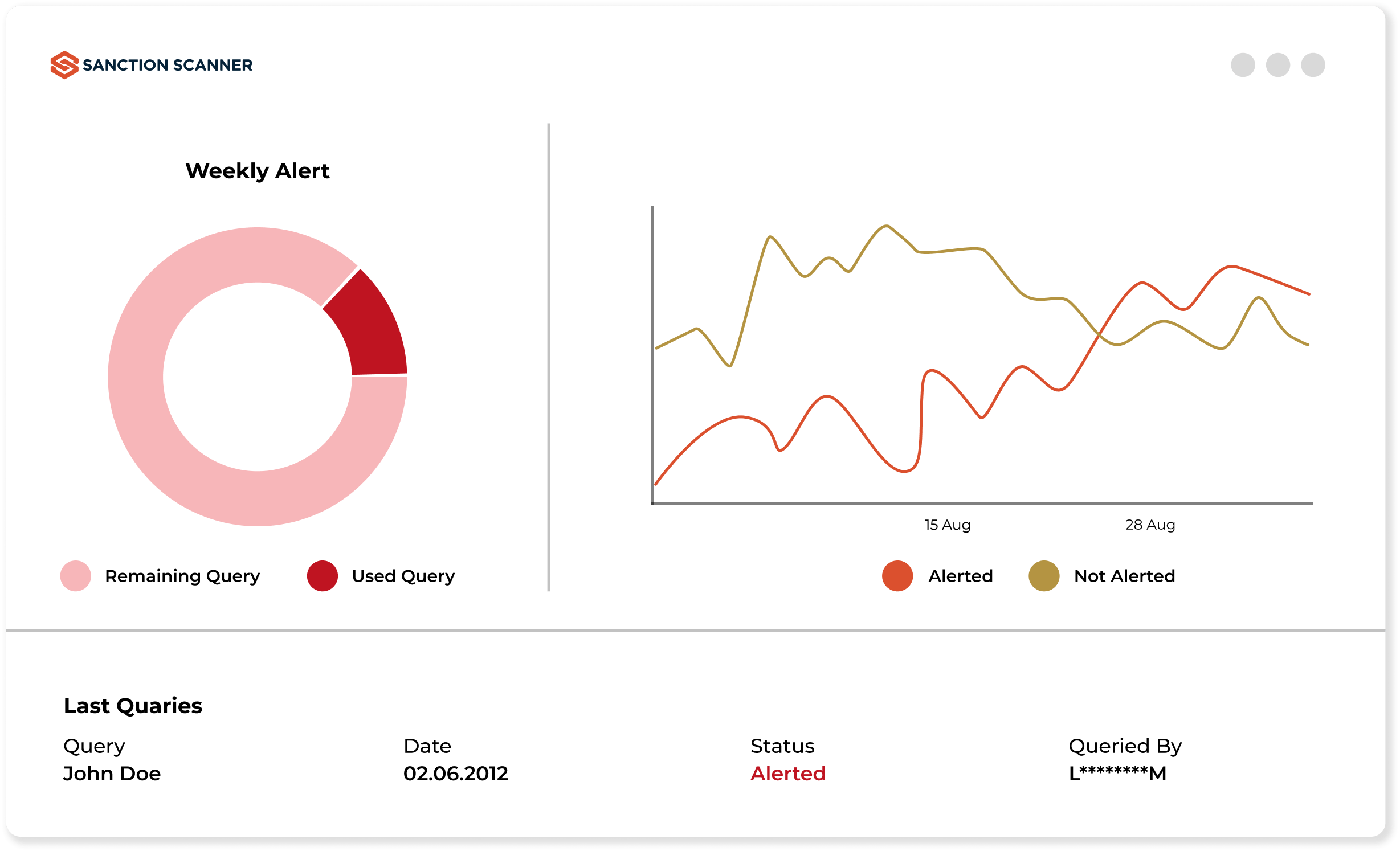

Numbers of customer increase rapidly as the world becomes more digital. This situation creates a risk for the firms as lending companies have to check actions of each customer of their. Meet Sanction Scanner AI-Driven AML/CFT Software to meet AML and Counter-Terrorism Finance compliance to minimize the risk.

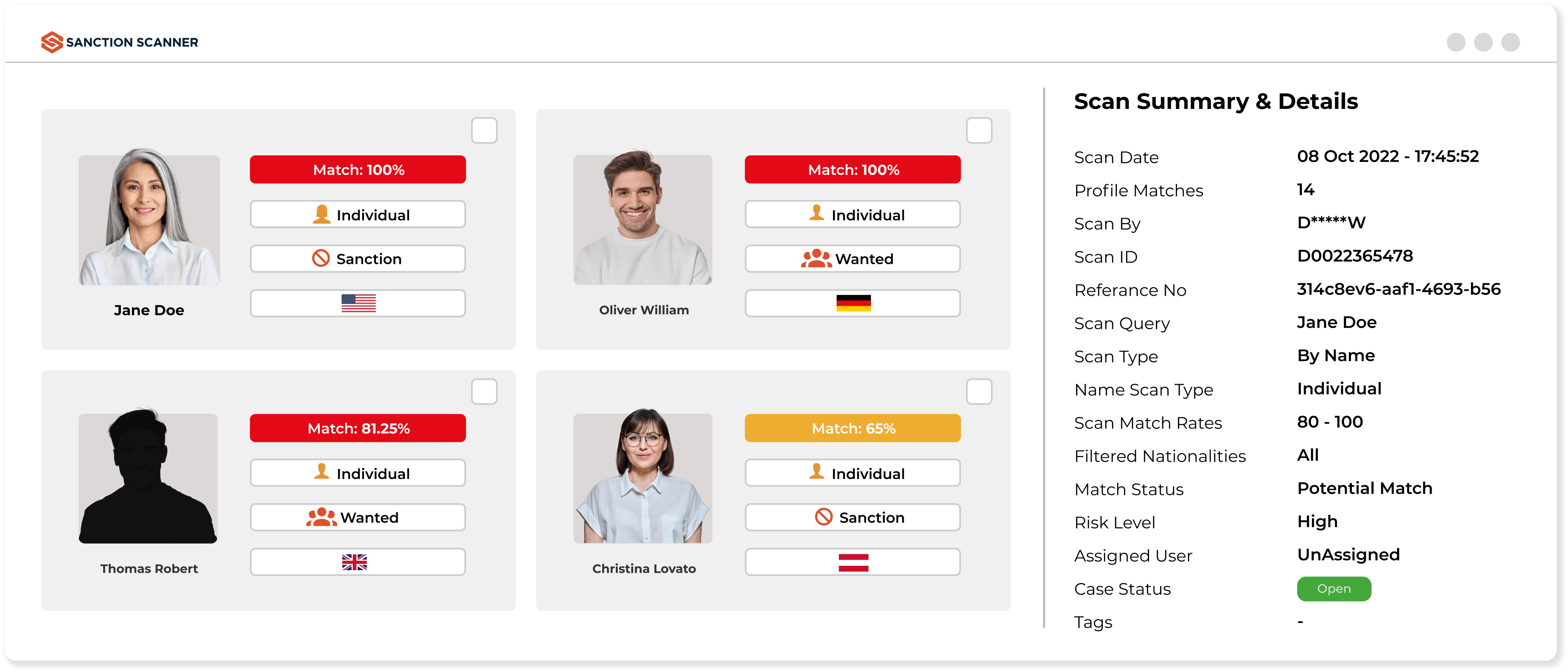

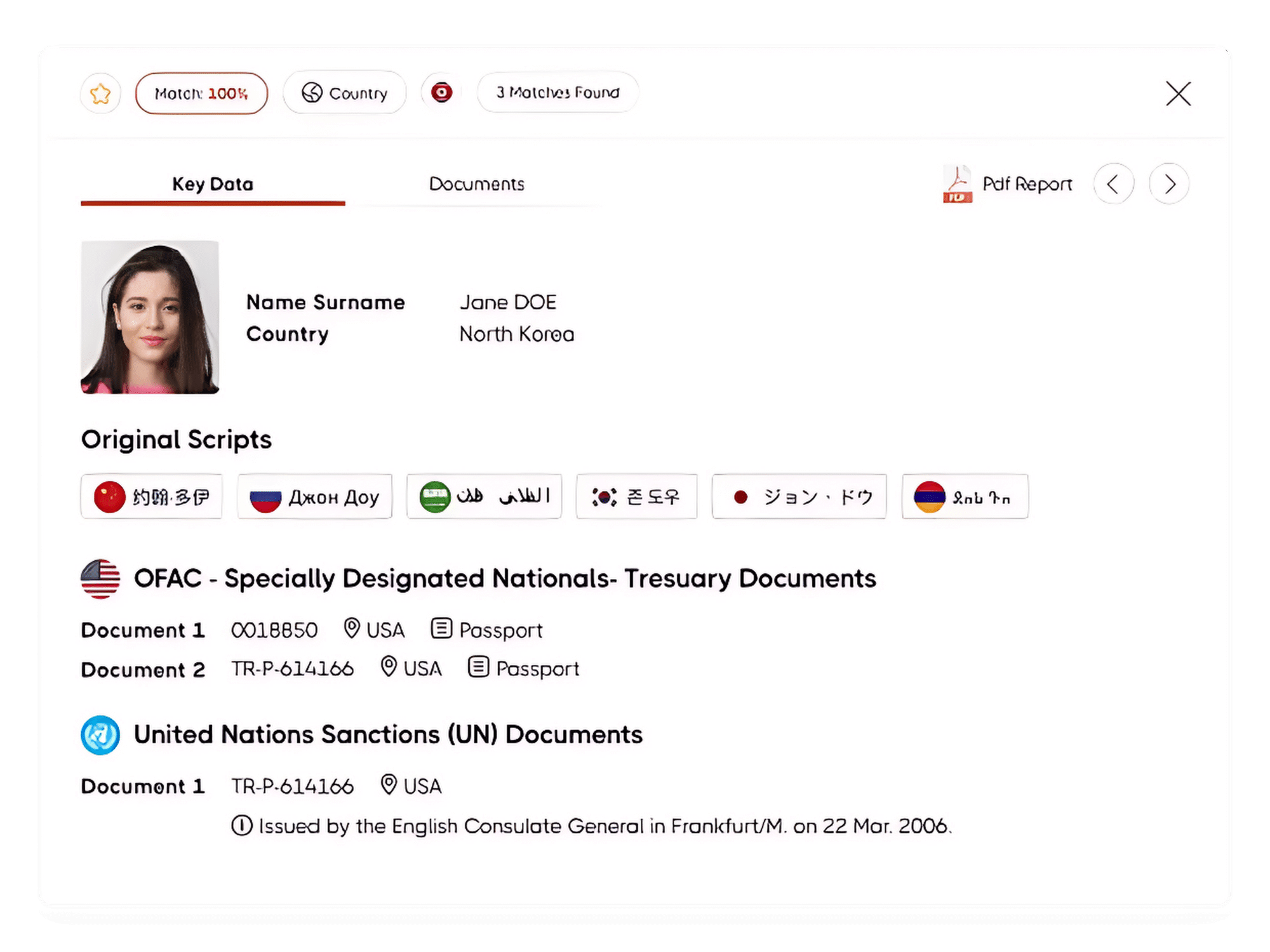

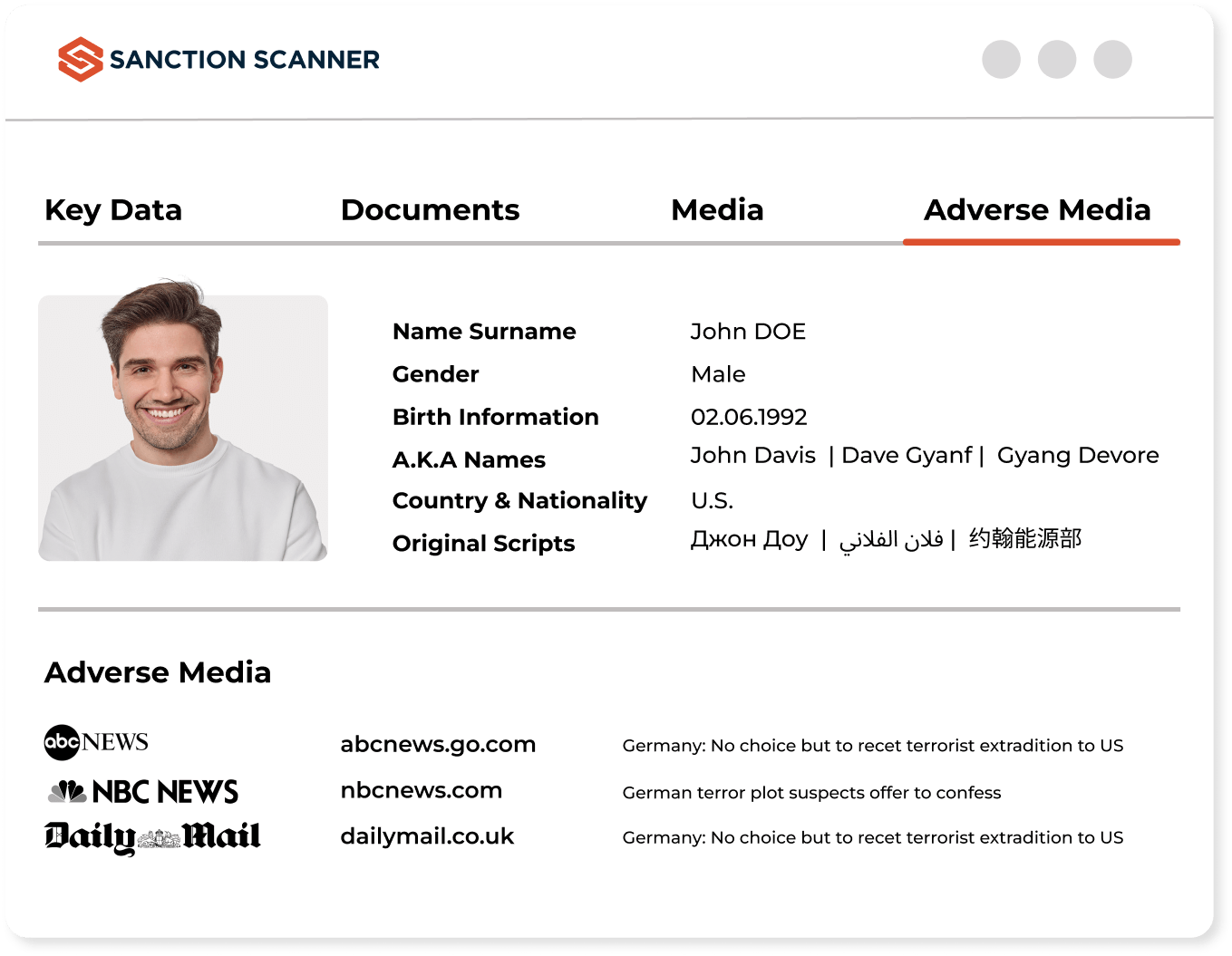

Automate Customer Onboarding with API

Sanction Scanner has a global AML database that updates itself each 15 minutes. In addition to that, our AML Screening Software provides sanction, PEP, and adverse media screening on customer onboarding. Lending companies can meet all AML requirements in customer onboarding and automate the AML control process with API integration

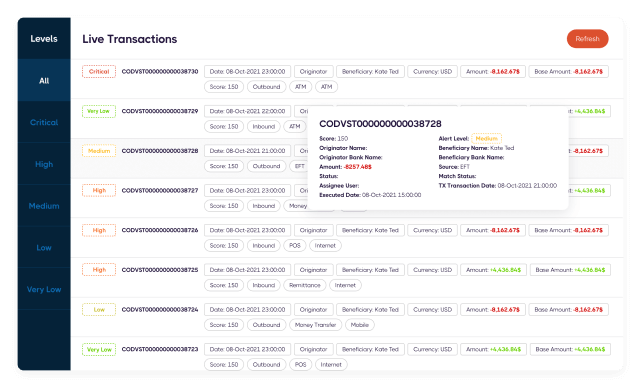

Detecting Suspicious Transactions

LLending firms need a transaction monitoring tool because of the financial crime risk. Our AML Transaction, Monitoring Software Tool warns you when one of your customers make a suspicious transaction. All kind of transactions are checked by our Transaction Monitoring tool so you can meet all AML obligations with our products.

Featured news and press releases

FAQs about Lending Industries

Yes. All lenders—traditional, digital, and cross-border—must follow AML laws including KYC, transaction monitoring, and SAR reporting.

Criminals may repay loans with illicit funds or use fake identities to clean money through loan structures—especially in digital lending.

Personal loans, BNPL, small business loans, and unsecured credit are high-risk due to limited checks and rapid fund disbursement.

Red flags include early repayments, third-party payments, repeated applications from the same IP, and unverifiable income sources.

KYC helps verify borrower identity, check for sanctions, and assess fraud or money laundering risk at the onboarding stage.

Yes. P2P platforms must perform KYC on both parties, monitor activity, and report suspicious behavior to regulators.

It tracks loan repayments and account activity to flag anomalies—like mismatched payment sources or inconsistent borrower behavior.

Penalties include fines, license revocation, regulatory bans, and legal action—plus long-term reputational damage.

Yes. Sanction Scanner offers API-based AML tools for real-time screening, KYC, and risk scoring within lending platforms.

EDD involves deeper background checks, SoF validation, and extra reviews for high-risk borrowers or complex transactions.

Fake documents, unusually fast repayment, inconsistent income, and loan requests from high-risk regions are key red flags.

Yes. These services are often targeted due to high volume and minimal KYC—making AML controls mandatory in many jurisdictions.

They can request pay slips, tax records, or bank statements, and screen fund origin for high-risk indicators using AML tools.

Yes. Business lenders must perform KYB (Know Your Business), screen UBOs, and assess industry-specific financial risks.

PEP screening is integrated into AML tools to flag high-risk individuals during borrower verification and ongoing monitoring.

Yes. Criminals may repay loans with illicit funds to disguise money as "legitimate" income—classic layering/integration tactic.

It tailors due diligence based on borrower profile, loan size, transaction pattern, and geographic or industry risk.

At least annually, or whenever regulatory updates, internal policy changes, or risk level shifts occur.

Yes. Lack of in-person checks and instant fund transfers increase exposure without proper KYC and monitoring.

Yes. AI enhances anomaly detection, reduces false positives, and improves monitoring efficiency across borrower segments.