AML Solutions For Fintech Companies

We help Fintech Companies in the AML compliance process with our next-generation AML solutions!

TRUSTED BY OVER 800+ CLIENTS

We bring solutions that will make it easier for our customers to comply with AML Regulations.

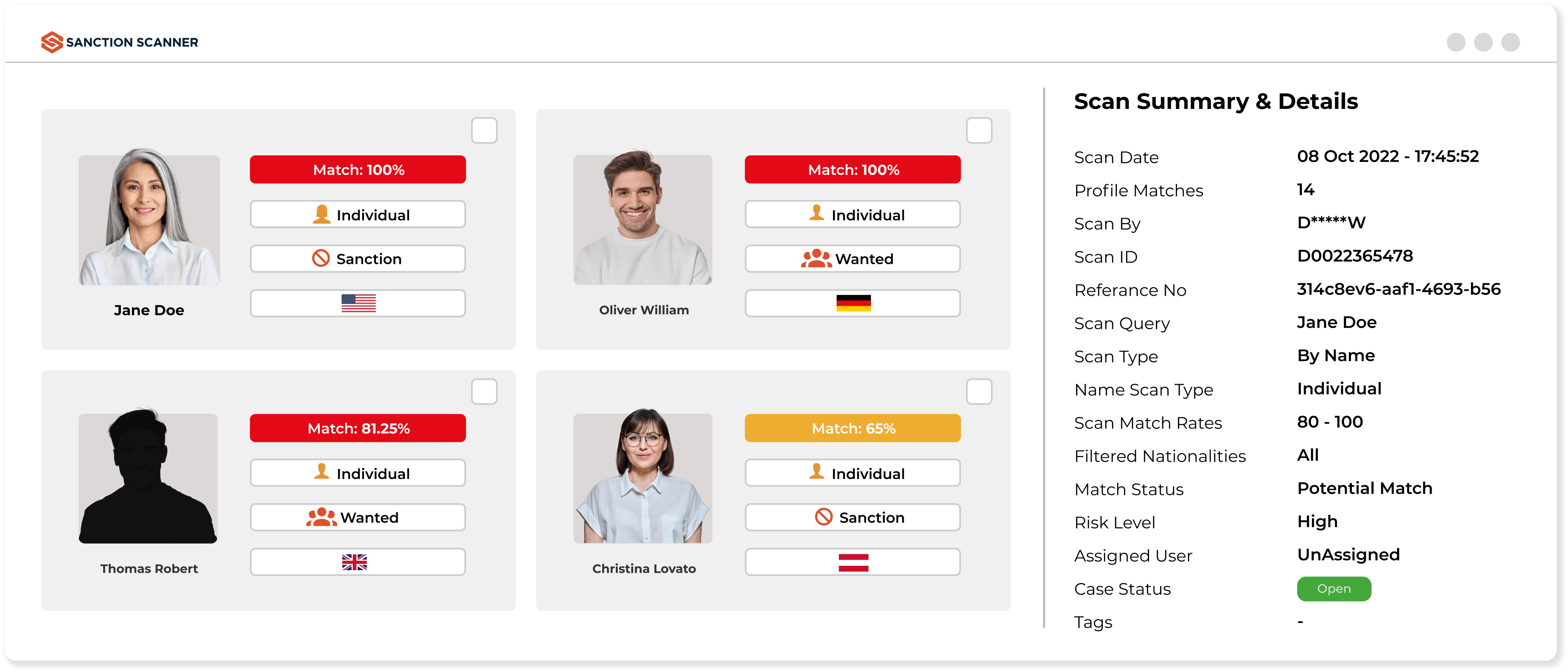

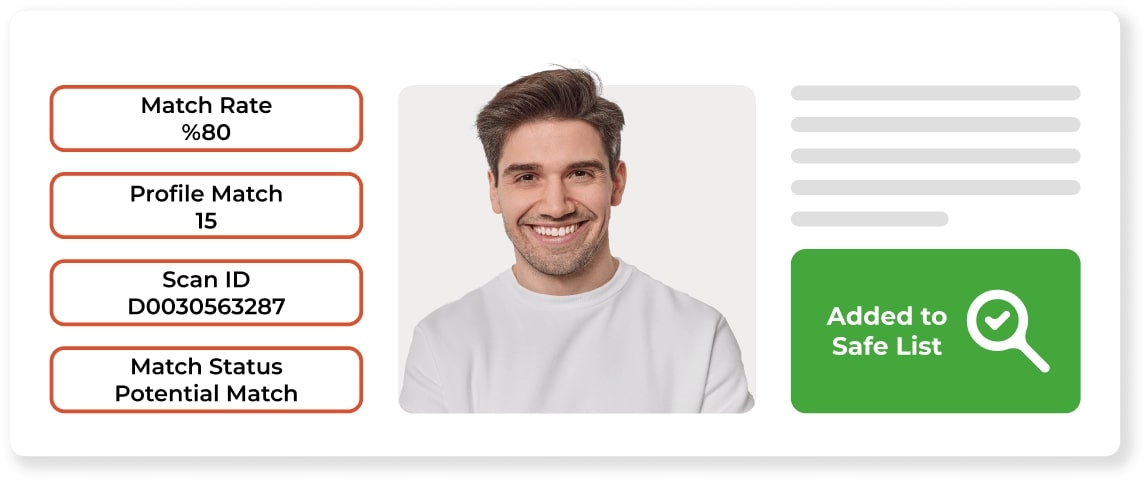

Customer Onboarding Process

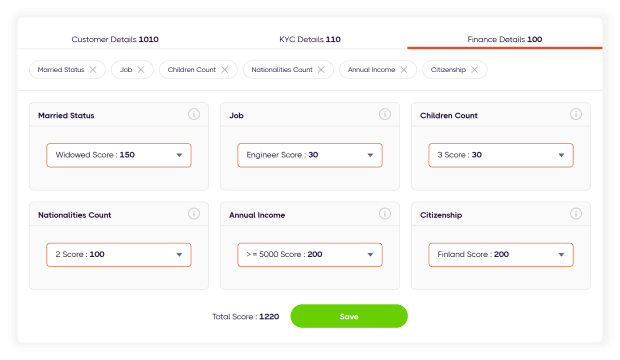

FinTech companies must implement KYC and CDD procedures during the customer onboarding process. AML Name Screening Software helps financial technology companies perform traditional and digital customer onboarding in seconds. Discover our global comprehensive and real-time AML, PEP, and Adverse Media data for your AML controls.

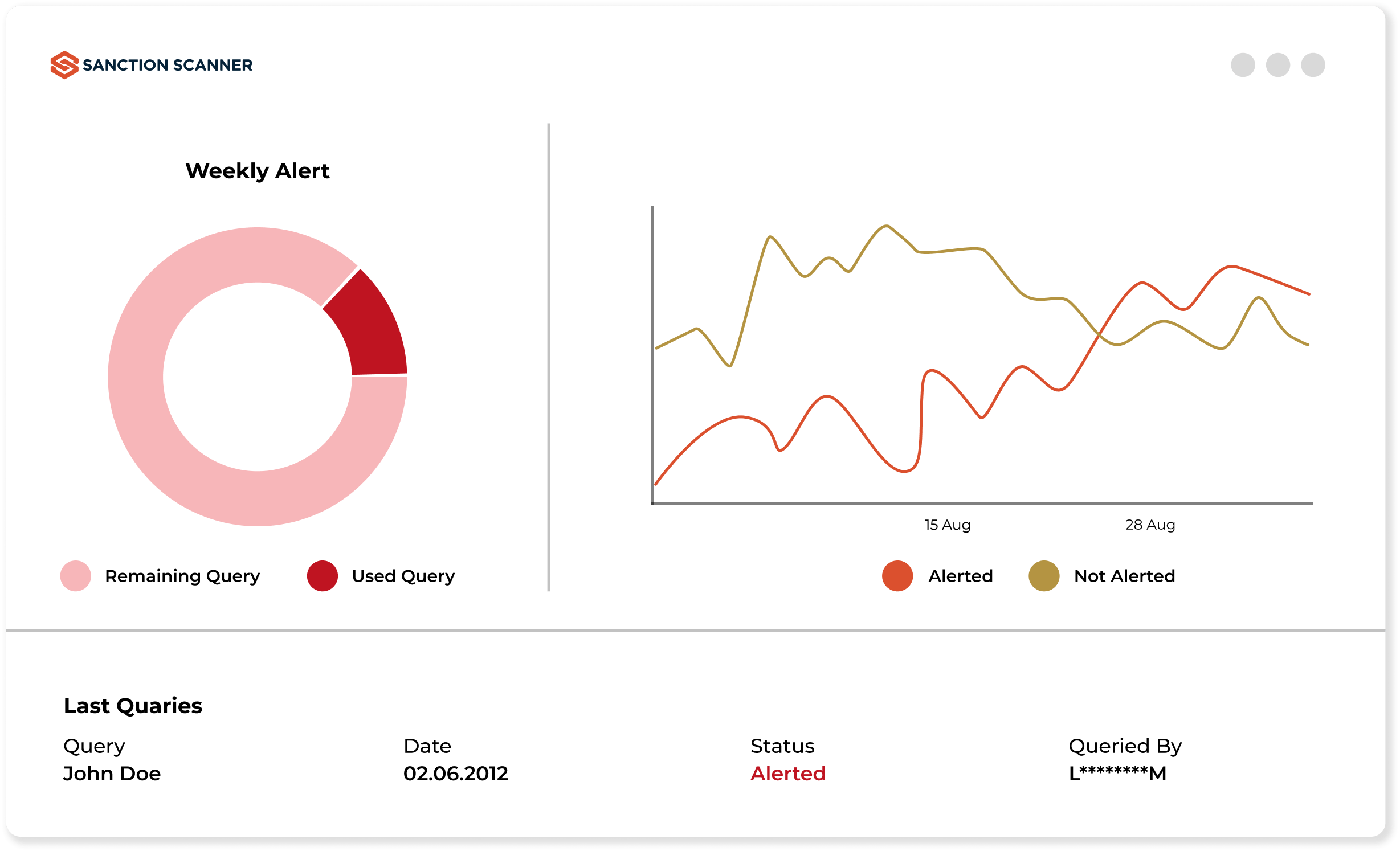

The Importance of Integration

FinTech mainly focuses on integration with other banks, third parties, and service providers. Therefore, painless and easy integration is essential for them. They have to automate Know Your Customer and Customer Onboarding processes, transactions and minimize manual workload. Sanction Scanner’s flexible and robust APIs strong FinTech’s Anti-Money Laundering requirements. The integration is super easy, and our rich API enables easy integration with your project workflow.

“Sanction Scanner's software is easy to use, and we enjoy working with it. Since implementing its solution, we have significantly reduced false positives. The time and effort we previously spent on false positive alarms can now be directed towards other aspects of the business, which contributes to its growth.”

Guy Shaked

Legal Counsel at ironSource

“What I like best about Sanction Scanner is its real-time screening capability and automated alerts. It helps us detect potential matches instantly and take immediate action, which is critical for our AML compliance.”

Tolgahan Kapanci

Head of Compliance at PeP

“With Sanction Scanner, we offer a fast, easy, and secure customer onboarding process. Thanks to its enhanced scanning tool, we focus on real risks, not false positives. Thus, we can meet our AML obligations and our customers' expectations.”

Arda Akay

Chief Compliance Officer at Tom Bank

“Sanction Scanner provided us the most comprehensive database to screen our clients. It includes lists from all over the world and is always up-to-date.”

Gulnihal Akartepe

Global Vice President at TPAY

“With Sanction Scanner, we reduce the risks of money laundering and terrorist financing by controlling on local and international lists also to avoid risks during our onboarding process.”

Oğuzhan Akın

Experienced Banking & Expansion Manager (MEA) at WİSE

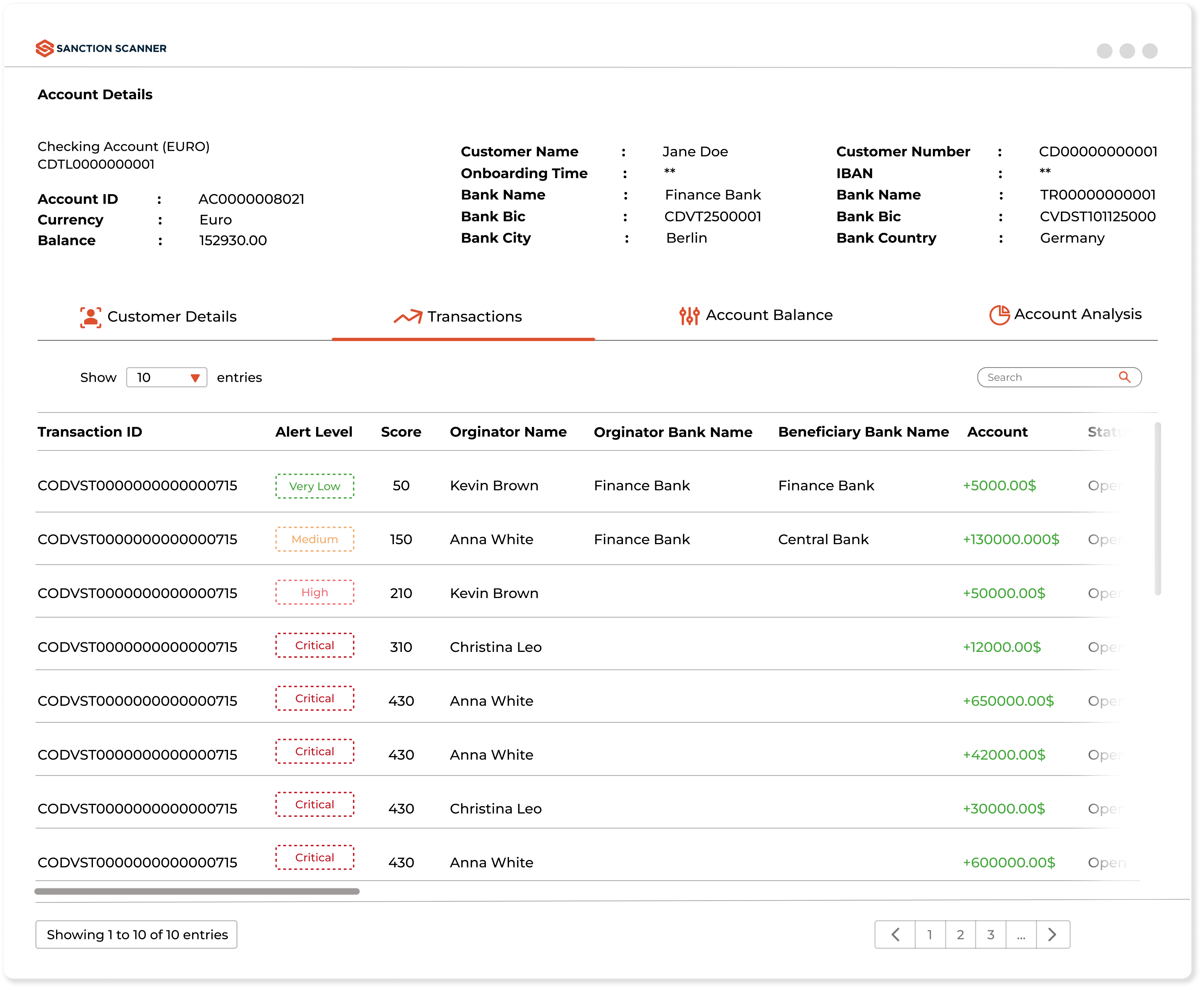

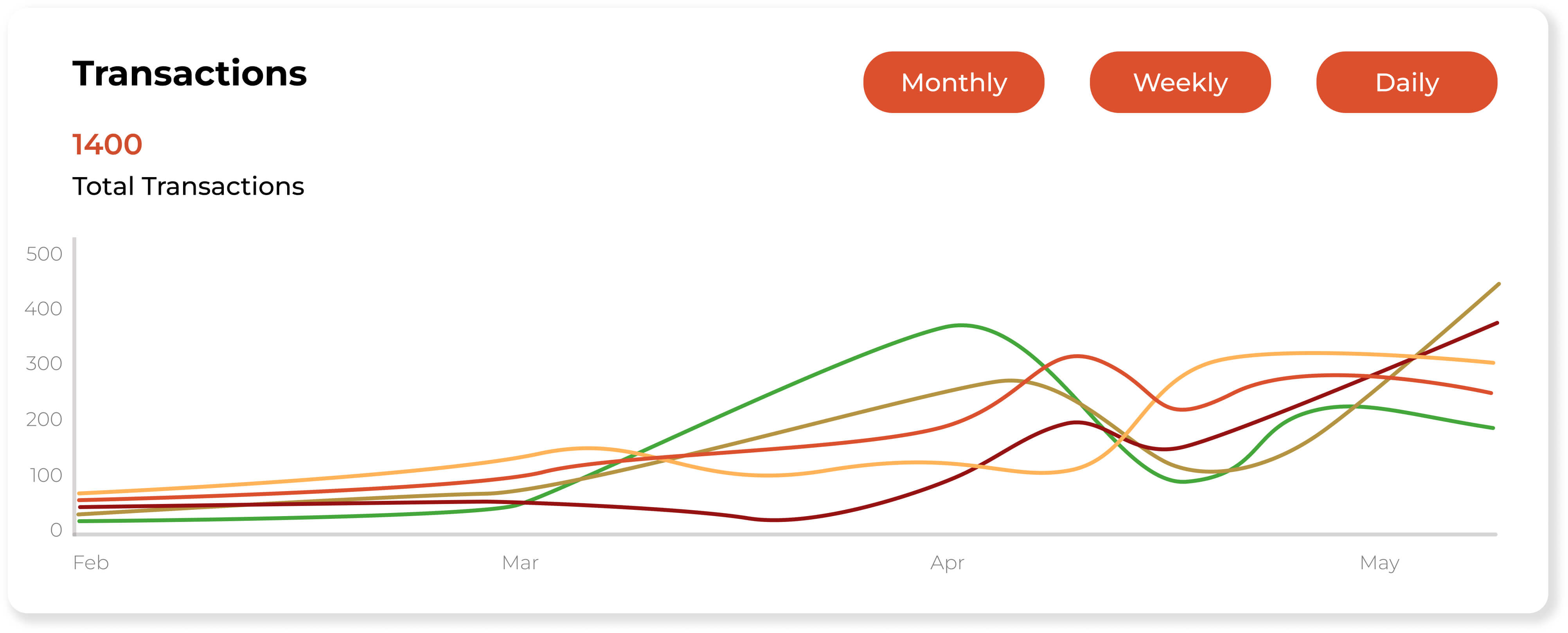

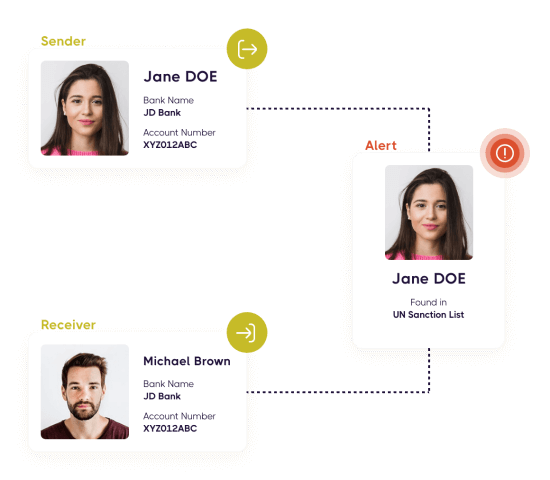

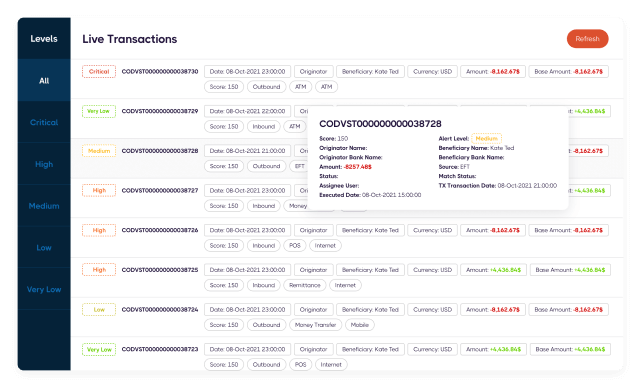

Transaction Screening Software for FinTech

FinTech companies that provide money transfer and payment services have to control the sender and the receiver in transactions to avoid sanction violations. Sanction Scanner's global comprehensive database contains sanction and PEP data from more than two hundred countries. FinTech companies can control the transaction they mediate automatically within seconds and prevent sanction violations using our products.

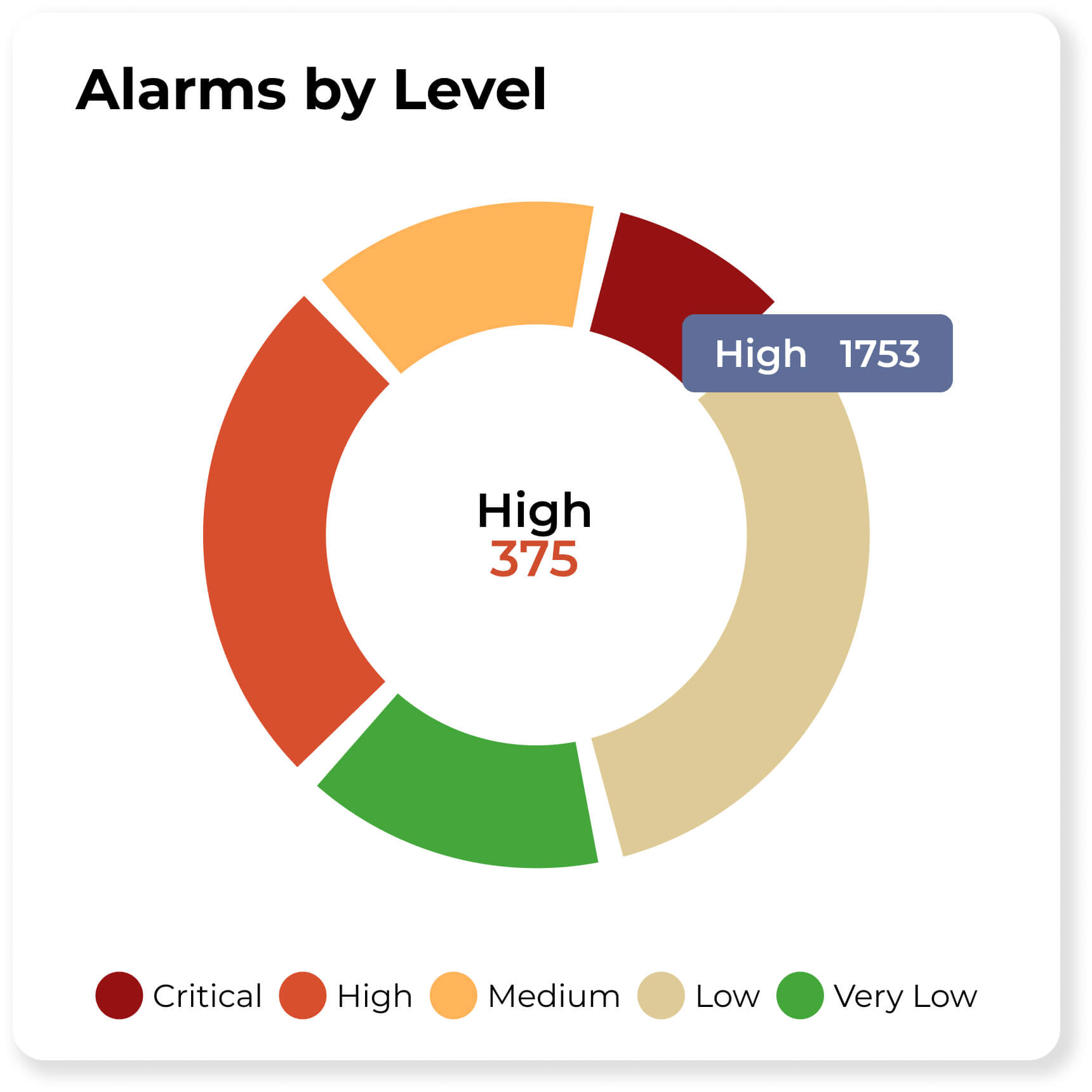

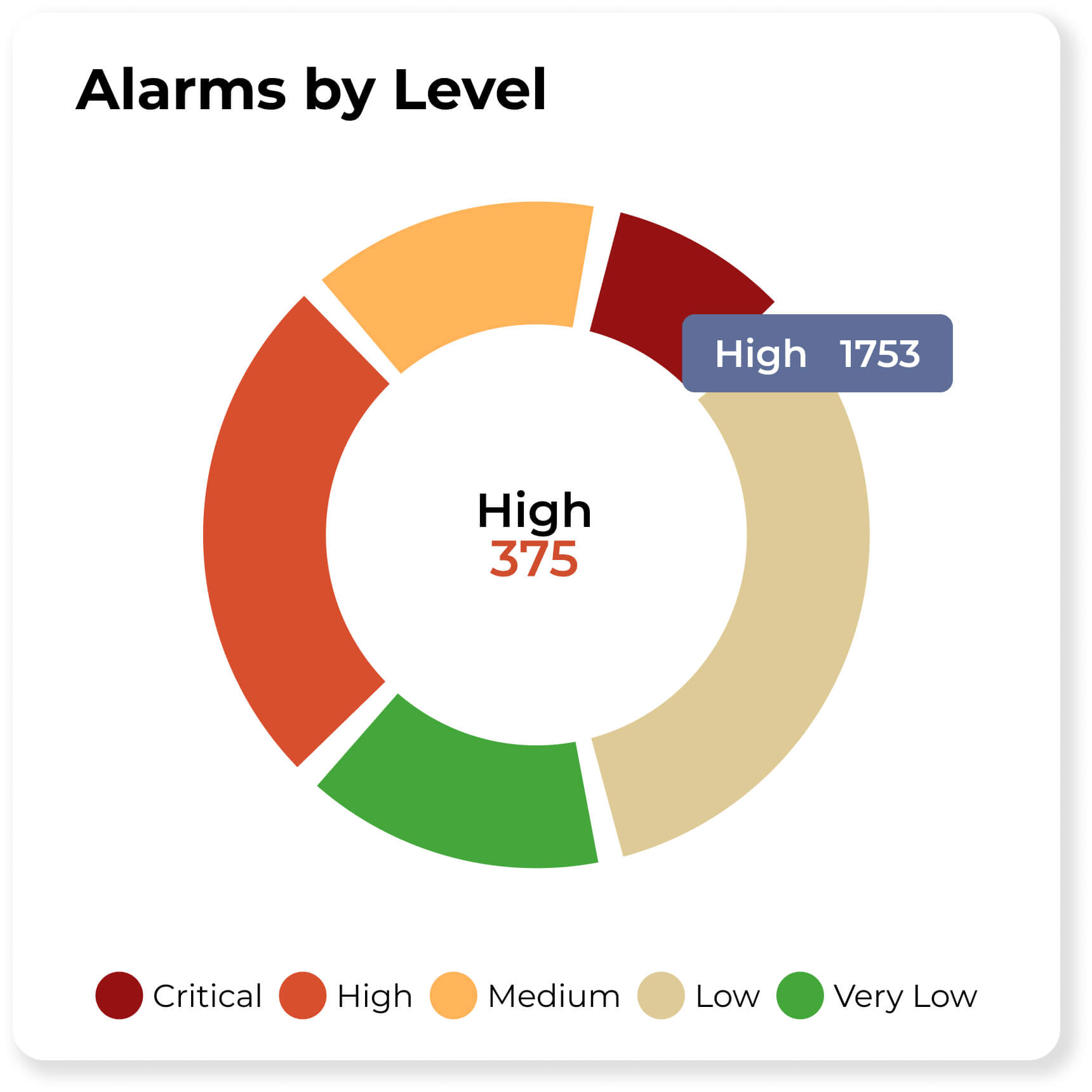

Transaction Monitoring Software for FinTech Companies

FinTech companies focus on flawless customer experience. That's why they need to automate the process of Monitoring to avoid delays in customer transactions. AML Transaction Monitoring tool provides end-to-end solutions to meet the need of FinTech companies of all sizes during their transaction monitoring process.

Featured news and press releases

FAQs about Fintech

Yes. Fintechs offering payments, lending, wallets, or crypto services must follow AML laws, including KYC, monitoring, and reporting obligations.

Key risks include identity fraud, money mules, synthetic accounts, and rapid fund layering—common in digital-first environments.

Fintechs use digital KYC tools like ID verification, biometrics, and liveness checks to validate customer identities during onboarding.

It tracks transaction behavior to detect structuring, peer-to-peer laundering, and anomalies. Real-time monitoring is essential for proactive AML risk management.

By using AI-powered fuzzy matching, dynamic thresholds, and behavioral analysis to filter alerts and prioritize real risks.

It ensures fintechs don’t transact with sanctioned parties. Real-time screening against OFAC, UN, and EU lists is mandatory for compliance.

Yes. BNPL providers may be classified as lenders and must apply KYC, monitor repayments, and report suspicious activities per local regulations.

FATF supports fintech innovation but requires firms to adopt risk-based AML programs tailored to digital and cross-border services.

Yes. Sanction Scanner’s API-based tools support KYC, screening, and monitoring, integrating into onboarding, CRM, and compliance dashboards.

Non-compliance can result in fines, license revocation, regulatory bans, and reputational loss—threatening both operations and growth.

KYT refers to real-time monitoring of transaction patterns to detect suspicious activity. It complements KYC by focusing on behavior, not just identity.

Yes. Payment gateways processing financial transactions must implement KYC, transaction monitoring, and sanctions screening under most AML regulations.

Embedded finance providers must apply AML controls to users accessing financial products via third-party platforms, including onboarding and transaction risk checks.

AML policies should be reviewed annually or whenever there are regulatory changes, internal risk shifts, or new service launches.

High-risk models include peer-to-peer lending, remittance platforms, digital wallets, crypto exchanges, and BNPL services due to transaction volume and anonymity risks.

KYC applies to individual customers, while KYB (Know Your Business) verifies corporate clients; checking UBOs, registration data, and risk levels.

Yes. Both individuals and corporate clients must be screened against global sanctions lists (e.g., OFAC, UN) to prevent unlawful transactions.

It detects links between users and financial crime, fraud, or corruption by scanning news, regulatory notices, and enforcement actions across global sources.

Yes, fintechs can partner with RegTech providers for KYC, transaction monitoring, and reporting. However, legal responsibility for compliance remains with the fintech.

Unusual login locations, inconsistent spending patterns, multiple account registrations, and rapid peer-to-peer transfers often trigger AML alerts.