Over 800+ companies ensure compliance through our ongoing monitoring.

Protect Your Business

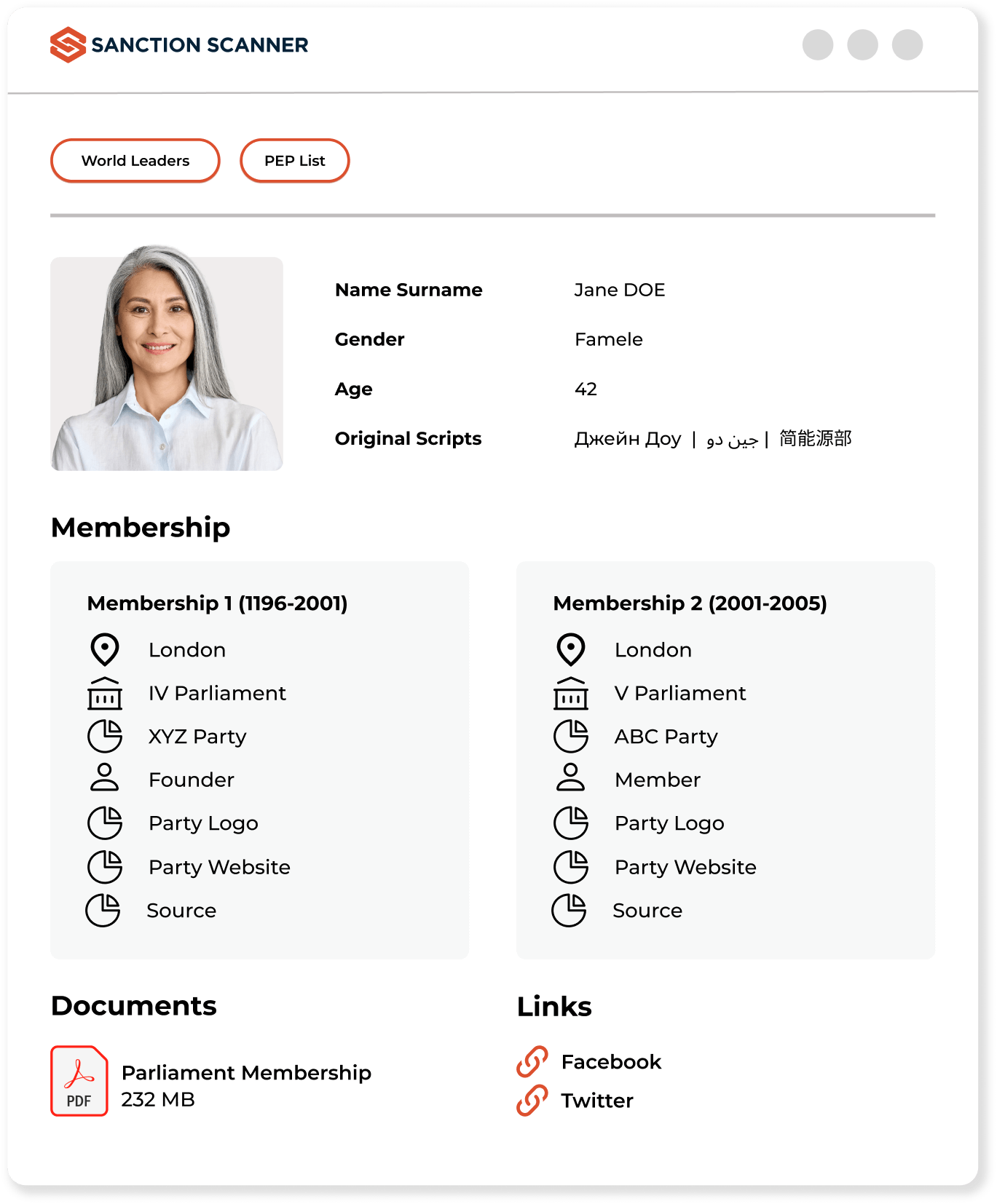

Business must check their high-risk customers to meet AML Compliance. Automated Daily Ongoing Monitoring checks high-risk customers on Sanction and PEP lists periodically.

Plan Your Automated Daily Ongoing Monitoring Process

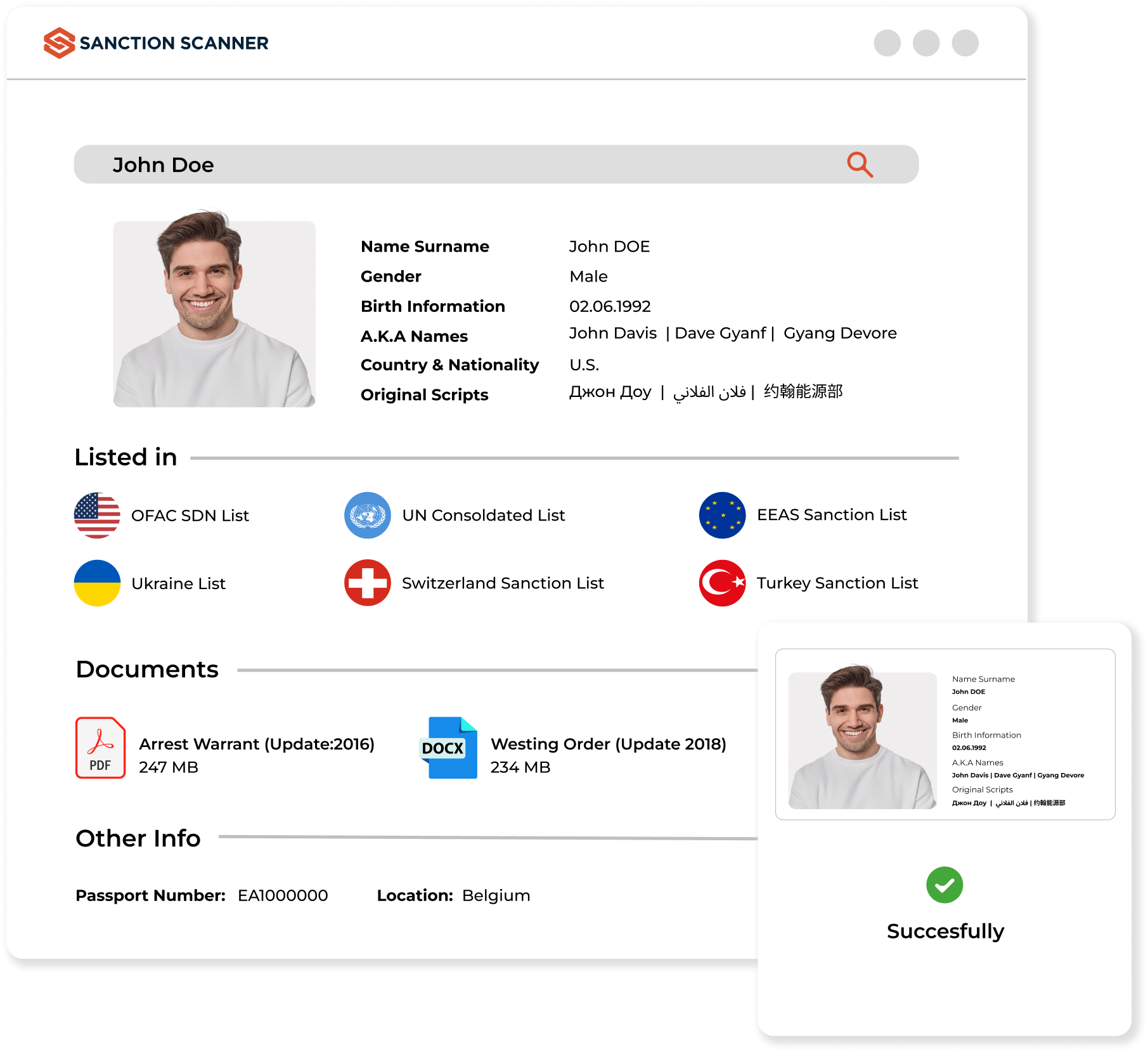

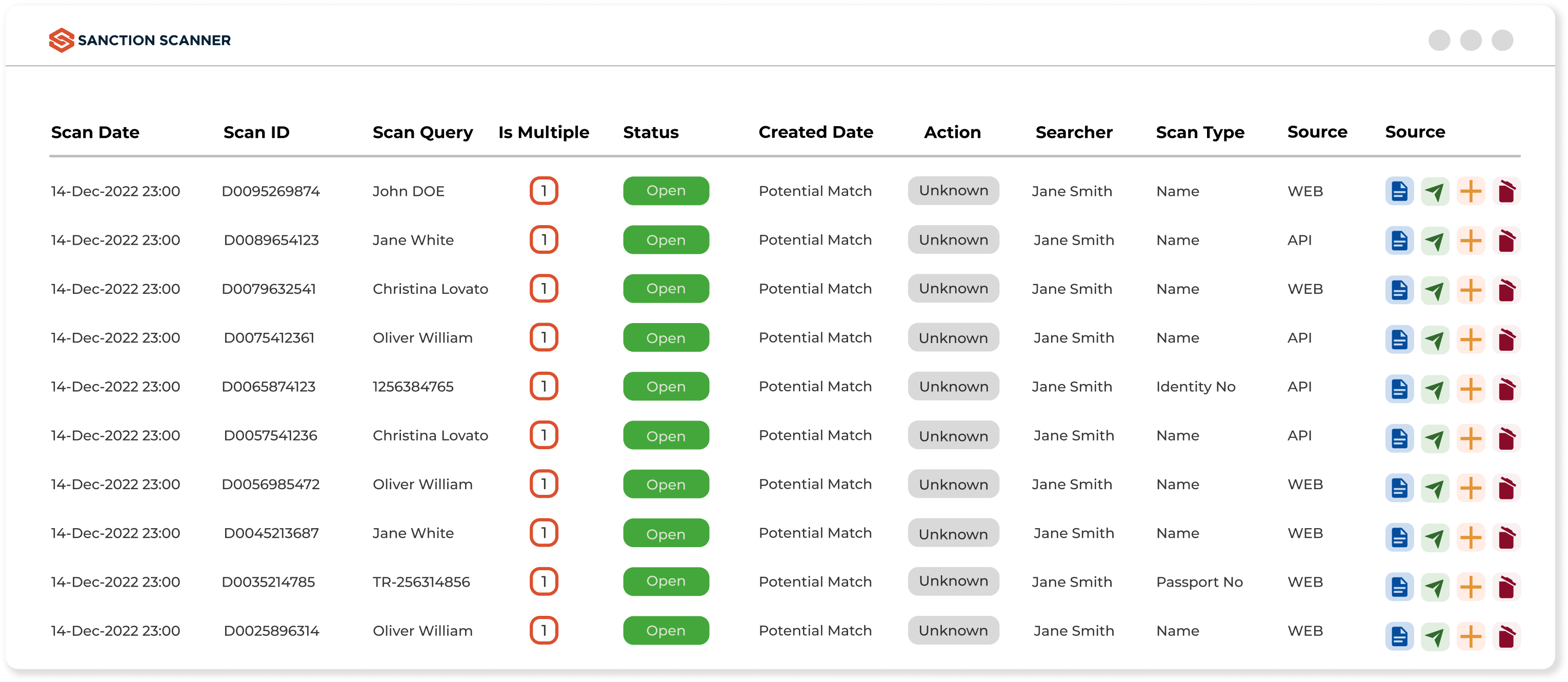

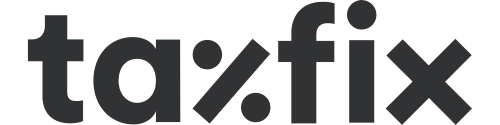

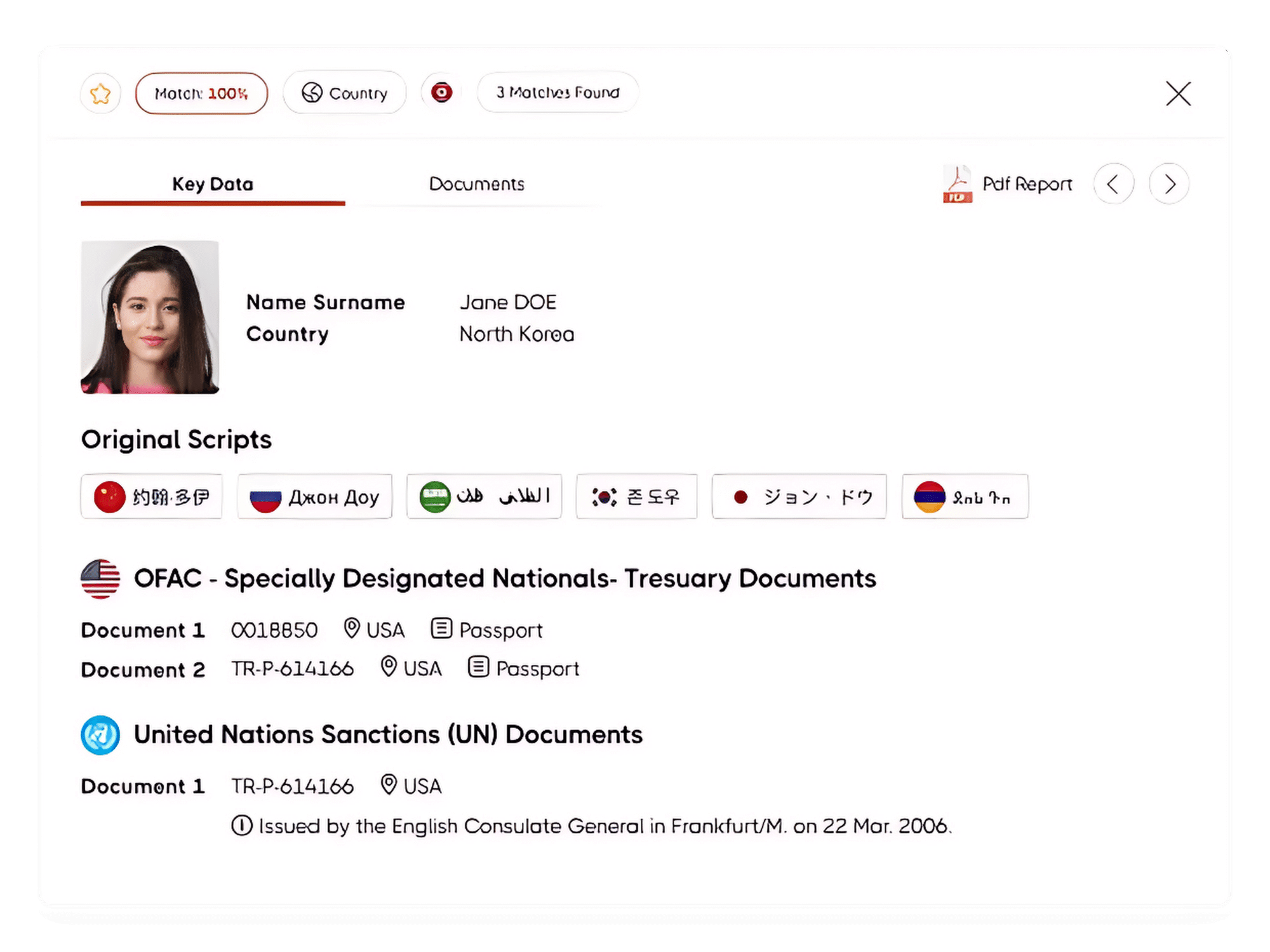

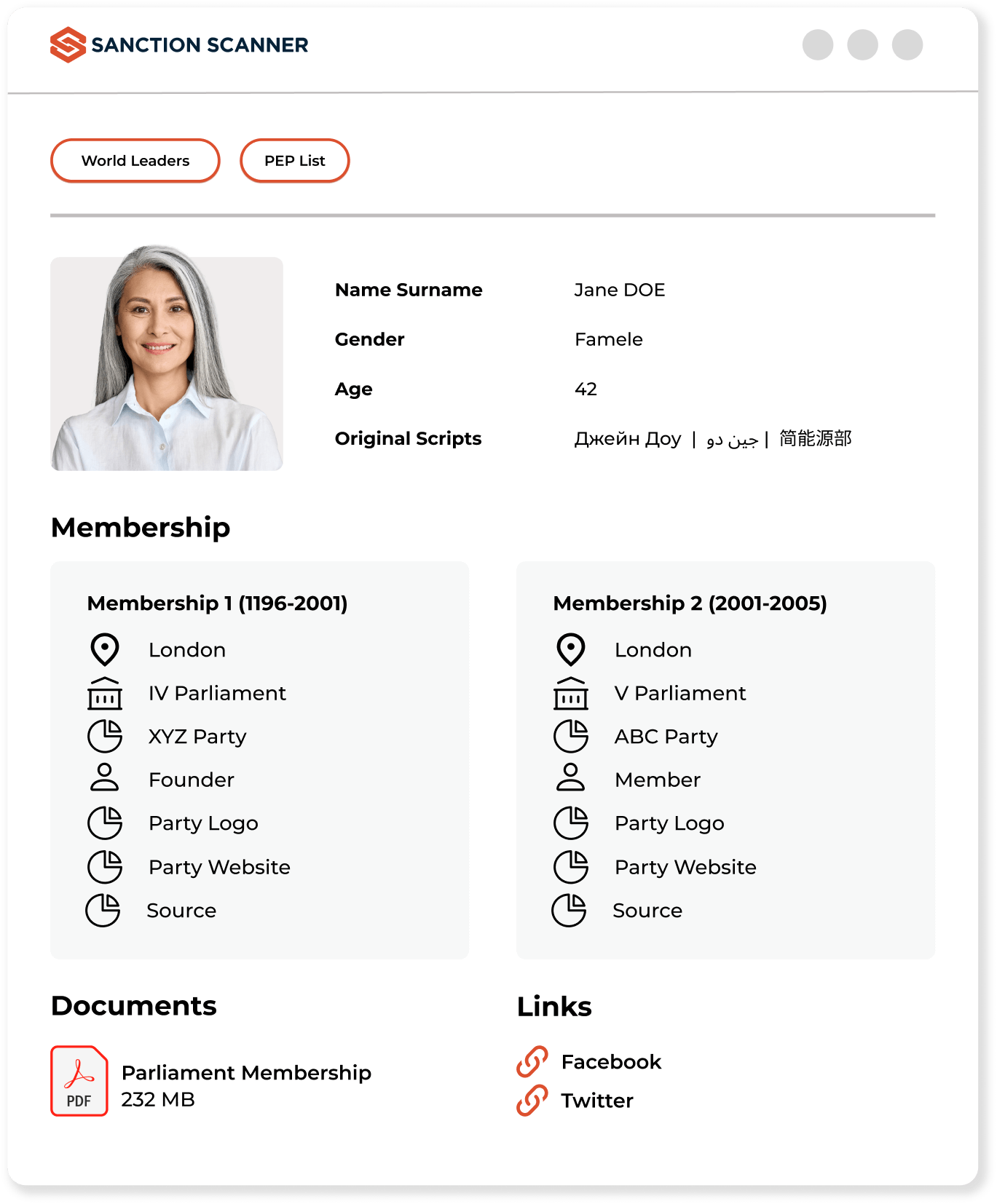

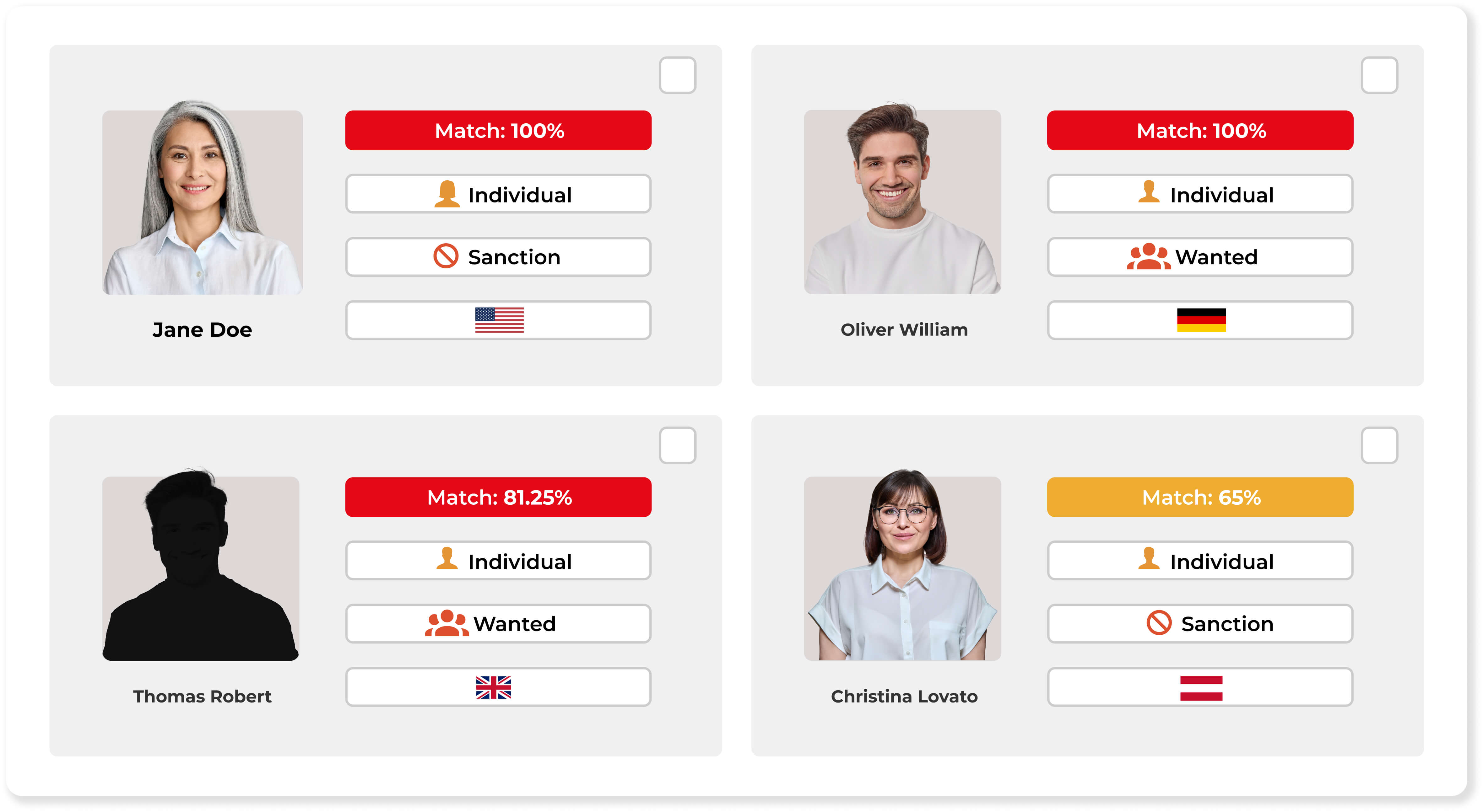

Businesses can change the period of auto-scan according to their customers' risk levels. Reduce false positives by choosing the data (Sanctions, PEPs, Watchlists) you want to scan your customers with.

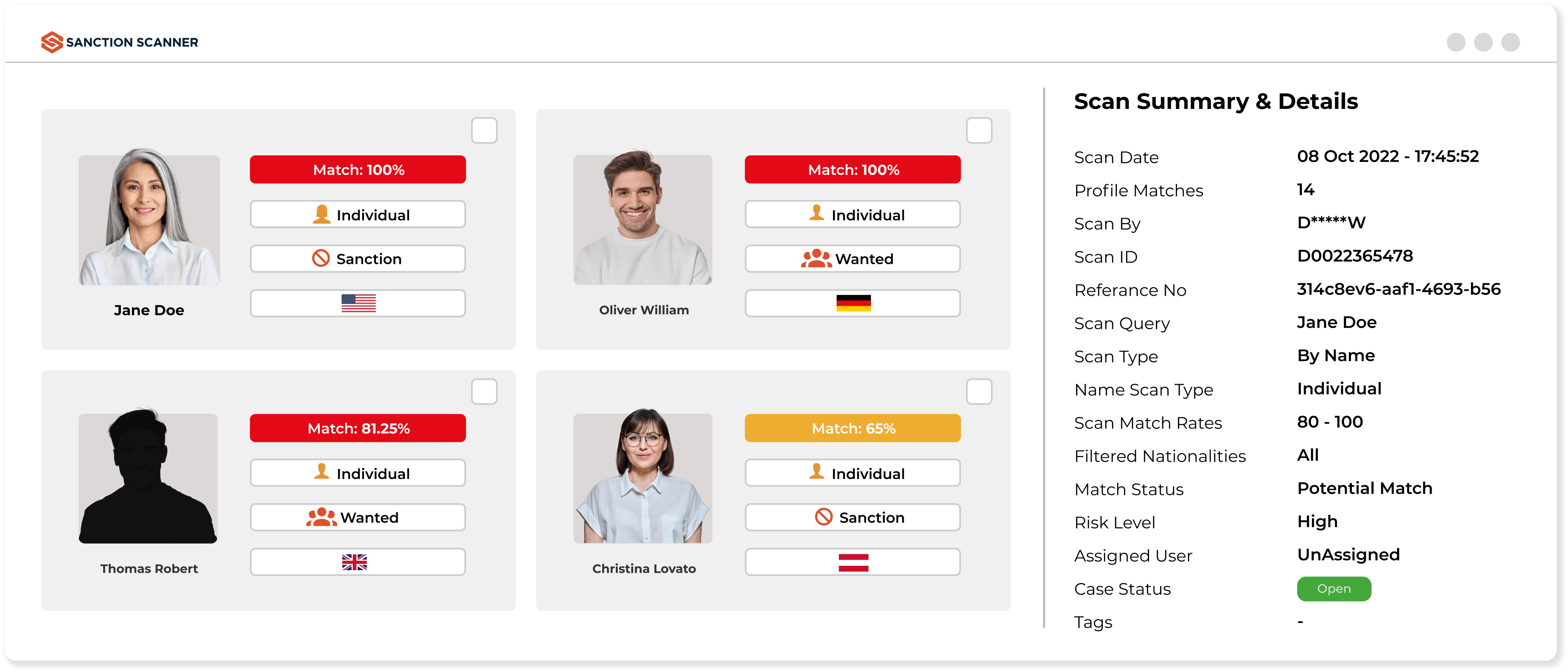

Powerful Case Management

You can manage your scans with Automated Daily Ongoing Monitoring Case Management. You can change the scanning period of a customer and view the results history.

“Sanction Scanner's software is easy to use, and we enjoy working with it. Since implementing its solution, we have significantly reduced false positives. The time and effort we previously spent on false positive alarms can now be directed towards other aspects of the business, which contributes to its growth.”

Guy Shaked

Legal Counsel at ironSource

“What I like best about Sanction Scanner is its real-time screening capability and automated alerts. It helps us detect potential matches instantly and take immediate action, which is critical for our AML compliance.”

Tolgahan Kapanci

Head of Compliance at PeP

“With Sanction Scanner, we offer a fast, easy, and secure customer onboarding process. Thanks to its enhanced scanning tool, we focus on real risks, not false positives. Thus, we can meet our AML obligations and our customers' expectations.”

Arda Akay

Chief Compliance Officer at Tom Bank

“Sanction Scanner provided us the most comprehensive database to screen our clients. It includes lists from all over the world and is always up-to-date.”

Gulnihal Akartepe

Global Vice President at TPAY

“With Sanction Scanner, we reduce the risks of money laundering and terrorist financing by controlling on local and international lists also to avoid risks during our onboarding process.”

Oğuzhan Akın

Experienced Banking & Expansion Manager (MEA) at WİSE

Be Aware of Changes

When there is any change in the risk profile of the customers that are checked periodically, Sanction Scanner automatically reports this change to the relevant person and sends it.

Automated Daily Ongoing Monitoring

Automated Daily ongoing monitoring means continuously screening customers, transactions, and related parties to identify potential financial crime risks in real time.

Sanction Scanner's Daily Ongoing Monitoring solution automatically re-checks customer data and transactions, ensuring your compliance team is always informed of new risks.

Daily ongoing monitoring helps financial institutions detect suspicious activity before it escalates into regulatory or reputational damage.

Sanction Scanner's Real-time Monitoring solution provides real-time alerts, is SAR-friendly, and helps firms meet FATF, EU AMLD, and OFAC requirements.

Banks monitor sanctions, PEP, watchlists, and adverse media to identify customer profile risk changes.

Sanction Scanner updates all lists every 15 minutes, keeping track of client information, activity updates, and global compliance updates to ensure it is accurate.

Yes. Institutions are required by regulators such as FATF, EU AMLD, FCA, MAS, and AUSTRAC to implement continuous monitoring as part of AML systems.

Sanction Scanner keeps businesses in compliance with continuous monitoring integrated into KYC and Enhanced Due Diligence (EDD) processes.

Batch screening is a scheduled process that checks static data sets on a periodic basis, while continuous monitoring runs uninterruptedly in the background and alerts you in real-time when a new risk arises.

Sanction Scanner offers both modes, where organizations have the discretion to choose periodic screening or automated, real-time monitoring.

Automated monitoring ensures that there is no likelihood of human error and ensures no important update is missed.

Sanction Scanner minimizes the risk of compliance through real-time alerts, user-definable risk rules, and AI-powered filtering for eliminating false positives.

The platform refreshes global sanctions, watchlists, and PEP information every 15 minutes across more than 220 nations.

This constant refreshing ensures that your monitoring process is always current with the new changes in regulations and global enforcement activities.

Yes. The Sanction Scanner API facilitates immediate integration with onboarding, transaction, and case management systems.

This allows for real-time screening as part of your own internal processes without disrupting current operations.

Yes. Businesses can customize thresholds, risk levels, categories, and frequency based on their internal compliance policies.

Sanction Scanner provides complete control overrule settings, whereby you can align monitoring accuracy with your industry and risk tolerance.

Failure to continually monitor customers may result in significant regulatory penalties, suspension of licenses, and reputational harm.

The latest case, including Barclays' £42M FCA penalty, highlights the importance of ongoing monitoring. Sanction Scanner maintains your institution safe and compliant.