The secret behind 800+ firms' success in flawless transaction vetting.

Detect Suspicious Transactions

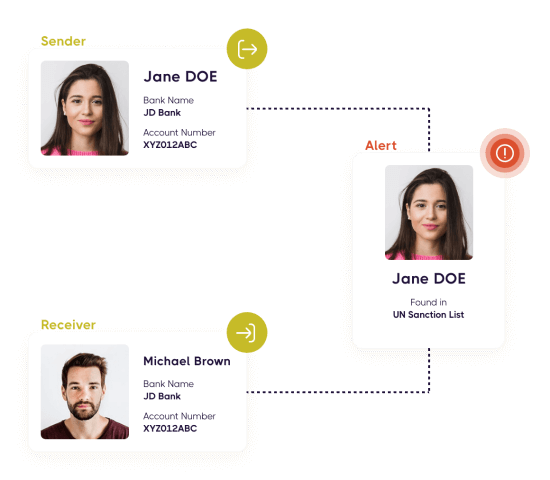

You can check the receiver and sender without delay with AML Transaction Screening.

Discover Our Algoritm

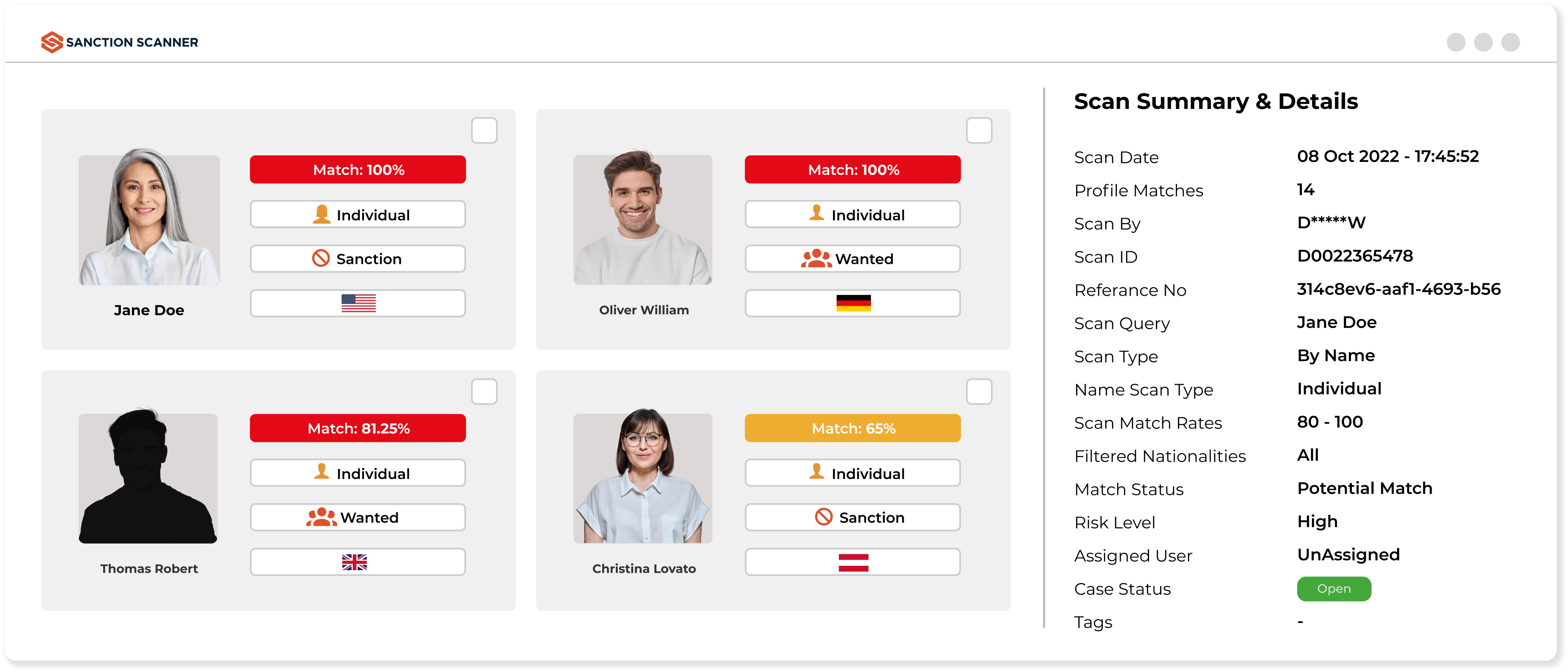

Sanction Scanner provides more comprehensive results by configuring the data it collects with unique algorithms developed with artificial intelligence. You can also scan transactions your customers make by various preferences such as name, identification number, and passport number.

Automate the Control Process

Automate and speed up the entire control process using Transaction Screening. You can integrate your project with API support within minutes and check the receiver and sender while the transfer is processed.

“Sanction Scanner's software is easy to use, and we enjoy working with it. Since implementing its solution, we have significantly reduced false positives. The time and effort we previously spent on false positive alarms can now be directed towards other aspects of the business, which contributes to its growth.”

Guy Shaked

Legal Counsel at ironSource

“What I like best about Sanction Scanner is its real-time screening capability and automated alerts. It helps us detect potential matches instantly and take immediate action, which is critical for our AML compliance.”

Tolgahan Kapanci

Head of Compliance at PeP

“With Sanction Scanner, we offer a fast, easy, and secure customer onboarding process. Thanks to its enhanced scanning tool, we focus on real risks, not false positives. Thus, we can meet our AML obligations and our customers' expectations.”

Arda Akay

Chief Compliance Officer at Tom Bank

“Sanction Scanner provided us the most comprehensive database to screen our clients. It includes lists from all over the world and is always up-to-date.”

Gulnihal Akartepe

Global Vice President at TPAY

“With Sanction Scanner, we reduce the risks of money laundering and terrorist financing by controlling on local and international lists also to avoid risks during our onboarding process.”

Oğuzhan Akın

Experienced Banking & Expansion Manager (MEA) at WİSE

Transaction Screening

Transaction screening is the checking of parties to a transaction against sanctions, PEP, and watchlists before the payment is made.

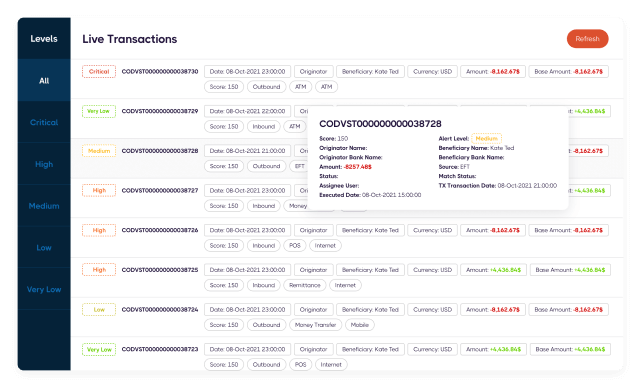

Sanction Scanner's Transaction Screening solution examines transactions in real-time to detect and block transfers related to sanctioned or high-risk parties and entities.

Transaction screening checks each transaction against global sanctions and watchlists before a transaction occurs, whereas transaction monitoring analyzes patterns of transactions and behavior over a period.

Sanction Scanner combines the two systems, and financial institutions can now block financial crime both before and after a transaction occurs.

It is important for financial institutions to verify that no payments are made to or from sanctioned individuals.

Sanction Scanner helps banks, payment institutions, and fintech's to prevent illicit transactions, protect their reputation, and stay compliant with AML and counter-terrorism financing regulations.

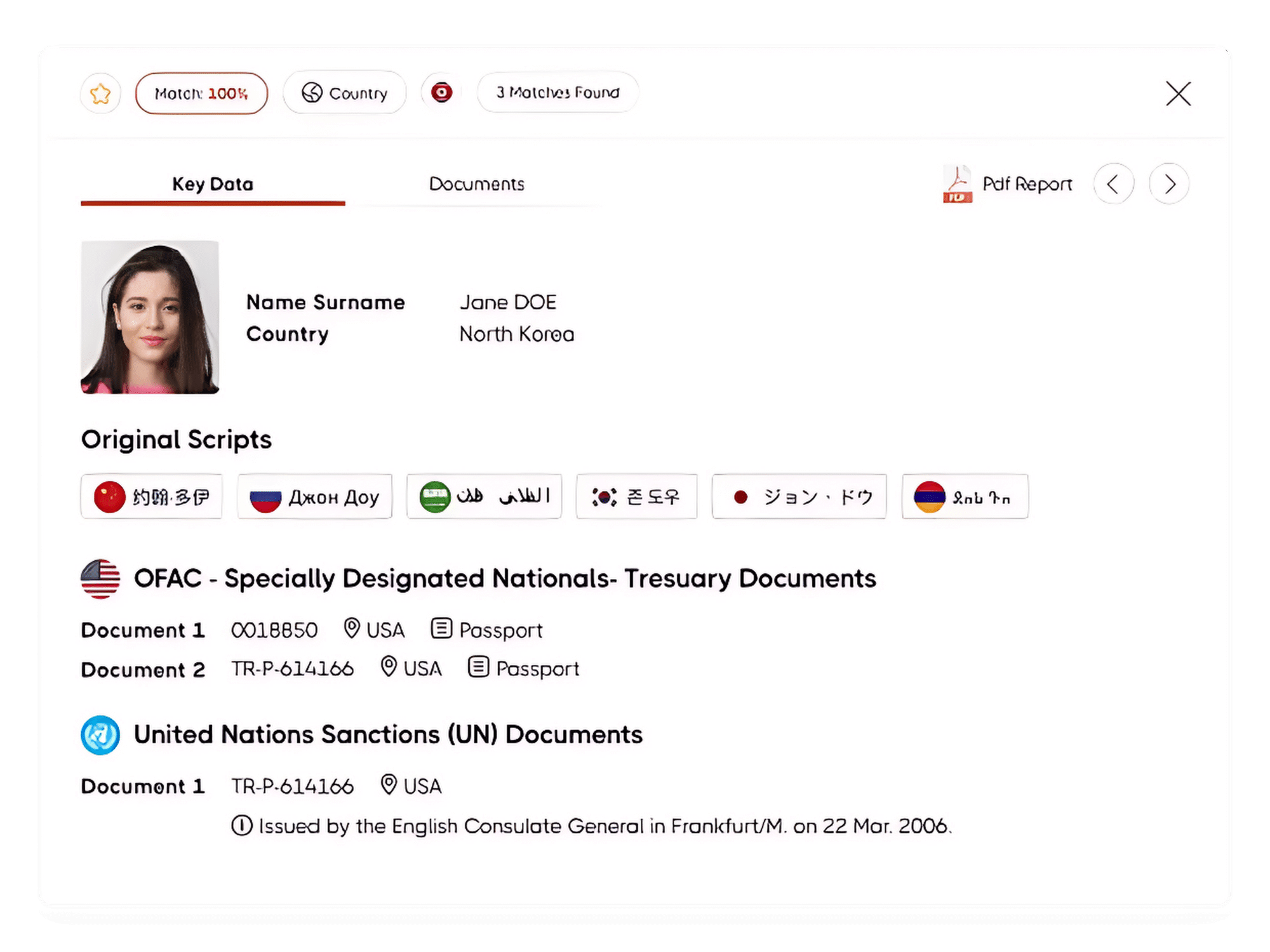

Transaction screening includes screening data against significant global and regional lists like OFAC, UN, EU, UK HMT, MAS, and AUSTRAC.

Sanction Scanner checks over 3,000 international and local lists across 220+ jurisdictions, updated every 15 minutes for perfect accuracy.

Yes. Real-time screening enables suspicious transactions to be identified and stopped before processing.

Sanction Scanner delivers sub-second response times and can automatically block transactions if the recipient is a match for sanctions or watchlist.

Transaction screening looks at key data fields such as sender and recipient name, account number, country, currency, and transaction purpose.

Sanction Scanner's platform uses AI-based fuzzy matching to compare this information against global databases and detect hidden risk.

Poor screening of transactions can lead to severe regulatory fines, assets being frozen, reputational risk, and even criminal exposure.

Sanction Scanner avoids such outcomes by ensuring every transaction is searched against new global compliance data.

Fuzzy matching identifies name spellings, misspellings, and phonetic equivalents to accurately detect.

Sanction Scanner's advanced fuzzy logic reduces false positives at the cost of only slightly lower detection rates, increasing efficiency and confidence in compliance.

Transaction screening is essential for banks, payment processors, fintech's, and crypto exchanges handling high traffic volumes.

Sanction Scanner supports all regulated industries based on scalable infrastructure and support for both digital and traditional payment systems.

Yes. Integration allows for real-time screening without disrupting workflow.

Sanction Scanner offers seamless two-way API integration with central banking, payment gateways, and SWIFT networks for automated compliance screening.

Yes. Our APIs embed screening directly into transaction engines, core banking, or PSP platforms without disrupting customer flow.

Yes. Global standards mandate screening transactions for links to sanctioned entities as part of any AML framework.

Screening systems parse structured formats like SWIFT MT103, ISO 20022, or SEPA fields to extract and analyze critical transaction data in real time.

Daily or multiple times per day. Sanction Scanner syncs with all major list providers automatically to prevent outdated risk exposure.

Yes. You can define logic and thresholds by: Region (e.g., OFAC-only for U.S. clients), Entity type (corporate vs. individual), Amount or transaction purpose.

Yes. We screen structured SWIFT MT (e.g., MT103, MT202) and ISO 20022 message content in real time—extracting key fields for fuzzy logic-based screening. This enables compliance with correspondent banking and cross-border payment regulations.