Turnkey Risk Solutions

Anti-Money Laundering operations are no longer complicated. Fast and Safe Solutions!

Trusted by over 800+ clients

We make it easy for our customers to comply with AML Regulations.

Award-winning company

Our Products

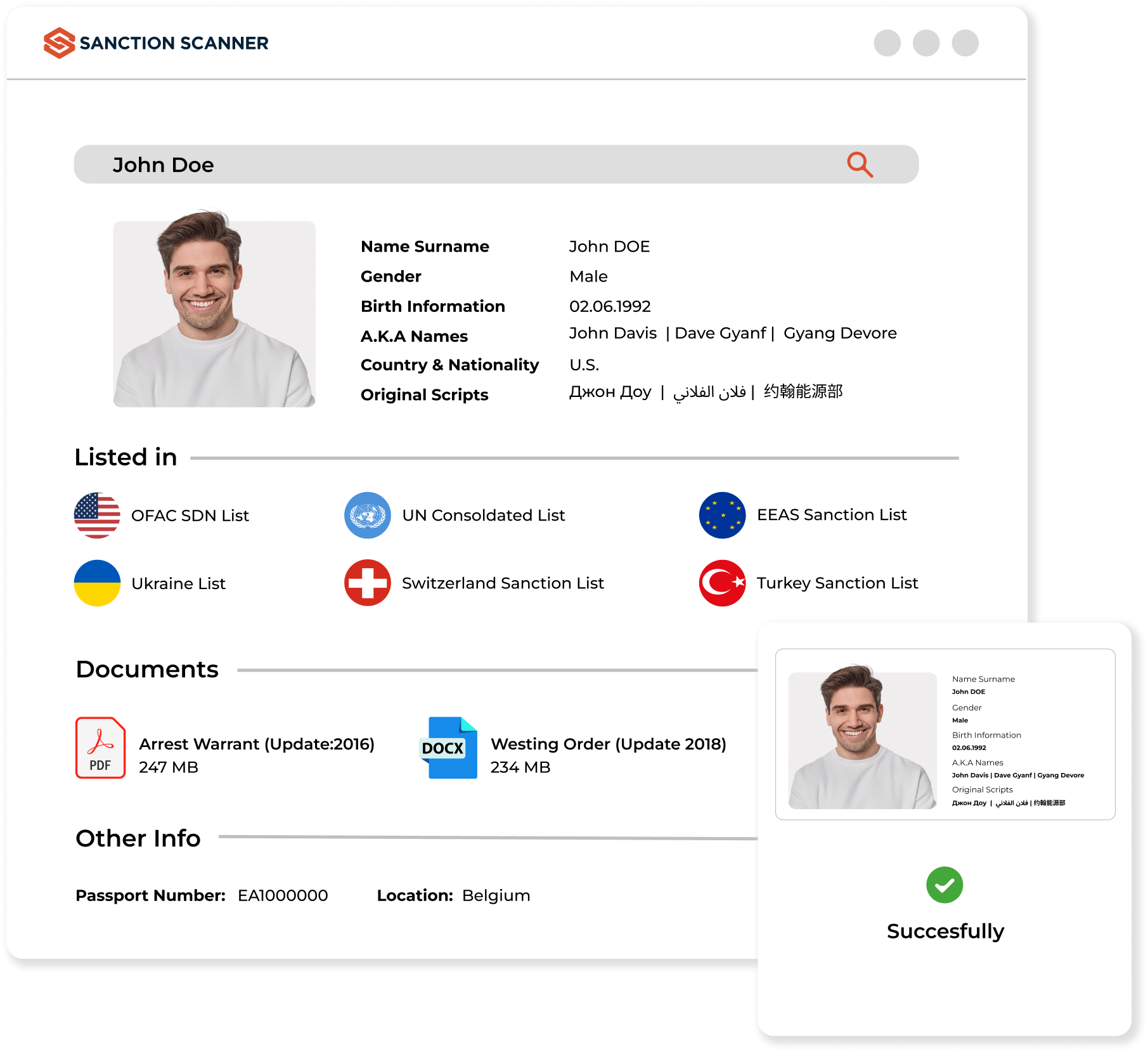

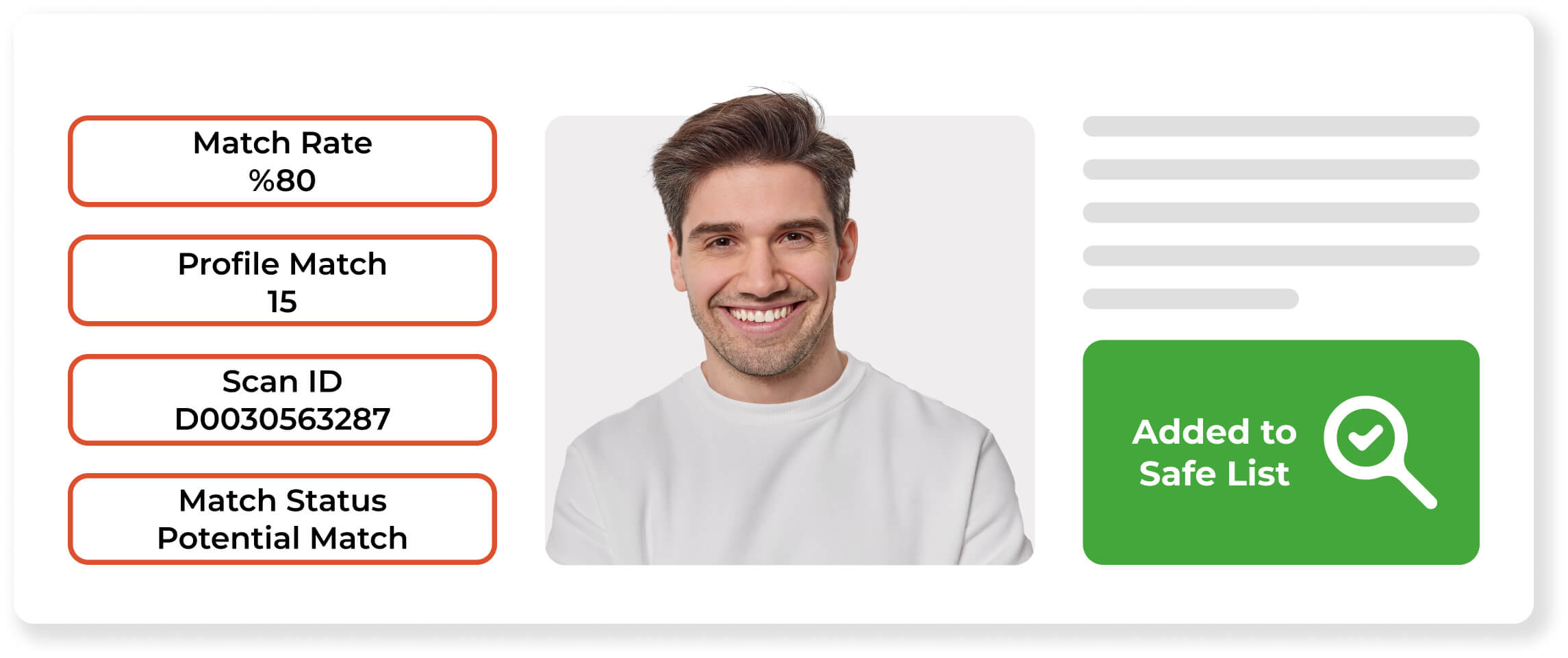

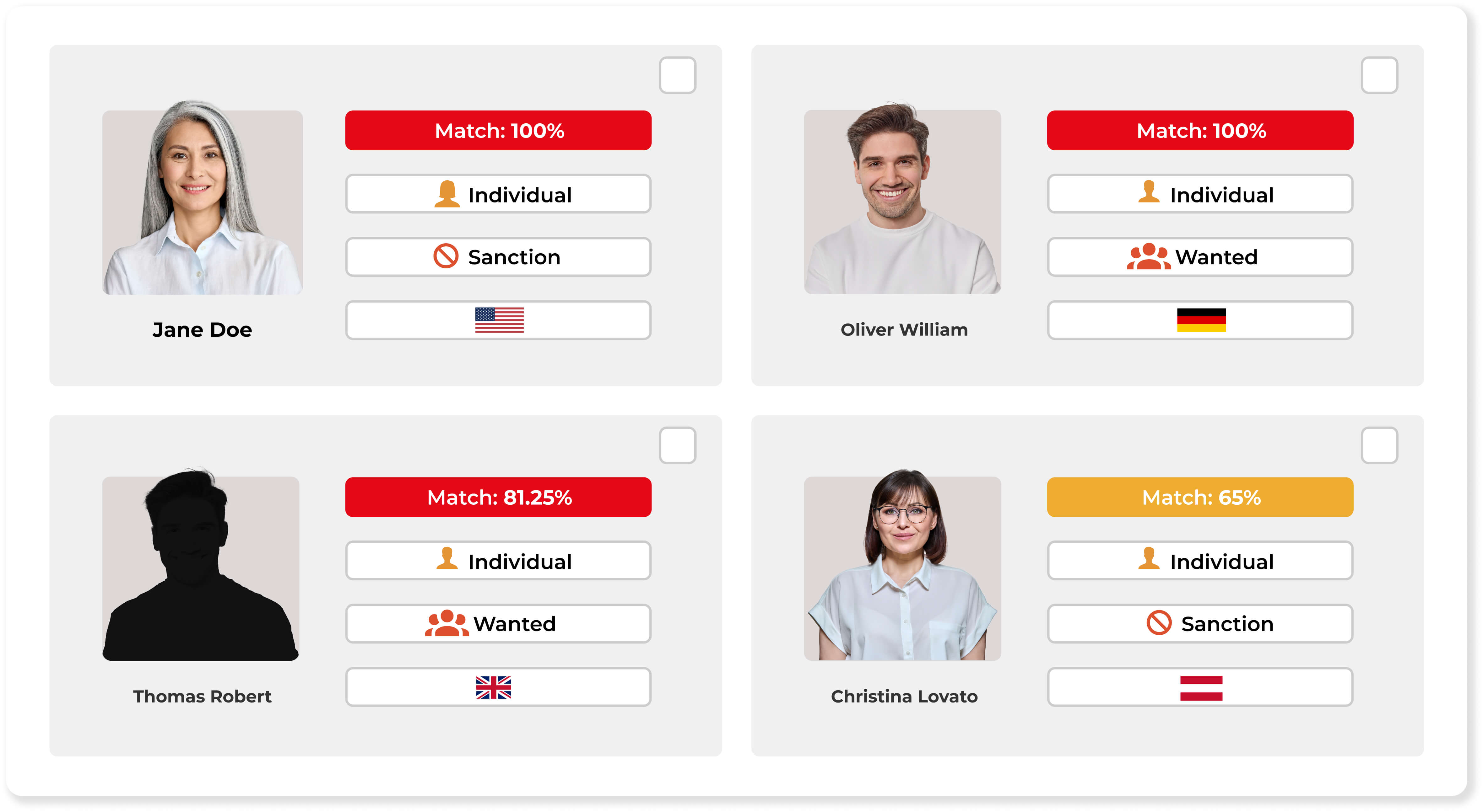

AML Name Screening

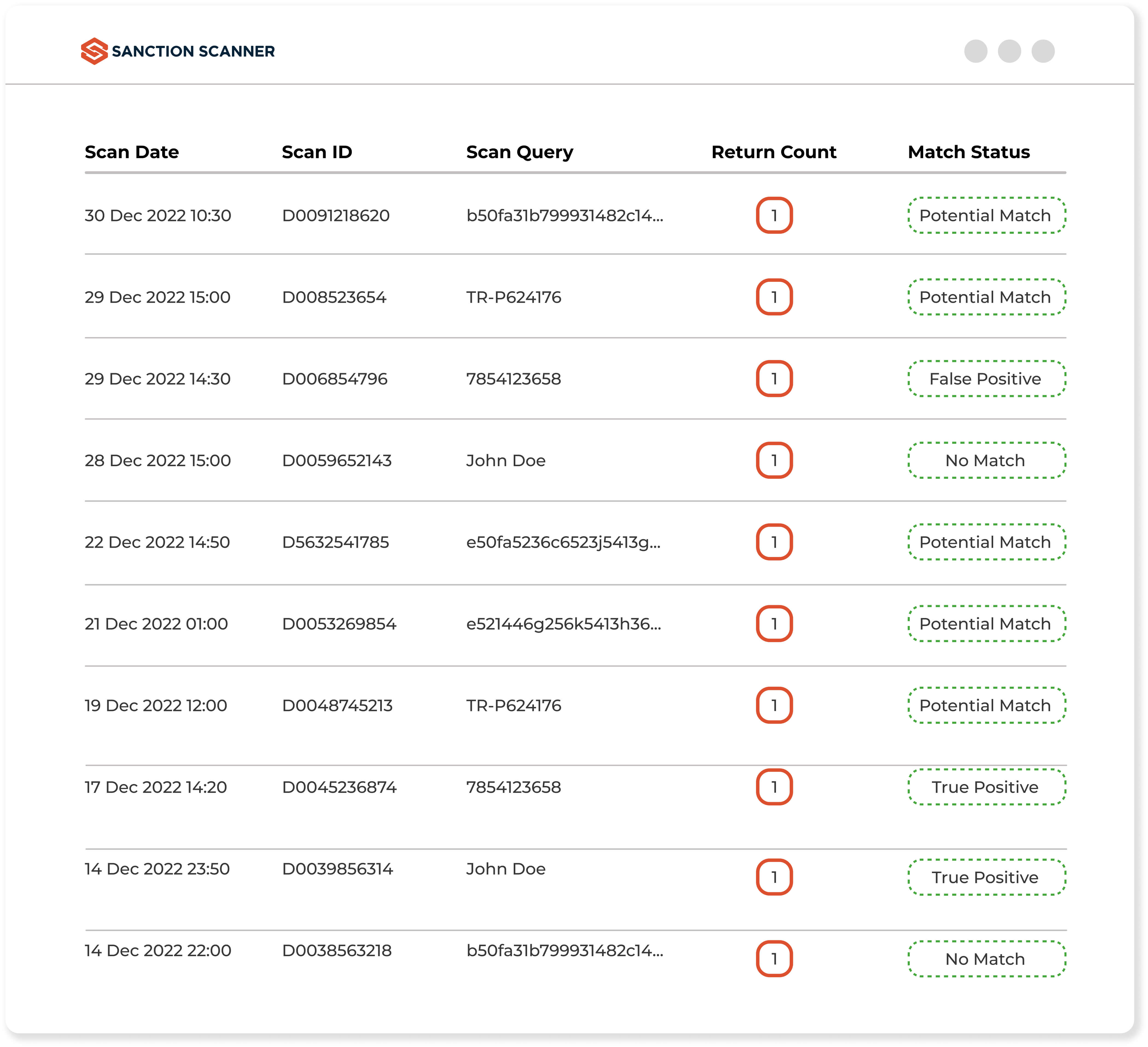

Scan your customers in 3000+ global Sanctions, Political Exposed Person lists, and Watchlists and see their risk. The data is updated every fifteen minutes.

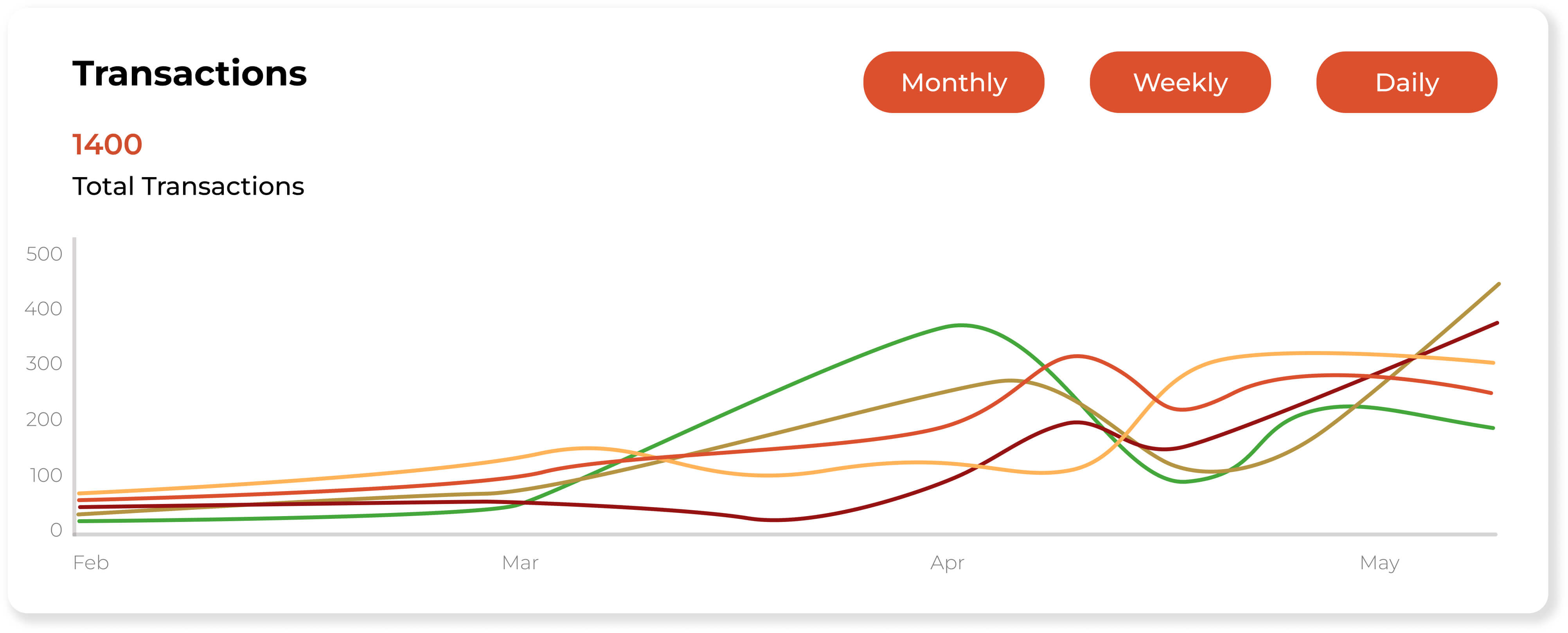

Learn MoreTransaction Monitoring

Monitor your customers' transactions, such as money transfers, with no delays. Financial institutions can automate their transaction monitoring process.

Learn MoreTransaction Screening

Financial institutions such as banks, or money transfer companies can check the receiver and sender with no delays. Automate and speed up the entire process.

Learn MoreCustomer Risk Assessment

Assign scores to your customers according to criteria such as profession, age, income, country, and currency, and make risk assessment easier.

Learn MoreKnow Your Business (KYB)

Verify Businesses, Uncover Ownership, Stay Compliant KYB is a process of verifying the information provided by a company before engaging in business with them.

Learn MoreAML Compliance is No More Complicated

Meet AML Needs

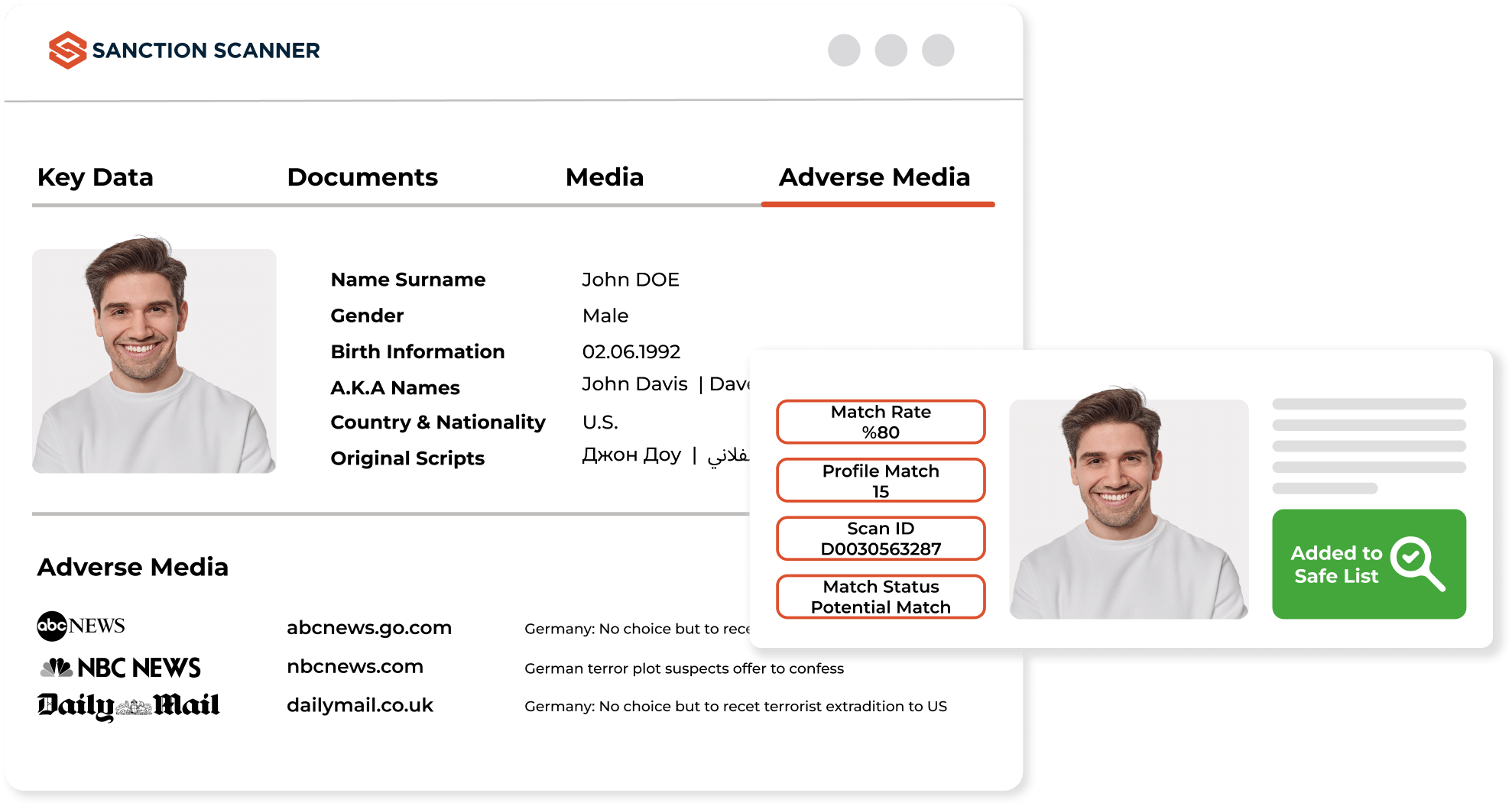

You can meet the AML needs with Global Sanction, PEP, and Adverse Media Data.

Global AML Data

We have more than 3000 different Sanctions, PEPs Wanted and Watched Lists from 220+ countries.

End-To-End Features

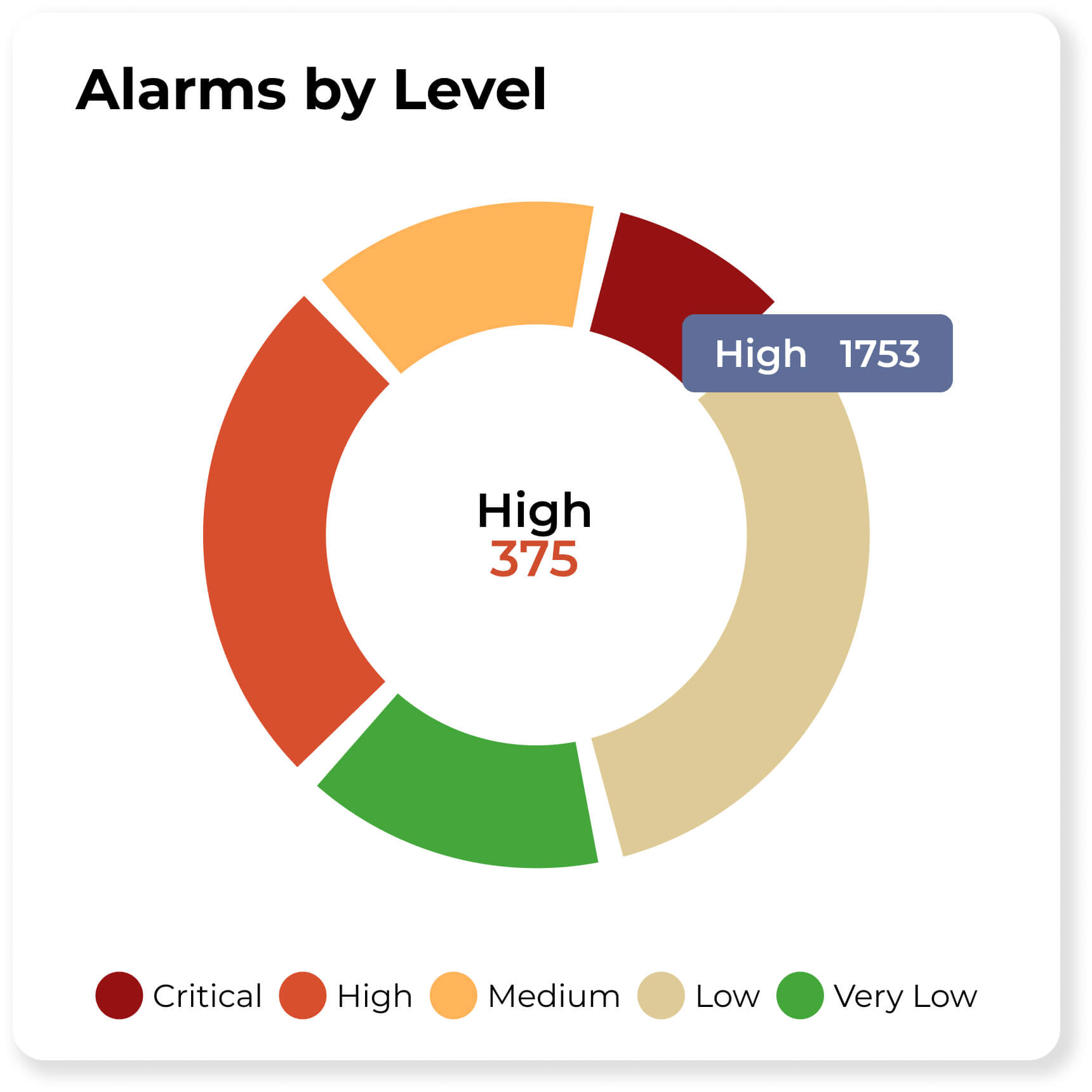

Companies of all sizes meet their Transaction Monitoring Fraud, AML, and CTF obligations using Sanction Scanner.

Industries We Serve

HOW DOES SANCTION SCANNER HELP?

Here are a few reasons to choose Sanction Scanner

Easy to use, Easy to Integrate

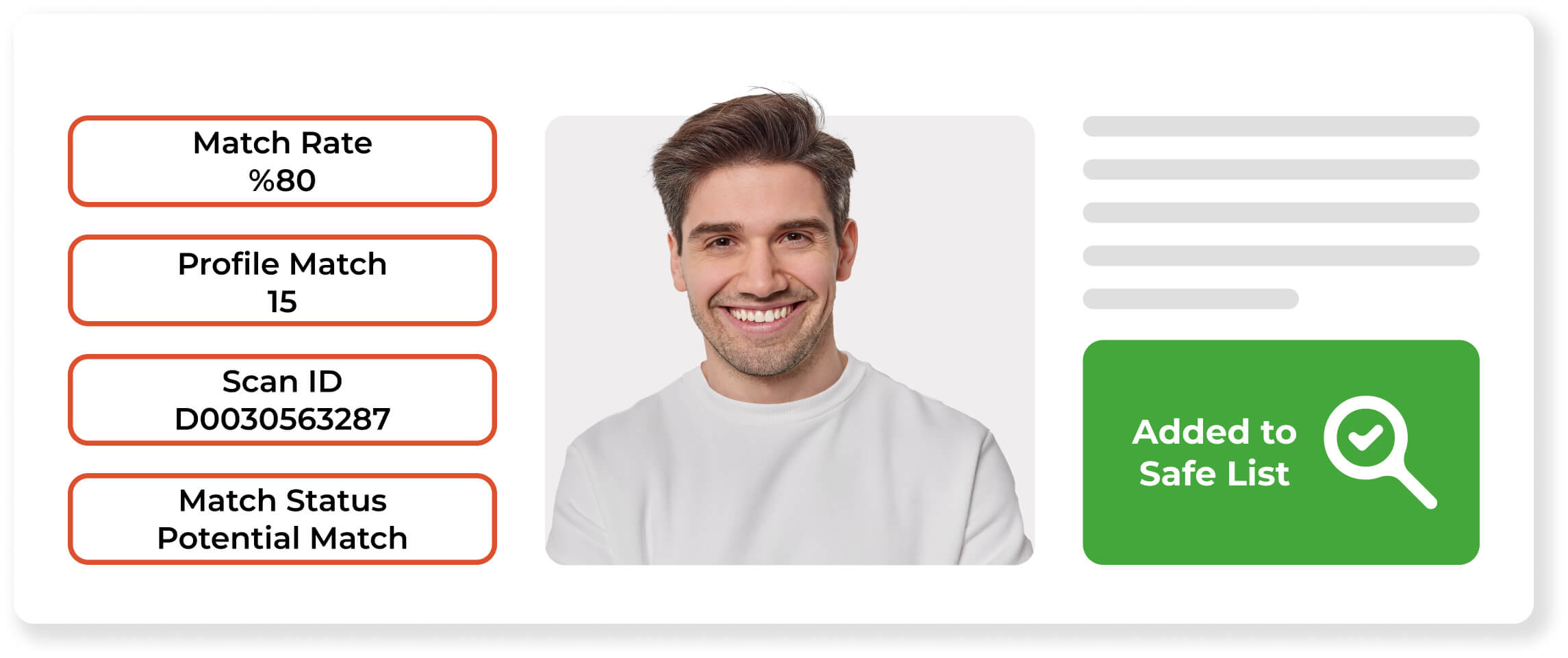

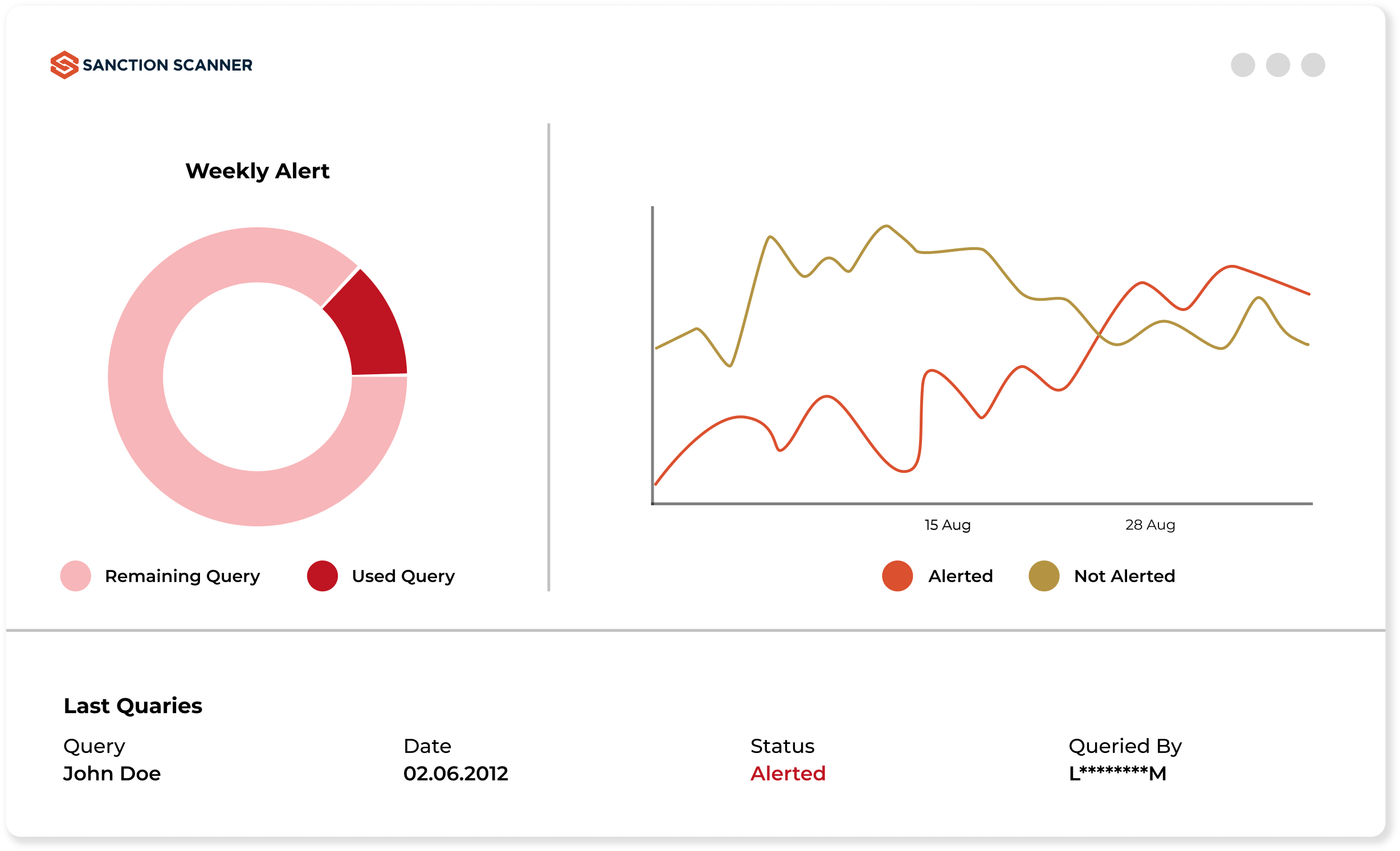

Anti-Money Laundering operations are not complicated anymore with the power of AI. Our products are easy to integrate and use. You can manage our compliance products through enhanced dashboards.

Full Data Coverage

Sanction Scanner provides a database of more than 3000 different Sanctions, PEP, Wanted and Watched lists from over 220 countries. You can automate your company's sanction lists control and classify according to risk levels.

- United Nations Sanctions (UN)

- US Consolidated Sanctions

- OFAC — Specially Designated Nationals (SDN)

- Office of the Superintendent of Financial Institutions (Canada)

- Department of State, Nonproliferation Sanctions (US)

- EU Financial Sanctions

- UK Financial Sanctions (HMT)

- Her Majesty’s (HM) Treasury List and 1000+ different government lists

Powerful API

Restful API allows projects to be flexible integrated, managed and interacted with. Sanction Scanner API has been powered by webhook. With Webhook you can provide two-way data transfer between Sanction Scanner and your own project.

- In hours integration, fast and easy integration

- 250ms average call response time

- 99.95+% uptime

Resources

“Sanction Scanner's software is easy to use, and we enjoy working with it. Since implementing its solution, we have significantly reduced false positives. The time and effort we previously spent on false positive alarms can now be directed towards other aspects of the business, which contributes to its growth.”

Guy Shaked

Legal Counsel at ironSource

“Partnering with Sanction Scanner transformed our payout operations, enhancing our compliance and customer service. Their AML solutions integrated effortlessly with our systems, resulting in a notable improvement in our operational efficiency within just one quarter.”

Michal Brzeski

Head of Global Payments at AirHelp

“What I like best about Sanction Scanner is its real-time screening capability and automated alerts. It helps us detect potential matches instantly and take immediate action, which is critical for our AML compliance.”

Tolgahan Kapanci

Head of Compliance at PeP

“With Sanction Scanner, we offer a fast, easy, and secure customer onboarding process. Thanks to its enhanced scanning tool, we focus on real risks, not false positives. Thus, we can meet our AML obligations and our customers' expectations.”

Arda Akay

Chief Compliance Officer at Tom Bank

“Sanction Scanner provided us the most comprehensive database to screen our clients. It includes lists from all over the world and is always up-to-date.”

Gulnihal Akartepe

Global Vice President at TPAY

FAQs about Sanction Scanner

Sanction Scanner is an AML compliance answer that enables companies prevent financial crime the usage of AI-powered answers. The platform allows groups meet regulatory responsibilities at the same time as minimizing guide attempt and prices the use of real-time screening, transaction tracking, and advanced danger evaluation. With a consumer-pleasant interface and robust API structure, the platform gives groups the agility to evolve and stay in advance of recent compliance demanding situations. It provides real-time screening, monitoring, and risk assessment tools tailored for dynamic regulatory environments.

Sanction Scanner offers services to a broad range of sectors that are subject to AML compliance requirements. Banks, fintechs, crypto exchanges (VASPs), and insurance firms rely on it to effectively screen customers and transactions. It also services investment firms, money transfer operators, law firms, and even non-governmental organizations operating in risky territories. Regardless of whether you are in finance, law, or global philanthropy, Sanction Scanner assists your staff in staying compliant.

Sanction Scanner is an end-to-end AML and fraud prevention solution that offers real-time monitoring, risk scoring, and seamless API integrations. Key features include: AML Name Screening, AML Transaction Monitoring, Fraud Detection, Adverse Media Screening, Sanction List Screening & Monitoring, PEP List Screening & Monitoring, Automated Daily Ongoing Monitoring, Customer Risk Assessment.

Sanction Scanner meets international AML regulation. The answer supports FATF regulations, EU AML Directives like 6AMLD, in addition to OFAC, FinCEN, and MAS directives. No matter if you run on a one-regime structure or hold local compliance initiatives in place, Sanction Scanner delivers flexible rule-composition tools to meet expectations across over 200 countries.

Real-time screening allows entities to screen customer or transaction data in real-time against sanctions lists, watchlists, PEP databases, and adverse news feeds. The moment there is a hit, the system notifies the risk in real-time via API or dashboard notification. The instant visibility allows teams to make knowledgeable decisions before onboarding a client or processing a transaction, reducing exposure and improving risk management.

Sanction Scanner is built with integration in mind. Its API-first approach allows it to be easily deployed into CRMs, banking cores, onboarding platforms, and case management systems. For teams who do not have in-house developers, no-code integration pathways and configurable modules allow for rapid deployment with minimal resources.

The platform’s facts updates occur in actual-time, frequently day by day or maybe hourly, depending on the supply. With feeds from over 3,000 respectable resources—such as OFAC, the United Nations, HM Treasury, MAS, and others—you’ll continually paintings with the most modern-day facts. This guarantees that your compliance efforts continue to be sharp and aligned with the modern international hazard intelligence.

That’s one among its key strengths. Sanction Scanner changed into built to scale with businesses of all sizes. Startups, regulation firms, and mid-sized fintechs benefit from employer-degree functions with out going through inflated costs. The cloud-primarily based platform grows together with your desires—supplying crucial tools at the beginning and taking into account enlargement as your chance environment evolves.

The platform supports screening and monitoring in more than one languages and throughout worldwide areas. It can come across risks in over 200 nations and incorporates localized compliance necessities. This makes Sanction Scanner a strong fit for companies that operate internationally or serve a numerous clientele across a couple of jurisdictions.

Getting commenced is easy. You can book a personalized demo on the website, join up for a loose trial, or speak at once with one of the platform’s compliance specialists. We will assist tailor a bundle that aligns with your enterprise, your size, and your regulatory duties.