Businesses in Nigeria, particularly those in the financial services industry, must make sure that regulatory standards are followed. Know Your Customer (KYC) is a mandatory procedure designed to reduce financial crimes, preserve trust, and improve accountability in the financial system. This guide provides a thorough analysis of Nigeria's KYC requirements, including its implementation, regulatory framework, and ongoing monitoring procedures.

What Is KYC in Nigeria?

Know Your Customer, or KYC, is a legal mandate intended to confirm and authenticate consumers' identities in order to stop financial crimes like fraud, money laundering, and financing terrorism. It is essential to maintaining the stability of Nigeria's financial system and guaranteeing the integrity of financial transactions.

KYC is not just a formality; regulatory agencies enforce it as a legal requirement to safeguard the institution and its customers and promote a transparent and safe financial environment.

Who Regulates KYC in Nigeria?

Nigeria's KYC framework is overseen by a number of important authorities, each of whom is essential to its execution and supervision:

Central Bank of Nigeria (CBN)

The main regulatory body in Nigeria for banks and other financial institutions is the Central Bank of Nigeria. The CBN creates thorough KYC (Know Your Customer) rules that financial institutions must abide by through its AML/CFT (Anti-Money Laundering/Combating the Financing of Terrorism) Regulations. In order to promote trust and lessen vulnerabilities to fraud, money laundering, and other financial crimes, these guidelines are intended to make sure that risk management policies and customer onboarding procedures comply with international standards.

Nigerian Financial Intelligence Unit (NFIU)

The identification, avoidance, and reporting of questionable transactions in financial institutions is the main objective of the Nigerian Financial Intelligence Unit. As the primary organisation in charge of financial crime intelligence, the NFIU conducts data analysis, produces reports that can be put into action, and works with regional and global organisations to stop money laundering, fraud, and the funding of terrorism.

Securities and Exchange Commission (SEC)

The Securities and Exchange Commission is in charge of monitoring KYC compliance in Nigeria's capital markets, making sure that securities transactions follow stringent ethical and anti-money laundering guidelines. In order to identify anomalies, protect investor interests, and maintain transparency, the SEC also keeps an eye on market activity. financial misconduct.

National Information Technology Development Agency (NITDA)

Protecting the confidentiality and security of digital customer data, especially during the identity verification procedures necessary for KYC compliance, is the responsibility of the National Information Technology Development Agency. Sensitive consumer data, including biometric information and personal information, is handled securely and morally thanks to NITDA's enforcement of data protection laws.

What Are the KYC Requirements in Nigeria?

Nigeria's KYC procedure requires different levels of customer data to be gathered according to the customer's operational needs and risk profile. The minimal specifications for both individual and business clients are broken down as follows:

Minimum Information Required

| Individuals | Corporate Customers |

| Full Name, Address, and Date of Birth | Certificate of Incorporation (CAC) |

| BVN (Bank Verification Number) | Tax Identification Number (TIN) |

| Valid ID (NIN, Passport, Driver’s License) | Board Resolution and Authorized Signatories |

| Utility Bill (Most Recent) | Registered Address and Ownership Structure |

Additional Requirements (Ongoing Monitoring)

Customer Risk Profiling: To ensure customised risk management, evaluate each customer's profile and activity to assign them to low, medium, or high-risk categories.

Identification of Politically Exposed Persons (PEPs): To properly handle any possible risks related to their status, conduct enhanced due diligence on clients who have been designated as PEPs.

Verification of Wealth/Funds Source: To stop and protect against illegal financial activities, require clients to disclose the source of their funds.

Frequent updates to KYC: Revise Know Your Customer (KYC) data on a regular basis according to the risk category of the client:

- Low risk: Every 3 years

- Medium risk: Every 2 years

- High risk: Annually

How Do Nigerian Banks Implement KYC?

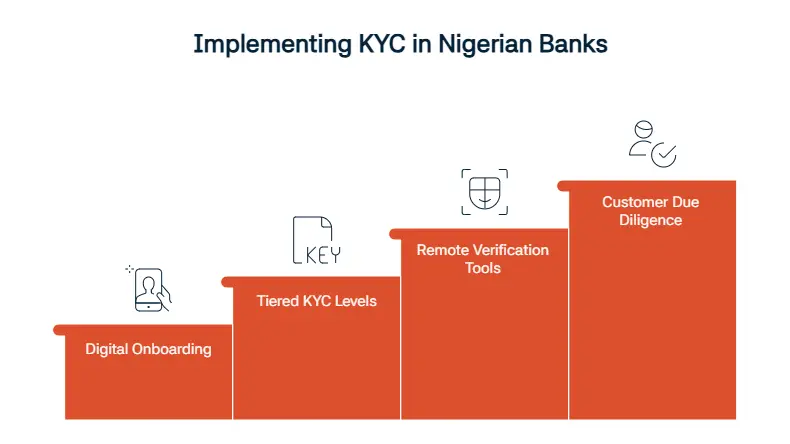

Nigerian banks use a number of strategies to successfully execute KYC while adhering to legal requirements:

Digital Onboarding

In order to facilitate electronic KYC (eKYC), many banks now use a combination of BVN (Bank Verification Number) and NIN (National Identity Number), greatly expediting the customer onboarding process. People can now open accounts or access banking services conveniently from their devices, frequently in a matter of minutes, thanks to this digital approach that does away with the need for a lot of paperwork.

Tiered KYC Levels

To accommodate different customer risk profiles and financial needs, the Central Bank of Nigeria (CBN) implemented tiered KYC (Know Your Customer) levels:

Tier 1 accounts are intended for low-risk clients; they need little paperwork and are best suited for people who don't do much with their money. To reduce risk, they do have transaction limits, though.

Higher-risk clients or those making larger transactions are the target of Tier 2 and Tier 3 accounts. To meet regulatory requirements, they are subject to more stringent scrutiny and demand more comprehensive documentation, such as evidence of residency or income.

Remote Verification Tools

Banks are using sophisticated remote verification tools to enhance identity verification. These consist of OTP-based address verification techniques, secure document upload portals for identity verification, and facial recognition software. By eliminating the need for in-person trips to bank branches, these innovations not only improve security but also streamline the procedure.

Customer Due Diligence (CDD)

Banks must conduct Customer Due Diligence (CDD) both when opening an account and continuously after that. By keeping customer profiles current and accurate, this procedure lowers the possibility of fraud and non-compliance. Verifying customer identities, keeping an eye on transactions for questionable activity, and making sure that anti-money laundering (AML) and counter-terrorism financing (CTF) laws are followed are all part of CDD.

What Are the Penalties for KYC Non-Compliance in Nigeria?

Non-compliance with KYC regulations can result in significant penalties, ranging from financial fines to reputational damage:

| Violation | Penalty |

| Failure to conduct Customer Due Diligence (CDD) | Up to ₦1 million per instance |

| Not reporting suspicious transactions | Criminal prosecution & potential license revocation |

| Breach of data privacy during verification | Up to ₦10 million (NITDA fine) |

Since 2022, enforcement by the CBN and EFCC has increased, resulting in heightened accountability across Nigeria’s financial institutions.

How Does KYC Apply to Crypto, Fintech, and Mobile Money in Nigeria?

KYC requirements have had to be expanded to include cryptocurrency exchanges, fintech platforms, and mobile money operators due to the growing use of technology-driven financial services:

Cryptocurrency exchanges

In order to comply with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations, cryptocurrency platforms must establish comprehensive KYC (Know Your Customer) procedures, even though formal licensing frameworks are still developing. These procedures frequently incorporate biometric verification tools like fingerprint and face recognition, therefore allowing platforms to safely confirm user identities.

Fintech Startups

To stop fraud, improve transparency, and guarantee accurate identity verification, digital lenders, mobile wallet providers, and other fintech companies must strictly adhere to the CBN's 2023 KYC Guidelines. This includes multi-tiered KYC procedures, like enhanced due diligence for high-risk users and basic KYC for low-risk users. Keeping thorough user records and reviewing their compliance protocols on a regular basis are things fintech startups must also do to stay in line with changing regulations.

Mobile Money Operators

By using SIM-NIN (Subscriber Identity Module-National Identification Number) integration, mobile money operators lower the risk of fraud and identity theft by instantly verifying the identities of their customers. In order to guarantee correct data collection and adherence to legal requirements, agent networks, which are essential to customer onboarding, are thoroughly trained in KYC protocols.

Digital Identity & BVN/NIN Integration in Nigeria

Two key technologies facilitate KYC implementation in Nigeria:

Bank Verification Number (BVN): All Nigerian bank customers must have this special identification number. To guarantee safe banking transactions, it offers biometric verification services like fingerprint and facial recognition. In order to fight fraud and boost confidence in the financial industry, the BVN is an essential part of digital identity management.

National Identity Number (NIN): Utilised in a variety of industries, such as banking, telecommunications, and fintech applications, the NIN is crucial. It is a fundamental tool that facilitates extensive electronic Know Your Customer (eKYC) procedures, expedites identity verification, and drastically lowers fraudulent activity. It promotes a single national identity system while guaranteeing that people can access services more effectively and securely

FAQ's Blog Post

KYC (Know Your Customer) in Nigeria refers to the process of verifying the identity of customers to prevent fraud, money laundering, and terrorist financing.

The Central Bank of Nigeria (CBN) issues KYC guidelines, supported by the Money Laundering (Prevention and Prohibition) Act and related AML/CFT laws.

All banks, financial institutions, fintechs, and certain designated non-financial businesses and professions (DNFBPs) must comply.

Typically, a valid ID, proof of address, and in some cases, additional verification like BVN (Bank Verification Number) are required.

Yes, all account holders must complete KYC to open and maintain a bank account.

Yes, KYC applies to mobile money operators and fintechs, with requirements adjusted for different account tiers.

Your account may be restricted, frozen, or closed until KYC verification is completed.

Financial institutions must update KYC records periodically, especially when there are changes in customer information or risk profile.