What is Compliance Software?

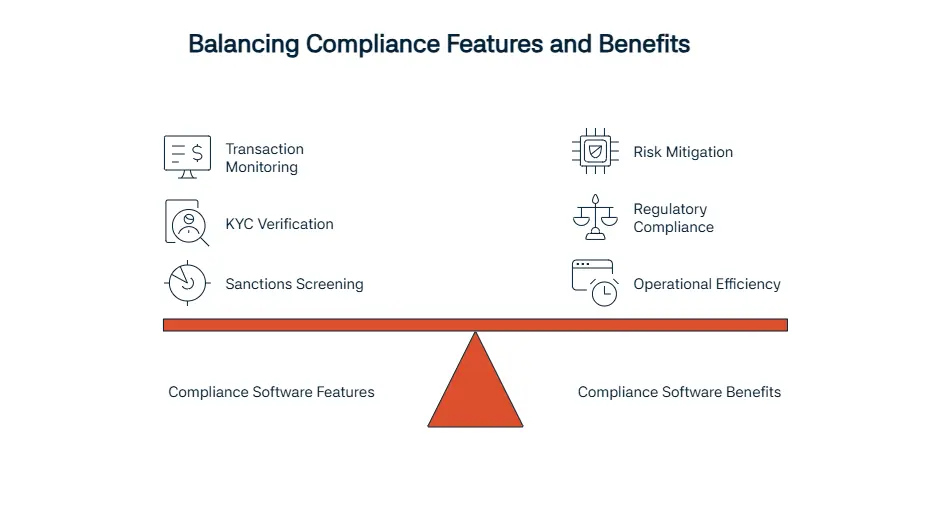

In this blog post, we’ll talk about what compliance software is and the best examples of companies who provide these softwares. Compliance software is used by companies who are looking to reach anti-money laundering (AML) compliance. The compliance software also provides transaction monitoring, Know Your Customer (KYC) verification, risk assessment, and regulatory monitoring.

The software also provides sanctions screening for those who are looking to check customers agains global watchlist. Another similar but equally important feature is adverse media monitoring, which goes through negative news to figure out whether your customer is of high risk or not. According to Biztech Magazine, one other feature that helps immensely is automation; this feature should be included in your software in 2025 to help speed up the process of reaching compliance. The features we mentioned above also help support customer due diligence (CDD). The final feature we’ll mention, multi-jurisdictional compliance helps businesses operate without trouble in different jurisdictions.

The 12 Best Compliance Software Tools and Solutions for 2025

1. Sanction Scanner – Best All-in-One AML Compliance Software

Sanction Scanner is the first software tool we’ll talk about. This company offers compliance solutions designed for sectors like fintech, crypto, banking, and DNFBPs. It’s a regulatory technology (RegTech) company that prioritises API integration; it has features that help with AML screening, PEP list monitoring, and transaction monitoring.

Sanction Scanner is ISO 27001 certified and GDPR-compliant; these prove that Sanction Scanner is the right option for you. Firms have had a 45% reduction in false positives and a 60% faster customer boarding process thanks to this company. Teams can assign scores to customers based on specific criteria such as profession, country, currency and more. The customer feedback supports this company as well; Sanction Scanner has a 4.9 rating out of 5 on G2 and a 4.8 rating out of 5 on Gartner.

2. ComplyAdvantage

ComplyAdvantage is another RegTech company on our list. This company is known for their AI-driven compliance tools that have a risk database. Using these tools, ComplyAdvantage helps firms prevent financial crime in an efficient way.

ComplyAdvantage offers dynamic risk scoring for counterparties; this feature makes sure both the customer and partner profiles are updated constantly. Real-time adverse media monitoring and regulatory updates are other features this company brings to the table. The flexibility offered by ComplyAdvantage’s customer screening and transaction monitoring solutions has significantly reduced false positives and streamlined alert management.

ComplyAdvantage proves its expertise by its 4.6 out of 5 rating on G2 and 4.5 out of 5 rating on Gartner.

3. LexisNexis Risk Solutions

LexisNexis is another example of companies that offer compliance tools and solutions. The sectors that use this company the most are banking, insurance, and the public sector. So, what does LexisNexis offer? AML compliance, ID verification, fraud prevention, and regulatory intelligence are some of the features their tools offer.

LexisNexis Risk Solutions operates within the Risk & Business Analytics market segment of RELX, a multinational information and analytics company based in London. LexisNexis is best known for their deep KYC verification and identity resolution, bringing a sense of safety to companies that use them. Enterprise-level global data coverage is given by LexisNexis for companies that might need this volume of work.

LexisNexis has a 4.5 out of 5 rating on G2 and a 4.4 rating out of 5 on Gartner.

4. Dow Jones Risk & Compliance

We’ll talk more about Dow Jones Risk & Compliance now. This company focuses mostly on sanctions data, PEP screening, and corporate ownership mapping. These features help companies in reaching compliance and keeping safe.

Lack of visibility into risk profiles of third parties, inability to manage regulatory compliance at scale, and ongoing supply chain disruption can make it difficult for ethics and compliance teams to make informed decisions about who to do business with. Proprietary sanctions and PEP databases are also important for this company since these features are what make Dow Jones shine the most. Also, regulatory due diligence tools offered by Dow Jones are helping compliance teams investigate suspicious transactions.

This company has a 4.6 out of 5 rating on G2 and a 4.5 out of 5 rating on Gartner.

5. NameScan

NameScan is our next example, mostly known for its solutions that are tailored to startups, SMEs, and businesses seeking low-cost tools that still deliver compliance. Sanctions screening, PEP monitoring, and white label AML solutions are offered by NameScan, with a pay-as-you-go model that ensures companies reach accessible help.

NameScan has a flexible API system that is easily integrated to your already existing frameworks. One thing that sets NameScan apart from other companies is that it doesn’t need long-term contracts. With its affordable pricing, businesses of all sizes can try NameScan. NameScan has a 4.4 rating out of 5 on G2, and a 4.3 out of 5 rating on Gartner.

6. Fenergo

One other example we can give for the best compliance tools is offered by Fenergo. This company offers a Client Lifestyle Management (CLM) solution that is supported by banks, wealth managers, and investment firms. Its main focuses are onboarding automation, client due diligence, and regulatory compliance. With Fenergo, you get an end-to-end client lifecycle management that also offers embedded KYC and AML workflows, which help with even the strictest compliance standards.

It has a 4.5 out of 5 rating on G2 and a 4.6 out of 5 rating on Gartner.

| Tool Name | Best For | G2 Rating | Gartner Rating |

| Sanction Scanner | All-in-One AML & Compliance | 4.9 | 4.8 |

| ComplyAdvantage | Real-Time Risk Intelligence | 4.6 | 4.5 |

| LexisNexis Risk Solutions | Enterprise-Level Compliance | 4.5 | 4.4 |

| Dow Jones Risk & Compliance | Advanced Regulatory Research | 4.6 | 4.5 |

| NameScan | Affordable PEP & Sanction Screening | 4.4 | 4.3 |

| Fenergo | Client Lifecycle Management |

4.5 | 4.6 |

| Amlock | Transaction Monitoring Focus | 4.3 | 4.2 |

| Encompass Corporation | KYB & Corporate Intelligence | 4.5 | 4.4 |

| NorthRow | Fast Identity Checks | 4.4 | 4.3 |

| Shufti Pro | eKYC & AML Integratio | 4.6 | 4.5 |

| Ondato | Simplified Compliance Suite | 4.3 | 4.2 |

| Beam Solutions | AML for Startups | 4.2 | 4.1 |

7. Amlock by 3i Infotech

3i Infotech is the next company we’ll talk about. The this company offers, AMLOCK, is best known for its rules-based monitoring and risk-based alerting. The intelligent alert generation this tool offers will deal more with high-risk customers and will make sure compliance teams are not spending the same amount of time on both high-risk and low-risk customers.

One of the important features of 3i Infotech’s AMLOCK Analytics is the reduction of false positives using risk profiling, through predictive analytics that identifies potential risk automatically. This tool also filters out false-positives effectively, helping you reach your desired result faster without any fake results.

This company has a 4.3 rating out of 5 on G2 and 4.2 out of 5 rating on Gartner.

8. Encompass Corporation

Our next company we’ll talk about is Encompass Corporation. This company is best known for working with B2B fintechs, legal tech providers, and supply chain finance organizations. The features Encompass offers are KYC onboarding, ultimate beneficial ownership (UBO) visualisation, and ownership screening. With Encompass, you’ll get real time UBO and shareholder mapping. How does this help? The purpose of this feature is to help compliance teams when they are uncovering hidden ownership layers. With its global corporate registry integration, it keeps your company’s information correct constantly and reduces the time needed for onboarding.

With Encompass Corporation’s new EC360 platform, integration of public and private data sources, provides banks with a 360-degree view of their corporate clients.

This company has a 4.5 our of 5 rating on G2 and a 4.4 out of 5 rating on Gartner.

9. NorthRow

One other company on our list is NorthRow. This company works mostly with regulated SMEs, HR services, and the real estate sector. It offers biometric onboarding, KYC automation, and compliance screening that help during the AML compliance process. With NorthRow’s fast biometric ID verification service, onboarding is made faster and more safely. When paired with streamlines AML onboarding, NorthRow will help you reduce your compliance costs.

It has a 4.4 out of 5 rating on G2 and a 4.3 rating out of 5 on Gartner.

10. Shufti Pro

Shufti Pro is another company we’ll give more information about. This company mostly collaborates with crypto firms, fintech companies, and organizations requiring remote onboarding. It has features like facial recognition KYC, sanctions list screening, and global AML compliance that help deliver the best results for companies. The company is known for offering multilingual, multi-country onboarding, with helps companies work with customers all around the world. The strong fraud prevention layer that is provided by Shufti Pro helps prevent activities that might be done with fake or stolen documents.

This company has a 4.6 out of 5 rating on G2 and a 4.5 rating out of 5 on Gartner.

11. Ondato

Ondato is our second-to-last company that offers software tools on the list of best 12 compliance tools. This company works with digital lenders, neobanks, and EU-regulated organizations. It offers customers an AML suite that comes with onboarding flow automation and KYC/KYB processes.

This platform is known for their fully automated onboarding flowes, which reduces manual labor and speeds up the onboarding process. It also offers GDPR-aligned verification processes that help ensure companies get the privacy and regulation compliance they deserve. The Video Identity Verification tool they offers allows businesses to remotely verify customers’ identities in real-time and onboard them while meeting all personal data protection laws. Ondato has a 4.3 rating out of 5 on G2 and a 4.2 rating out of 5 on Gartner.

12. Beam Solutions

The last company on our list is Beam Solutions. This company works with fintech startups and seed-stage firms mostly. They offer cost-effective AML tools for these type of companies who are just getting started on their compliance journey. Beam Solutions offers simplified compliance with an easy setup, coupled up with rapid implementation.

The no-code user interface by the company helps you make changes without technical expertise. With an affordable entry plan, Beam Solutions is great for those who are starting their compliance journey with a small budget. This company operates mainly in the U.S. This company has a 4.2 out of 5 rating on G2 and a 4.1 out of 5 rating on Gartner.

How to Choose the Right AML Compliance Solutions in 2025

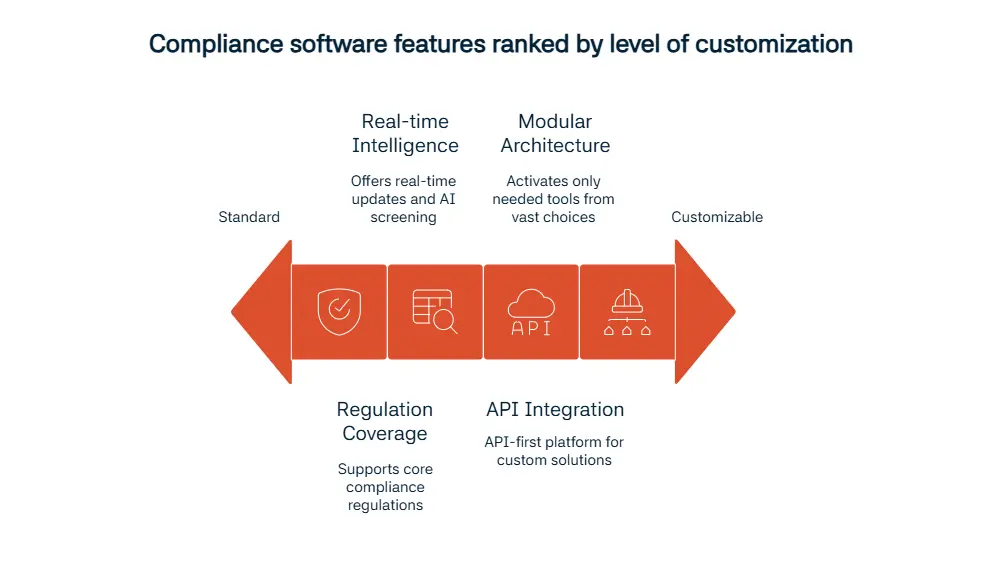

Now that we’ve talked about the best software tools offered by well-known companies, it’s time to give advices about the right software for you. The first thing to consider is the regulation coverage. The right platform for you should support FATF, EU AMLDs, FinCEN, FCA, MAS compliance and more.

Another thing to keep in mind is the real-time intelligence. Tools with real-time sanction list updates, also offering adverse media and AI screening are the right ones for you. One other feature to ask for is API integration. Sanction Scanner or ComplyAdvantage are great for scaling since they are API-first platforms that support customisation. One other thing to consider is security compliance; making sure that ISO 27001, GDPR, and SOC 2 Type II certifications are obtained by your software and company of choice is essential.

Finally, modular architecture will help you greatly. This system will help you activate only the tools you need from the vast choices you have.

Why Sanction Scanner Leads Compliance Software in 2025

We at Sanction Scanner are sure that you won’t regret using our software for reaching compliance. Sanction Scanner has data coverage of more than 220 countries. What’s more is, you can get real time AML/PEP/adverse media alerts with Sanction Scanner. Our API is customisable, meaning you have the control to implement what you want for your company. Our Sanction Scanner team offers tools for fintechs, crypto firms, and regulated corporates. Our tools and software are ready for FATF, BSA/AML, GDPR, and EU AMLD requirements.

FAQ's Blog Post

We define compliance software as a tool that helps businesses meet AML, KYC, and regulatory requirements with automation and accuracy.

We believe every compliance tool today should offer AML screening, transaction monitoring, CDD, sanctions checks, and adverse media monitoring.

We help businesses reduce financial crime risk, avoid penalties, and automate compliance across jurisdictions.

We provide customizable APIs, and risk scoring tools that speed up onboarding and cut false positives.

We work with fintechs, banks, crypto firms, insurers, and DNFBPs—basically any regulated entity that needs AML tools.

We support teams with automated identity checks, PEP/sanction list screening, and ongoing monitoring to meet KYC/CDD obligations.

We offer a modular, API-first platform with 220+ country coverage and some of the fastest onboarding tools in the industry.