What is PEP?

A Politically Exposed Person (PEP) is an individual who holds a prominent public position or has held such a role in the recent past, and as a result, is considered at higher risk for involvement in bribery, corruption, or other financial crimes. The term includes not only the person in the role but also close family members and known associates.

Why Are PEPs Considered High Risk?

As they have political power, PEPs can access public funds, and they have power over decision-making processes, which might give them the opportunity to engage in illicit activity. PEPs do not simply imply wrongdoing, but rather that they are significant threats to financial institutions. That is why financial institutions apply Enhanced Due Diligence (EDD) to control potential risk factors.

Who is Considered a Politically Exposed Person?

A Politically Exposed Person (PEP) is someone who holds — or has recently held — a prominent public position that may present a higher risk of involvement in corruption, bribery, or financial crime due to their influence and access to funds.

Being a PEP is not an indication of wrongdoing, but it requires financial institutions to apply enhanced due diligence when entering into or maintaining a business relationship with such individuals.

Government Officials

Government officials include senior regional or local officials like mayors and governors, members of high-level judicial units like the Supreme Court and Constitutional Court, ministers and deputy/assistant ministers, heads of state and government like presidents, monarchs, and prime ministers, and lastly members of high-level judicial bodies like the Constitutional Court and Supreme Court.

Public Sector Executives

Senior officials of enterprises that are owned by the state, like CEOs, CFOs, and board members, central bank and deputy governors, board members and heads of regulatory bodies such as financial, telecom regulators, etc., senior police and law enforcement officials, and senior military officials are all counted as the public sector executives.

Judiciary and Prosecution Officials

People who fall under the judiciary and prosecution officials are judges of the supreme or constitutional courts, officials in high-ranking positions in oversight bodies, and attorneys general and public prosecutors.

Political Party Leaders

Party chairpersons and deputy leaders are political party leaders. Furthermore, members of executive committees or central councils, party general secretaries, and national spokespersons are also included in the political party leaders category.

Officials of International Organizations

Apart from ambassadors and high commissioners, members of governing bodies in international organizations like UN, EU, NATO, etc. and executive heads of UN agencies or international financial institutions are also officials of international organizations.

Family Members and Close Associates (RCAs- Related/Close Associates)

PEPs’ siblings, children, their children’s partners, their own partners, parents and parents-in-law, people who are known to have united beneficial ownership of legal entities with the PEP, and lastly, people who own close business ties or joint accounts with the PEP are all close associates and family members of the PEP.

Legal Entities and Structures Associated with PEP

This category includes organizations where the PEP has an important amount of control or impact, the foundations ot trusts in which a PEP is a trustee, beneficiary, or settlor, and companies where a PEP has %25 or more of the shares or voting rights.

Categories of Politically Exposed Persons

Politically Exposed Persons (PEPs) are individuals who hold prominent public positions or have significant influence in government, politics, or public administration. These individuals are categorized into distinct types based on their roles and responsibilities.

| Types of Politically Exposed Persons | Category | Examples |

| Domestic PEPs | Individuals holding prominent public positions in their own country | Members of Parliament, mayors |

| Foreign PEPs | Individuals holding public positions in foreign countries | Foreign ambassadors, foreign presidents |

| International Organization PEPs | Senior members of international institutions | UN, IMF, World Bank executives |

| Family Members | Relatives of a PEP | Spouse, children, siblings, parents |

| Close Associates | Persons linked to a PEP through business or personal ties | Long-term partners, legal representatives |

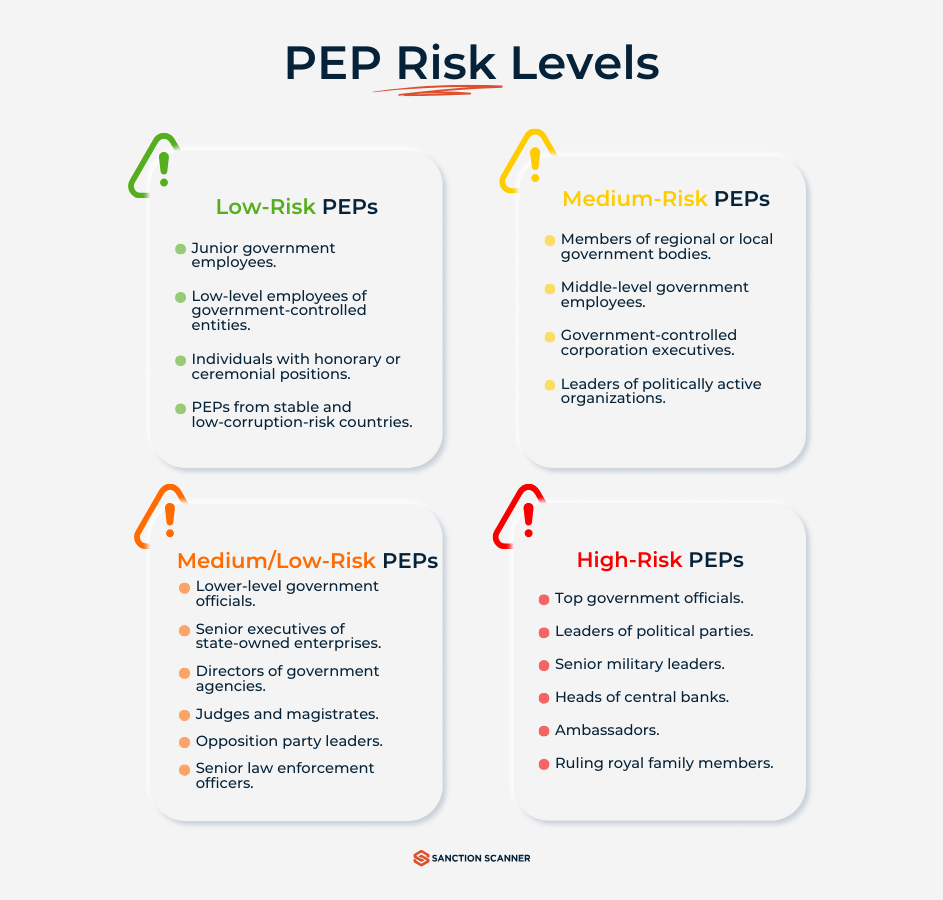

What Are the Risk Levels of a Politically Exposed Person?

High-risk individuals with high political influence pose a threat in financial crimes or fraudulent practices.

Medium-risk individuals indirectly involved with high-risk institutions are still required to be monitored.

Low-risk individuals with minimal exposure are less likely to be involved in high-risk activities, yet they must be monitored closely.

What Are the Red Flags of a Politically Exposed Person?

- Bribery includes the offering and receiving of something of value to change actions.

- Illicit enrichment is gaining assets that cannot be legally justified by the officially declared income of individuals.

- Use of shell companies and other proxies includes the process of hiding the ownership of assets to avoid taxes.

- Abuse of public authority is the misuse of political power for personal gain.

How to Identify Politically Exposed Persons?

Screening Tools

Screening tools such as Sanction Scanner’s provide professional solutions that can select relevant data from global PEP databases and sanctions lists (UN, OFAC, EU etc.). The purpose here is to match customer profiles and company details against risk profiles.

Why are Screening Tools Important?

Regulatory Compliance: Automated checks under FATF, FinCEN, and EU AMLD rules are mandatory.

Speed Efficiency: Quickly process records and avoid systemic delays.

High Accuracy: AI-powered matching systems make sure the results are correct and that the hidden acts are revealed.

Best Practices

- Utilize professional screening tools in your KYC/CRM systems.

- Monitor customers continuously, not just once.

- Use a system with multiple languages to catch name changes.

- Save all records and matches for a full audit trail.

Enhanced Due Diligence (EDD)

Enhanced Due Diligence (EDD) is an advanced process that is used for high-risk customers, especially Politically Exposed Persons (PEPs). The aim here is to assess their source of wealth and determine their financial behavior beyond standard KYC.

Why is Enhanced Due Diligence (EDD) Important?

- It reduces corruption risks, ensuring that funds are not linked to illegal activities.

- It provides clear records of PEPs.

- It detects negative media and unusual PEP activity.

Best Practices

- Verify with official sources such as tax returns and assets.

- Screen regularly to achieve the best results.

- Get approval from seniors before starting relations with high-risk PEPs.

- Provides clear records for a secure system.

Risk Scoring Models

Risk scoring models include customer details such as a person’s country of origin, political position, job sector and transaction behavior. The aim here is to measure how risky customers are. Scores automatically change as new data comes in.

Why are Risk Scoring Models Important?

- Prioritization: Focuses on high-risk customers.

- Consistency: Ensures everyone is reviewed no matter the location.

- Efficiency: Uses resources detecting the roots of higher risk factors.

Best Practices

- Check global data sources like FATF and Transparency International.

- Combine rules and AI/ML smart technology systems. This helps you detect both known facts and unusual risks.

- Add new transaction data so that the risk scores can remain accurate.

- Test the system to ensure it works well. Document any changes in methodology.

What are the Key Challenges in Detecting Politically Exposed Persons?

Managing PEP-related compliance is a critical yet complex task for financial institutions and regulated entities. While screening for PEPs is essential for preventing financial crime, compliance teams face several ongoing challenges:

1. Real-Time Status Changes: It is common for PEP activities to suddenly change. That is why institutions must be attentive to the following updates.

2. Global Database Inconsistencies: As PEP lists are not centralized, it can be difficult to detect PEPs’ activities.

3. High False Positive Rates: Screening similar names can consume time and increase the workload.

4. Manual Enhanced Due Diligence (EDD) Workloads: As identifying PEPs requires conducting EDD procedures, this process can slow down onboarding and cause extra expenses.

5. Jurisdictional Variability: It can be challenging to follow up-to-date policies for each region in the world to identify PEP risks.

6. Lack of Contextual Risk Scoring: As many screening tools only show a simple yes or no PEP results, this makes it difficult to distinguish real risk factors.

What Is PEP Status and Why Does It Matter in Compliance?

PEP status indicates if one is a Politically Exposed Person, who holds or held an outstanding public position like politicians, judges, military officials, and etc. Because they can reach public funds or influence them easily, this status is an alert for a higher risk of involvement in money laundering or fraud.

PEP Status Meaning in KYC and Customer Due Diligence (CDD)

PEP status in KYC is the categorization of people that can entail a higher amount of risk when it comes to money laundering since they have outstanding public functions.

Understanding PEP Status in Mutual Funds and Investment Platforms

In order to provide AML compliance, mutual fund platforms and MF Central evaluates PEP status. In this part, we discover PEP classification's influence on investor onboarding and risk profiling in the asset management sector.

Global PEPs Table – July 2025

| Category | Name | Position / Title | Country / Organization |

| Heads of State | Xi Jinping | President | China |

| Narendra Modi | Prime Minister | India | |

| Luiz Inácio Lula da Silva | President | Brazil | |

| Emmanuel Macron | President | France | |

| Donald Trump | President | United States | |

| Prime Ministers | Olaf Scholz | Chancellor | Germany |

| Justin Trudeau | Prime Minister | Canada | |

| Fumio Kishida | Prime Minister | Japan | |

| Giorgia Meloni | Prime Minister | Italy | |

| Royalty | King Charles III | King | United Kingdom |

| Mohammed bin Salman | Crown Prince | Saudi Arabia | |

| Queen Máxima | Queen (Former Finance Executive) | Netherlands | |

| Prince Albert II | Sovereign Prince | Monaco | |

| Judiciary / Senior Roles | John Roberts | Chief Justice | U.S. Supreme Court |

| Baroness Brenda Hale | Former President of the Supreme Court | United Kingdom | |

| Christine Lagarde | President | European Central Bank (ECB) | |

| International Organizations | António Guterres | Secretary-General | United Nations |

| Kristalina Georgieva | Managing Director | International Monetary Fund (IMF) | |

| Ursula von der Leyen | President | European Commission | |

| Tedros Adhanom Ghebreyesus | Director-General | World Health Organization (WHO) | |

| Former Senior Officials | Hillary Clinton | Former Secretary of State / U.S. Senator | United States |

| Boris Johnson | Former Prime Minister | United Kingdom |

What Are the Regulations of Politically Exposed Persons?

FATF (Financial Action Task Force):

Financial Action Task Force (FATF) is an international body that sets global standards to prevent money laundering and terrorist financing. FATF identifies Politically Exposed Persons (PEPs) by applying Enhanced Due Diligence (EDD). In this way, it manages the risk factors and prevents the abuse of political power. FATF does not publish a PEPs list but it helps institutions monitor individuals through a guideline.

EU 6th AML Directive:

The EU 6th Anti-Money Laundering Directive emphasizes the importance of identifying PEPs as part of combating financial crimes within the European Union. It mandates both the identification and ongoing monitoring of PEPs to ensure transparency and accountability. The directive also enforces strict legal liability for financial institutions in cases of non-compliance, reinforcing the importance of adhering to AML regulations across member states.

UK Law:

UK Law clearly declares in the 2017 Money Laundering Regulations (MLR) that firms must manage the transactions of Politically Exposed Persons (PEPs). The Financial Conduct Authority (FCA) provides guidance to businesses on PEP-related risks.

U.S. FinCEN Guidelines:

U.S. FinCEN Guidelines encourage financial institutions to effectively manage PEP-related risks. Institutions are better protected when they monitor their activities and file Suspicious Activity Reports (SARs) under the Bank Secrecy Act (BSA).

What Are the PEP and Compliance Requirements by Jurisdiction?

| Country/Region | Legal Definition of PEP | Monitoring Period | Primary Regulator |

| United Kingdom | Yes (Money Laundering Regulations 2017) | Lifetime + 12 months post-role | Financial Conduct Authority (FCA) |

| United States | No strict legal definition | Risk-based approach | Financial Crimes Enforcement Network (FinCEN) |

| European Union | Yes (6th Anti-Money Laundering Directive) | Legally defined in national laws | European Banking Authority (EBA) & Local Regulators |

| Singapore | Yes (Monetary Authority of Singapore Guidelines) | Risk-based approach | Monetary Authority of Singapore (MAS) |

What are the Differences between PEPs and Sanctioned Individuals?

Politically Exposed Persons (PEPs) are in high positions while sanctioned figures are listed by governments because they are involved in illegal activities such as money laundering, terrorism, and human rights violations.

| Aspect | PEP | Sanctioned Individual |

| Risk Type | Political exposure | Legal and national security risk |

| Listed Publicly? | Not necessarily | Often on official government lists |

| Business Restrictions | Enhanced Due Diligence (EDD) required | Usually full restriction or prohibition |

| Global Obligation | Risk-based approach | Mandatory compliance |

Consequences of Failing to Screen for PEPs

Failure to adequately screen and manage Politically Exposed Persons (PEPs) can result in severe regulatory, financial, and reputational consequences. Below is a summary table followed by real-world case studies to illustrate the risks of non-compliance.

Key Consequences of Inadequate PEP Screening

| Consequence Type | Description |

| Regulatory Fines | Monetary penalties imposed by regulators for breaches in AML/EDD obligations. |

| License Suspension | Temporary or permanent revocation of banking or operating licenses. |

| Reputational Damage | Loss of customer trust, media scrutiny, and brand deterioration. |

| Criminal Liability | Individual accountability for executives and compliance officers. |

| Increased Audit Pressure | Intensified scrutiny from financial watchdogs and regulatory agencies. |

| Operational Disruption | Delays, resource strain, and internal reviews that impact core business. |

| Closure of Entity | In extreme cases, institutions have been forced to shut down entirely. |

Examples of PEP Cases in Different Sectors

Below are real-world examples that demonstrate the high-risk nature of PEPs and the consequences of failing to manage that risk.

Case 1: HSBC (2012)

- Issue: HSBC failed to monitor PEPs and allowed suspicious transactions from high-risk countries.

- Consequence: $1.9 billion fine from U.S. authorities, with lasting reputational damage.

- Lesson: Weak PEP and sanctions controls can have long-term institutional costs.

Case 2: Danske Bank (2007–2015)

- Issue: The bank’s Estonian branch processed €200+ billion in suspicious payments involving PEP-linked shell companies.

- Consequence: CEO resigned, share price dropped over 40%, and multiple regulatory investigations launched.

- Lesson: Failing to escalate PEP risk signals can lead to systemic AML failures.

Case 3: FBME Bank (2014)

- Issue: The U.S. Treasury identified PEP-related money laundering activities through FBME.

- Consequence: Classified as a "primary money laundering concern" under the USA PATRIOT Act; the bank was effectively shut down.

- Lesson: Ignoring high-risk PEP clients can lead to total operational collapse.

Case 4: Deutsche Bank (2023)

- Issue: Inadequate PEP screening processes in place, especially concerning politically connected clients from Russia.

- Consequence: Regulatory penalties and forced restructuring of AML procedures.

- Lesson: Even large institutions are not immune to compliance breaches.

How May Sanction Scanner Help You?

Sanction Scanner provides advanced compliance tools that help organizations identify, monitor, and manage Politically Exposed Persons (PEPs) effectively and in real time. Whether you're a financial institution, fintech company, or professional service provider, Sanction Scanner enables you to stay compliant with local and global AML regulations.

Key Ways Sanction Scanner Supports PEP Compliance:

PEP Screening with Global Coverage

Screen customers and third parties against a continuously updated database of PEPs, sourced from official government and international lists across 200+ countries.

Automated Risk Classification

Classify detected PEPs based on role, jurisdiction, and exposure level — helping your compliance team prioritize actions based on actual risk.

Ongoing Monitoring

Receive automatic alerts when a person's PEP status changes or new risk information becomes available, ensuring continuous due diligence.

Detailed Audit Trails & Reports

Generate comprehensive reports and maintain audit-ready documentation for regulators, internal reviews, and compliance audits.

Real-Time API Integration

Integrate PEP and sanction screening into your onboarding or transaction processes with Sanction Scanner’s flexible, developer-friendly API.

FAQ's Blog Post

When organizations create a PEP risk profile, they consider the following details: the individual's role, influence, and geographic risk.

PEP by association refers to family members, business partners, and the relatives of PEPs.

According to FATF guidance, former PEPs should be considered high-risk for at least 12–18 months after they leave office.

Domestic PEPs hold a public position in their own country. Foreign PEPs hold similar power abroad and are likely to be high-risk individuals due to cross-border complexity.

No. People in high-ranking positions with significant influence are considered PEPs.

A PEP is an individual in a high public position with an increased risk of involvement in corruption or financial crimes. They require enhanced due diligence.

PEPs may misuse their power for illicit financial gain, making them vulnerable to money laundering. AML programs must apply stricter controls.

They use automated screening tools and global PEP databases. Ongoing monitoring ensures up-to-date risk assessment.

Types include domestic PEPs, foreign PEPs, and international organization PEPs. Each has varying levels of risk.

A PEP is not necessarily sanctioned but poses a higher risk. A sanctioned individual is officially listed due to legal violations.

PEP screening should be continuous and updated in real time. Regular updates reduce the risk of undetected exposure.

Yes, close relatives and associates are also classified as PEPs. They may be used as channels for illicit activities.

Sanction Scanner provides real-time PEP screening and monitoring with global coverage. It ensures compliance with AML regulations efficiently.