Financial crime is evolving and so must the tools used to detect and prevent it. At Sanction Scanner, we’ve built an integrated suite of AML solutions designed for the realities of modern compliance teams: rising data volumes, dynamic risks, and growing regulatory pressure. Central to this design is artificial intelligence (AI), which we apply purposefully across every stage of the compliance journey. From the moment a customer is onboarded to their ongoing transactions and activity, our system provides a 360-degree view of financial crime risk automated, explainable, and real-time.

AI-Driven Risk Funnel: From Onboarding to Risk-Based Decisions on Full Customer Cycle

We don’t treat AML components as isolated modules. Instead, we’ve built a connected risk funnel that allows institutions to ingest data once, analyze continuously, and act confidently.

1. AML Customer & Transaction Screening

Customers are screened against 3,000+ global sanctions lists, PEPs, and watchlists, updated every 15 minutes.

AI features include:

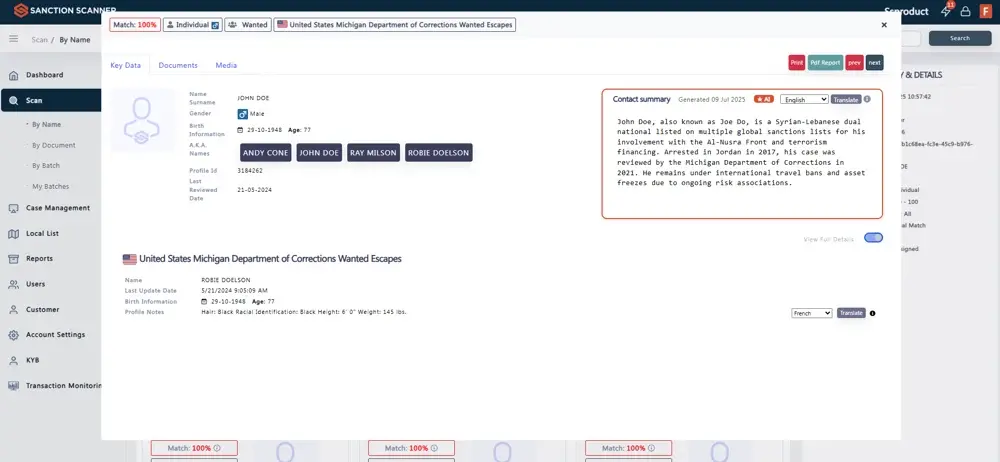

AI-Generated Enhanced Profile Summaries: We now use AI to generate profile summaries that explain why a match occurred and what kind of risk it involves. These summaries are updated as new data arrives and help teams understand the context quickly. Our recent improvements make these summaries more focused and actionable.

False Positive Reduction: Up to 30% reduction in unnecessary reviews through improved entity resolution and fuzzy logic matching.

Initial Gate: Risk Categorization Based on Match Type, List Sensitivity, and Geographic Relevance.

On Case Management: We use AI to generate profile summaries that explain why a match occurred and what risk it represents. These summaries update with new data and help analysts act faster with clearer context.

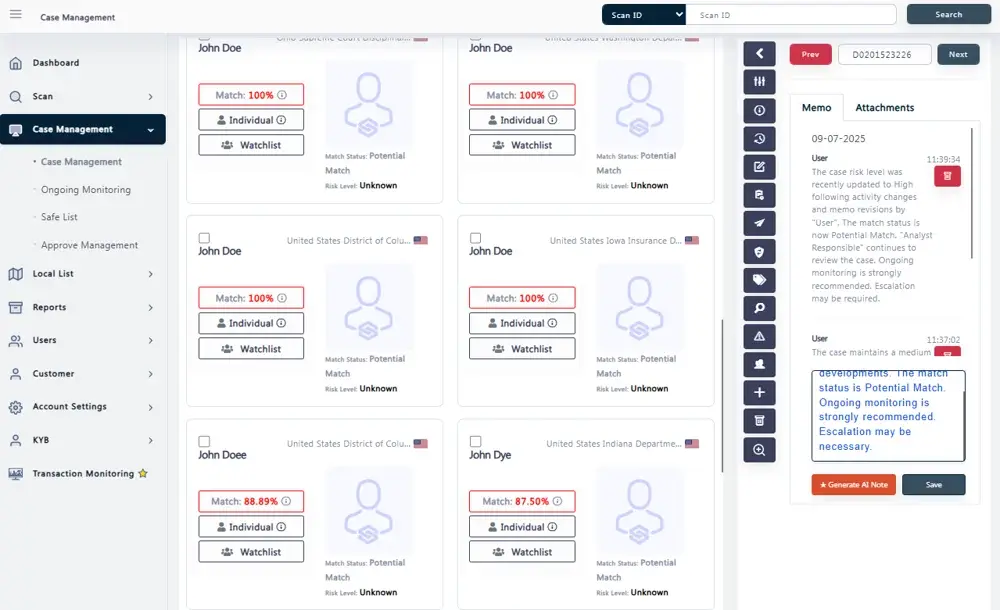

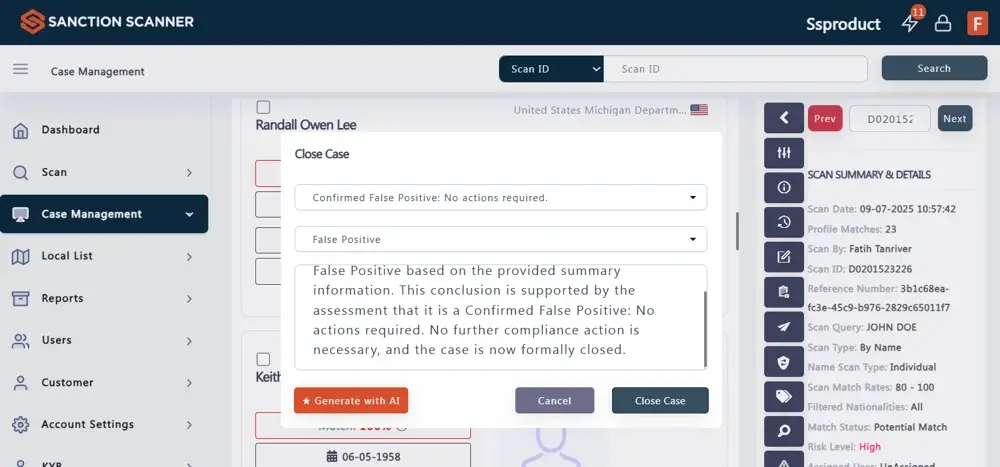

In case management, AI supports documentation through:

- Memory Notes – Key updates across the case lifecycle

- Close Reason Notes – Why a case was resolved

- Reopen Reason Notes – Why a case was reopened

This ensures consistent, auditable records with less manual effort.

2. Transaction Monitoring

Our transaction monitoring engine evaluates customer activity in real-time, detecting suspicious behavior patterns across money transfers, payments, and other financial interactions.

AI-powered capabilities include:

- Scenario Optimization: Machine learning improves detection rules over time.

- Alert Prioritization Models: High-risk alerts surfaced first, reducing review backlog.

- Behavioral Pattern Recognition: Unusual activity flagged based on historical customer behavior, not just static thresholds.

Process: Behavior → Trigger → Dynamic Risk Re-evaluation → Case Creation.

In recent performance benchmarks, institutions using our monitoring system reduced false positive transaction alerts by 24%, while increasing case-to-SAR conversion efficiency by 31%.

3. Customer Risk Assessment

Rather than static scoring, our system enables ongoing, dynamic risk profiling using AI-weighted attributes:

- Geography, occupation, income, age, transaction volume, and more.

- Profiles are continuously adjusted based on screening and behavioral outcomes.

- Risk scoring outcomes influence alert thresholds, onboarding decisions, and periodic review frequency.

- Institutions using our risk scoring framework saw a 43% improvement in identifying high-risk customers during the first 90 days of onboarding.

Process: Profile Data → AI-Based Scoring → Risk Tiering → Policy-Based Actions (EDD, onboarding halt, etc.)

4. Ongoing Monitoring

Compliance doesn’t stop after onboarding. Our Ongoing Monitoring engine keeps profiles under watch, automatically triggering:

- Re-screening upon list updates or profile data changes.

- Case reopening with AI-generated contextual notes and memory tracking.

- Audit-ready records tied to every change or decision point.

- AI ensures consistency and context in monitoring results, significantly reducing the time analysts spend on routine checks.

Workflow Automation: Screening Event → AI Summary + Justification → Human-in-the-loop Validation → Archival.

Connected Compliance: Why Integration Matters

Each of these services feeds into the next. Risk identified in name screening informs transaction monitoring logic. Transaction anomalies trigger reassessment of risk scores. Case outcomes shape future detection scenarios.

- Rather than fragmenting compliance tools, Sanction Scanner connects them. This enables a unified risk picture, critical for effective AML governance.

- According to industry data, fragmented compliance tools can increase operational overhead by up to 35% and lead to oversight gaps in over 22% of high-risk cases.

- Our system is designed to eliminate that fragmentation, supported by a modular API structure and real-time integration capabilities.

AI Across the Name Screening Lifecycle - New AI Features

To support faster, more consistent, and more explainable screening decisions, we’ve added two new AI-powered features to our Name Screening product. These enhancements aim to help compliance teams reduce manual workload, surface high-risk profiles more efficiently, and document decisions with greater transparency:

1. AI-Generated Profile Summaries

To reduce manual analysis time, Sanction Scanner now provides automatically generated summaries of each profile's name screening results:

- The system evaluates list type (e.g., sanctions, PEPs, watchlists), match score, and other metadata to craft concise summaries.

- These summaries are designed to deliver key insights upfront—such as whether a match is related to a high-risk jurisdiction, a known political figure, or a previously screened entity.

- Compliance analysts no longer need to parse multiple fields just to understand the risk context of a match. The AI delivers a human-readable, decision-supportive synopsis within seconds.

This enhancement bridges the gap between raw data and actionable intelligence, streamlining onboarding and ongoing monitoring workflows.

2. AI-Generated Notes for Memory, Close, and Reopen Reasons

We’ve also introduced automated AI-generated notes for case documentation, covering various decision points:

- Memory Notes summarize key case developments or notable events, such as changes in screening results during periodic re-checks.

- Close Reason Notes provide a contextual explanation when a case is resolved, capturing why the risk was deemed mitigated or irrelevant.

- Open Reason Notes do the same when a case is reopened, ensuring every action is documented with consistent logic.

- In addition to context-aware explanations, the AI adapts to the user’s writing style over time, mirroring the tone and terminology typically used by the analyst or institution. This results in a smoother integration of AI into internal compliance narratives and audit records.

These notes help ensure consistency across teams, improve auditability, and reduce the time spent on manual documentation—all while preserving decision rationale.

Why This Matters: Accuracy, Efficiency, and Transparency

These updates to Sanction Scanner’s Name Screening product reflect a core commitment to three operational pillars that compliance teams consistently rank as top priorities: speed, consistency, and auditability.

Faster Decision-Making

By automating both the interpretation of screening results and the creation of case documentation, compliance teams can transition from alert review to final decision up to 40% faster particularly in environments processing hundreds or thousands of names per day. In a recent client benchmark, organizations using AI-generated summaries and memory notes reduced average case handling time from 12 minutes to just under 7 minutes, without compromising risk assessment quality. This acceleration allows teams to refocus efforts on higher-risk or complex cases.

Operational Consistency

Manual interpretation of match results often leads to variations in how analysts assess risk, especially across large or distributed teams. Sanction Scanner’s AI-generated summaries and notes apply standardized language and logic, helping reduce analyst-to-analyst variation by over 60%, according to internal QA reviews across multiple institutions. This ensures that decision-making is aligned with policy and repeatable—two factors critical for compliance effectiveness and regulatory trust.

Compliance Readiness

Every AI-generated memory note, close reason, or open reason is logged with traceable logic tied to actual screening results. This structured documentation supports stronger internal controls and simplifies regulatory audits.

In regulated sectors like banking or payment services, where recordkeeping obligations under regimes such as EU AMLD, FinCEN, or FATF standards are mandatory, teams using automated documentation reported a 25% reduction in audit preparation time. We do not position AI as a substitute for human judgment. Instead, our tools serve as a force multiplier—enhancing the speed and confidence with which decisions are made, while minimizing analyst fatigue and reducing false positive handling effort by up to 30%, based on aggregate customer feedback.

_1.webp)

Our Approach to Responsible AI

Sanction Scanner’s AI integrations are grounded in real-world compliance logic, not generic automation. We follow three key design principles to ensure our AI outputs are practical, explainable, and aligned with regulatory expectations:

User-Adaptive Language Models

Our models learn from institutional tone, terminology, and phrasing preferences over time. Whether the team uses formal, legalistic language or brief notations, the AI mirrors these preferences resulting in seamless internal communication and fewer manual edits.

Contextual Awareness

Rather than producing static templates, our system tailors summaries and notes based on actual match characteristics: list type (e.g., sanctions vs. PEP), match strength, screening history, and profile metadata. This ensures that outputs are relevant, case-specific, and regulator-friendly.

Built-in Transparency

Every AI-generated note can be traced back to its source logic. Analysts can inspect, edit, or override any suggestion, maintaining human-in-the-loop control. This transparency also aligns with global regulatory expectations around explainability in AI decision-support tools.

By training our models on screening-specific data and real-world analyst workflows, Sanction Scanner avoids the pitfalls of “one-size-fits-all” AI. We believe effective AI in compliance must not only accelerate operations, but also enhance clarity, reliability, and accountability.

Smarter Name Screening, Stronger Compliance

The fight against financial crime is evolving, and so must the tools we use to fight it. By integrating AI at key points across the name screening workflow, match analysis, profile interpretation, and case documentation. Sanction Scanner empowers compliance teams to operate with greater precision, speed, and clarity. Our latest updates represent a step forward not only in product development but in the broader mission of making financial crime risk management more intelligent and more human-centric without compromising regulatory rigor.

Request a demo to explore how our AI-driven summaries and case management tools can streamline your compliance workflow and reduce manual workload.