Customer risk management is not a box-checking afterthought compliance - it is key to running a safe and compliant financial institution. In today's globalized world, identifying high-risk customers is not just a matter of checking the regulatory box. It's a matter of protecting your institution from fraud, money laundering, and reputational harm. You might be employed by a multinational bank, fintech company, or remittance operator, but how you monitor customer risk determines your compliance success and risk avoidance.

Who Are High Risk Customers?

High-risk customers generally behave in ways—or are in circumstances—that increase the risk of money laundering, fraud, or non-compliance. Others operate in industries that are more exposed to financial crime. Others are from nations that international regulators, like the Financial Action Task Force (FATF), view as high-risk. You also have those whose ownership is complex, or have ties to politically exposed individuals, who require additional checking.

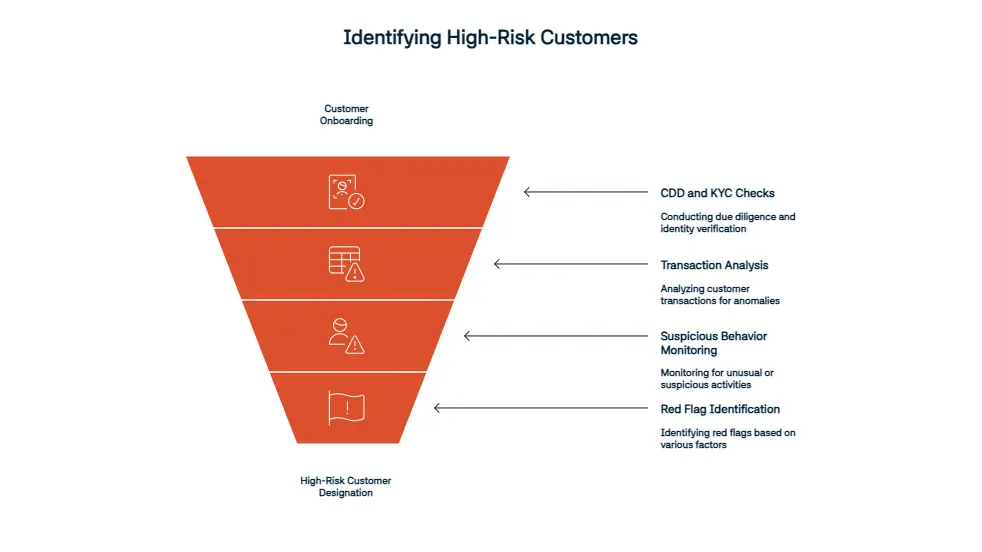

The Customer Due Diligence (CDD) and KYC procedures are where most of them begin to reveal themselves. Here, through these steps, the institution will identify an accounts' identity, analyze their transactions, and watch on an ongoing basis for suspicious behavior. Once an account is generating one or more red flags—by way of geography, job, or action—it moves into high risk and gets locked into a feedback loop of higher levels of monitoring.

Most financial crimes in our experience don't begin with a red alert full-blown. It's sneaky—a few unusual deposits, evasive answers to source of funds questions, or small inconsistencies in company ownership records. But once you can identify the patterns, you appreciate how critical the early warning signs are.

Why It’s Crucial to Identify High-Risk Accounts Early?

Unless banks identify risky customers at the beginning, they offer the channels for criminal activity to flourish. Money laundering, fraud, and unmonitored cross-border movement of money happen when such weaknesses are manipulated. These offenses are not just harmful to the global financial system but also result in irreparable damage to the reputation and goodwill of the bank.

By detecting high-risk accounts in the early stages, companies can act before problems develop. Detection at the onboarding stage or during regular reviews gives compliance groups a chance to dig deeper, add more controls, or terminate a relationship as required.

A compelling reason to put high priority to this process is regulatory compliance. Regulators don't want to see institutions peeking only superficially. If you steer clear of a crimson flag or postpone, you are risking your employer with big fines or court cases. Reputation damage in itself can take a decade to get over. So even if a client is profitable inside the brief time period, their vulnerability to lengthy-time period chance would possibly cause them to too luxurious to maintain. Finally, threat-based client identity is important in making sure business stability. Suspicious transactions are probable to trigger inner scrutiny, account freeze, or escalation that disrupts commercial enterprise-as-standard transactions. Active risk management, institutions ensure continuity, protect clients, and build lasting trust.

Top 6 Types of High-Risk Customers

Not every high-risk account is cut from the same cloth. But over time, some common profiles emerge across geographies and industries. One fashionable class is politically exposed persons (PEPs). These are folks that hold excessive-profile public workplaces - authorities ministers, judges, military generals, and bosses at nation-owned corporations. Because of their positions, they are vulnerable to bribery, corruption, and abuse of power. Even if they're operating legitimately, their money owed deserve extra scrutiny because the opportunity of outside chance is so great.

Another category that warrants close monitoring is customers with connections to high-risk nations. FATF and other organizations periodically issue lists of jurisdictions that have insufficient AML controls in place. If a customer is located in - or doing business with - one of these locations, that increases the risk of exposure to illicit activity. That does not automatically require you to exclude all such clients, but it does necessitate more thorough due diligence and close monitoring.

Then, there's a rise in crypto users. Digital assets offer transparency through blockchain but also complexity. The pseudo-anonymity of wallets and the speed of transfers have made crypto the go-to vehicle for money laundering. If you see clients transacting heavily in crypto, especially without any evident purpose, then it's time to look closer.

Offshore account holders ought to set off your risk alarm as well. Offshore banking can be legal and legitimate, yet it is often used to hide ownership, reduce tax liability, or move money quietly across borders. Whenever there are offshore entities involved, ascertain whether the setup has a valid commercial purpose or if it's just a front for financial secrecy.

Another red flag profile is the shell company. These are businesses that exist solely on paper and don't engage in any legitimate business. They don't have any employees or earn any legitimate revenue. They're sometimes established just to move money under the radar. Sometimes shell companies lie at the center of global laundering networks. Determining who's really behind them—what we call beneficial ownership—is one of the most effective means of breaking the chain. Lastly, clients with extremely complex ownership structures should draw attention. When a company’s control passes through multiple layers, across multiple jurisdictions, with minimal transparency, you’re likely dealing with someone who’s trying to hide something. This structure may be legal on the surface, but compliance teams must work harder to map it, understand it, and assess whether it poses a hidden risk.

How to Identify High-Risk Accounts?

High-risk clients often flaunt themselves in certain patterns. One of the most typical behavior is abnormal transaction patterns. If a client makes multiple deposits just below the reporting limits by the legislation—e.g., $9,900 instead of $10,000—that's a pretty clear sign they are trying not to be noticed. This is also referred to as smurfing, and this is a standard technique in money laundering.

The other warning sign is the lack of transparency. If they won't share their business model, won't show their funding source, or won't present their documents showing ownership, then you have to be wary. Some people have had instances when customers avoided questions time and time again, or mailed in-incompleted documents—it was most likely the end for them in terms of compliance issues.

You should also be careful with clients who work in sectors that are associated with financial crime risks. These are gambling, real estate, casinos, and virtual asset services. These industries are of interest to criminals because they deal with large, fast-moving amounts of money that are difficult to track. Abnormal account data changes can also sign troubles. If a customer maintains converting their deal with, editing signatories, or changing beneficiary information again and again, this could be an try to re-create their virtual footprint. Without a valid enterprise cause, these repeated changes want nearer examination. Abnormal account data changes can also sign troubles. If a customer maintains converting their deal with, editing signatories, or changing beneficiary information again and again, this could be an try to re-create their virtual footprint. Without a valid enterprise cause, these repeated changes want nearer examination.

Risk-Based Approach to Customer Due Diligence (CDD)

Not every customer deserves the same level of scrutiny. That's why a risk-based system for KYC and due diligence works. It enables institutions to not waste resources on low-risk accounts to the extent of neglecting customers who do pose a risk.

Low-risk customers typically have standard due diligence. This consists of minimum identity checks and basic documentation. Medium-risk clients observe institutions ask for more documentation, such as business documents or business activity records. High-risk customers, however, undergo enhanced due diligence (EDD). These would include source-of-funds checks, background screening in great detail, and ongoing transaction monitoring. Such kinds of customers can also be required to undergo senior compliance officer approval before onboarding. By distributing time and equipment according to risk, institutions become more effective. They identify problems earlier and give their teams time to work on actual issues not red tape.

Tools and Technologies for Detecting High-Risk Customers

Technology plays a significant part in modern AML initiatives. With so much data flowing through institutions nowadays, manual review is impossible. Real-time transaction monitoring systems powered by AI now trigger on atypical behaviors in real time. Such solutions allow compliance teams to focus efforts on suspicious trends without being bogged down with alerts.

Sanctions screening software is equally vital. They screen customer data against international watchlists and prevent companies from inadvertently doing business with blacklisted parties or individuals.

PEP and negative media screening platforms offer another level. These websites will scan automatically for any political association or negative media attention surrounding accounts. If someone was just accused of corruption, for example, the platform can pull up that information before onboarding even begins. And then there is customer risk scoring. These tools determine risk levels based on numerous criteria: geography, industry, transaction behavior, legal history, and so on. The higher the score, the closer the gloves get to being removed. This systematic process keeps teams from relying on gut and instead making informed decisions.

How Often Should You Review High-Risk Customers?

Risk is dynamic, therefore so should your reviews. For excessive-danger accounts, the banks will usually check them every 12 months or each two years. These could be used to test if the purchaser's conduct has changed or new hazard signs have emerged.

Trigger-based evaluations need to be done every time something noteworthy occurs. For instance, if the general manager moves to a excessive-danger usa, drastically will increase their transaction quantity, or is the situation of bad exposure, you want to review their profile at once. Along with that, constant monitoring should always be there. Automated systems should alert behavioral anomalies, while compliance teams monitor from time to time if each customer still fits in their assigned risk category. Staying ahead of risk in real time is the only way to ensure long-term compliance.

FAQ's Blog Post

A high-risk customer is an individual or business that poses a greater risk of involvement in money laundering, terrorist financing, or fraud due to factors like their location, industry, transaction behavior, or political exposure.

Banks use risk-based approaches, including KYC checks, transaction monitoring, and enhanced due diligence (EDD) to assess customer profiles, detect red flags, and determine if an account should be classified as high risk.

Common red flags include large cash transactions, frequent international wire transfers, shell company involvement, reluctance to provide information, or links to high-risk countries or PEPs.

Examples include politically exposed persons (PEPs), non-resident clients, cryptocurrency traders, offshore businesses, and clients from FATF-blacklisted jurisdictions.

High-risk customers require Enhanced Due Diligence (EDD), including deeper identity verification, source of funds checks, ongoing monitoring, and senior management approval.

High-risk customer accounts should be reviewed at least annually or more frequently if suspicious activity is detected or regulatory requirements dictate.

Yes, but the institution must conduct thorough risk assessments and implement stricter monitoring procedures to comply with AML and CFT regulations.