Compliance is not the best formality—it’s of critical importance for responsible business conduct. In the current environment, in which criminal duties have come to be extra complex and public expectations for transparency and duty are growing, businesses must encompass compliance as a strategic priority. It safeguards operations, takes stakeholders into account , and helps prolonged-term growth and recognition.

What Does “Compliance” Mean?

Essentially, compliance refers to following the laws, pointers, internal regulations, and moral requirements that govern an industrial agency. This includes complying with external regulations set by regulators, or upholding internal codes of conduct that reflect an organization's values and operational protocols. Whether it is personal fraud, handling facts responsibly, or preserving environmental requirements, compliance enables an organisation to comply with legal requirements at the same time as reinforcing ethical culture.

In our professional field, we often see businesses that use compliance as a basis to construct agreement and reliability— not just as a tool for avoiding fines. For instance, a financial institution that implements anti-money laundering (AML) controls not only meets the effective regulatory requirements but also actively contributes to the steadiness and safety of the financial system.

The History of Compliance in Business World

The idea of compliance as a based enterprise function evolved through the years, especially in response to scandals and rising regulatory complexity. During the 80s and 90s, compliance became a focal point for industries like banking and healthcare. Events that include financial fraud, unethical corporate conduct, and privacy violations led to excessive profile reforms. Two predominant legislative acts— The Sarbanes-Oxley Act (2002) and The USA PATRIOT Act (2001)—marked milestones. The former reinforced financial oversight and company responsibility, while the latter improved requirements around financial crime and terrorism financing. These laws made it clear that compliance couldn’t be an afterthought. We believe that they have driven companies to treat regulatory adherence not as non-obligatory, but as vital to their form and strategy.

What Is the Purpose of Compliance?

Compliance has various aims to retain operational and moral integrity. When complying with the regulations fails in a company, an important amount of fines, and legal sanctions can emerge alongside loss of licenses. Moreover, the most detrimental effect can be on the reputation of a company. On top of these, compliance can make sure that businesses are able to protect the confidential data, maintain the safety standards, and perform in the most beneficial way for customers, employees and the whole community.

Furthermore, using a proactive compliance program is a perfect sign that the company has a sense of responsibility and trustworthiness, which also enhances the reputation. This can lead to smoother audits, faster partnerships, and higher level of entry to capital. We believe that a good compliance application doesn’t merely reduce the risks—it actively supports business stability and scalability.

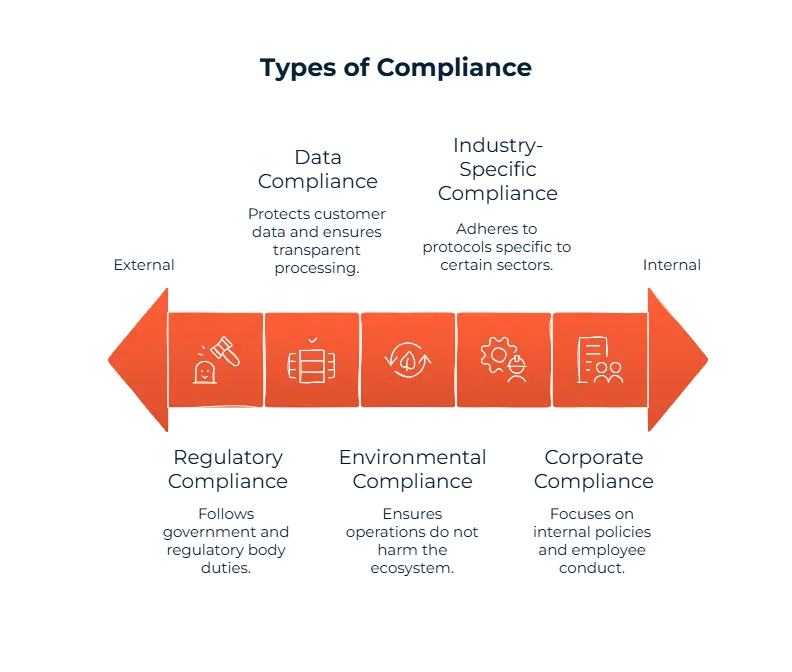

What Are the Types of Compliance?

The level of bureaucracy involved in compliance depends on the specific business and industry.

1. Regulatory Compliance: Regulatory compliance refers to duties imposed by governments and regulatory bodies. For example, a financial services organization must comply with regulations related to AML, data reporting, and tax transparency.

2. Corporate Compliance: Corporate compliance, then again, focuses on inner policies which includes employee conduct, whistleblowing, and administrative center ethics.

3. Data Compliance: Data compliance has gained great interest in recent years because of the emergence of laws like the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). Organizations need to protect customer data, process it with consent, and provide transparency about its use. Failing to comply can lead to fines and a loss of the individuals’ trust.

4. Environmental Compliance: Environmental compliance involves ensuring that a corporation’s operations do not harm the ecosystem. This can include waste control, emissions control, and sustainable sourcing.

5. Industry-Specific Compliance: Finally, there is a company-specific compliance, which covers precise protocols designed for sectors like pharmaceuticals, creation, or fintech. For example, a fintech company may need to comply with the Payment Card Industry Data Security Standard (PCI DSS) to securely handle credit card transactions.

Which Sectors Are Most Heavily Regulated?

Technology Companies: Not all industries are regulated similarly. Sectors such as Banking and Finance are quite strict to inhibit money-laundering and fraud while providing transparency. It’s of vital importance to comply with AML and GDPR regulations.

Healthcare Sector: The healthcare sector, on the other hand, ensures to keep sensitive patient information confidential and maintain moral practices while complying with some laws such as HIPAA.

Insurance Sector: When it comes to insurance, the key factor in this sector is to keep pursuing the trust with laws highlighting the equity, inhibiting the fraud and ensuring personal information confidentiality.

Energy Companies: To maintain sustainable use of resources and protection of the environment, the industry of energy has quite stricts regulations as well.

Pharmaceutical Sector: By complying with FDA regulations in pharmaceuticals, compliance is a must to ensure drug safety, manufacturing processes, and clinical experiments.

Technology Companies: Lastly, in technology companies, particularly the ones who handle the customer (user) data must meet strict requirements to provide privacy, data protection, and cybersecurity to comply with such laws as GDPR and CCPA.

Who Is Responsible for Compliance?

Compliance obligations are shared across various levels of an organization. Compliance Officers usually lead the program by drafting policies, training staff, and conducting internal evaluations. They work closely with risk managers, who help perceive ability threats and increase mitigation techniques. In large corporations, the Chief Risk Officer or General Counsel might also oversee the entire framework to ensure that the compliance approach aligns with business objectives and regulatory adjustments.

In our professional field, we’ve found that the best compliance programs are those where leadership embraces compliance as a cultural value— not only a regulatory requirement. When the tone from the top reflects integrity, it flows throughout each department.

What Are Regulatory Bodies and What Is Their Role in Compliance?

Regulatory agencies function as watchdogs to make sure industries perform legally, ethically, and transparently. These establishments set rules, conduct audits, investigate misconduct, and issue penalties. Their number one position is to protect clients, reduce hazards in markets, and promote equity in business practices.

Well-known bodies consist of the International Organization for Standardization (ISO), which sets technical and operational requirements throughout industries; the Financial Action Task Force (FATF), which leads worldwide efforts against money laundering; the U.S. Securities and Exchange Commission (SEC), which regulates the financial markets; and the European Data Protection Board (EDPB), which ensures consistent GDPR enforcement throughout the EU.

We believe that our bodies provide significant form in a fast-moving and globalized economy. Without them, markets could lack consistency, and consumer protection could suffer.

Regulatory Compliance vs. Corporate Compliance

| Aspect | Regutory Compliance | Corporate Compliance |

| Definition | Adherence to laws, regulations, and guidelines set forth by governmental or regulatory bodies | Internal adherence to policies, standards, and ethical codes established by the organization |

| Objective | To ensure that the organization operates within legal boundaries and avoids penalties | To foster ethical behavior, promote business integrity, and align internal processes with company values |

| Scope | Focuses on external legal and regulatory requirements | Concentrates on internal company policies and standards |

| Enforcement | Monitored and enforced by external regulatory authorities | Enforced internally by compliance officers or dedicated teams within the organization |

| Examples | GDPR, SEC regulations, tax compliance | Code of conduct, anti-bribery policies, workplace safety protocols |

How Do Companies Stay Compliant?

- Conduct Risk Assessments

- Develop Comprehensive Policies

- Train Employees

- Monitor and Audit

- Reporting and Documentation

Maintaining compliance requires a prepared and proactive technique. The system typically starts with a risk assessment, in which agencies examine which regions are most vulnerable. With this assessment, you can reveal which gaps to deal with as soon as possible and assign the resources to address these gaps proficiently.

From there, companies develop guidelines that clearly define techniques and expected behavior. These should be documented and communicated across the employees so that they know what to comply with when it comes to ethical and legal standards.

Employee training is another dispensable component to make sure that compliance requirements and the role of the employee in maintaining these requirements are perceived well and correctly. Workshops, real-life scenario games and some learning materials can be parts of this training.

To stay as proactive as possible, monitoring and audits need to be implemented constantly so that you can be alert about compliance issues before they escalate. Audits can be utilized to evaluate the impact of compliance programs and, if necessary, to make improvements.

When a violation is identified, organizations have to act quickly with a powerfully structured plan. Apart from addressing the current issue, Corrective actions should also be capable of preventing the potential recurrences. With persistent improvement, compliance can be strengthened over time.

What Are the Penalties of Non-Compliance?

The dangers of ignoring compliance can be devastating. Regulatory fines can financially cripple a business, especially for smaller businesses. Some violations, such as failing to meet licensing requirements, can also result in suspension or revocation of operational authority. Reputation harm is another critical risk. In an age of on-line reviews and real time data, public trust can evaporate overnight.

Non-compliance with data protection laws will increase the risk of breaches that may reveal severe violations that can result in criminal charges for company leadership. We believe that even one overlooked regulation can jeopardize years of brand-constructing and operational success.

How Can Sanction Scanner Help You About AML Compliance?

Sanction Scanner helps businesses to stay AML compliant by offering real-time name screening, transaction monitoring, and PEP & sanctions list checks. With automated AML solutions, your company have a change to reduce false positives and meet global regulatory requirements,

FAQ's Blog Post

Compliance in business refers to following all relevant laws, regulations, and internal policies to operate legally and ethically.

PCI compliance refers to adherence to the Payment Card Industry Data Security Standard (PCI DSS) — a set of security requirements established to protect credit and debit card transactions and cardholder data. It applies to all businesses that store, process, or transmit cardholder information, regardless of their size or transaction volume.

A compliance officer is a professional responsible for ensuring that an organization adheres to legal, regulatory, and internal policy requirements. They help protect the company from legal risks, reputation damage, and regulatory penalties.

Regulatory compliance refers to an organization’s adherence to laws, rules, and regulations relevant to its industry. This includes financial laws, data protection rules, labor regulations, and industry-specific requirements. It ensures businesses operate legally, ethically, and with accountability to avoid fines or sanctions.

508 compliance refers to the requirement under Section 508 of the Rehabilitation Act, which mandates that federal agencies' electronic and information technology must be accessible to people with disabilities. This includes websites, PDFs, and software, ensuring compatibility with screen readers and other assistive technologies.

ADA compliance means meeting the standards of the Americans with Disabilities Act (ADA) to make digital and physical spaces accessible to individuals with disabilities. For websites, this includes keyboard navigation, readable fonts, color contrast, and alternative text for images.

GDPR compliance involves following the General Data Protection Regulation, a European Union law that governs how organizations collect, process, and store personal data. Key requirements include obtaining user consent, ensuring data security, allowing data access/deletion, and reporting breaches within 72 hours.

Rules are specific directives or instructions that must be followed — often created by regulatory bodies, governments, or organizations to ensure lawful or ethical behavior. Compliance, on the other hand, is the act of adhering to those rules, laws, or internal policies. It’s about implementing, monitoring, and demonstrating that the organization or individual is following the required standards.