In 2025, KYC compliance is more important than ever for companies. Efficient onboarding, AML compliance, and fraud prevention can all be achieved by making the right choice while choosing a software provider. In this blog post, we’ll be talking about which KYC software provider is the right one for your company.

What is KYC Software and Why Does It Matter?

Let’s first explain what a KYC software is. This software is a tool for helping your company verify customers, monitor transactions, and meet anti-money laundering (AML) compliance requirements. This software makes dealing with document checks, biometric verification, and sanctions screening easier by automating the entire process, and it helps ensure that the onboarding part is done faster and more securely. With this tool, you can prevent regulatory penalties and fraud within your company.

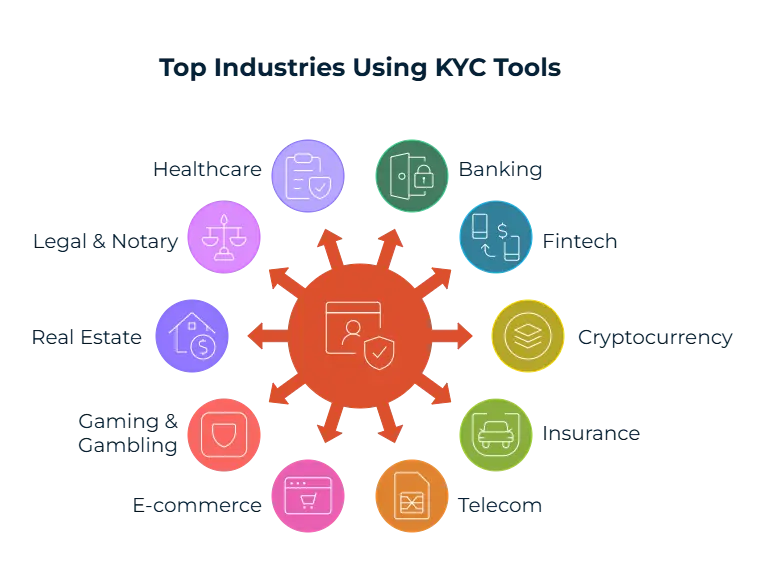

Top Industries Using KYC Tools

The first industry that uses KYC tools is banking; the strict regulations set by regulators need to be met and identity fraud must be prevented during account creation and risk profiling with the help of your KYC tool. Fintech firms are also in need of KYC tools; these firms use the help of the tool during digital onboarding to make it faster and achieve regulatory agility since they offer e-wallets and lending services. KYC tools are also critical for cryptocurrency firms since is has high risks of fraud; the tool makes sure the FATF Travel Rule is followed during exchange onboarding and transaction monitoring.

Insurance firms can benefit from using KYC tools during identity verification and while trying to prevent policy fraud. Customer onboarding and claims verification can be safely done using the tool. Telecom companies use the tool to stop SIM-related fraud and ID spoofing. During prepaid or postpaid activation or account linking, having KYC tools at service for you is essential. With e-commerce firms, preventing payment fraud and promo abuse is essential. KYC tools can help conduct checkout rick checks and offer identity-based offers according to the customer’s profile.

The gaming and gambling industries are really risky since you need to comply with AML laws and make sure your consumers are of appropriate age. During player onboarding, and to stop the abuse of bonuses, the KYC tool is helpful. Real estate firms deal with money laundering through property, and stopping this is possible with KYC tools. The tool is also helpful during buyer or seller verification and UBO screening to make sure identity fraud is not occurring.

The legal and notary industry is also using KYC tools often because of CDD regulations and AML checks. Conducting KYC checks before onboarding new clients helps a lot in this industry. Finally, with healthcare industry companies, medical fraud and insurance fraud pose critical risks to compliance. Using KYC tools for ID verification for services and possible benefits is recommended by our Sanction Scanner team.

Top 12 KYC Software Providers and How We Ranked Them

We’ve compiled a list of the top 12 KYC software providers that you can use in 2025 for our readers. We’ve thought of and analysed several features during the compiling of this list like G2, Capterra, and Gartner ratings as well as possession of core features like identity verification which we’ve mentioned above is important, PEP and sanctions screening to reduce risks, and the feature of an audit trail. We’ve also considered the scability, how easy it can be integrated to your systems, and how well the tool helps each industry.

Sanction Scanner

Our first KYC software provider is Sanction Scanner. This company offers a KYC/KYB platform that also has real time PEP and adverse media screening. Fintech firms, RegTech companies, and firms that would prefer identity and compliance tools together can benefit from using Sanction Scanner. With their usage of sanctions lists, your onboarding process will be faster and more efficient while also offering risk management to prevent any waste of time.

iDenfy

iDenfy is our second example for KYC tools. This company is known for its identity verification services; it supports over 3500 document types while also providing a mobile-first process. iDenfy’s Magic Link feature is different from the rest since KYC flows can be started from their one-time link that helps reduce drop-offs. Their setup process is passwordless and requires no code, which makes onboarding faster. iDenfy’s Magic Link feature has recently been used in the iGaming sector with iGaming Express collaborating with the company.

Sumsub

Our third company example is Sumsub. Sumsub uses AI help with identity verification and its AML tools are great for VAPSs and fintechs. It recently started using device intelligence with the help of Fingerprint Technologies to prevent bot activity, account takeoverse, or multi accounting. Also, Sumsub’s Beast 2.0 campaign and recent ROI study shows how it is getting more recognised within the market.

Onfido

Onfido is another compaany we’ll talk about and explain for our readers. This company is known for its facial recognition and faud detection services; it uses biometric liveness checks with document image validation to reach high accuracy rates. Banks and digital platforms use these features a lot and might prefer Onfido’s solutions because of it. Onfido uses AI based technology to work on and prevent complex situations like deepfakes and doctored IDs.

Trulioo

Trulioo is our next example; this company combines address checks with document support worldwide. This feature is especially useful for companies who operate internationally. Scalability and its service of providing identity help for many countries and document types is what makes Trulioo different from the rest. Those who are looking for worldwide coverage can rely on Trulioo to complete their work.

IDMERIT

IDMERIT is the next company on our list. This software provider offers identity verification for more than 175 countries, focusing more on insurance and telecom industries since they are broadly used. Its system uses government and utility records for verification which helps reduce fraud. IDMERIT was given the Spring 2024 Top Performer Award decided by SourceForge users, placing them at the 10% most favoured on the software review platform.

PassFort

PassFort is another company we’ll talk about. This firm is known for its audit-ready document control that helps companies that are in highly regulated sectors like banking and insurance. Its features make sure that you can trace back every step in the compliance process. Firms that are preparing for external audits and regulators’ due diligence can use this tool to ensure compliance.

FOCAL

FOCAL is one other company we’ll be giving more information about; this company is known for its localised KYC logic that includes Latin-script matching and Arabic-language capabilities. Government agencies and multinational risk teams can use this tool with ease. Your local regulatory requirements and varied name formats with aliases or transliterations can be helped by this modular compliance engine.

Incode

Incode is next on our list; this tool is great for banks and national e-ID systems since it claims a 98% pass rate for enterprise-grade ID work. Advanced biometric liveness and fraud detection tools it provides make sure your company’s compliance is not compromised. Incode has bought AuthenticID in August, 2025 to help strengthen its AI-powered fraud detection features.

MemberCheck

MemberCheck is another company that provides a top notch KYC software. This tool is great for small firms who are looking to implement a PEP and sanctions screening tool quickly. It’s a practical tool that conducts fast checks against updated risks. MemberCheck can be used by startups or SMEs if they’re looking for a fast solution.

Finclude

One other example for you is Finclude; this company operates mainly within the EU and helps fintechs and lending firms with risk scoring. Behavioural analytics are provided with this tool as well to make sure you are understanding which customers of yours are more risky.

KYC Hub

Our final example for great KYC software providers is KYC Hub. This solution combines KYC, KYC, AML monitoring and it provides a flexible rules engine for compliance teams to change as they like without coding. Teams that manage complex jurisdictional rules can benefit greatly from this tool.

| # | Provider (Rating) | Key Strengths |

| 1 | Sanction Scanner | Real-time global sanctions, PEP & adverse media screening, full KYC/KYB automation |

| 2 | ComplyFit | biometric liveness detection |

| 3 | IDMERIT | Adaptive AI |

| 4 | AMLBot | Strong biometric facial matching |

| 5 | IDMERIT | Personal & business verification |

| 6 | PassFort | Government data sources |

| 7 | MemberCheck | Strong document lifecycle |

| 8 | Finclude | Multilingual name matching |

| 9 | KYC Hub | Instant onboarding |

| 10 | KYC3 | Basic watchlist |

| 11 | Incode | GDPR-aligned risk scoring |

| 12 | IDenfy | KYB + AML, configurable rules |

What to Look for in KYC Software?

We’ve given you information about KYC software solutions and some examples for great companies that you can choose from. But what do you need to watch out for when looking for a KYC software? We’ll first talk about the must-haves for the KYC software you should be using. Our first feature is ID verification since it is needed when verifying identification documents and providing biometrics. You should also choose a tool with sanctions and PEP screening, these screenings will ensure FATF and 6AMLD compliance.

KYB and UBO checks are also great must-haves. These are required for B2B onboarding to verify the company you’re about to collabroate with and find the ultimate beneficial owner (UBO). You should also have real-time monitoring to make sure you’re missing no suspicious activity that is occurring within your company. Audit trails and logs are also needed to report according to regulations and ensure traceability. Your company should implement risk scoring to divide your customers according to CDD and EDD to make sure you spend more time checking on high-risk customers and less on low-risk ones. API and SDK integration is our last must-have, this feature is important since it allows your company to implement this new tool into your already existing systems.

Adverse media screening is a feature that is nice to have, this is since it provides an extra layer of protection against reputational risks by scanning negative news. Graph analysis is also a nice add-on to the tool since it can help visualise UBOs and shell structures.

How to Choose the Right KYC Provider?

Our last question to answer for this blog post is about the right KYC provider for your company and special needs. If your company is a fintech startup, you might benefit more from a modular solution. Flexibility and cost control can be achieved with companies like iDenfy and Sanction Scanner since these companies allow you to pick the features you like and need. Unnecessary costs are avoided this way and you can scale as your company grows. Crypto companies should focus more on picking blockchain-aware tools like Sanction Scanner and Sumsub, these companies offer blockchain analysis and wallet screening. Your company can get help by using these tools’ illicit fund detection and Travel Rule protocol (TRISA, IVMS 101) compliance features.

Those who are looking for worldwide compliance need a tool that offers great document support, language handling, and regulatory adaptability. Companies like Trulioo and KYC Hub can help you verify different types of IDs worldwide and conduct KYB and UBO checks according to that particular jurisdiction’s regulations. For those who are looking for a budget-friendly solution, our recommendation is a pay-as-you-go model. The companies who offer this feature are Sanction Scanner, MemberCheck, and KYC3. This model will help your company by giving predictable costs and providing great support still. SMEs and firms in new markets can benefit greatly from these solutions.

FAQ's Blog Post

A KYC tool helps businesses verify customer identity, assess risk, and comply with AML regulations.

Companies need a KYC solution to prevent fraud, onboard customers faster, and meet global compliance standards.

The best KYC tool includes ID verification, document checks, face match, PEP/sanction screening, and ongoing monitoring.

Banks, fintechs, crypto exchanges, payment providers, and even e-commerce platforms use KYC tools.

KYC software automates identity checks, reduces manual errors, and speeds up onboarding decisions.

KYC software helps reduce identity fraud, fake accounts, money laundering, and regulatory penalties.

Sanction Scanner provides real-time screening, risk scoring, and ongoing KYC monitoring with full regulatory coverage.