What is KYB Onboarding?

KYB onboarding is a process put in place to verify businesses and assess their legitimacy. The process entails checking registration documents, figuring out who the Ultimate Beneficial Owners (UBOs) are, analysing ownership structures, and conducting screenings for further risks. In this blog post, we’ll be talking about what you need to watch out for during KYB onboarding and more.

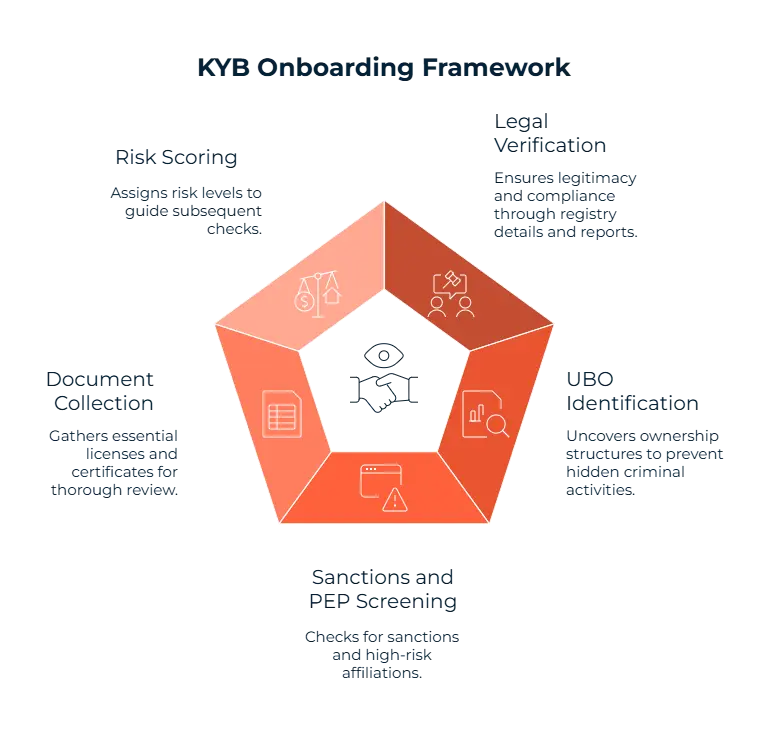

What are the Core Elements of KYB Onboarding?

There are some marks to be hit when it comes to Know Your Business onboarding. The first category is legal verification. Your company will ask for registry details and compliance reports to make sure the firm you’re about to collaborate on some level is legitimate and compliant. UBO identification is also crucial since you need to know details about ownership structures of the company. UBO mostly refers to anyone or any company that holds 25% or more ownership. UBOs are often hidden by companies who are involved in criminal activities. The next category is sanctions and PEP screening. This is needed to ensure the company is not sanctioned or to note if they are of high-risk. Document collection is also done to gather all the important details like licenses and certificates regarding the company. Risk scoring is the final category to think of when it comes to KYB onboarding. The companies you’re about to collaborate with need to get assigned a risk score to then proceed with checks accordingly.

What is the Purpose?

One of the reasons why KYB is conducted is to prevent the use of shell companies. These opaque corporate structures are used by criminals to commit acts of money laundering, fraud, or terrorist financing. The regulatory risk your company is up against is also another important reason. International frameworks like the FATF recommendations as well as more regional regulations like the Fifth and Sixth Anti-Money Laundering Directives (AMLD5/6) ask this of your company to help you reach compliance. According to sources of Private Banker International, Switzerland’s Financial Market Supervisory Authority (FINMA) has ordered domestic lender Julius Baer to pay more than $4.76m for compliance and anti-money laundering failings in its handling of high-risk clients. This shows how important it is to detect and keep an eye out for high-risk clients.

What Does the KYB Onboarding Process Involve?

The KYB onboarding process is designed to be a part of your company’s overall AML procedures to help stay in compliance. The first step involves getting the relevant documents from the company like registry details, licensing documents, tax IDs, certificates, and more. The UBO verification step is next. You’ll be determining who the UBOs are for that company. This is then followed by sanctions, watchlist, and PEP screening using lists from OFAC, UN, and EU sanctions to make sure both the company and UBOs are good to go regarding your collaboration. You may discover that the involved parties are sanctioned or of high-risk, and act accordingly. Risk scoring will help you place this company in a category and watch them with proper care. A high-risk company gets higher scrutiny whereas a low-risk company is deemed safer and their checks are assigned according to their level. Ongoing due diligence (ODD) and monitoring is then expected of you to ensure you miss no updates about your customer. New information about the company is added to your system thanks to monitoring efforts. The firm is added as one of your customers or rejected according to how well this process goes.

Industry Benchmark: How Long Does KYB Take?

It is estimated that the regular KYB verification process takes more than two weeks. This is due to how much time manual checks and document collection take. The traditional type of onboarding is done by verifying the relevant documents, ownership structures, and whether the company is compliant over different jurisdictions. This way of manual onboarding then takes a lot of time. If the UBO data is incomplete, or if international verification is needed, the process may take even longer. Automated KYB checks using software is the faster and more efficient answer for KYB onboarding. Our Sanction Scanner tool will reduce this time to mere minutes.

KYB Onboarding vs. KYC Onboarding

KYC is the individual level version of the KYB process. They share lots of similarities but since they involve different parties, differences are also existent. KYC onboarding focuses on information like the customer’s name, ID details, and PEP status. When it comes to KYB, registration details, UBOs, and the legal structure of the company is the main information to focus on. When compared to KYC, KYB onboarding is more complex since it involves figuring out different regulations for several jurisdictions, and investigating ownership layers some companies have. With KYC, people who are involved with identity fraud may try to trick teams during onboarding with false information. PEP exposure is also another fact your company needs to be careful about, flagging the customer as high-risk is likely the best way to go about it. When it comes to KYB, companies who are sanctioned are your first red flag. You should also be aiming to uncover and avoid shell companies. Corruption may be going on with these companies you’re involved with, and detailed checks will help you prevent losses.

How to Perform an Effective KYB Onboarding?

To make sure you’re missing no steps during KYB onboarding, you should be following our Sanction Scanner team’s advices. Having access to real-time global registries will ensure up-to-date and accurate information was sent out by the company. Another important point is automating UBO discovery, since this is one of the longer steps of the KYB onboarding process. This automated system will work even against complex structures. Another advice is standardising document workflows. This way, errors can be reduces and the process is sped up. Calibrating risk scoring models is the last advice of our team. Your company can pay more attention to higher-risk companies and apply due diligence accordingly. You can perform direct compliance actions including AML checks on companies and individuals, link findings to case management, set match status, assign users, and add tags using our Sanction Scanner tool.

FAQ's Blog Post

KYB onboarding is the process of verifying the identity and legitimacy of a business client. It helps prevent fraud, money laundering, and compliance violations.

It typically includes company registration checks, UBO identification, sanctions screening, and document verification. The process can be manual or automated via KYB platforms.

Common documents include business registration, shareholder list, proof of address, and ID documents of directors or UBOs. Requirements may vary by jurisdiction and industry.

KYC targets individuals, while KYB focuses on verifying businesses and their ownership structure. Both aim to assess risk and ensure regulatory compliance.

Manual KYB checks can take days or weeks. Automated KYB solutions can reduce onboarding time to just a few minutes.

Identifying UBOs in complex ownership structures and collecting accurate documents are major challenges. Regulatory differences across regions also slow down the process.

They can use KYB software with API integrations, real-time screening, and document parsing. Automation speeds up compliance and reduces operational costs.

UBO is the natural person who ultimately owns or controls a company. Identifying UBOs is essential to detect hidden risks and comply with AML regulations.