What Is Business Verification Service?

In this blog post, we will be talking about business verification services to inform our readers of its purpose, and how it can help your company in the long run. Business verification services make sure to collect a company’s legal status, they also have the duty of confirming the ownership and the risk profile of the said profile before you, our readers, start a partnership with the said company. These services are greatly needed to ensure KYC and AML compliance. What’s more is that these services also confirms that there are no ties with shell companies, sanctioned entitites, or fraudlent vendors.

Why Are Business Verification Services Important?

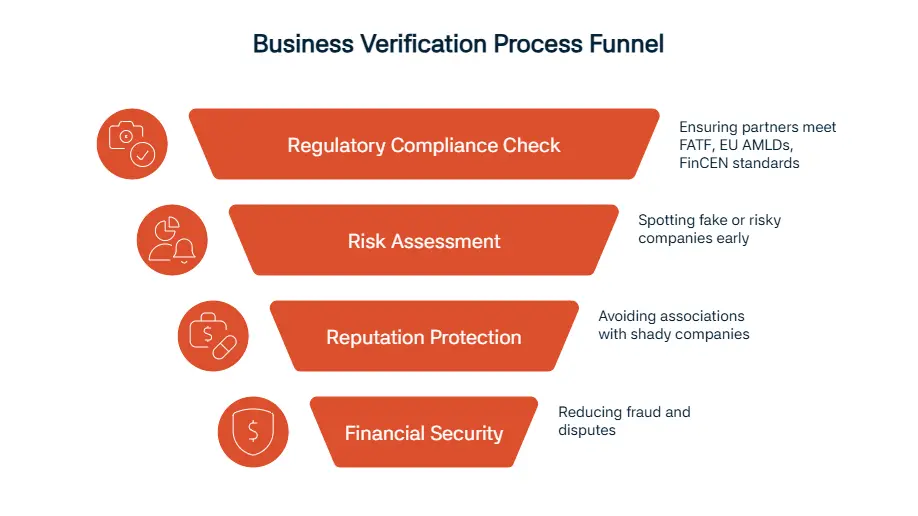

Our readers must be curious about why these business verification services are of such importance for their companies. Let’s try to explain in detail for you. First of all, these services make sure that the company you are about to enter a partnership with meets FATF, EU AMLDs, FinCEN standards. These regulatory compliance being met is the first and mayhaps the most important step to a safe partnership.

The second reason for using business verification services is spotting fake or highly risky companies early on. This act helps you prevent any accidents or financial crimes that might occur when entering a partnership with said company. You should also pay attention to business verification services because of our third reason, and that is reputation protection. When your institution is in a partnership with a shady company like mentioned above, you company’s reputation may also take damage. Because of this, avoiding illicit associations is important.

Finally, the last reason we will be mentioning during this part of our blog post is financial security. By using these services, you will be reducing fraud and disputes that may arise from the partnership with risky companies. These reasons are especially important to highlight since PwC’s 2024 data shows us that 30% of companies faced third-party fraud in 2 years. This percentage is too big to ignore, and should provoke a call for action in our readers.

How Do Business Verification Services Work?

After highlighting the reasons for using business verification services, we will now focus on helping our readers understand how these services work. These services first check whether or not the company you are about to enter a partnership with exists or not. After completing this, checking for UBO identification is the next big step. Having more information about the UBO is really helpful when deciding the company’s trust score.

What business verification services do next is verifying the directors or shareholders that are involved with the company. After these important steps, making sure the address and other operational information is actually correct is the other helpful step these services provide. Finally, sanctions and PEP screening with ongoing monitoring is also other benefits these services help provide.

Which Businesses Need Verification Services?

You may be wondering who needs these business verification services more. Banks, PSPs, fintechs, B2B marketplaces, import/export firms, crypto exchanges, legal and accounting firms are the most important examples we can give.

What Information Is Checked?

After reading all this information, you may be confused. So, what exactly is checked? First and foremost, the company’s registration details and incorporation date as well as the company’s jurisdiction is checked. This is, as you can imagine, to check whether the company is actually providing correct information about their roots.

Afterwards, UBOs and ownership structure is examined since UBOs (Ultimate Beneficial Owner) are an important part of the company’s structure. These services, of course, check whether the licenses and permits are legit as well. When entering a new partnership with a company that was previously unknown to you might be scary, and it is a big step. For these reasons, the verification services also check the financial health and the credit history of the company you are about to enter into a partnership with. Finally, links to sanctions, PEPs, and adverse media is also checked between these other information.

How Do They Support AML & KYB Compliance?

AML and KYB compliance is what you should try to achieve within your company, and with other companies before a potential partnership as well. Because of this, we should discuss how business verification services help achieve the needed AML and compliance. The first step taken is verifying the companies before onboarding.

Secondly, these services decide when CDD/EDD measures are needed and apply them afterwards. The third step these services take to ensure AML and KYB compliance is keeping auditable records. These records might be important when checking whether the company is safe to work with. Finally, business verification services monitor risk profiles in real time.

Benefits of Using Business Verification Services

You might still be hesitating when thinking of business verification services. Let’s talk more about what benefits these services bring your company. You will get instant and accurate checks when using these services. Always having these services monitor your and the company you’re interested in collaborating with’s information will prevent your company from being fined and entering a risky business partnership.

These services are also scalable for high volumes. They also provide you with reduced risk from hidden connections. Your company’s safety when moving forward with a partnership should be our readers’ first priority, therefore these benefits are some great reasons to choose business verification services.

Risks of Operating Without Verification

We’ve talked about the benefits of using the business verification services. What might occur when you’re not using them? The first risk you might come across is onboarding fraudulent companies. This could end with your company suffering from financial losses from potential scams that might occur, reputational damage from partnering with these companies, regulatory penalties for non-compliance, and many more.

You might also suffer from slow due diligence. Ensuring due diligence is important and the slowness of these processes might hurt your company in the meantime. Finally, you will be missing sanctions or PEP updates if you decide to not use business verification services.

Key Features to Look For

When choosing the right services for you, you must be on the lookout for certain characteristics. Global registry access is the first feature we will be highlighting. Especially if you’re a company that works in global scale, this is important. Automated UBO discovery will speed the process of making sure a company is safe, so having this feature is a must.

Real time sanctions and PEP screening is also something that should be provided when looking for a business verification service. Ongoing monitoring and alerts when something isn’t right is what makes your company immune to fines and accidental financial crimes. API and CRM integration is really helpful since you’re looking for sped up onboarding and improved compliance. Finally, risk scoring is something these services should provide, since our readers must be always in need of achieving the goal of a compliant company.

How Can Sanction Scanner Help?

We, at Sanction Scanner, are eager to help our reader that are looking for a business verification service. Sanction Scanner has 300+ registry integrations. We also deal with real-time sanctions, PEP, and adverse media checks. Automated UBO and shareholder identification is something that is essential and it is provided by us, Sanction Scanner. We also provide ongoing monitoring with instant alerts. API integration for onboarding is really important and you can be sure that Sanction Scanner will be with you along the way, exactly providing this service.

FAQ's Blog Post

Business verification is the process of confirming a company’s identity, registration, ownership, and compliance with AML/KYC requirements.

Companies need business verification to prevent fraud, ensure compliance, and build trust in B2B transactions.

Businesses usually provide registration certificates, licenses, ownership details, and financial records.

Business verification with automated solutions takes minutes instead of days.

Business verification is mandatory in regulated industries like finance, payments, and crypto.

Business verification reduces risks of fraud, money laundering, shell companies, and sanctioned entities.

Banks, fintechs, payment providers, insurance firms, and marketplaces use business verification services.

Business verification supports AML compliance by validating ownership structures and screening against sanction and PEP lists.