What Is AML in Real Estate?

Anti-Money Laundering (AML) practices certainly do not only apply to traditional financial institutions. There are several industries that must adhere to AML regulations and real estate is one of these, particularly due to the reasons such as allowing to channel illicit income into property and regularly processing large transactions. In this post, we will cover everything related to AML in the real estate industry.

Why Is Real Estate High Risk for Money Laundering?

It is not uncommon for real estate deals to involve millions of dollars, which makes it ideal for criminals to inject illicit money into a single property purchase. This is partly connected to our second point: Illiquidity. Buying a property is a stable asset that has a chance of increasing in value. So, these single property purchases can not only help criminals make a profit but also gives them the chance of making these eventual resale profits look clean.

Moreover, it is possible to buy property with complex ownership structures or offshore buyers such as shell companies, trusts, nominee buyers or offshore corporations. Through these legal vehicles, an ultimate beneficial owner that is considered to be a criminal can buy properties. Similarly, these criminals can transfer their funds across jurisdictions, often from countries with stricter oversight into those with weaker controls.

While already speaking of the countries with weaker controls, let’s add more on this subject. Some countries do not even require real estate agents to file suspicious transaction reports. In these kinds of jurisdictions with lighter AML obligations, money launderers often exploit the gaps by buying properties.

Furthermore, it is known that criminals often rely on professionals to facilitate transactions. However, these professionals, such as lawyers, notaries and brokers, may be complicit or negligent. So, they may use trusted professionals to add another layer of legitimacy to their transactions.

How Criminals Launder Money Through Property

In these attempts, there are numerous methods that criminals use. They may directly pay large sums in cash, use shell companies/trusts/nominees, buy and sell property at manipulated prices to create legitimate gains, use fake invoices for renovations, construction or other services, take a mortgage or structured loan after buying with illicit funds, use a third party on behalf of themselves, use fake or manipulated rental agreements, prefer crypto payments and more.

How Is AML Regulated in Real Estate?

It is actually a little bit different from the financial institutions. In the recent years, the Financial Action Task Force (FATF) has started to consider real estate as high risk. Since it is the global regulator regarding AML, let’s see what its stance is on real estate. The FATF classifies real estate agents, brokers and notaries as Designated Non-Financial Businesses and Professions (DNFBPs). DNFBPs are required to apply a risk-based approach, conduct Customer Due Diligence, keep records and report Suspicious Transaction Reports.

AML Real Estate Regulation Examples by Region

Besides the FATF Recommendations, there are varying requirements for different jurisdictions. Let’s start with the EU. Under 5AMLD and 6AMLD, the EU requires real estate agents, intermediaries, and notaries to verify client identity as well as the ultimate beneficial owner (UBO), check source of funds, file STRs, implement restrictions on large cash transactions, keep records and provide AML training for staff.

In the UK, estate and letting agents are obligated to register with HMRC for supervision, implement KYC (Know Your Customer) and CDD (Customer Due Diligence), file STRs with National Crime Agency, keep records and train staff for AML. As you may have noticed, the UK’s requirements are very similar to those of the EU. However, we should note that the UK has introduced a public register of overseas owners of UK property in the recent years, which aims to expose foreign shell company ownership.

Let’s move away from Europe a little and check how the US regulates the real estate market. In fact, real estate is partially covered in the US. It differs from the UK and the EU by not fully covering real estate professionals under the Bank Secrecy Act (BSA). It mostly relies on FinCEN Geographic Targeting Orders. The main requirements include identifying and reporting beneficial owners of shell companies when buying all-cash and filing reports with FinCEN but there are a lot of factors such as the transaction threshold and the area.

Key AML Obligations for Real Estate Professionals

In the previous section, we have covered some of the key AML obligations. Now, let’s delve deeper into these.

- The main goal of KYC (Know Your Customer) and CDD (Customer Due Diligence) processes is to identify and verify clients.

- If it is not a client but rather a company, trust or other legal entity, the aim shifts to verifying ultimate beneficial owners (UBOs) due to the role that being aware of the control structure plays in mitigating potential risks.

- Aside from these, KYC processes help you understand whether the money used for the purchase is legitimate by verifying the source of funds. This is usually done through requiring proof via bank records, validating the legitimacy of money or preventing tax evasion.

- However, we should also note that if your client is higher-risk, like a Politically Exposed Person, offshore structure or coming from high-risk jurisdiction, you must apply Enhanced Due Diligence (EDD).

What Are the AML Red Flags in Real Estate?

Common Indicators of Money Laundering in Real Estate

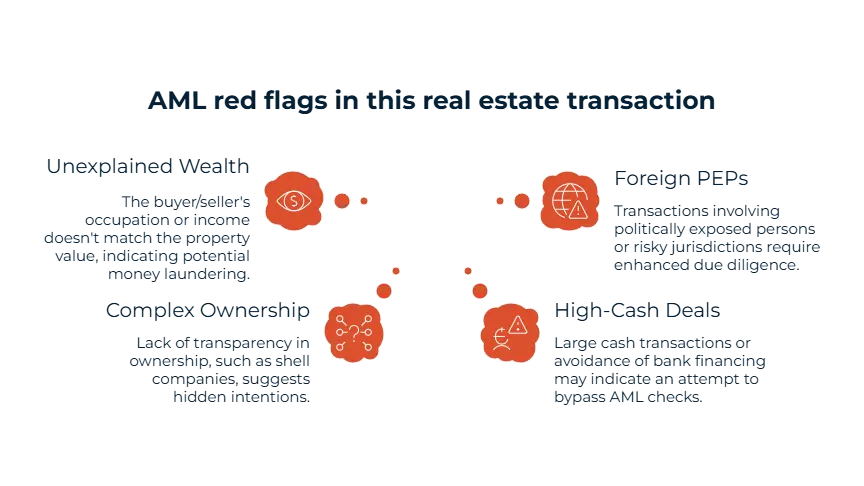

1. Unexplained wealth: If buyer/seller’s occupation or income doesn’t match the property value, then this may be an indicator of money laundering. Similarly, we consider sudden appearances of large funds with no credible explanation as red flags as well.

2. Complex ownership: Ownership can give away a lot. Lack of transparency regarding Ultimate Beneficial Owner (UBO), such as shell companies, offshore trusts or nominees, is one of the main red flags.

3. High-cash deals: You must watch for structured payments that are just below reporting thresholds. However, you also should not neglect purchases fully or largely in cash, crypto or money orders. Additionally, do not forget to check if your client avoids financing through banks because this may be an attempt to avoid triggering AML checks.

4. Foreign PEPs - Risky Jurisdictions: We have already mentioned that you must apply EDD to higher-risk clients in the previous section. However, there’s more to that. You should always watch closely when PEPs or their associates, buyers with connections to corruption-prone industries, clients from countries with weak AML enforcement or secrecy laws are about to make a transaction.

AML Risk Assessment in Real Estate

Just like the other industries, real estate can benefit immensely from client risk scoring. So, how do you assign scores to your clients? Often, businesses classify customers as low, medium and high risk. Let’s give examples for each of these: We consider a local buyer with a regular salary and mortgage as low risk, a small business owner that purchases another home abroad as medium risk, and a foreign Politically Exposed Person who buys luxury apartments through Cayman Islands company in cash as high risk.

In addition to client profiles, you may assign risk levels based on jurisdiction/product/channel risk. These include strictness of AML controls in their country, product’s value, and which channel they use.

Notable Real Estate Money Laundering Cases Around the World

1. The $1 Billion 1MDB Scandal – Luxury Properties in the U.S.

This infamous case revolves around a sovereign wealth fund that was created by the Malaysian government in order to promote economic development. However, billions of dollars were misappropriated from the fund and transferred through various means, including luxury real estate. Among these properties, there were billions of dollars’ worth of property in Beverly Hills and Manhattan, which even included an apartment owned by Jay-Z and Beyonce before.

2. Vancouver’s Real Estate Laundromat – The “Snow Washing” Epidemic

Now, let’s look at an incident so infamous that investigators call it the “Vancouver model”. Even, the term “snow washing” was coined to describe the flow of dirty money entering the Canadian economy. In 2018 alone, it is estimated that C$5.3 billion was laundered through real estate in British Columbia. In these incidents, there were several organized crime groups such as Sinaloa Cartel from Mexico, Big Circle Boys triad from China, and Iranian gangs. These crime groups used various methods such as shell companies, straw buyers, inflated invoices, over-declared rental income, and all-cash purchases to disguise their illicit income. It even worsened the housing affordability crisis in the region by around 5%.

3. Danske Bank Estonia – Real Estate Link in the Baltics

In 2017, it was revealed that Danske Bank’s Estonian branch had allowed over €200 billion (according to the sources of Reuters) of suspicious transactions to move through its channels. At first this was largely attributed to the lack of communication between Copenhagen and Estonian branch, however in fact it turned out to be highly corrupt because the executive board couldn’t enforce proper communication routes and monitor whether its branches were functioning legally. Prosecutors seized ten million euros worth of property that they earned through providing money laundering services.

4. Russian Oligarchs in London – “Londongrad” Real Estate

London has been an attractive city for Russian oligarchs and elites for some time now . This even led to birth of the nickname “Londongrad”. These oligarchs more often than not, use offshore companies and trusts to conceal their identities. They mainly buy luxury properties in areas such as Belgravia, Knightsbridge and Mayfair. However, due to the invasion of Ukraine back in 2022, the UK froze many of these assets.

5. United States FinCEN GTO Findings – All-Cash Buyers in Miami & NYC

We have already mentioned that all-cash purchases are often red flags and this case sets a good example of this. What served as a wake-up call in this case is that, around one in three all-cash luxury transactions belonged to the buyers who were flagged for potential links to money laundering. Another troubling indicator was that the majority of these used LLCs and other opaque corporate vehicles. Today, the U.S. requires beneficial ownership information (BOI) under the Corporate Transparency Act and Geographic Targeting Orders in order to mitigate these risks.

How Sanction Scanner Helps With Real Estate AML Compliance

At Sanction Scanner, we offer all of the solutions you will need for staying compliant in the real estate industry. As for what we offer, we can start with our AML/KYC screening tools. In just a few seconds, you can scan buyers and sellers against thousands of sanctions lists, PEP lists, wanted lists, and adverse media, all of which get updated every 15 minutes.

The start of a business relationship is always the most important part in mitigating future risks. We have already touched upon what the lack of verification systems can result in, such as the all-cash buyers in the U.S., Russian oligarchs in London, or the “Snow Washing” epidemic in Canada. So, we have developed software solutions that will help you with Know Your Business/Know Your Customer and identifying Ultimate Beneficial Owners processes.

If you decide to use Sanction Scanner’s solutions, you will be presented with our risk-based customer risk assessment tools as well. With these tools, you can assign risk levels to your clients to see if enhanced due diligence is needed.

We are also aware that real estate is one of the most dynamic sectors. Through ongoing monitoring and automated risk scoring, you can continuously monitor your clients and transactions to see if there are any changes in their risk level. For example, a buyer may become a Politically Exposed Person, or a seller may appear on a sanction list. Last but not least, we also help with your documentation processes. In case of a regulatory audit, you will have automatically generated reports to show as evidence.

FAQ's Blog Post

AML compliance is important in real estate because property deals are often used to hide illicit funds.

Real estate faces risks like shell companies, cash purchases, and foreign high-risk buyers.

Real estate AML is regulated by FATF standards, EU AMLDs, FinCEN rules, and local authorities.

Real estate firms must perform KYC, verify ownership, and check source of funds.

Agents, brokers, developers, and notaries must comply with AML rules in property sales.

AML breaches in real estate can lead to heavy fines, license suspension, and reputational harm.

Sanction Scanner helps real estate firms with KYC, UBO checks, and real-time transaction monitoring.