Cryptocurrency is significantly reshaping the financial system globally, and Malaysia has been a part of this development. The country has introduced very well-defined regulatory measures in order to govern cryptocurrency activity, where the goal is to ultimately create a secure and transparent space for investors, users, and businesses

Is Cryptocurrency Legal in Malaysia?

The answer is yes. Cryptocurrency is legal in Malaysia, but it is still not considered legal tender. Instead, digital assets are categorized depending on how they are utilized, whether as securities or as investment assets.

Even though crypto trading, staking, and even exchanges are permitted. This system ensures compliance, prevents fraud, and encourages investor confidence in the market.

What Are the Key Laws Governing Crypto in Malaysia?

Malaysia has significantly developed a comprehensive legal framework for digital assets. All of the care regulations include:

1. Capital Markets and Services Act 2007 (CMSA)

This Act ensures that digital assets are secured. Any platforms that offer such assets or facilitate trading are responsible for complying with licensing and must disclose rules under the CMSA.

2. Anti-Money Laundering, Anti-Terrorism Financing, and Proceeds of Unlawful Activities Act 2001 (AMLA)

The AMLA applies to all crypto-related entities. This legislation controls all that service providers establish systems in a way that will prevent money laundering and terrorism financing.

3. Guidelines on Digital Assets (Securities Commission Malaysia)

The Securities Commission on Guidelines on Digital Assets has set out what the regulatory conditions are for Initial Exchange Offering (IEOs), which focuses on securing investors as well as enhancing transparency in the market.

4. AML/CFT Guidelines

These guidelines are addressed specifically to Virtual Asset Service Providers (VASPs) and other relevant entities. This offers a detailed set of standards to identify, prevent, and report financial crimes that involve digital assets.

Who Regulates Cryptocurrency Activities in Malaysia?

Malaysʼs crypto is overseen by three main regulatory authorities, which are:

1. Securities Commission Malaysia (SC)

The SC serves as a role model, leading as the main regulatory authority for crypto markets. It oversees the licensing for Recognised Market Operators (RMOs) and Digital Asset Exchanges (DAXs). Their main mission is to implement fair practices, promote further innovations, as well as protect investor interests.

2. Bank Negara Malaysia (BNM)

Bank Negara Malaysia, also known as BNM, is responsible for focusing on financial stability and anti-financial crime compliance. They require VASPs to apply anti-money laundering (AML) and Know Your Customer (KYC) measures such as Customer Due Diligence (CDD) and enhanced due diligence, specifically for high-risk profiles. These regulations and obligations promote the insurance that crypto services do not become channels for illicit financial activity.

3. Labuan Financial Services Authority (Labuan FSA)

Labuan FSA is responsible for overseeing offshore digital finance operations in Malaysiaʼs Labuan region. They provide crypto-friendly licensing for firms globally that are engaged in token offerings, custody services, and digital finance. This allows them to function and operate within internationally recognized compliance standards.

Note: This Securities Commission stays as the primary authority for licensing and the main regulator for onshore crypto platforms and exchanges.

What Are the Licensing Requirements for Crypto Platforms in Malaysia?

Crypto service providers in Malaysia are required to have specific licenses to legally operate:

- Exchanges and custodians are required to initially obtain approval as a Recognized Market Operator (RMO) or Digital Asset Exchange (DAX)

- Platforms that are offering Initial Exchange Offerings (IEOs) are required to be hosted by licensed exchanges

- Major licensed exchanges include Luno, Tokenize Xchange, and SNEGY, which are seen as the standards for regulatory compliance and best practices for operating.

These licensing standards are established to promote transparency, security, and integrity of the markets across Malaysiaʼs cryptosystem.

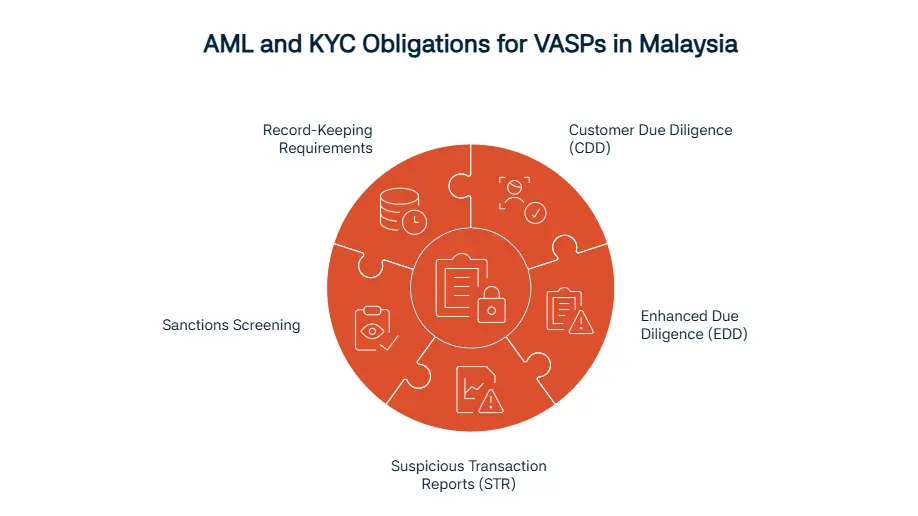

What Are the AML and KYC Obligations for VASPs?

VASPs in Malaysia encounter strict AML and KYC requirements. These obligations are significant in preventing the misuse of crypto platforms.

Key compliance regulations include:

Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD):

VASPS are required to verify the identity of their customer before they are able to do onboarding. For higher-risk clients, extra documentation and verification steps are a must.

Suspicious Transaction Reports (STR):

Unusual or suspicious activities are to be reported promptly to NBM

Sanctions Screening:

Clients are required to be screened against local and global sanctions databases as well as Politically Exposed Persons (PEPs) lists.

Record-Keeping Requirements:

All transactions and any information related to the customer must be stored for at least six years in order to support potential audits and investigations. An enforcement case in 2021 that involved Xpay, an unregistered platform, has showcased Malaysiaʼs intolerance of entities. The SC demanded its shutdown after violating KYC regulations, which highlights the regulatory emphasis on strict adherence.

How Is Cryptocurrency Taxed in Malaysia?

Malaysia does not currently impose a specific tax on cryptocurrencies. However, digital asset transactions could be subject to income tax, which depends on how they are conducted and classified as well.

1. Taxability of Gains

Profits that are derived from cryptocurrency activities could fall under income tax rules if it is not considered part of a “business activityˮ. This usually includes regular trading, mining, or any other consistent income generated consistently. Even occasional transactions or one-off transactions could be taxable if their pattern, motive, or scale showcases commercial behavior.

In order to stay compliant, investors are required to keep accurate and detailed transaction records that show dates, asset types, values, and the counterparties involved.

2. Institutional Tax Obligations

For businesses and corporations, crypto-related operations, sp, specifically those that involve cross-border transactions, could trigger transfer pricing (TP) requirements. These rules make sure that the pricing between related parties in different countries is fair and shows the real market value. Firms are required to:

- Maintain clear documentation of transaction pricing

- Justify the valuation methods used

- Align the practices with both local and international tax standards.

Failure to comply could result in penalties, audits, and as well as reputational risks. Since crypto taxation is continuously evolving, professional tax advice is needed for exploring complex obligations effectively. Note: The Inland Revenue Board (LHDN) has heightened its monitoring of cryptocurrency activity, which shows greater enforcement and scrutiny over time.

What About Stablecoins and Central Bank Digital Currency (CBDC)?

Stablecoins are still not yet regulated in Malaysia, but are still subject to AML and compliance protocols, specifically platforms that operate their trade and custody. On the other hand, Bank Negara Malaysia (BNM) is currently exploring the future developments of a Central Bank Digital Currency (CBDC). Done through Project Dunbar, the country has joined forces with other ASEAN countries to test multi-CBDC platforms, which are aimed at making cross-border payments smoother. This program highlights Malaysiaʼs strategic interest in digital financing structure, even as it emphasizes regional cooperation with other nations.

What Are the Risks and Red Flags in Malaysia's Crypto Market?

Since cryptocurrency is evolving quickly in this day and age, the threats that come with it also increase. Understanding abnormal or suspicious behavior is important for both compliance as well protection of investors.

Some of the common risks include:

- Pump & Dump Projects: Prices could be manipulated and changed through artificial hype, which is followed by mass sell-offs. Victims, most likely to be retail investors, are subjected to only being left with devalued tokens.

- Fraudulent Investment Guarantees: Promises of high and even “guaranteedˮ profits are usually the common type of scam indicators. These are legitimate crypto investments that can guarantee or ensure fixed returns.

- Unregistered OTC Transactions: Off-market trades or over-the-counter transactions (OTC) that avoid compliance checks are a big sign that exposes participants and entities to money laundering risks, and those who offer no legal protections.

- Fake Investment Platforms: According to a report of The Securities Commission Malaysia has blacklisted over 30 fraudulent crypto platforms in 2024. These sites can often mimic legitimate exchanges as a way to steal user funds.

To diminish risk and emerging threats, users should only engage with legitimately licensed exchanges and apply due diligence before making any type of investment.

How Does Malaysia Align with Global Crypto Regulations?

Malaysiaʼs regulatory approach is both progressive as well as internationally aligned, which helps establish credibility and investor trust.

FATF Compliance

Malaysia constantly complies with the Financial Action Task Force (FATF) Travel Rule, which demands crypto firms collect and share transaction information in order to prevent illicit financial activities. By doing so, this aligns Malaysia with notable global economies on AML/CFT formalities.

International Comparisons

The Securities Commission Malaysia (SC) maintains a balanced framework parallel to global standards such as

- The Markets in Crypto Asset Regulation (MiCA)

- Singaporeʼs Monetary Authority of Singapore (MAS) laid out guidelines.

Regional Collaboration:

Malaysia has been actively collaborating with the countryʼs neighboring countries, such as Thailand, Indonesia, and Singapore, on blockchain, as well as with their regulators. These collaborations aim to establish ASEAN-wide fintech innovation that improves cross-border crypto cooperation among different nations and regional payment usage.

Most Popular Cryptocurrencies in Malaysia in 2025

Malaysia has remained a regional leader in cryptocurrency utilization, with around 6.2 million active users since early 2025 (Source: TTriple-A SC Malaysia). Some of the factors that helped with this growth are:

- Popular extensive access to mobile-first financial apps

- Strong utilization of digital payments

- Licensed exchanges that are recognized by the government, such as Luno, Tokenize, and SINEGY

Top Cryptocurrencies by Popularity in Malaysia

| Rank | Cryptocurrency | Why is it commonly used? | Estimated Usage Share |

| 1 | Bitcoin (BTC) | Long-term store of value and wide exchange support | 35% |

| 2 | Ethereum (ETH | DeFi ecosystem and staking opportunities | 28% |

| 3 | Tether (USDT) | Stability in MYR conversion and commonly used on OTC desks | 20% |

| 4 | Solana (SOL) | Low fees, active NFT, and gaming use | 10% |

| 5 | Ripple (XRP) | Cross-border payments and popular with fintechs | 5% |

Because of MYR volatility and the increased popularity of cross-border transactions as USDT, there has been a rise in usage within Malaysiaʼs OTC crypto trading market, as stated by the Securities Commission Malaysia. On the other end, Ethereumʼs utility in financing and DeFi continuously resonates strongly with digitally native investors, specifically the ones who explore passive income models as well as distributed financial tools.

Is Malaysia a Crypto-Friendly Country in 2025?

The answer is yes, but within clear regulatory limits. Malaysia fosters a supportive space for digital sets, balancing compliance. Although cryptocurrencies are not yet considered legal tender, they are legally tradable, investable as well and issuable. Hence, as long as activities are done through SC-licensed, it is acceptable.

Malaysiaʼs Crypto-Tolerance Summary Table in 2025:

| Category | Status | Details |

| Ownership | Legal | Recognized as digital assets under SC guidelines |

| Trading | Permitted | Allowed only through licensed Digital Asset Exchanges aka DAXs |

| Taxation | Case-by-case | Not specifically taxed although income tax may apply |

| Payment Use | Limited | Not legal tender but voluntary use by merchants |

| Regulatory Clarity | High | Clear licensing process under Capital Markets Act |

| Innovation | Under development stage | eKYC, CBDC pilot (Project Dunbar) and blockchain sandbox programs |

Malaysia is known as one of the top three ASEAN nations in crypto regulatory development. The countryʼs cooperation in Project Dunbar, a cross-border CBDC developed a national partnership with Singapore and Australia,c, further highlights the fact that their role is seen as a regional leader in blockchain innovation. Supported by a clear set of regulatory frameworks, Malaysia now supports three licensed cryptocurrency exchanges, which include Luno, Tokenize, and SINEGY. This ensures that digital asset activities happen in a secure and legitimate space.

FAQ's Blog Post

Yes, cryptocurrencies are legal in Malaysia but are not recognized as legal tender; they are regulated mainly for trading and investment purposes.

The Securities Commission Malaysia (SC) oversees digital asset regulations, while Bank Negara Malaysia monitors for AML/CTF compliance.

Yes, digital asset exchanges must be registered as Recognized Market Operators (RMOs) and approved by the Securities Commission.

Malaysia currently does not impose capital gains tax on individuals, but businesses profiting from crypto may be subject to income tax.

Crypto service providers must comply with strict KYC and AML regulations, including customer verification and reporting suspicious transactions.

Yes, but it’s recommended to use SC-approved platforms; using unlicensed platforms may pose legal and financial risks.

ICOs are permitted but must comply with guidelines issued by the Securities Commission, including whitepaper disclosure and investor protection rules.

Yes, Bank Negara Malaysia and the Securities Commission offer regulatory sandbox frameworks for fintech and crypto-related innovations to be tested safely.