Strong Know Your Customer (KYC) laws have been adopted by nations all over the world in response to the increase in financial crimes like money laundering and terrorist financing. Malaysia is not an exception. Companies that operate here have to adhere to strict KYC regulations in order to safeguard their reputations, align with international regulatory standards, and guard against financial crime risks.

This guide examines the legal framework, fundamental requirements, and real-world applications of Malaysia's KYC environment. Comprehending these regulations is essential for your operations, regardless of whether you are a bank, fintech company, or money service business (MSB).

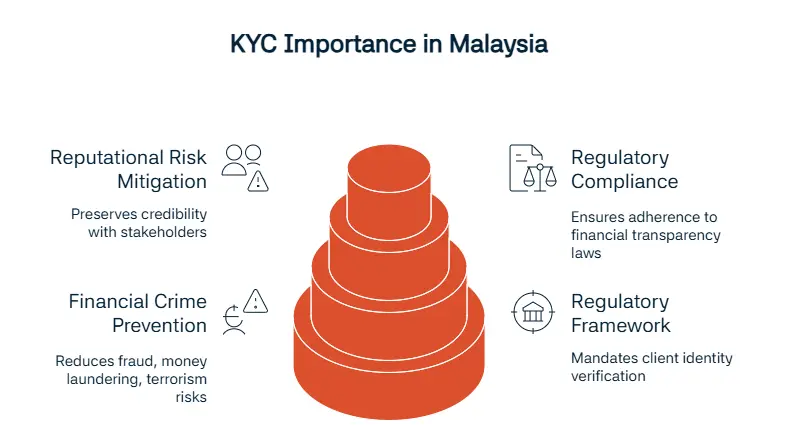

What Is KYC and Why Is It Important in Malaysia?

A regulatory framework known as Know Your Customer (KYC) mandates that companies confirm the identities of their clients. This procedure guarantees that organisations involved in financial operations adhere to rules pertaining to counter-financing of terrorism (CFT) and anti-money laundering (AML).

The following goals highlight the significance of KYC in Malaysia:

Preventing Financial Crimes

Know Your Customer, or KYC, is a vital tool for lowering the risks associated with fraud, money laundering, and the funding of terrorism. Businesses can identify and stop suspicious transactions by confirming the identity of their clients.

Enhancing Regulatory Compliance

Companies that follow KYC requirements are guaranteed to abide by regional laws intended to encourage financial transaction transparency. This compliance also improves the financial system's integrity.

Reputational Risk Mitigation

Businesses can preserve credibility and trust with clients, partners, and other stakeholders by putting in place efficient KYC procedures. Malaysia's KYC regulatory mandate comes from two main sources and aims to bring the nation's financial sector into compliance with international standards:

The 2001 Anti-Money Laundering, Anti-Terrorism Financing, and Proceeds of Illicit Activities Act (AMLA)

This act lays out stringent guidelines for customer due diligence and reporting suspicious activity and is the cornerstone of Malaysia's fight against financial crimes.

Bank Negara Malaysia (BNM)

In order to ensure compliance with national and international standards, these documents give financial institutions comprehensive guidelines and expectations for implementing strong anti-money laundering (AML) and counter-financing of terrorism (CFT) measures.

What Is the Legal Framework for KYC in Malaysia?

Malaysia has created a thorough KYC regulatory framework that complies with both international and national standards. An outline of the main legal pillars assisting with KYC compliance is provided below:

AMLA (2001)

Malaysia's AML/CFT laws are based on the Anti-Money Laundering, Anti-Terrorism Financing, and Proceeds of Unlawful Activities Act. It mandates that companies:

Confirm the identities of their clients.

Keep an eye on transactions and notify the appropriate authorities of any suspicious activity.

The 2013 Financial Services Act (FSA) and Islamic FSA

To guarantee appropriate governance and risk management in their operations, banking institutions, conventional and Islamic, must abide by these rules.

AML/CFT Policy Documents (Updated 2023)

The guidelines issued by Bank Negara Malaysia outline specific requirements for banks; designated non-financial businesses and professions (DNFBPs); money services businesses (MSBs); and virtual asset service providers (VASPs).

These documents stress the value of e-KYC systems and present a risk-based approach to CDD.

Who Regulates KYC Compliance in Malaysia?

Malaysia has a strong regulatory framework, with several organisations making sure that KYC regulations are followed. Important regulators consist of:

Bank Negara Malaysia (BNM)

As Malaysia's central bank, Bank Negara Malaysia (BNM) is in charge of monitoring the financial industry to guarantee stability and adherence to anti-money laundering and counter-financing of terrorism (AML/CFT) regulations.

Securities Commission Malaysia (SC)

In order to protect investors' interests and adhere to AML/CFT regulations, the SC makes sure licensing and monitoring operations are included in their regulatory purview.

Labuan Financial Services Authority (Labuan FSA)

In Malaysia's Labuan jurisdiction, a recognised global centre for business and finance, offshore financial institutions are governed by the Labuan Financial Services Authority (Labuan FSA). To stop illegal financing, Labuan FSA strictly enforces adherence to AML/CFT regulations. It ensures that the Labuan region's banking, insurance, trust, and other financial service providers adhere to both local and international regulatory standards.

What Are the Core KYC Requirements for Malaysian Entities?

To guarantee compliance, Malaysian entities must put the following essential KYC procedures into place:

Customer Identification and Verification

Companies need to gather and confirm important identifying information, such as:

For individuals, a driver's license, passport, or national ID.

Certificate of Incorporation (SSM Documents) for corporate clients.

Risk-Based Classification of Customers

Based on their profiles and transaction patterns, clients should be divided into low, medium, and high risk categories.

Ongoing Transaction Monitoring

To identify odd or suspicious activity, ongoing monitoring is essential. High-value cash transactions or quick transfers of funds into foreign accounts can be given as examples of warning signs.

Record-Keeping

For at least six years, all financial records, including those pertaining to customer transactions and KYC paperwork, must be maintained.

What is Malaysia's Customer Due Diligence (or CDD) Process?

A key component of KYC compliance is CDD. Based on the type of customer and the complexity of the transaction, Malaysian businesses are required to perform thorough checks.

Key Steps in CDD:

Individual versus Business Clients

Collect and confirm client and legal entity identification information. Valid government-issued identification and proof of address are required for individuals, while comprehension of ownership structures, identification of ultimate beneficial owners (UBOs), and verification of company registration documents are required for corporate clients.

Source of Funds and Wealth Verification

Get supporting documentation, such as bank statements, pay stubs, or company financial records, to confirm the authenticity of customer funds. This measure aids in the prevention of illegal activities like fraud and money laundering

Sanctions and PEP Screening

To find possible threats, compare customer names to databases of politically exposed persons (PEPs) and international sanctions lists.

Use of E-KYC Resources

To expedite client verification procedures, use authorised electronic Know Your Customer technologies like liveness detection, optical character recognition (OCR), and biometric face matching.

When Is Enhanced Due Diligence (EDD) Required?

For high-risk clients or transactions, EDD is essential. Examples consist of:

Politically Exposed Persons (PEPs) may be more likely to be involved in bribery or corruption because of their positions.

Complex Corporate Structures. These include multiple levels of ownership and frequently conceal the real beneficial owners through the use of offshore companies. These kinds of arrangements may be used for money laundering, tax evasion, or other illegal purposes.

The Financial Action Task Force (FATF) or local regulators have designated certain nations or areas as high-risk jurisdictions because they have inadequate anti-money laundering (AML) regulations, little transparency, or a higher risk of financial crime.

Non-Face-to-Face Onboarding describes onboarding procedures in which clients do not physically meet. Additional verification methods, such as video KYC, live biometric checks, and enhanced due diligence, are frequently necessary because they raise the risk of identity fraud.

Which Sectors Are Required to Implement KYC in Malaysia?

Know Your Customer (KYC) procedures must be implemented by a number of industries in Malaysia in order to prevent financial crime and maintain regulatory compliance. These sectors consist of:

- Banks and Financial Institutions: Leading the charge in KYC enforcement, banks make sure that client identities are confirmed in order to stop money laundering, fraud, and the funding of terrorism.

- Money Services Businesses (MSBs): MSBs, which include currency exchange and remittance services, adhere to stringent KYC procedures in order to keep an eye on transactions and identify any illegal activity.

- Cryptocurrency exchanges and wallet providers (VASPs): In order to verify client identities and stop the misuse of cryptocurrency assets in illicit financial transactions, KYC procedures help.

- Legal, Accounting, and Company Service Providers (DNFBPs): In order to reduce the risks connected to corporate structuring and financial advising services, non-financial enterprises and professions are required to follow KYC regulations.

- Precious metal dealers, pawnshops, and online gambling operators: These high-risk industries are required to put strong KYC procedures in place to identify clients and stop financial abuse.

How Does Malaysia’s KYC Framework Align with Global Standards?

The Financial Action Task Force (FATF) Recommendation 10, which emphasises Customer Due Diligence (CDD) to prevent money laundering and related crimes, is followed in the design of Malaysia's KYC framework. The 2023 FATF Mutual Evaluation report identified areas that need improvement in order to fully comply with international standards.

Important markers of Malaysia's progress consist of:

- Stronger Adoption of e-KYC: Malaysia has been more successful in adopting e-KYC systems than many of its regional counterparts like Thailand and Indonesia.

- Alignment with Singapore's Strict Risk-Based Approach: Singapore is renowned for its strict regulatory compliance, and it has a risk-based approach to customer profiling and EDD that is comparable to Malaysia's. Malaysia seeks to prevent financial crimes while preserving an atmosphere that is conducive to business by customising KYC procedures to the degree of risk associated with each individual customer.

- Growing Innovation and Technology Use: To improve KYC procedures and make them safer and more effective, Malaysian financial institutions and regulators are increasingly relying on cutting-edge technologies like artificial intelligence and machine learning.

Major KYC Failures in Malaysia

| Case Name / Entity | Year | Nature of Failure | Regulatory Violation | Outcome / Penalty |

| XPay Fintech | 2023 | Weak onboarding; failed to verify UBOs in business accounts | Breach of AMLA 2001; BNM KYC Guidelines | License suspended; RM1.5M fine |

| Maybank (Alleged) | 2021 | Incomplete CDD on HNW clients; missing risk classification | AMLA + BNM AML/CFT Policy Document non-compliance | Internal probe; risk management practices updated |

| Offshore Corporate Services Firm (Unnamed) | 2022 | KYC skipped for multiple shell companies linked to high-risk jurisdictions | Failure to identify beneficial ownership under AMLA | License revoked; STR enforcement initiated |

| Crypto OTC Broker (Private) | 2023 | No KYC documentation collected; anonymous crypto-to-fiat transactions | Non-registration as MSB; No CDD performed | Platform shut down by BNM and SC |

| Law Firm (DNFBP Sector) | 2020 | Failure to screen politically exposed persons (PEPs) | Violation of BNM Guidelines on DNFBPs | Warning issued; mandatory AML training imposed |

FAQ's Blog Post

KYC in Malaysia involves verifying customer identity using official documents, risk assessment, and ongoing monitoring to prevent money laundering and terrorism financing.

Banks, fintech firms, insurers, and Designated Non-Financial Businesses and Professions (DNFBPs) are required to follow KYC under Bank Negara Malaysia regulations.

Yes, Bank Negara Malaysia has permitted e-KYC for onboarding individuals remotely, provided financial institutions meet strict security and verification standards.

Typically, a valid ID such as MyKad or passport, and proof of address are required, although the exact documents depend on the institution and risk level.

KYC is a key component of AML compliance, helping institutions detect suspicious activities and meet obligations under the Anti-Money Laundering, Anti-Terrorism Financing and Proceeds of Unlawful Activities Act (AMLA).

Yes, institutions that fail to comply with KYC obligations may face administrative penalties, fines, or even criminal prosecution under Malaysian law.

Bank Negara Malaysia (BNM) is the main regulatory authority overseeing KYC and AML compliance across the financial sector.

Customer information must be reviewed periodically based on the customer’s risk level—higher-risk profiles require more frequent updates and monitoring.