To understand the Philippines’ legal framework to stay informed about cryptocurrencies that transform the world of finance, we need to understand the government’s innovative regulations to balance the financial inclusion of cryptocurrencies with security.

Is Cryptocurrency Legal in the Philippines?

Yes. Even though it is not a legal tender yet, cryptocurrencies are digital assets that are treated as legal virtual commodities in the Philippines. The government also advocates for blockchain innovation through its Virtual Asset Service Provider (VASP) framework, which ensures sector growth and reduced risks of money laundering and fraud.

The Legal Framework for Crypto in the Philippines

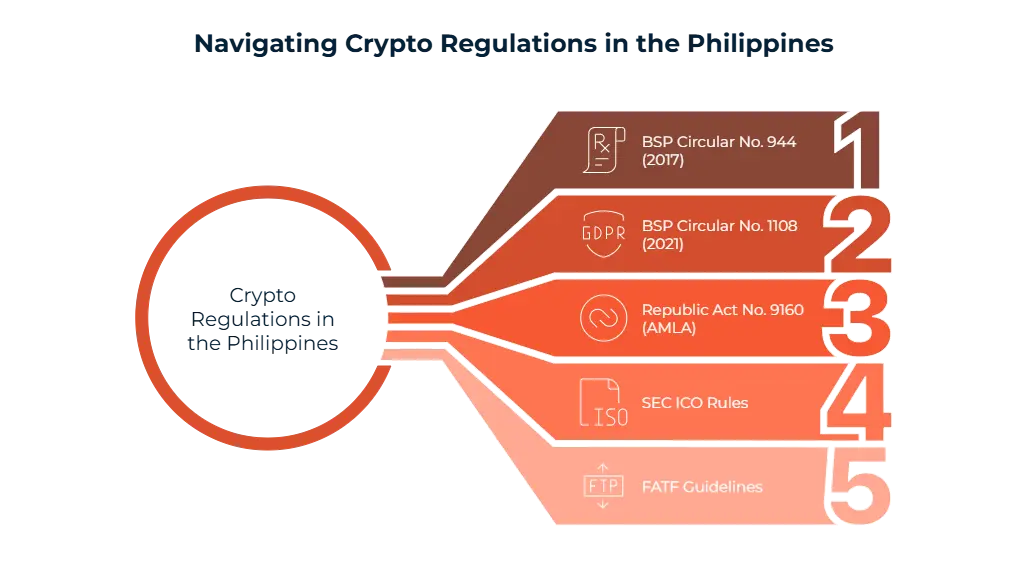

Cryptocurrency activities are legally regulated in the Philippines. Some major regulations that shape crypto compliance are:

- BSP Circular No. 944 (2017): This circular is to regulate virtual currency exchanges in the Philippines by registering them with the Bangko Sentral ng Pilipinas (BSP) and complying with the rules of anti-money laundering (AML) and counter-terrorism financing (CTF).

- BSP Circular No. 1108 (2021): No. 1108 has introduced stricter operational requirements and cybersecurity standards for the Virtual Asset Service Providers (VASPs) to ensure better consumer protection and risk management.

- Republic Act No. 9160 (AMLA): For stricter reporting and monitoring to fight financial crimes, the Anti-Money Laundering Act was amended to include cryptocurrency-related businesses.

- SEC ICO Rules: To ensure more transparent and accountable investor activities, initial coin offerings (ICOs) are required to meet an investment contract to register with the Securities and Exchange Commission (SEC).

- FATF Guidelines: The Philippines has aligned its policies with the Financial Action Task Force (FATF) cryptocurrency guidelines to address concerns around money laundering and terrorism financing and foster a secure crypto environment.

According to our experts, the Philippine government is committed to fostering innovation and maintaining its global standards with the help of these regulations.

Role of BSP and the VASP License

Since all cryptocurrency exchanges and wallet providers need to register as Virtual Asset Service Providers (VASPs), VASP licensing is mandatory. A VASP license entails:

- Capital Requirements: VASPs offer custodial services to make sure of financial stability and protection of user funds by maintaining a minimum capitalization of ₱50 million (~$900,000).

- KYC and Monitoring: To verify user identities and monitor real-time transactions for preventing fraudulent activities and following anti-money laundering regulations, robust Know Your Customer (KYC) and Customer Due Diligence (CDD) processes must be implemented.

- Cybersecurity Standards: VASPs should establish a comprehensive cybersecurity framework for protecting sensitive user data and cyber threats, including encryption, security audits, and so on.

- Operational Presence: VASPs should maintain their primary operations, like offices and key management personnel within the Philippines, to ensure accountability and facilitate regular monitoring.

- Periodic Audits: Financial and operational reports must be regularly submitted to the Bangko Sentral ng Pilipinas (BSP) by VASPs to ensure transparency and to assess the overall performance of performance.

To provide transparent lists of licensed VASPs to users and stakeholders, the BSP makes the VASPs publicly available.

AML and KYC Obligations for Crypto Companies

To prevent the digital assets, the Philippines has adopted strict anti-money laundering measures. VASPs are classified as “covered persons” and they are subject to these obligations:

KYC & Due Diligence: The customer identities need to be verified by using reliable documentation. They also need to assess the origin of customer funds to make sure

that they are linked to illegal activities for building trust and reducing financial crime risks.

Reporting Requirements:

- All transactions over ₱500,000 (~$9,000) must be reported to the Anti-Money Laundering Council (AMLC) for transparent regulatory standards with a formal report.

- Authorities can investigate illegal and unusual activities further through Suspicious Transaction Reports (STRs).

Sanctions Screening: Performing real-time screening for identifying transactions, accounts of the sanctioned entities, and Politically Exposed Persons (PEPs) is important to minimize the risk of illegal activities and conformity to international sanctions.

Ongoing Monitoring: Unusually high transactions and sudden changes have to be monitored continuously to detect suspicious patterns and identify potential risks.

Multi-million-peso fines and criminal liabilities are at stake in the case of a failure to follow these obligations.

Cryptocurrency Taxation in the Philippines

The Philippines doesn’t have cryptocurrency tax laws, but its general income tax principles can be applied:

| Crypto Activity | Tax Treatment |

| Trading | Capital gains tax on profits from buying and selling assets |

| Mining |

Income tax as it is treated as business activity |

| Airdrops/ Staking Rewards | Taxable as additional income |

| Corporate Crypto Usage | Regular business income tax rules apply |

Are Crypto Assets Treated as Securities?

No. According to our experts, we cannot classify all cryptocurrency tokens as securities. If only a token meets the Howey Test criteria and presents itself as an investment contract, we can say it can fall under securities law, such as Initial Coin Offerings (ICOs).

Under SEC regulations, any unregistered public offering is illegal; therefore, ICO issuers have to register with the SEC regulations.

Cross-Border Crypto Transfers

The Philippines follows the FATF Travel Rule for their cross-border crypto transactions and under FATF Recommendation 16, VASPs have to:

- Collect sender and recipient information in detail,

- Monitor suspicious activities and transfers such as high-risk jurisdictions,

- Report criminal activities to the authorities.

FATF travel rules facilitate traceability and security for international payments.

Adoption and Public Perception of Cryptocurrency

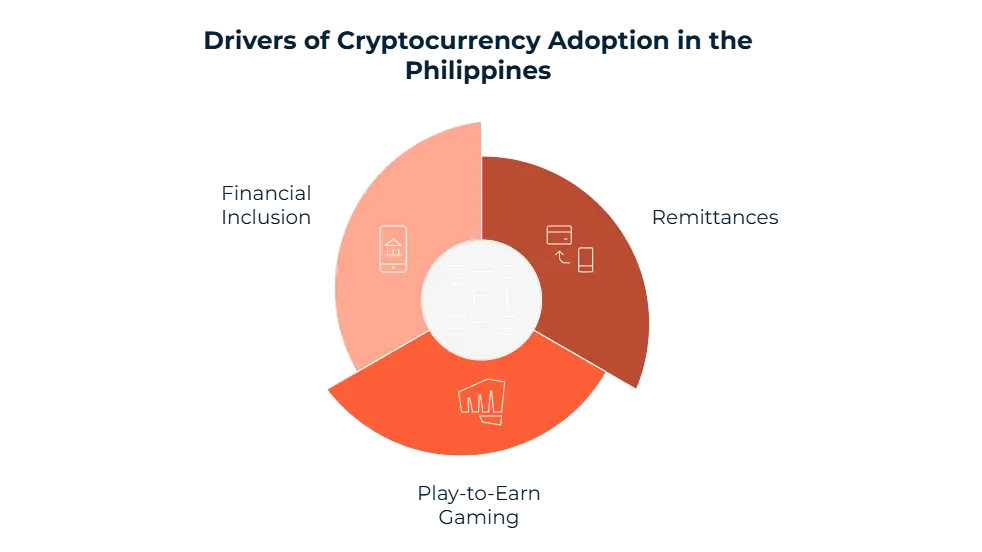

As our research suggests, nearly 6.1 of Filipinos own cryptocurrency in 2025 (Statista). Cryptos are popular for several reasons, such as:

- Remittances: Cryptocurrency is a much faster and cheaper way for families to receive more money sent to them by Overseas Filipino Workers (OFWs), just in minutes, since they do not have to pay high fees to traditional remittance services.

- Play-to-Earn Gaming: Thanks to blockchain-based games like Axie Infinity, gamers now interact with digital assets like cryptocurrencies or NFTs by playing, and they combine entertainment with income generation, which is now massively popular in countries like the Philippines.

- Financial Inclusion: People can save, transfer, and invest in cryptocurrencies to achieve greater financial independence, only using a smartphone and an internet connection now, without any traditional banking infrastructure.

However, regular monitoring and public education initiatives are necessary to prevent fraudulent activities.

Penalties for Non-Compliance

Not complying with the cryptocurrency regulations can lead to serious consequences, such as:

- Fines: With the purpose of deterring violations, companies and individuals who violate legal regulations may be imposed penalties over ₱5 million, based on its severity and impact.

- Asset Freezes: To prevent misuse of resources and recover losses or damages, any illegal operation can result in the freezing of assets such as financial accounts, properties etc.

- Criminal Liability: Individuals or entities who engage in illicit activities can face legal consequences such as imprisonment and heavy fines which can ensure accountability for ethical and lawful conduct.

We can exemplify BSP sanctions on VASPs that fail to effectively monitor crypto flows linked to the darknet.

Developments in 2025

Regulatory bodies have taken key steps to promote the development of cryptocurrencies:

- Regulatory Sandbox Framework: Companies need to experiment with new financial technologies to ensure stability with innovation. Thus, the Bangko Sentral ng Pilipinas (BSP) has introduced a regulatory sandbox to pilot-test applications of Decentralized Finance (DeFi) and blockchain technology.

- Public Education: To prevent crypto-related scams and inform individuals to identify fraud schemes and help them make informed decisions regarding their digital assets, the Securities and Exchange Commission (SEC) has presented public education campaigns.

- Future Legislation: The future of cryptocurrency in the Philippines is a hot debate right now. The discussions include crypto-specific tax policies and a digital asset framework to standardize regular monitoring and provide clarity for businesses and customers.

Crypto-Friendliness Scorecard: Philippines (2025)

The Philippines has one of the most active crypto markets in Southeast Asia due to its young population and strong mobile internet usage. It is not legal tender, yet it is legal and regulated. The BPS now holds VASPs accountable under a formal licensing regime, and the Philippines is considered “moderately crypto-friendly with strong AML oversight.”

| Criteria | Philippines Score (2025) | Notes |

| Legal Status of Crypto | Legal (not legal tender) | Crypto trading and ownership are legal, but not accepted as payment |

| BSP/VASP Registration | Mandatory for platforms | BSP Circular No. 1108 requires licensing for all crypto exchanges |

| AML/KYC Enforcement | Strong | AMLA applies to VASPs; KYC, STRs, and monitoring are required |

| Tax Clarity | Unclear | No specific crypto tax law; general income tax principles may apply |

| Institutional Adoption | Growing | Fintechs lead adoption; banks remain cautious |

| CBDC Development | In Pilot | BSP is piloting Project CBDCPh with selected financial institutions |

| Public Perception | Positive | High retail interest, especially among OFWs, gamers, and digital natives |

| DeFi & NFT Regulation | Not yet defined | SEC guidance pending; DeFi and NFTs in a legal gray area |

| Regulatory Stability | Improving | Ongoing updates to AMLA and crypto-specific laws anticipated |

Overall Crypto-Friendliness Rating: 7.2 / 10

There are gaps in tax and DeFi regulations, but it is still a considerably well-regulated environment with strong public interest.)

Top Traded Cryptocurrencies in the Philippines (2025)

Remittance demands, play-to-earn gaming, and mobile-first adoption can affect crypto activities in the Philippines. Most actively traded cryptocurrencies, depending on their use and local volumes, are,

| Rank | Cryptocurrency | Popular Use | Notes |

| 1 | Tether (USDT) | Remittances & stable savings | Widely used for P2P transfers, especially among OFWs |

| 2 | Bitcoin (BTC) | Long-term holding | Used for savings and capital appreciation on major exchanges |

| 3 | Ethereum (ETH) | DeFi, NFTs, Web3 apps | Popular with Axie Infinity players and NFT collectors |

| 4 | BNB | Trading fee discounts | Used on Binance and other centralized exchanges |

| 5 | XRP (Ripple) | Cross-border payments | Active use by Filipinos sending/ receiving money to the Middle East |

| 6 | SLP & AXS | Play-to-earn rewards | Core tokens for Axie Infinity and other local blockchain games |

| 7 | Cardano (ADA) | DeFi & staking | Growing adoption via wallet apps and staking incentive |

FAQ's Blog Post

The Bangko Sentral ng Pilipinas (BSP) regulates virtual asset service providers (VASPs) under Circular No. 1108.

Yes, cryptocurrencies are legal and regulated primarily for anti-money laundering (AML) compliance and investor protection.

Yes, they must register with the BSP as a VASP and comply with AML/CFT obligations.

The circular mandates customer due diligence, reporting obligations, and cybersecurity measures for all VASPs.

The BSP requires VASPs to implement strong cybersecurity, transparent fee disclosures, and customer complaint mechanisms.

Yes, gains from cryptocurrency trading are subject to income tax, and businesses must follow BIR guidelines.

Yes, but ICOs must comply with securities laws and may need to be registered with the Securities and Exchange Commission (SEC), depending on their nature.