There is no doubt that cryptocurrency industry is renowned for its innovation, but it comes with its own set of problems. One striking risk that cannot be ignored is the threat of fraud because of how much it undermines trust and drives calls for increased regulation. Here, we will touch upon the ten largest crypto frauds in history from their methods, to long-term implications for the industry.

Top 10 Crypto Scams in History

PlusToken Scam (China, 2019)

Fraud Type: Ponzi scheme

Estimated Loss: $2+ billion

PlusToken operated as a high-yield wallet that promised returns of up to 30%. It was actually claiming to invest user deposits in cryptocurrency trading but what actually happening was the pooling of funds to pay earlier "investors" in a classic Ponzi structure. The scheme swindled millions before its operators disappeared with over 180,000 BTC, 6 million ETH, and other tokens.

Regulatory Impact: China's response was swift. They intensified its crackdown on crypto-related activities. PlusToken's downfall also became a global case study in anti-money laundering (AML) practices cited by the Financial Action Task Force (FATF).

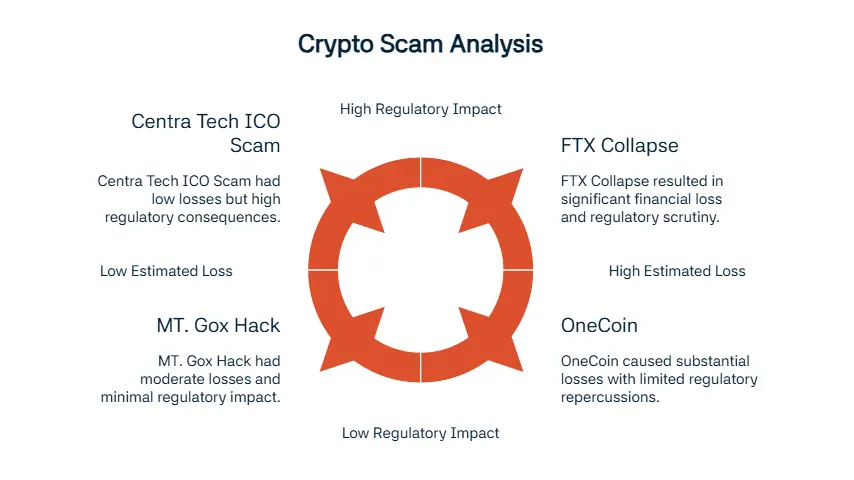

OneCoin (Global, 2014–2017)

Fraud Type: Fake cryptocurrency / MLM scam

Estimated Loss: $4.4 billion (possibly higher)

Marketed by Ruja Ignatova, often called the “Crypto Queen”, OneCoin attracted investors from 175 countries but never actually operated a blockchain. Instead, it sold educational packages and rewards while enticing users into its multilevel marketing scam, which eventually collapsed.

Regulatory Impact: OneCoin remains one of history’s largest pyramid schemes. It prompt-ed multiple international investigations by Interpol and the US Department of Justice (DOJ).

FTX Collapse (USA/Bahamas, 2022)

Fraud Type: Misuse of customer funds / accounting fraud

Estimated Loss: $8–10 billion

FTX made a name for itself as a leading cryptocurrency exchange until its crumbling under the revelations of unauthorized fund use and hidden liabilities tied to its sister firm, Alame-da Research. The central figure in this scandal was none other than the founder of the institution, Sam Bankman-Fried.

Regulatory Impact: The most significant regulatory crackdown followed the collapse, in which agencies like the SEC, CFTC, and DOJ imposed stricter governance on exchanges. Sam Bankman-Fried also got his share of it by getting convicted in 2023 and his sentence further laid bare the legal risks for noncompliance.

MT. Gox Hack (Japan, 2014)

Fraud Type: Exchange hack + internal fraud

Estimated Loss: 850,000 BTC (~$500 million in 2014; ~$40B at peak value)

MT. Gox used to handle 70% of all Bitcoin trades at the time. Unfortunately, this came to an end after hackers drained its reserves. Its appalling internal security measures and years of mismanagement certainly didn’t help as well. All of these led MT. Gox to declare bankruptcy.

Regulatory Impact: As a response, Japan formalized crypto exchange regulation under its Financial Services Agency (FSA), which was an early adopter of crypto-focused compliance standards.

BitConnect (Global, 2016–2018)

Fraud Type: Ponzi scheme / lending platform scam

Estimated Loss: $1–2 billion

BitConnect promised daily returns of 1% thanks to their proprietary trading bot. Its BCC to-ken peaked at a market cap exceeding $2 billion, just before the unraveling of its deception that led to the token’s crash by 99% overnight.

Regulatory Impact: The SEC filed lawsuits against BitConnect promoters. This carries a great importance because it set a precedent for enforcement actions on fraudulent lending platforms.

Thodex Exit Scam (Turkey, 2021)

Fraud Type: Exchange exit scam

Estimated Loss: $2+ billion

The Turkish exchange Thodex abruptly halted withdrawals in April 2021, claiming to seek investment. Meanwhile, its CEO vanished to Albania and left behind defrauded investors and vague statements.

Regulatory Impact: Turkey introduced emergency regulatory measures to mitigate further scams. Thodex's failure brought the urgent need for international cooperation in crypto enforcement to light.

Mirror Trading International (South Africa, 2020)

Fraud Type: Ponzi scheme via BTC trading

Estimated Loss: ~$1.2 billion

MTI claimed an AI-powered trading bot could generate guaranteed investment returns. It gathered over 23,000 BTC from unsuspecting victims before collapsing.

Regulatory Impact: Because of this major crackdown, South African authorities tightened crypto licensing frameworks, with FATF citing MTI in global guidance on Virtual Asset Service Providers (VASPs).

WoToken (China, 2018–2020)

Fraud Type: Clone of PlusToken Ponzi

Estimated Loss: $1 billion

There are many similarities with WoToken and PlusToken but the actual difference stemmed from targeting of a different user base. It roped in 715,000 users through multilevel marketing gimmicks that helped to sustain the fraud until its abrupt end.

Regulatory Impact: WoToken resulted in China banning crypto wallets outright but additio-nally it reaffirmed the dire need for crypto marketing restrictions globally.

Centra Tech ICO Scam (USA, 2017)

Fraud Type: Fraudulent ICO

Estimated Loss: $25 million

One definitely wouldn’t expect to see endorsements of celebrities, such as Floyd Mayweather and DJ Khaled, in a Crypto campaign. However, with the help of these and fake part-nerships with Visa and Mastercard, Centra Tech managed to gain a remarkable level of notoriety. As a consequence, investors lost millions in one of the earliest fraudulent Initial Coin Offerings (ICOs).

Regulatory Impact: It highlighted the risks of celebrity endorsements in unregulated spaces and paved the way for the SEC's first significant crackdowns on ICO fraud.

Africrypt (South Africa, 2021)

Fraud Type: Disappearance + suspected internal hack

Estimated Loss: $3.6 billion (contested)

Africrypt’s founders claimed a devastating hack had ruined the platform and then fled shortly afterward but the evidence showed that what they were actually doing was funneling funds through coin mixers based.

Regulatory Impact: Africrypt served to unveil Africa’s glaring regulatory gaps and fueled calls for global oversight on crypto businesses.

How Are Stolen Crypto Funds Laundered?

If we are to compare laundering stolen crypto and traditional money, it is possible to place crypto in a far more complex place than traditional money, but of course, this doesn’t stop cybercriminals to develop effective techniques to obscure transaction trails and cash out illicit gains.

- Let’s start with mixers and tumblers. These allow users to break the chain of custody by pooling funds with others and redistributing them in smaller chunks with the help of tools like Tornado Cash, ChipMixer, and Blender.io. The U.S. Treasury sanctioned Tornado Cash for aiding the laundering of over $7 billion in crypto, including the funds that were stolen by North Korea, back in 2022.

- Launderers also move assets between blockchains in order to break traceability and by-pass many monitoring tools focused on single chains (e.g., from Ethereum to Binance Smart Chain), which can be referred as “chain-hopping".

- Furthermore, the fact that Monero (XMR), Zcash (ZEC), and similar coins using privacy protocols to hide wallet balances and transaction history doesn’t help much because this allows launderers to use them to obfuscate source of funds before re-entering the market.

- P2P exchanges and gambling platforms deserve a mention here. They allow conversion to fiat or other assets with minimal KYC. Additionally, gambling sites also offer “smurfing” opportunities for stolen funds.

- Sometimes criminals convert stolen crypto into non-fungible tokens (NFTs) and resale them in secondary markets later on, which provides a new digital asset class for laundering with limited oversight

How Crypto Frauds Impact Global Regulation Trends

Major frauds and exchange collapses have almost always resulted in tightened rules and expanded oversight worldwide.

- To begin with, countries now require crypto platforms to verify user identities, monitor transactions, and file suspicious activity reports.

- After that, the global implementation of The Financial Action Task Force (FATF) Travel Rule remains non-negligible, which mandates crypto firms to share originator and beneficiary data during transfers over a certain threshold.

- Now, let’s discuss DeFi a little. In fact, it was originally meant to be decentralized but regulators are pushing for “responsible intermediaries”, such as frontend operators and aggregators, to implement controls.

- There are more radical approaches that we can encounter in some areas of the world. Due to reasons such as fraud and capital flight, countries like China, Algeria, and Morocco have outright banned crypto trading. There are also others that issue temporary freezes on new crypto products.

- Finally there are two concepts that we must mention. The first one is called MiCA (Markets in Crypto-Assets), effective 2024–2025 in the EU, and it introduces a licensing regime as well as reserve requirements.

- REGA (Responsible Encryption and Governance Act), on the other hand, is a U.S. draft bill aiming to regulate DeFi, stablecoins, and custody providers after the FTX collapse.

According to IMF data, over 70 countries proposed new crypto regulatory frameworks between 2021–2024 following high-profile frauds.

Lessons from the Biggest Fraud Cases

The combined losses from these ten cases exceed a staggering $30 billion. Most of these schemes shared a reliance on minimal regulatory oversight, insufficient Know Your Customer (KYC) protocols, and opaque offshore registrations. Robust compliance measures are not negotiable anymore to mitigate these risks for businesses and regulators.

How Technology Can Help Prevent Crypto Frauds

Let’s mention some of the key tools that can come very handy in this fight. Wallet Screening & Monitoring platforms identify suspicious activity, KYC/AML Verification Tools ensure ro-bust customer vetting, Adverse Media Screening highlights red flags during onboarding and On-Chain Analytics such as Chainalysis and TRM Labs allow real-time fraud detection. Every organization seeking to operate in the cryptocurrency space must adopt proactive compliance tools to safeguard itself and its users.

FAQ's Blog Post

The biggest crypto fraud to date is the FTX collapse, involving over $8 billion in missing customer funds. It exposed massive misuse of assets and lack of financial oversight.

OneCoin was a Ponzi scheme disguised as a cryptocurrency, raising over $4 billion without having a real blockchain. Its founder, Ruja Ignatova, remains a fugitive.

BitConnect promised high returns through a lending platform but turned out to be a Ponzi scheme. It collapsed in 2018, wiping out billions in investor money.

FTX failed due to fraudulent use of customer deposits, poor internal controls, and the mismanagement of funds between FTX and its sister company, Alameda Research.

Yes, despite regulatory efforts, crypto scams continue to evolve through phishing, rug pulls, and fake investment platforms. Users should verify sources and platforms carefully.

Always research the project, check for regulatory compliance, and avoid promises of guaranteed high returns. Use reputable exchanges and never share private keys.

The U.S., China, India, and several EU countries have been major targets due to high investor interest and less mature regulatory frameworks in earlier years.

In some cases, funds are partially recovered through legal actions or exchange reimbursements, but most victims never fully recover their losses.