Fraud brings both financial and reputational damage to companies. Therefore, fraud detection tools are needed in businesses. Since operations are getting more digitalised by the day, early detection will help you prevent losses of every kind and protect customer trust. In this blog post, we’ll be talking about the tools used in fraud detection, most common types of fraud, and risks that come with non-compliance.

What Is Fraud Detection?

Fraud detection is the combination of tools, technologies, and methods that are used specifically for identifying fraud. Acts like unauthorized payments, using fake or synthetic IDs, and insider threats can be found out using these tools. Your company can benefit from detecting fraud early to stop any fraudulent activity from causing more harm.

Why Is It Essential?

Fraud affects your company’s both financial and reputational well-being; therefore, detection help is needed and proactive defense is the way to go. In 2024, U.S. consumers reported $12.5 billion in total fraud losses. This is a 25% increase from 2023. Moreover, PwC’s Global Economic Crime Survey 2024 notes that globally, in Central and Eastern Europe (CEE), 41% of organizations reported experiencing fraud in the past 24 months. These cases causes billions of dollars in losses and more damage regarding customer trust is inflicted upon your company as well.

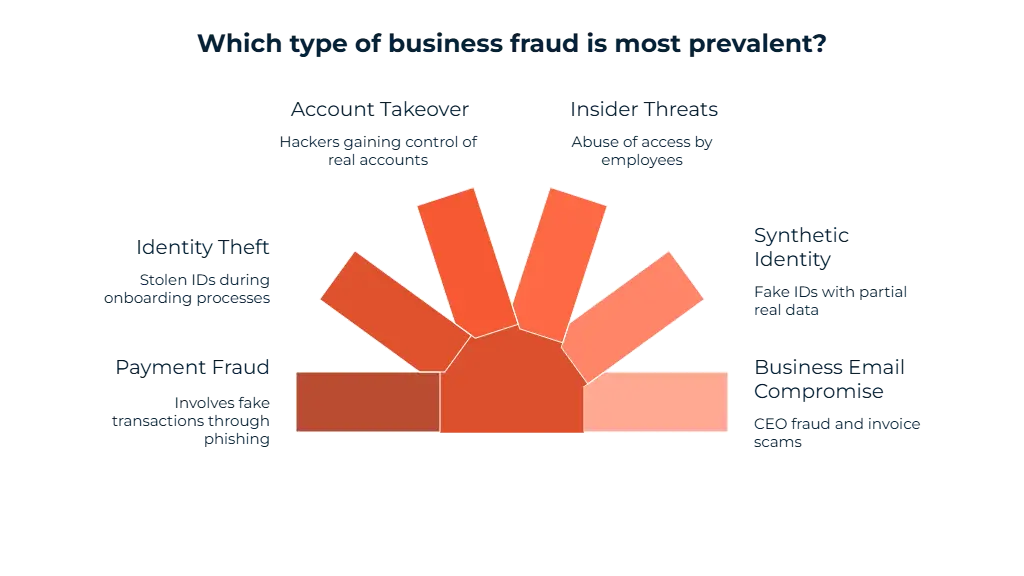

What Are the Most Common Types of Business Fraud?

Most common types of business fraud are payment fraud, identity theft, account takeover (ATO), insider threats, synthetic identity, and business email compromise (BEC). The first type, payment fraud still is popular amongst criminals. Stolen card data, where criminals use your card details to make purchases; and friendly fraud, where a customer of yours disputes the purchase they made to falsely receive a refund, also known as chargeback abuse can be given as prime examples of this fraud. Identity theft is another dangerous type of fraud. It works by criminals using stolen ID information for onboarding. Account takeover (ATO) is another problem companies face. Hackers gain control of someone’s account through acts like credential stuffing, where they use leaked usernames and passwords from previous breaches, and phishing, where they send deceptive emails and such to users, hoping to gain their login information. Using data from over 150 million ID scans, shows rise in synthetic identities, deepfakes, document manipulation.

Insider threats are caused by employees abusing their access to your company systems or data, and using these for personal gain. Another problem is synthetic identity fraud, where criminals mix both real and fabricated information to create a new identity that can be used for fraud. Business email compromise (BEC) is another dangerous type of fraud for your company. This one uses tactics like CEO impersonation or fake invoice schemes to trick employees into giving money or sensitive data about the company.

| Fraud Type | Description |

| Payment Fraud | Fake transactions via phishing |

| Identity Theft | Stolen IDs during onboarding |

| Account Takeover (ATO) | Hacker controls real account |

| Insider Threats | Employee abuse of access |

| Synthetic Identity | Fake ID with partial real data |

| Business Email Compromise | CEO fraud, invoice scams |

What Does Fraud Detection Tool For?

A fraud detection tool is used to figure out and prevent fraudulent acts thanks to technologies like AI and machine learning. These tools have advantages like real-time alerts, which detects suspicious activity; identity verification, where fake or stolen credentials are detected; transaction scoring, where risky acts are set aside for inspection; and anomaly spotting, which helps detect fraud better.

The U.S. Department of the Treasury’s Office of Payment Integrity used machine learning and enhanced risk-screening tools for improper payments and fraud, which led to the recovery of over $4 billion last fiscal year (October 2023-September 2024).

How Do Fraud Detection Algorithms Work?

Developments in technology brings with it solutions like fraud detection algorithms. These algorithms use several techniques to help figure out suspicious activity better. Supervised machine learning learns from previous fraud data that is public information to predict fraudulent transactions and flag them for inspection. Unsupervised machine learning works by discovering risks that were previously unknown like detecting odd patterns that were unnoticed before. Rule-based systems are known to apply thresholds to catch anomalies. Neural networks are used to model complex behaviours and interactions, helping identify hidden fraud patterns. Graph analytics are also tasked with mapping relationships between companies to reveal fraud networks like rings of coordinated accounts or colluding insiders.

What Are the Business Risks of Not Detecting Fraud?

There are several consequences to miss to detect fraud. The first one is penalties that are caused by not complying with AML regulations like the 6th Anti-Money Laundering Directive (6AMLD) of the EU and the Bank Secrecy Act (BSA) of the United States. These penalties can be huge fines and other legal consequences. Your company will also suffer reputational damage, as well as getting your operations disrupted because of audits and internal reviews. For instance, in September 2025, Turkish prosecutors seized 121 companies, including major broadcasters Haberturk and Show TV, as part of a fraud, tax evasion, and money laundering investigation involving Can Holding. This action underscores the severe operational and reputational impacts of fraud-related issues.

Which Industries Are Most Affected by Fraud?

Let’s examine the industries that are targeted the most by fraudsters. Banking and finance are targeted because of the large amounts of money involved. These companies are targeted using account takeovers, money laundering, and fake ID onboarding. E-commerce also struggles because of types of fraud like card fraud and refund abuse. The healthcare industry deals mostly with billing fraud and identity theft that’s linked to patient records. Another industry affected is telecom providers. The industry is affected because of SIM-swap attacks and fraudulent account setups. One other industry we can for sure include on this list of industries affected is the crypto sector. The sector is exposed to Ponzi schemes, wash trading, scam exchanges, and more.

| Industry | High-Risk Scenarios |

| Banking & Finance | ATO, laundering, fake IDs |

| E-Commerce | Card fraud, refund abuse |

| Healthcare | Billing fraud, ID theft |

| Telecom | SIM swap, fake accounts |

| Crypto | Ponzi, scam exchanges |

How Can Businesses Implement an Effective Fraud Detection Program?

For a strong fraud detection system, there should be several steps to your solution. The first step to the system is behavioural biometrics and transaction monitoring. Real-time transaction monitoring is helpful for flagging suspicious activity when used with rule based alerts and risk scoring models. These risk levels created by the risk scoring models help you divide your monitoring attention proportionate to customers’ score. Another helpful feature is AI models that blend supervised and unsupervised machine learning efforts to enhance detection abilities. Adaptive rules will help your company stay updated with the ever-changing regulations and fraud techniques.

How Does Fraud Detection Support Compliance Efforts?

For AML efforts, detection tools identify suspicious transactions and patterns that may indicate money laundering. For KYC processes, detection tools verify the identities of customers. These will ensure that onboarding and ongoing monitoring meet legal standards. Compliance with PCI DSS helps your company by protecting payment data and flagging unauthorized transactions. Tools like Sanction Scanner combine AML efforts with fraud detection, as well as real-time alerts. The tool provides a platform that strengthens both compliance and operational security.

What Metrics Should You Track to Measure Fraud Detection Effectiveness?

Your company will need to focus on some KPIs to make sure your fraud detection solutions are effective and safe. The first is the false positive rate. This will show you how much of legit activity gets flagged as fraudulent. If it’s too high, your compliance costs go up and your customers most likely will be mad. Detection rate is another measure of the detection tool. The percentage of fraud caught will show you the effectiveness of your solution. Time to detect is another important category, since detecting crime earlier will reduce the consequences your company will face. Financial impact saved will show you the amount your company saved by detecting and preventing fraud. Customer retention is the final metric we’ll mention. It helps show the customer engagement after incidents occur. The reputational damage can be partly measured using this feature.

Can Fraud Detection Software Be Tailored to Different Business Sizes?

Yes, you can tailor fraud detection software according to your company’s size. Scalable, API-first platforms help fintechs, banks, e-commerce companies, crypto firms, and SMEs by allowing them to integrate fraud monitoring easily. You can customise your tool based on transaction volume, risk profiles, and industry requirements. These will ensure protection regardless of your company’s size or the budget you have.

FAQ's Blog Post

Fraud detection is the process of identifying suspicious transactions or behaviors that indicate possible fraud.

Fraud detection works by analyzing data patterns, scoring risks, and flagging abnormal activities in real time.

Common techniques include rule-based systems, machine learning, anomaly detection, and behavioral analytics.

Fraud detection is important because it protects businesses from financial loss and regulatory violations.

Banking, fintech, insurance, and e-commerce industries rely heavily on fraud detection systems.

Challenges include false positives, data silos, evolving schemes, and limited visibility across systems.

Sanction Scanner supports fraud detection with AI-powered monitoring, real-time alerts, and advanced risk scoring.