What Is a SAR/STR?

In this blog post, we’ll be talking about and explaining in detail what a SAR/STR is. As an introduction, you should know that SAR stands for Suspicious Activity Report and STR stands for Suspicious Transaction Report. These reports are filed for a Financial Intelligence Unit (FIU) when your company discovers suspicious activity. SAR is mainly used in the U.S., whereas STR is more used in EU, UK, and other similar regions. The reason for filing these reports is to detect money laundering, terrorist financing, fraud, and other crimes of this nature.

When Should You File a SAR/STR?

There are times when you should be filing these reports, and we’ll talk more about them for our readers now.

Firstly, if you are suspecting criminal proceeds or terrorism financing, you shouldn’t waste any time and file these reports right away. Another reason for filing is if you suspect the activity or transaction is being structured to avoid thresholds.

Our third item for filing is when the activity seems to lack a clear lawful purpose, this should be a red flag for our readers. Our final reason for filing a SAR/STR report is activity that is inconsistent with the customer’s profile. When their previous and current activities don’t match, you should be worried and take action. According to UK NCA 2023 data, 901,000+ SARs were filed, and many of them were because of deposits that were just under reporting limits.

Regulatory Requirements

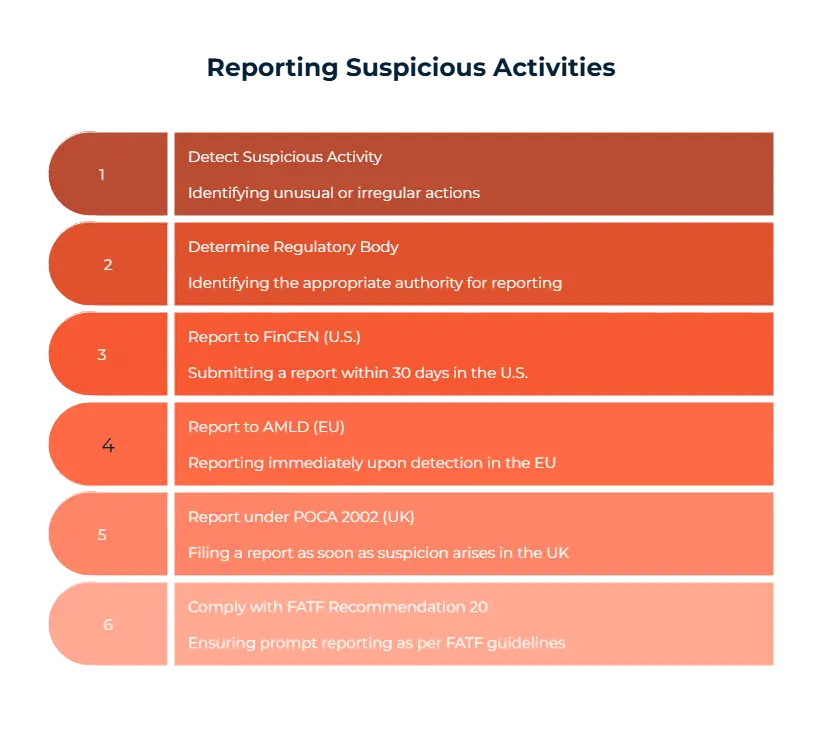

There are several regulatory bodies that deal with these kinds of suspicious activity. We’ve compiled the data you need for knowing when to report these suspicious activities or transactions. For those who are residing in the U.S., FinCEN is your way to go when reporting. FinCEN demands that when you’re against odd activities, you should report within 30 days of detecting the said activity. This ensures safety and compliance.

Let’s talk about another region. For those who are in the EU, AMLD is the regulatory body that is the right one for you. AMLD wants to make sure that you report right away without delay when you detect suspicious activity. In the UK, it is similar as well. POCA 2002 is the one that decides the UK regulatory requirements. According to POCA 2002, you should file a report as soon as the suspicion starts creeping in.

According to FATF Recommendation 20, prompt reporting is required when faced with suspicious activity as well.

Key Information to Include

So, the unwanted occurred and you’re face-to-face with a suspicious activity or transaction. By this point, you should know better than doing nothing, filing a SAR/STR report should be your first action. For those looking to file this report, our Sanction Scanner team compiled a list of information that you should include. The first information to look for and report is the details of the reporting entity. Afterwards, you should include key details that will help identify the customer to help the authorities with their investigation.

Since you are reporting a suspicious transaction, including the details of said transaction is a must. You should also include reasons for your suspicion and supporting evidence that helps your narrative, this will make the regulatory body’s job easier.

Writing an Effective Narrative

Since you are reporting a suspicious activity or transaction, you should try to explain and support your narrative about why this activity is odd. To help with this, you should try and include every detail that might come up as a question later. Leaving no space for inconsistency or doubt is the first purpose.

Afterwards, you should use chronological order to help easily detect and explain the said activity. You will also make the regulatory body’s job easier. While taking all of these steps, you should avoid adding details that might look like speculation. This is about showing a suspicious activity; therefore, making baseless claims just to speculate might ruin your entire report.

Finally, linking facts to risk indicators will show how reliable your report is. According to FinCEN, multiple $9,800 deposits at different branches later showed $2.3M laundering scheme; this data shows how the said customer or company might try to commit financial crimes while trying to fly under the radar.

Step-by-Step Filing Process

After finding suspicious activity, you should make sure that you file a SAR/STR report soon. To help our readers, we’ll walk you through the steps of the filing process. The first step you should, of course, take is actually detecting the said suspicious activity. After detecting this activity, escalating it internally is important for the process. You will need evidence for this activity to be counted in the odd cateogry. For this, you should be investigating and collecting evidence as well.

After taking these steps, you are ready to start your report. You should get started with your SAR/STR form and make sure to write your narrative well to help the regulatory body whose job is investigating your report. You should strive to attach the evidence you previously collected to your report.

These all mean nothing if you don’t submit your report on time. As we mentioned above, there are different time limits for different countries and regulatory bodies. Making sure that you submit on time will help your company be clear of fines as well. Since this is a serious problem that could affect the customer or company you’re filing a report about, you should retain your records for 5 years.

What Are the Common Mistakes?

Let’s talk about what mistakes you might make while in the process of filing a SAR/STR report. These mistakes might be costly for our readers and their companies, we advise you to pay attention to these details.

First mistake that is done by companies is filing late. From what you can see above, filing on time is important for the regulatory body to investigate on a timely manner as well. Late filing might cost you fines and more. Another mistake that can be made is giving narratives that are too weak. You need to give the authorities a well-researched report filled with strong evidence. If some of these are missing, your report might not be enough.

Another mistake is missing identifiers. This will help the customes that is committing suspicious actions greatly. To make sure you are filing your report the right way, pay extra attention to identifiers. Finally, not filing the report at all since you aren’t sure enough is one of the biggest mistakes you can make during this process. Since something prompted you to feel suspicious in the first place, it is safer to file this is a SAR/STR report just in case. You won’t be losing anything for a seemingly suspicious report that then turns out to be an innocent transaction; but the possibility of not filing something that could be a suspicious activity will have great consequences for you as well.

How Technology Helps

When dealing with filing a SAR/STR report, the ever-changing and developing technologies that are in this sector can help you greatly.

These technologies will help detect suspicious activity automatically. Automating this process will save you time. Another benefit you can have is having your forms pre-filled. Pre-filling forms will help you in the process of filing these reports. We’ve talked about how big of a mistake not filing a SAR/STR report when faced with a suspicious activity is. For this reason, these technologies sending you deadline alerts should excite you greatly. They make sure you aren’t missing any deadlines and you won’t have any report unfilled by that time. As our last benefit, these technologies also stores your reports for future use. We’ve mentioned before that these reports should be kept for five years after filing. Therefore, having these audit-ready records will help your company.

How Sanction Scanner Helps

We at Sanction Scanner are eager to help our readers, especially if they’re dealing with the cases we’ve mentioned above. Filing a SAR/STR report will be much easier with our expertise, and it will save you from potential financial crimes as well as preventing any fines you might face.

Our AI-powered transaction monitoring will make sure you miss no suspicious activity committed by your customers. Next, our auto-generated case files will help you save time during this tedious process. Our team at Sanction Scanner will help you with real-time sanctions, PEP, and adverse media checks. These are important things to have under your belt to help your company reach greatness. We also have export-ready SAR/STR formats for FIUs. Your time is precious and making sure you have correct and fast solutions to your problems is what Sanction Scanner does.

FAQ's Blog Post

A Suspicious Activity Report (SAR) or Suspicious Transaction Report (STR) is a document filed with regulators to report suspected financial crime.

Banks, financial institutions, fintechs, casinos, and other obliged entities under AML laws must file SAR/STRs.

It should be filed as soon as suspicious activity or transactions are detected, without tipping off the customer.

Key details include customer data, transaction records, reasons for suspicion, and supporting evidence.

SAR/STRs are submitted electronically via the relevant financial intelligence unit (FIU) reporting system.

The FIU reviews the report, investigates the case, and may pass it to law enforcement.

No. Informing the customer is prohibited and considered “tipping off,” which is a criminal offense.

Failure to file may lead to regulatory fines, loss of license, or even criminal liability.

AML tools automate detection, streamline reporting, and ensure compliance with global AML standards.