As compliance requirements get stricter and financial crimes get more complex, customer identity verification is more than just a step in onboarding. Customer verification is the process that you research on your potential & current partner companies. Since digital transactions are done more frequently thanks to technological developments, companies should act accordingly and make sure their Know Your Customer (KYC) processes are both compliant and efficient. Your company can gain the trust of customers while also protecting yourselves. In this blog post, we’ll be talking about the best practices when it comes to customer verification.

Why Is Customer Verification Important for KYC?

Customer verification ensures that firms know who they’re dealing with; this fact makes customer verification the core of a strong KYC framework. Global regulations put in place to ensure AML compliance like the Bank Secrecy Act (BSA), FATF standards, and the EU’s 6AMLD take KYC measures very seriously. These measures help prevent fraud by stopping criminals from using stolen or fake identity details. Customer verification helps stop money laundering, sanctions breaches, and reputational damage in high-risk sectors like banking, fintech, and crypto. It is also important to build customer trust. Customers will feel safer with a system that includes identity verification which contributes to a more secure onboarding process.

What Are the Best Practices for Verifying Customers?

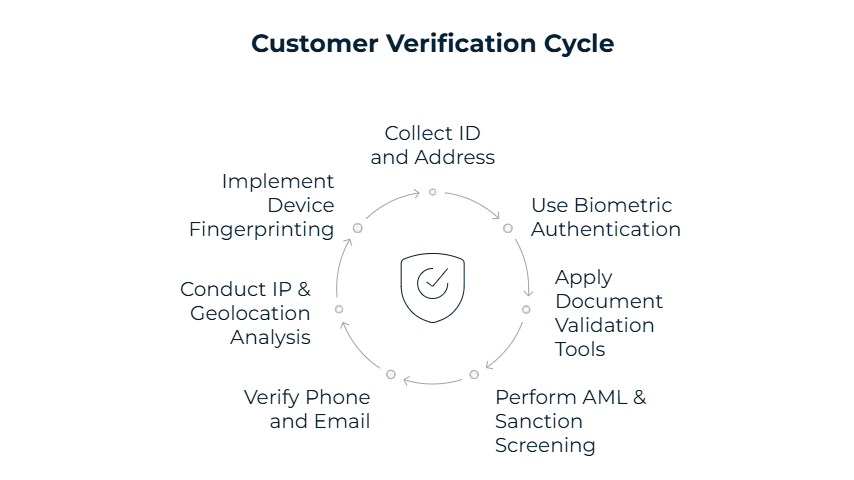

1. Collect Government-Issued ID and Proof of Address

The first step for customer verification should always be collecting official documents from the new client. Their passport, driver license, or national ID card is needed with proof of residence using utility bills or banks statements. Key data points like name, date of birth, address, and expiry date are provided by these documents. Your company then can cross-check your customer’s statements against the documents.

2. Use Biometric Authentication

Biometric verification is widely used in modern KYC since traditional checks are not enough by itself to ensure safety. Techniques like facial recognition, fingerprint scans, and liveness detection help confirm that the documents match person. Real-time selfie checks supported by AI powered validation tools will make it harder for fraudsters to use stolen or fake IDs.

3. Apply Document Validation Tools

To fight forging or tampering identity documents, firms have started using advanced document validation tools. The tools include optical character recognition (OCR), MRZ scanning, barcode analysis, and hologram detection. These tools help verify authenticity by detecting altered images, invalid fonts, or expired IDs. Your company can double-check documents by using these features.

4. Perform AML & Sanction Screening

Customer verification isn’t enough by itself to ensure that your customers aren’t committing financial crime. Your company should also be screening customer names against global sanctions lists, politically exposed persons (PEP) databases, and international watchlists like OFAC, EU, and UN lists to make sure you’re missing nothing because of insufficient screenings. Fuzzy matching, alias detection, and transliteration tools are really helpful when you’re looking to uncover altered spellings and prevent criminals from getting away with it. High-risk or blacklisted individuals can be avoided thanks to this step.

5. Verify Phone Number and Email

The next step involves another verification layer. By integrating the customer’s contact information into tools like two-factor authentication (2FA), you can make sure that the customer’s reachable. The tool works by sending one-time passwords to the customer’s phone number or email. These details then can be checked against fraud databases to find out if the contact information is disposable or suspicious. This step is an extra layer of security that can uncover scams and identity theft.

6. Conduct IP & Geolocation Analysis

A customer’s digital footprint is a good place to find red flags. IP address and geolocation data show if the user is using a VPN, logging in from a high-risk jurisdiction, or displaying mismatched location details which are different from their verified address. Ongoing analysis can help your company spot unusual patterns and prevent fraud.

7. Implement Device Fingerprinting

The final step is device fingerprinting, which tracks the details of a customer’s device, like its hardware, operating system, browser type, and overall usage behaviour. A digital “fingerprint” of customers can help your company detect if the same device is being used for multiple suspicious accounts or if there is an unusual pattern.

Which Industries Must Prioritize Customer Verification?

Contrary to popular belief, customer verification is needed in many sectors, it’s not just limited to the banking sector. Banks, fintechs, and virtual asset service providers (VASPs) are in fact the most risky sectors, this is because they deal with large volumes of tranctions and are regulated under AML and KYC frameworks. Insurance companies, payment providers, and e-commerce platforms should also prioritise verification. These companies can prevent fraudulent claims, chargebacks, and more by implementing customer verification measures. Gambling, telecom, and online gaming sectors are also of high-risk, they should also be careful agains underage users, stolen identities, and illicit financial flows. The best way to ensure they block these cases is by customer verification.

How Does Strong Verification Reduce Fraud?

Strong verification is one of the earliest defense mechanisms for fraud. Pre-onboarding risk detection helps your company with identifying suspicious applicants. You can then block them from opening accounts and prevent synthetic identity and mule account creation, since these are often used to launder illicit funds or for scams. With effective verification, you can also protect your company from regulatory fines and penalties, which come with weak KYC/AML controls.

Circles.Life (telecom) in Australia was fined by ACMA for failing to correctly verify customer identity when processing mobile number transfers. According to Austrian sources, the failures made it easier for fraud/number‐porting scams. Circles.Life was fined $413,160. This case shows how important customer verification is for preventing fraud.

What Are the Key Technologies Used?

There are new technologies added to the customer verification process to make it safer and more efficient. The first key technology is AI powered ID recognition. This feature can validate documents and figure out if there are any inconsistencies your company team can miss. OCR scanning is another feature that helps. This feature extracts and verifies data from passports, driver’s licenses, and similar documents with high accuracy results. Machine learning models also help with analysing customer behaviours to then give them risk scores. These scores are then used to pay more attention to higher-risk customers. Blockchain-based digital IDs are becoming more popular since they’re a tamper-proof and decentralised way to store personal details. Finally, KYC API integrations are recommended for your company since these allow you to embed verification tools into your onboarding workflows, making integration easier.

What Are the Common Mistakes to Avoid?

Let’s share some of the most common mistakes to make sure our readers are avoiding them during their customer verification framework journey. The first mistake is conducting only manual checks, since these checks slow your onboarding process down and leaves space for human error. Some companies also skip AML and sanction screening. Not conducting these screenings regularly will leave you with the risk of getting regulatory fines and onboarding high-risk or blacklisted people. One other common problem is companies failing to re-verify customers. Ongoing checks help your company keep an eye out on updates about customers and this in turn brings compliance. Without re-verification, you risk missing suspicious activities about your customers. Working with outdated data slows you down since your company and team aren’t sure if the verification you’re conducting is reliable. Up-to-date data is needed for information like addresses, IDs, or watchlist statuses. The user experience (UX) also shouldn’t be overlooked, since failings in UX will drive your customers away and lead to high drop-off rates for your company.

Germany’s Federal Commissioner for Data Protection and Freedom of Information (BfDI) has fined Vodafone GmbH, the German arm of the global telecom provider, €45 million (about $51.4 million) for privacy and security violations. The penalty stems from two major issues: fraudulent activities by partner agencies and serious flaws in customer authentication systems. The €30 million targets weaknesses in the company’s MeinVodafone platform and customer hotline, which left eSIM profiles vulnerable to unauthorized access.

How Sanction Scanner Helps with Customer Verification

Our Sanction Scanner team can help you by providing an end-to-end compliance and fraud prevention solution. Our tool enables real-time ID and document validation, where personal details are instantly checked. Sanction Scanner also conducts instant PEP and sanctions screening, high-risk individuals and entities are therefore flagged before they can get away with financial crimes. After initial checks, Sanction Scanner also supports ongoing AML monitoring, which can continuously track customer activities behaviours to find suspicious ones. Our Sanction Scanner tool also provides AI-driven fraud detection with behavioural analysis and machine learning leading to identifying unusual patterns.

FAQ's Blog Post

Customer verification is the process of confirming identity with documents, biometrics, and database checks.

Customer verification is important because it prevents fraud, ensures AML compliance, and builds trust.

KYC verification requires ID, proof of address, and sometimes source of funds documentation.

Digital KYC speeds up onboarding with e-ID checks, liveness detection, and automated verification.

Best practices include multi-factor checks, PEP/sanctions screening, and ongoing monitoring.

Businesses reduce errors by automating checks and using AI-powered identity verification tools.

Sanction Scanner provides real-time verification, sanctions/PEP checks, and risk scoring in one platform.