With global efforts in preventing the fast spread of financial crime, Japan has introduced an enhanced Know Your Customer system in order for the country to stay aligned with international standards and prevent regulatory risks. For banks, cryptoexchanges, and fintech firms, knowing what KYC is and the regulatory requirements is key for effective compliance in 2025. This guide will explore the current legal frameworks, foundational responsibilities, and Enhanced Due Diligence measures in Japan, and how the KYC system is applied in real life across different sectors.

Legal Framework Governing KYC in Japan

Japanʼs KYC requirements are primarily influenced by two regulatory authorities:

1. Act on Prevention of Transfer of Criminal Proceeds (犯罪による収益の移転防止に関する法律)

This law is a foundational core that supports Japanʼs efforts in preventing money laundering and terrorist financing. They ask businesses to apply customer due diligence (CDD) for both individual as well as corporate clients. This act applies not only to financial institutions but also to sectors such as real estate and other designated service providers. If these sectors fail to comply, it can result in financial penalties and possible criminal liability.

2. Financial Services Agency (FSA) AML/CFT Guidelines Revised in 2021

The 2021 revision updated the FSAʼs guidelines and now supports a risk-based approach (リスクベースアプローチ) to Anti Money Laundering (AML) and Countering the Financing of Terrorism (CFT) compliance. This revision helps highlight the need to adapt to measures based on customer risk profiles, transaction behavior, and geographic factors. The guidelines communicate the expectations around internal controls, which include employee training, surveillance systems, and regular audits. On top of that, there is a strong focus on international cooperation and alignment with the standards globally, which is established by the Financial Action Task Force (FATF).

FATFʼs recommendations guide these regulations in order to align with the standards globally, while Japanʼs Payment Services Act (資⾦決済法) implements KYC measures, specifically for crypto and Travel Rule.

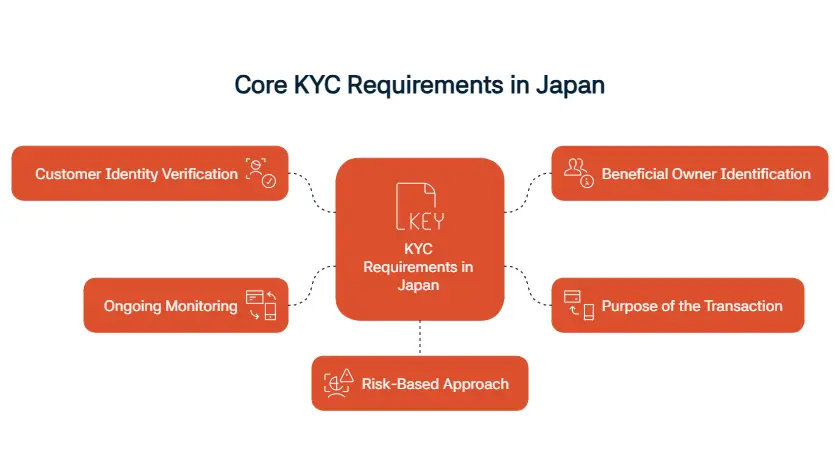

Core KYC Requirements in Japan

Regulated entities such as banks, insurance firms, crypto exchanges, and designated non-financial businesses and professions (DNFBPs) must follow these important KYC steps:

1. Customer Identity Verification (本⼈確認)

- Collect and validate the customersʼ' identities, such as a driverʼs license or a MyNumber card.

- Verify the residential address through supporting documents in order to confirm the customer is who they claim to be.

2. Beneficial Owner Identification (実質的⽀配者の確認)

- Companies must identify individuals who own or control over 25% or more ownership in legal entities.

- Beneficial Owner Identification is required for entities such as corporations, partnerships, and trusts that are operating within Japanʼs jurisdiction.

3. Purpose of the Transaction (取引の目的の確認)

- Businesses must examine the record and the stated purpose of each transaction during the onboarding process

- Required both at account setup and whenever a change in activity or profile warrants reassessments (when necessary)

4. Ongoing Monitoring (継続的な顧客管理)

- Transactions must be monitored continuously in order to flag unusual or suspicious behavior.

- Clients who are high-risk must undergo frequent reviews and be assessed often as part of the process of diligence.

5. Risk-Based Approach (リスクベース‧アプローチ)

- Customer are assigned with risk rating based on their behavior, patterns of transactions, and geographic exposure.

- Customers who are flagged as high risk are required to comply with Enhanced Due Diligence procedures.

![]()

Enhanced Due Diligence (EDD) Requirements

Enhanced Due Diligence (EDD) is required in cases where risks of financial crime are present or possible. In such cases, having a deeper system for stricter verification and control. EDD applies in scenarios such as:

- Politically Exposed Persons (PEPs)

In Japan, when dealing with Politically Exposed Persons (PEPs), businesses are required to implement stricter scrutiny. Due to PEPsʼ public roles and influence over people, they are considered high-risk clients under Japanese regulations. Firms must conduct assessments and examinations of PEPs' source of wealth, check their legitimacy, and practice stricter monitoring to prevent financial crimes such as money laundering or corruption. In order to establish or continue a business relationship, entities are required to obtain approval from senior compliance officials.

- High-Risk Jurisdictions

Transactions involving countries that are identified as high-risk by the FATF automatically trigger EDD obligations. Whether the transaction is inbound or outbound, it is required to undergo enhanced monitoring in order to oversee and detect any potential links related to illicit financial activity. Entities and businesses are expected to implement a more meticulous verification check, oversee the assessment of the risk level based on the jurisdiction involved, and ensure that all AML and CFT requirements are consistently as well as legitimately followed.

- Complex Ownership Structures

EDD is also required for entities such as shell companies or clients who are related to multi-layered ownership structures, where the situation is hard to find the ultimate true controlling party. Through these arrangements, disguising the identity of the ultimate beneficial owner can be done, which increases the risk of unlawful financial activity or money laundering. Businesses must utilize an in-depth investigation of the records of ownership, validate the legitimacy of financial activities, and confirm that the entity is not or has not been involved in illicit financial transactions. EDD in all of these cases includes a deeper examination of the source of funds and documents that justify the business relationship. This enhanced level of scrutiny serves as guidance to the firms in order to remain compliant with the present financial crime.

KYC Practices Across Sectors

Different sectors and entities in Japan apply LKYC requirements based on their specific regulatory mandates and operational risk profiles.

Banks and Insurers

Regulator: Financial Services Agency (⾦融庁)

- Required to implement the full CDD process, including meticulous onboarding and consistent monitoring.

- The increased use of biometric eKYC solutions is to enhance the accuracy of the verification and improve the experience of users, while staying compliant.

Crypto Exchanges

Regulator: FSA and JAFIC

- During onboarding, they must collect customer information and comply while referring to the FATF Travel Rule for any transactions exceeding ¥100,000

- Should focus on ensuring maintenance for transaction transparency and detecting financial illicit activity within the digital asset world.

Real Estate and Legal Services

Regulator: Partially supervised by JAFIC

- Real estate businesses must verify the identity of the client for transactions above 2 million yen.

- Law firms and notaries are responsible for identifying suspicious patterns during property ownership transfers.

Fintechs and Wallet Providers

Regulator: FSA & Local Financial Bureaus

- Payment services, remittance, platform, and digital wallet operations are expected to follow CDD steps, which should align with the bank's standards

- Since these entities face more scrutiny, they must implement a stricter KYC and AML framework similar to traditional financial institutions

Recordkeeping and Reporting Obligations

Under the Japanese KYC regulations, all entities that are regulated are obligated to maintain the identification of the customer and transaction records for a minimum of seven years. Through these documented requirements, transparency is ensured, potential audits are supported, and help the authorities to trace the financial activities during times needed. Additionally, beyond record keeping, a firm must immediately report any suspicious or out-of-the-ordinary behavior, such as falsified documents, inconsistent information, or even a slight unusual transaction pattern. The report must be submitted to the Japan Financial Intelligence Unit (JAFIC) through a Suspicious Transaction Report (STR 疑わしい取引の届出). Fast and accurate submission of reports is important and contributes greatly to Japanʼs broader AML and CFT enforcement efforts.

Key Points

- All regulated entities are required to retain KYC records for 7 years, including identity verification and transaction logs

- Any suspicious activities, such as forged documents or irregular behavior, must be reported to Japanʼs Financial Intelligence Unit (JAFIC) via an STR (疑わしい取引の届出) submission

Key Takeaways for 2025 Compliance

eKYC Solutions (オンライン本⼈確認)

Japan is progressing towards digital identity verification through eKYC, which allows smooth customer onboarding while maintaining the companyʼs regulatory integrity. The methodology, such as live video verification, facial recognition cia selfie and ID pairings, and NFC-enabled MyNumber card scans, is becoming the norm and standard in Japan. By utilizing these tools offer faster processing time, accurate information, and even stronger compliance with the countryʼs evolving KYC requirements.

Thresholds for KYC Checks

In Japan, the KYC procedures are legally required and mandatory checks for transactions exceeding ¥30,000, which impact organizations and sectors such as banking, fintech, and even crypto. Organizations are required to implement strict KYC protocols and use tools for verifying customer identities, assessing the levels of risks, and detecting any suspicious activity. By doing so, a compliant and secure onboarding process for businesses or sectors has a strong foundation.

FATF Travel Rule Alignment

For transactions related to cryptocurrency exceeding ¥100,000, compliance with the FATF Travel Rule is a legal obligation in Japan. So, these rules require businesses to include particular information such as the name of the recipient, account number, and the details of the transactions. The main goal is to increase and foster transparency and traceability in digital asset transfers because this helps prevent illicit use. Crypto services providers are required to have systems that are capable of monitoring, securing, and transmitting the information following global standards.

FAQ's Blog Post

In Japan, KYC requirements involve verifying customer identity, monitoring transactions, and reporting suspicious activities under the Act on Prevention of Transfer of Criminal Proceeds.

The Financial Services Agency (FSA) and Japan Financial Intelligence Center (JAFIC) oversee KYC and AML compliance in the Japanese financial sector.

Yes, Japan permits digital KYC methods such as facial recognition and e-verification, provided they comply with security standards and identity accuracy rules.

Banks, securities firms, insurance companies, crypto exchanges, and other regulated entities are required to implement KYC as part of AML compliance.

KYC is mandatory when opening accounts, conducting high-value transactions, or when there’s suspicion of money laundering or identity fraud.

Accepted documents include government-issued photo IDs (like a passport or residence card), utility bills, and My Number cards for address verification.

Financial institutions must periodically review and update customer information, especially for high-risk clients or when red flags arise.

Yes, cryptocurrency service providers in Japan must implement strict KYC measures under regulations by the FSA and meet AML obligations.