In this blog post, we’ll be talking about one of the most important steps to take when wanting to reach anti-money laundering (AML) compliance, transaction monitoring. Monitoring continuously allows companies to be aware of suspicious activities. This step is not optional, transaction monitoring is mandated by international entities like FATF Recommendation 10, which covers customer due diligence (CDD), and Recommendation 20, which mandates the reporting of suspicious transactions, and the 6th Anti-Money Laundering Directive (6AMLD) in the EU. Once you detect these suspicious activities with the help of transaction monitoring, you are then ready to complete another crucial step. This is submitting Suspicious Transaction Reports (STRs) and Suspicious Activity Reports (SARs) to help authorities while they investigate the party you reported. Transaction monitoring will help you reduce financial and reputational risks that may come your company’s way if you’re not careful against crimes.

How Does Transaction Monitoring Work?

Transaction monitoring is done by an ongoing analysis of financial activity to find suspicious activity among them. Some solutions use rule-based alerts to only monitor specific transactions like transactions of a certain threshold and above. AI based analytics also help these tools when dealing with more complex cases. A risk score based system is used to divide customers according to their risk levels and the time and effort spent on these customers are decided thanks to the system. After the system finds an activity that is unusual, it flags that certain activity for review. The next step is to escalate this red flag accordingly and file a Suspicious Activity Report (SAR) to warn authorities and give them the needed details for investigation.

Why Do Banks Need Transaction Monitoring?

Banks deal with a high volume of both customers and transactions; transaction monitoring is important since the value of daily transfers involving banks is hard to ignore. Fraudsters use a technique called layering to try and trick monitoring efforts by moving money to and from multiple accounts to hide the origin of funds, and we at Sanction Scanner advise our readers use ongoing monitoring to fight against this technique. Central banks and Financial Intelligence Units (FIUs) require transaction monitoring since it helps ensure anti money laundering (AML) compliance. Monitoring that is done well gives the collaborator company you’re working with a sense of trust in corresponding banking relationships; it helps prove that the transactions your company deals with are legitimate and reduces reputational or financial risks.

According to Fintech Weekly, the €2.6 million penalty that was issued in August of 2025 against Bunq illustrates the rising stakes in anti-money-laundering compliance for both fintechs and traditional banks.

How Do Fintech and Payment Platforms Benefit?

Fintech and payment platforms benefit from using transaction monitoring since this process helps watch peer-to-peer transfers, wallet top-ups, and international flows closely. Fintech firms, including electronic money institutions and payment service providers, are now rated as high risk by the FCA, having previously been considered medium. Fraud can be detected early during onboarding or later through ongoing monitoring. Our readers shouldn’t think security is the only reason for monitoring; reaching AML and counter terrorist financing (CTF) compliance is another benefit of regularly getting help from transaction monitoring. Since this feature is important and also helps you with compliance, your company can more easily get and keep licenses from regulatory bodies like the FCA in the UK or MAS in Singapore.

Why Is Monitoring Critical in Crypto and VASPs?

Being a crypto firm and a Virtual Asset Service Provider (VASP) doesn’t mean your company is exempt from transaction monitoring. The hish-risk of nature of these companies is caused by them being newer and their platforms involving digital assets. Being able to be anonymous while using these platforms and the rapid movement of crypto makes it more convenient for fraudsters to move their illegal money. The FATF Travel Rule also benefits from ongoing monitoring since it requires knowledge of the origin and destination of transactions. With monitoring, these platforms can detect mixing, tumblers, and suspiciously large withdrawals. Transaction monitoring also makes sure that your crypto firm and VASP is meeting its compliance requirements, often set by regulatory bodies like VARA in the UAE, FinCEN in the U.S., and MiCA in the EU.

How Do DNFBPs Use Transaction Monitoring?

Designated Non-Financial Businesses and Professions (DNFBPs) are also using transaction monitoring to comply with AML regulations. But, how so? In real estate, you can utilise monitoring by huge amounts of deals and third-part payments that may seem suspicious. Legal and accounting firms, on the other hand, use the feature to check trust accounts and wire transfers. Gold dealers and other high value asset traders of similar nature are using monitoring to identify bulk purchases and asset swaps, which may mean money laundering. When talking about all DNFBPs, monitoring is essential; it helps authorities when flagging suspicious activity with benefits like detecting front operations, unusual patterns, and unexplained wealth.

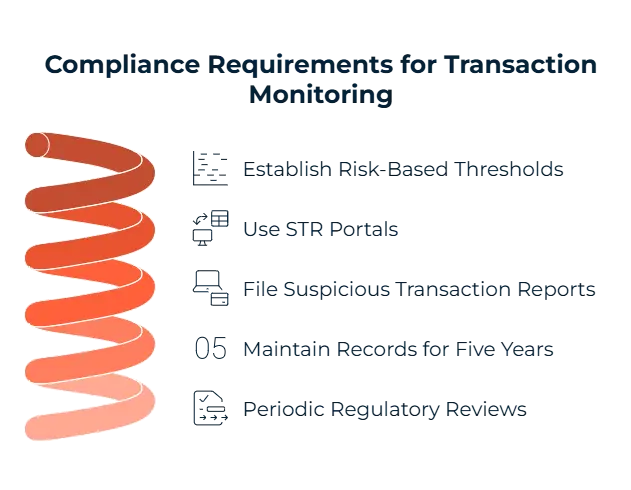

What Are the Compliance Requirements for Monitoring Transactions?

There are some requirements your company should follow when transaction monitoring. Risk based monitoring thresholds being established is recommended by our team at Sanction Scanner since it helps with choosing which type or what amount of transaction is alert worthy. Suspicious Transaction Reports (STR) portals like goAML, FinCEN and AUSTRAC must be used and the STR must be filed after noticing suspicious activity. You should also maintain records for at least five years to ensure an audit trail. Our final requirement is that these systems and records that are about transaction monitoring should be periodically reviewed by regulators to make sure nothing is wrong.

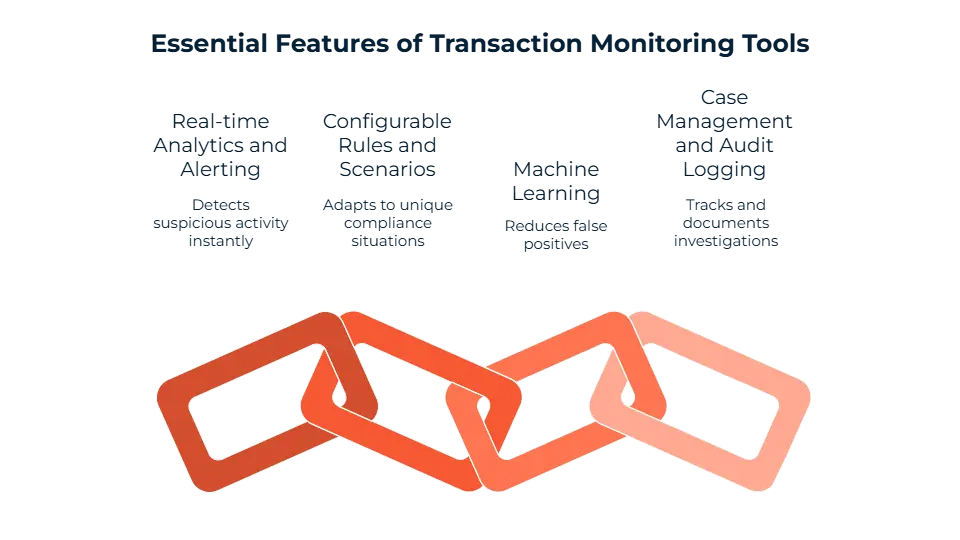

What Should You Look for in a Transaction Monitoring Tool?

There are several features that may be helpful in your transaction monitoring tool search. The first feature to look for is the real-time analytics and alerting; this feature ensures you detect suspicious activity as soon as possible. Configurable rules and scenaries come in handy when your compliance team comes across a unique situation that requires more preparation. Machine learning is rising in popularity and has been getting implemented into many tools in the recent years; this feature can help reduce false positives. The final feature we at Sanction Scanner recommend is case management and audit logging options to help keep track of what is tracked, investigated, and then documented in a clear way.

What Are the Consequences of Failing to Monitor Transactions?

We’ve talked about the ups of transaction monitoring. But, what happens if you’re not properly implementing this feature? Your company runs the risk of not detecting suspicious activity that can lead to fines and more serious penalties. Reputational damage you may suffer from a case of financial crime is serious, your customers will suffer this way. Another consequence may be the loss of financial licenses that your company possesses. Crimes like fraud, money laundering, and internal abuse will surely rise in an environment where the isn’t proper monitoring.

What Are the Benefits of Automated Transaction Monitoring?

Let’s talk more about what advantages automated monitoring has. This feature will make sure your detection process for suspicious transactions is faster. False positives also are reduced by using automated solutions, says our Sanction Scanner team. The workload your staff has will also be lessened since technology takes care of the mundane parts; your team can focus more on complex cases that require human judgement. With these systems, you get consistent risk scoring and escalation; this will allow you to prioritize which customers’ transactions to watch closely and alert first.

2026 Outlook for Transaction Monitoring

So, what should you be on the lookout for in 2026 when it comes to transaction monitoring? With international payments, DeFi protocols, and shell companies continuing to create more layered structures that are hard to detect, your company may face higher risk complexity. Regulatory pressure will also be on the rise with the technological developments; updates like real time anomaly detection, audit trails, and faster reporting when something suspicious occurs will be expected of your company. With all this, AI and automation usage for committing financial crimes is also increasing; companies should be able to fight back with equally strong AI based solutions like the one Sanction Scanner provides to detect money laundering.

Banks may be able to introduce AI-based transaction monitoring systems more rapidly than expected, according to the Wolfsberg Group. The organization said ‘classic’ testing methods may not be needed for new monitoring systems due to improvements in technology.

FAQ's Blog Post

Every industry that moves money can face financial crime, and transaction monitoring helps detect and prevent it.

Non-financial sectors risk unknowingly enabling fraud, sanctions breaches, or money laundering.

Industries like crypto, real estate, gambling, fintech, and e-commerce all benefit from real-time monitoring.

Transaction monitoring flags suspicious patterns and helps companies meet AML reporting obligations.

Companies that don’t monitor transactions face higher risks of fines, fraud, and regulatory action.

Small businesses can use lightweight, automated tools to monitor activity without heavy infrastructure.

Sanction Scanner offers scalable monitoring for any sector, with real-time alerts and easy integration.