Sanctions screening has become more important for companies than ever in 2025. There were over 70,000 unique sanctioned people globally in 2024, representing a 370% increase from 2017. Moreover, global regulations are getting more complex, financial crime tactics are evolving, and with the growing scale of international transactions, your company should be investing in strong sanctions screenings solutions. In this blog post, we’ll be talking about the biggest challenges your company may face during the process and explore much needed details.

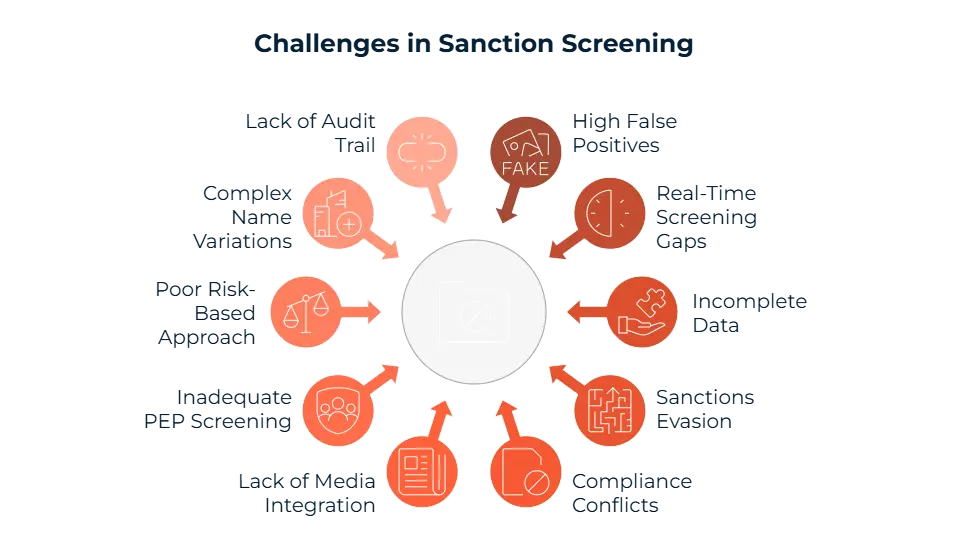

Top 10 Challenges of Sanction Screening

High False Positives

Since your company will be demanding screenings of large volumes of involved parties, false positives may become an issue. High false positives are largely caused by fuzzy matching issues. Screening tools you use may flag legitimate customers mistakenly because of name similarities, spelling variations, and language differences. One other cause is the lack of contextual screening that occurs within the process. Systems may be unable to understand whether the person you’re screening is a low-risk customer or a sanctioned entity with a similar name.

Poor data quality is another problem that leads to high false positives, with outdated or incomplete customer records resulting in unnecessary alerts. Because of these unnecessary results, your compliance team may get overwhelmed with the amount of reports and waste precious time investigating false alerts. The alert fatigue this causes in teams is another serious issue, where your team may not get affected by the warnings and red flags because of just how much time they spend on all of these alerts.

Real-Time Screening Gaps

Since sanctions screenings allow your company to figure out who among your customers may be sanctioned, real-time checks are really important. These sanctions and watchlists are getting updated frequently; so, not being able to update your database will lead to issues. The delay in updates will give sanctioned entities an opportunity to complete their transactions with no struggle. If your firm lacks API connectivity or automated systems, the problem deepens. These tools help you conduct ongoing checks, and with their absence, manual processes or periodic reviews are the next best choice. These manual processes and periodic reviews are not enough when it comes to the fast-paced environment of 2025.

Incomplete Data

You can’t get the best results out of sanctions screenings if you’re not providing the best data to the system. Key identifiers like birth dates, nationalities, or addresses are important for identifying a person; so, missing this kind of information will leave your company in a grey area where you’re not sure if you’re allowing sanctioned parties into your company. Limited metadata from customer profiles will also worsen the issue, screening systems will give out mediocre results because of the lack of context provided. Transliteration challenges will also make the problem more complex. If you’re not investing in data enrichment, these cracks in knowledge will make it more difficult to reach compliance.

Sanctions Evasion via Ownership Structures

Criminals love to use the technique of complex ownership structures to slip through sanctions screenings. These criminals are often having an indirect relation to their companies in order to not get their company sanctioned as well. Shell companies are used to allow sanctioned entities to hide behind layers of intermediaries which may confuse your company into allowing them to collaborate with you. If the beneficial ownership data is outdated or incomplete, the situation worsens. Compliance teams struggle more trying to trace links back to sanctioned parties. Blind spots like these are often exploited by sanctioned parties.

Multi-Jurisdictional Compliance Conflicts

This challenge is caused by the difficulty of managing operations across different jurisdictions which have varying regulations. The core rules are the same, but the divergence between OFAC of U.S., EU, UN, and SAMLA of UK may cause you to think of and spend more time on regulations of different jurisdictions and operate accordingly. To give an example, one authority may impose sanctions on an entity while another exempts it because of humanitarian grounds. Cases like these will leave your compliance teams confused and unsure of which one to follow. Listing and removal criteria also brings trouble since they vary across different places. Some jurisdictions may act quickly while others are slow to update, and this timing inconsistency will leave your company vulnerable and with more work to complete. Since global standardisation isn’t on the table when it comes to sanctions lists, your company will spend more time and resources on them while having errors and legal uncertainties. Multinational companies suffer from this challenge the most.

Lack of Adverse Media Integration

Sanctions screening also relies on sources like adverse media to clear your client’s name. If your company isn’t integrating negative news databases into your system, the risk is missing several red flags coming from these news. One example we can give is that a person may not yet be in OFAC or UN sanctions lists because of integration timing, but their links to corruption, fraud, or terrorism will already be in media reports. If the tools for adverse media screenings are not in place, your company risks missing criminals and letting their transactions through.

Inadequate PEP Screening

Politically exposed persons (PEPs) should be effectively screened to reach sanctions compliance, but there are difficulties with this step as well. PEP lists that are outdated cause you to let high-risk individuals through without assigning them their risk levels, which weakens your company’s security. If you miss the family members, relatives and associates links, your compliance levels will drop since the high-risk individual’s close circle may be used for financial crimes. International inconsistencies in PEP classifications may also raise difficulties for multinational companies. If an individual is on one country’s list as high-risk while it’s absent from another, compliance teams will need to spend more time figuring it out for each jurisdiction. The absence of automated triggers for Enhanced Due Diligence (EDD) will lead to high-risk clients not getting treated with the scrutiny that is matching to their risk levels.

Poorly Defined Risk-Based Approach

The risk-based approach is recommended for a strong sanctions screening tool, but not every company invests in a well-designed solution. These solutions mostly treat low and high-risk customers the same, and they defeat the purpose of implementing a risk-based approach. Segmentation by only geography will lead to an insufficient program, since categorizations like industry, transaction patterns, and exposure to high-risk jurisdictions are also encouraged. If dynamic scoring models are not there within your system, your risk based approach won’t be able to adapt to evolving risks. Because of this, your company may suffer from failing to detect threats and overwork your compliance team since the unnecessary alerts are not taken out. These poorly defined and designed risk scoring systems will leave your company with non-compliance against FATF guidance.

Inability to Handle Complex Name Variations

Complex name variations may be another difficulty for weak sanctions screening systems. The names written to these systems may be written using multiple alphabets, include diacritics, or written in scripts like Arabic, Chinese, or Cyrillic, which standard systems are unable to interpret confidently. If transliteration logic is not there to convert these names into comparable formats, your screening tool can bring up false negatives. Sanctioned individuals and entities can escape consequences this way. International companies suffer greatly from this problem, which is another reason to invest in strong screening solutions.

In December 2024, Sweden’s financial regulator tested sanction screening systems in 19 banks. It found none of them caught all names or entities on sanctions lists in test environments.

Lack of Audit Trail and Justification

As a last step for every sanctions screening program, every decision should be documented. These audits will later be used for accountability and regulatory reviews. A lack of audit trails will cause confusion within your company since the justification for why an individual was flagged, approved, or dismissed will be absent. Without audit trails, it will be harder to show compliance with frameworks like EU AML directives and SAMLA and towards regulators when you are inspected or investigated. Internal audits will also get affected because of missing logs. Identifying gaps, refining processes, and providing evidence of due diligence will be harder because of it. Maintaining a detailed audit trail ensures transparency within your company and towards regulators. When closing its Moscow office, Herbert Smith Freehills made payments to sanctioned Russian banks. HSF self-reported the breaches to authorities and cooperated with audit trails; the UK Office of Financial Sanctions Implementation (OFSI) reduced its penalty by 50% for voluntary disclosure. This shows the importance of audit trails when communicating with regulatory bodies.

FAQ's Blog Post

Sanctions screening is the process of checking customers and transactions against global watchlists and restricted entities.

Sanctions screening is challenging due to constant list updates, false positives, and data quality issues.

False positives occur when legitimate customers are flagged due to name similarities or incomplete data.

Poor or inconsistent data leads to missed matches, false alerts, and compliance gaps.

Real-time updates are critical to catch newly sanctioned entities and prevent prohibited transactions.

Technology like AI, fuzzy matching, and automation reduce manual errors and improve accuracy.