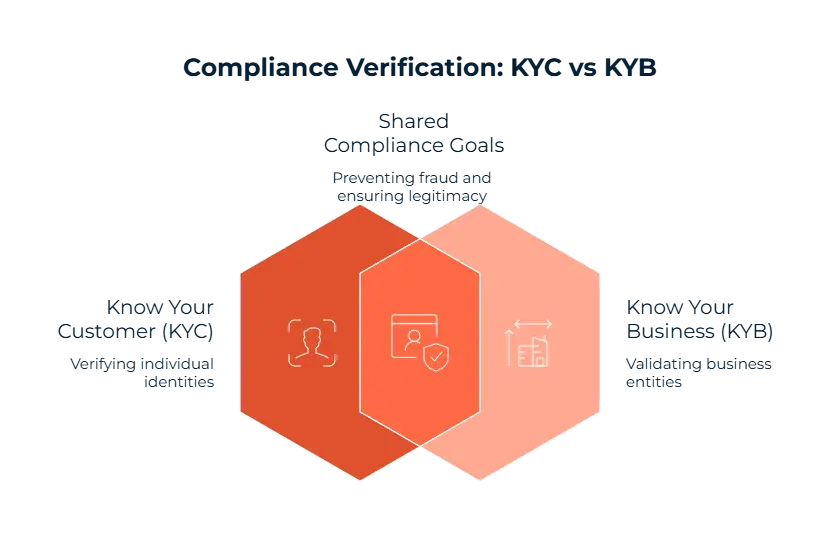

In this blog post, we’ll be talking about, giving details of, and comparing two different terms often used in the compliance world. Know Your Customer (KYC) and Know Your Business (KYB) both have their differences. KYC deals with verification on a customer level, checking their ID, date of birth, address, and similar important details that prove their existence. KYB is the business level of this verification process. Business registrations, ultimate beneficial owners (UBOs) and ownership structures are the focus points of KYB to make sure the company is real.

They are similar in the sense that both are used to prevent money laundering from happening, especially important steps in order to reach anti-money laundering (AML) compliance.

According to sources of FF News, approximately 139 financial penalties were levied in the first half of 2025, totalling $1.23 billion, a 417% increase on the same period in 2024. The fines relate to AML, KYC, sanctions, suspicious activity reports (SARs), and transaction monitoring violations. This shows how important KYB and KYC are for your company in 2025 and beyond.

Definition of KYC (Know Your Customer)

We’ve mentioned above that KYC is used for identification on an individual level. KYC is mostly used during onboarding. KYC measures are also used to assess a customer’s risk level, the customer is then paid attention to according to its risk level. Your company should use KYC as its first line of defense against money laundering and other potential financial crimes.

Other than asking for ID documents like passport and licenses and address proof, KYC also gets help from biometric tools in 2025. Facial recognition, fingerprints, and liveness checks are recommended for our readers looking to strengthen their KYC measures. Afterwards, screening against watchlists like sanctions and politically exposed persons (PEPs) will help reduce the risk of working with a sanctioned party or letting a high-risk individual go unnoticed.

The FCA has fined Monzo £21 million for repeatedly breaching rules against opening accounts for high-risk customers after the digital bank took on clients with obviously implausible information. One example is the company letting customers declare their address as the Buckingham Palace, or even Monzo’s own headquarters and not raising any red flags. The case showcases how important verification is for your company.

Key KYC Regulations to Know

KYC measures are the sum of several important regulations set by different regulatory bodies. The 6th Anti-Money Laundering Directive (AMLD6) is used in the EU and sets penalties for money laundering. The identity verification measures are also mandated for all member states. When we’re talking about global levels of compliance, FATF Recommendation 10 is there to set and enforce Customer Due Diligence (CDD) standards. Both customers and companies should be verified according to the CDD process. When it comes to the U.S., the FinCEN CDD Rule is known to obligate banks and other financial firms to perform CDD measures by checking identities of customers and firms and confirming the legitimacy of the information.

What Is KYB (Know Your Business) and What Does It Involve?

KYB is the company level version of the KYC process. Other than the steps taken we’ve mentioned above, the KYB process also deals with validating licenses, reviewing financial records and conducting adverse media screening on the company. Tax ID validation is also a part of the process to make sure tax fraud is not involved with the company.

In 2025, Barclays was penalised £42 million by the FCA for its weak KYB oversight. Failures included inadequate due diligence for WealthTek where they didn’t check for licenses and insufficient scrutiny of Stunt & Co’s connections to a money-laundering operation involving £46.8 million. Barclays also voluntarily paid £6.3 million to affected clients. Failings in KYB measures lead to millions as fines, as highlighted by this example.

Key KYB Regulations to Know

The FATF Recommendation 24 is the first and mayhaps the most important regulation regarding KYB. The Recommendation 24 is encouraging the identification and verification of UBOs to reach ownership transparency. Another regulation pushing for better KYB processes is the U.S. Corporate Transparency Act (CTA). This act mandates disclosure of company ownership which makes it harder for fraudsters trying to hide illicit funds. The AMLD6 is also the European leg for enforcing these KYB rules. Following these regulations enforced by regulatory bodies prevents shell companies, avoids penalties, and helps reduce the overall risk.

KYB vs KYC: Key Differences

We’ve talked before about how the KYC is targeted towards individuals whereas KYB is designed for legal entities to be checked. KYC deals with identity checks and KYB is more involved with proving that the company is legitimate. KYC is guided by regulations like FATF 10, AMLD6, FinCEN; and the regulations involving KYB are FATF 24, CTA, AMLD6. When conducting KYC checks, the customer’s ID, address, and biometrics data is checked against official information. When it comes to KYB checks, the focus points are figuring out UBOs, validating licenses and tax IDs. The screenings conducted as part of both KYC and KYB checks should be sanctions, PEP, and adverse media screening. KYC checks may benefit from the involvement of biometric tools and electronic KYC (eKYC) solutions. KYB checks may get faster when using UBO tools to better detect UBOs.

Why Is KYB a Priority in 2025?

Since the demand for ownership transparency has increased, KYB is an important point to hit for companies in 2025. Another reason for KYB still being important is the existence of shell companies and the rightfully concerned firms looking to protect themselves for compliance. AMLD6 in the EU and the U.S. Corporate Transparency Act (CTA) are prioritising KYB now more than ever. UBO reporting is being encouraged by these regulatory bodies in 2025 which shows how important KYB still is. Crypto firms and fintech companies have been growing rapidly in the recent years, and regualtory bodies act accordingly by giving them stricter guidelines. Stricter audits and KYB requirements are being asked from these companies to make sure they are safe and in compliance with regulatory bodies as well.

Why is KYB More Challenging Than KYC?

| Challenge | Why It Matters |

| Incomplete data | Slows verification |

| Complex UBOs | Obscures ownership |

| Cross-border rules | Multiple standards |

| No global KYB framework | Manual work, legal risk |

KYB and KYC in Practice

| Industry | KYC Use Case | KYB Use Case |

| Fintechs | E-wallet ID checks | SME onboarding |

| Crypto | Retail AML compliance | Institutional KYB |

| Marketplaces | Buyer verification | Seller legitimacy |

KYC vs KYB on Different Industries:

Fintechs and Neobanks

When it comes to companies like fintechs and neobanks, KYC and KYB are both important to have in your company. KYC is useful during personal account onboarding, the identity of your customer is checked with documents, screenings, and biometrics tools thanks to the process. However, KYB used for when vendor or business accounts are opened, the process ensures that these companies actually exist and their UBO and structure details are clear to examine when it is necessary.

In 2024, India's Reserve Bank (RBI) fined several public and private banks for KYC lapses. Punjab National Bank, State Bank of India, UCO Bank, Axis Bank, and other banks like ICICI, HDFC, Bank of Maharashtra, etc., also received fines ranging from ₹1 crore to ₹2.7 crore. It shows how fines can add up to millions if the KYC/KYB measures are ignored.

Crypto Exchanges

When it comes to crypto exchanges, KYC is mainly used for retail traders. These users need to be identified before they can deal with funds. KYB is used to check over-the-counter (OTC) desks, custodians, and firm clients. Since these businesses are dealing with large amounts of crypto, ensuring that they are safe and transparent is important for both your company and regulatory bodies.

Marketplaces and Payment Service Providers (PSPs)

Both of marketplaces and payment service provider sectors rely on KYC since it promotes consumer protection. The customer gets verified first to prevent financial crimes. KYB is used to confirm the legitimacy of vendors, partners, and business accounts. Checking the company for legitimacy, transparency, and its status of registry is important for protecting marketplaces and PSPs against money laundering and more.

Simplify KYC & KYB with Sanction Scanner

Our Sanction Scanner team is ready to step up your KYB and KYC compliance. Our team’s solution involves screening individuals and firms instantly both during onboarding and afterwards. Real time UBO and registry data your company will receive from Sanction Scanner will help prevent illegitimate companies from collaborating with you. With Sanction Scanner, your compliance reports will be filed accordingly and also be audit-ready. The all-in-one KYC and KYB platform is there for your compliance needs.

FAQ's Blog Post

KYB verifies the legitimacy and ownership of businesses, while KYC focuses on verifying individual customers. Both are essential for AML compliance.

It helps institutions detect shell companies, hidden ownership, and high-risk business relationships. This prevents money laundering and fraud.

It ensures customers are who they claim to be and assesses their risk profile. This protects businesses from identity fraud and financial crime.

Banks, payment providers, fintechs, and other regulated entities dealing with corporate clients. It is mandatory in many jurisdictions under AML laws.

Any business providing financial services or regulated activities to individuals. This includes banks, brokers, crypto exchanges, and insurers.

Company registration documents, shareholder details, Ultimate Beneficial Owner (UBO) identification, and business licenses.

Government-issued ID, proof of address, and sometimes proof of income or source of funds.

Yes, many compliance systems integrate both processes. This ensures full verification of both the business entity and its owners.