Adhering to Know Your Customer (KYC) regulations is the key to maintaining a secure and transparent financial environment as well as being a regulatory obligation in the UK. Businesses can build trust, detect illicit activities, and remain compliant with evolving laws through these measures. Whether it is a bank or a fintech startup that we are talking about, KYC processes form the backbone of customer onboarding and ongoing compliance monitoring.

What Is KYC and Why Is It Mandatory in the UK?

With KYC (Know Your Customer), businesses can verify the identity of their customers by collecting information like proof of identity and address to ensure the legitimacy of individuals or entities. Thus, making it an indispensable tool to maintain trust and security in financial transactions.

The fact that it helps detecting and preventing illegal activities such as money laundering, fraud and terrorist financing makes KYC situated very close to Anti-Money Laundering (AML) efforts. In the UK, the responsible in this regard is the Financial Conduct Authority (FCA), it enforces strict KYC regulations so that businesses comply with these standards to avoid penalties and protect their reputation.

What Are the Key KYC Regulations in the UK?

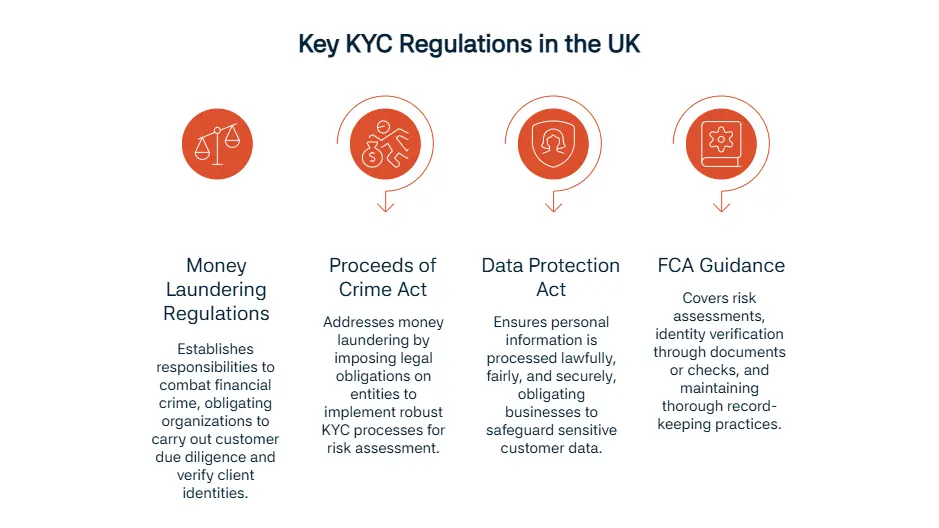

Several key regulations govern KYC requirements in the UK, forming the foundation of compliance obligations:

Money Laundering Regulations 2017

The Money Laundering, Terrorist Financing, and Transfer of Funds (Information on the Payer) Regulations 2017 establish clear responsibilities for businesses to combat financial crime. With these regulations, organizations are obligated to carry out customer due diligence (CDD), verify the identity of clients and monitor ongoing transactions.

Proceeds of Crime Act 2002 (POCA)

With The Proceeds of Crime Act 2002 (POCA), money laundering is addressed by imposing several strict legal obligations on entities like implementation of robust Know Your Customer (KYC) processes to identify and assess potential risks associated with financial transactions.

Data Protection Act

Handling customer data within the KYC framework must comply with the Data Protection Act (DPA). So that, it can ensure personal information to be processed in a lawful, fair and secure way. Businesses are obligated to safeguard sensitive customer data. Nevertheless, these customers should be assured that businesses will maintain transparency with them about how their information is used.

FCA Guidance for Regulated Entities

Thanks to the Financial Conduct Authority (FCA), regulated entities can follow their detailed guides, which basically cover essential areas such as conducting risk assessments to evaluate customer profiles, verifying the identity of clients through reliable documents or electronic checks, and maintaining thorough record-keeping practices.

Important Regulatory Bodies in the UK

There are a lot of key regulatory bodies in The United Kingdom that deserve a mention, who are responsible for overseeing financial activities, ensuring compliance, and maintaining market integrity so, we find it is very important to elaborate a little on these bodies.

1. The Financial Conduct Authority (FCA):

Here are the details of the guidance that FCA provided as we touched on in the previous section. It protects the customers, increase market rivalry and protect market integrity by regulating the financial firms, thus provides adherence to anti-money laundering (AML) and counter- terrorism financing (CFT) with other financial services guidelines.

2. The Prudential Regulation Authority (PRA):

Such firms as banks, credit unions, insurers, building societies, and major investment firms are regulated and supervised by PRA. It has also the purpose of promoting stability and maintaining the soundness of firms that are important for financial systems.

3. The Bank of England:

It maintains prospective supervision, controls payment systems and has the role of the lender of last resort during crises. The Bank of England also has the responsibility to provide the financial stability in the UK.

4. HM Revenue & Customs (HMRC):

When mentioning regulatory bodies, HMRC is definitely not the one to miss out on. What makes it important is that it ensures sectors like estate agency businesses, high-value dealers, and trust or company service providers to implement effective AML controls and meet regulatory requirements.

Which Documents Are Required for KYC in the UK?

Actually, the specific documents and information required for KYC depends on the type of customer. While individuals are expected to provide government-issued ID and proof of address, larger clients, such as businesses, are obligated to provide identification of the Ultimate Beneficial Owner (UBO), incorporation documents and corporate structure details but there is an exception, which is applicable in case a client is considered high-risk, who must present documentation proving the source of funds and evidence of wealth accumulation.

Customer Due Diligence in the United Kingdom (2025 Guide)

Customer Due Diligence (CDD) is a legal requirement under the UK’s Money Laundering Regulations 2017 (as amended) and plays a central role in preventing money laundering and terrorist financing. All “regulated entities” — including banks, payment providers, estate agents, accountants, crypto firms, and others — must carry out CDD before entering into a business relationship or conducting certain transactions.

CDD ensures that businesses “know their customer,” understand the nature of the business relationship, and can identify unusual or suspicious behavior.

When Is CDD Required in the UK?

Firms must perform CDD when establishing a new business relationship, conducting occasional transactions of €10,000+ (or £8,600 equivalent), a suspicious activity is detected, doubts arise about a customer’s identity, when dealing with politically exposed persons (PEPs) and when conducting remote onboarding (non-face-to-face).

What Does the UK CDD Process Include?

| Step | Description |

| Customer Identification | Collect official documents (passport, driving license, utility bill) |

| Verification | Check documents using reliable and independent sources |

| Nature of Relationship | Understand the intended purpose and type of business relationship |

| UBO Identification | For companies: identify the Ultimate Beneficial Owner (>25% ownership) |

| Ongoing Monitoring | Regularly review customer activity and reassess risk levels |

| Sanctions & PEP Screening | Screen against UK, UN, OFSI, and other global watchlists |

Beneficial Ownership UK Requirements

To enhance transparency regarding beneficial ownership, The United Kingdom has established specific requirements and these requirements are primarily governed by the People with Significant Control (PSC) regime, which mandates that companies and Limited Liability Partnerships (LLPs) identify and record individuals or entities with significant control over the organization.

One of the important requirements is maintaining a regularly updated PSC Register (a record of individuals with significant ownership or control) and this significant control is defined by possessing more than 25% of shares or voting rights. Some other key requirements include the obligation of reporting information about beneficial owners to Companies House, and thus making it publicly accessible (unless exempt due to specific confidentiality protections) as well as requiring companies to take reasonable measures to verify the accuracy of the information collected regarding their owners.

What Are the Ongoing Monitoring Requirements for KYC in UK?

Ongoing monitoring is a critical component of Know Your Customer (KYC) practices within the UK, as mandated by regulatory frameworks such as the Money Laundering, Terrorist Financing and Transfer of Funds (Information on the Payer) Regulations 2017. Financial institutions and obligated entities are required to continuously assess/monitor customer transactions and activities, to identify/mitigate potential risks associated with money laundering or terrorist financing by involving the review of customer information to ensure its accuracy and relevance, as well as the analysis of transactional patterns to detect unusual or suspicious behaviors.

Automated systems capable of real-time transaction monitoring which triggers alerts for activity that deviates from established customer profiles must be implemented. As you may expect, this is a continuous process, which makes it necessary to conduct periodic reviews of customer risk profiles to account for changes in a customer’s status or behavior. If a customer is deemed higher-risk (such as those classified as Politically Exposed Persons (PEPs) or entities with operations in high-risk jurisdictions), enhanced monitoring is required. Institutions must document their monitoring efforts and report any suspicious activities to the appropriate authorities, such as the UK’s Financial Intelligence Unit (FIU), through Suspicious Activity Reports (SARs). These measures ensure a dynamic and proactive approach to risk management in compliance with UK regulations.

How Is Enhanced Due Diligence Applied in the UK?

What Triggers Enhanced Due Diligence (EDD) in the UK?

Certain risk factors like Politically Exposed Persons (PEPs), transactions involving high-risk jurisdictions and large or unusual transactions that deviate from typical patterns require Enhanced Due Diligence (EDD).

Example of EDD Triggers

If a customer from a high-risk jurisdiction initiates a substantial international transaction, this would immediately trigger the need for EDD.

Steps in the EDD Process

The EDD process involves thorough documentation and verification, by collecting additional identification documents, verifying the source of funds/overall wealth and implementing comprehensive, ongoing transaction monitoring.

Entities Required to Follow KYC Requirements in the UK

· Financial Institutions:

- Banks: Banks play a critical role in the global economy because they manage customer deposits, lend, and facilitate financial transactions thus, strong KYC practices are required to help prevent fraud and money laundering.

- Credit Unions: These member-owned institutions are known to provide financial services such as loans and savings accounts, and this puts them into a position which requires thoroughly verifying customers and assess risks to be sure of the compliance.

- Building Societies: They must integrate robust KYC measures to maintain transparency and trust since they are responsible of providing mortgage lending and savings products.

Regulated Industries:

- Investment Firms: It is known that these firms handle assets and portfolios for clients which makes adhering to strict KYC standards is crucial for them.

- Insurance Providers: Policies and coverage that are covered by insurance providers have high chances of involving significant financial exchanges, so it is essential for them to conduct thorough customer verification procedures.

- Payment Service Operators: A large part of their business involve facilitating digital and online payments, and KYC helps to mitigate their susceptibility to fraudulent activities.

· Designated Non-Financial Businesses and Professions (DNFBPs):

- Legal Professionals: Lawyers and notaires often handle large financial transactions and in order to identify and mitigate risks, KYC checks must be performed.

- Accountants: Accountants are involved in managing financial records and advising clients on fiscal matters. It goes without saying that it makes them another key player in ensuring compliance through KYC processes.

- Real Estate Brokers: As is known to all, these often facilitate property transactions that often involve high-value deals. It is a must for them to require stringent customer due diligence to prevent illicit activities.

- High-Value Goods Dealers: Robust KYC practices are needed, since these dealers sell luxury items that range from jewelry to cars, which are at risk of being used for money laundering.

What Are the Penalties for KYC Non-Compliance in the UK?

You must avoid non-compliance with KYC regulations at all costs if you don’t want to face any serious financial penalty or any significant damage to your reputation. Mentioning two important cases that set good examples can help to demonstrate the seriousness of FCA Enforcement, such as the one of NatWest, which incurred significant penalties due to shortcomings in its money laundering controls, or Barclays which faced fines for inadequate monitoring of high-risk clients. Furthermore any civil liability may result in penalties like fines or, depending on the severity and the nature of the breach, criminal charges can arise but there are also impacts on licenses and reputation. The operational licence of an organization may be revoked or simply, or they may suffer lasting damage to their reputation.

How Can Sanction Scanner Help You With KYC in the UK?

Simplifying KYC processes may sound overwhelming after this information, but with tools like Sanction Scanner, your compliance can become thoroughly straightforward and efficient. We enable real-time identity verification and dynamic risk evaluation for your business to ensure swift and accurate compliance checks as well as allowing you to screen against global PEP and sanction lists to maintain compliance with regulatory requirements. Also, we step in to reduce administrative burdens and improve accuracy of your business by streamlining compliance with our automated monitoring, and you will also not have a hard time integrating with your existing systems due to our user-friendly API that delivers scalability to support your business as it grows.

FAQ's Blog Post

Yes. KYC (Know Your Customer) is a legal requirement under the UK’s Money Laundering Regulations (MLR 2017) for all regulated entities, including banks, fintechs, and crypto firms. It must be performed at onboarding and during the business relationship.

Typically, individuals must provide: Proof of identity (e.g., passport, driver’s license), Proof of address (e.g., utility bill, bank statement issued within the last 3 months). For businesses, on the other hand, registration documents, UBO information, and proof of operations are required.

Firms must review and refresh KYC information periodically, based on the customer's risk level. High-risk clients are subject to more frequent reviews (e.g., annually), while low-risk customers may be reviewed every few years.

KYC is enforced by regulators such as: FCA (Financial Conduct Authority), HMRC (for non-financial regulated firms), the Gambling Commission, Ofgem, and others, depending on the sector.

EDD is required for high-risk customers such as PEPs, offshore entities, or those with suspicious transaction patterns. It includes verifying the source of funds, UBO, and ongoing monitoring of activities.

Yes. Under MLR 2017 and FCA guidance, cryptoasset firms must perform full KYC and register with the FCA to operate legally in the UK.

Non-compliance can result in: Heavy financial penalties (often in the millions), Regulatory sanctions, License suspension or revocation, and Criminal liability in serious breaches

Yes. The UK accepts digital identity verification solutions (eKYC) as long as they meet regulatory standards on accuracy, privacy, and fraud prevention. Many firms use biometric checks, NFC ID scans, and digital onboarding tools.