The Isle of Man has gained a reputation as an international financial center across global markets. A recognition such as this comes with the responsibility to encourage anti-money laundering (AML) measures. The main goal of these measures is to battle illicit financial activities.

What Is the AML Regulatory Framework in the Isle of Man?

The Isle of Man's anti-money laundering framework works meticulously and aligns perfectly with internationally recognized standards with two key main components.

● Proceeds of Crime Act 2008 (POCA): This act is a vital instrument in identifying and combating financial crime.

● Anti-Money Laundering and Countering the Financing of Terrorism Code 2019 (AML/CFT Code): This all-inclusive code supports POCA and it further provides guidelines for anti-money laundering and counter-terrorism financing systems.

Who Regulates AML Compliance in the Isle of Man?

Organizations in the Isle of Man are subject to constant supervision to fulfill compliance standards. Although the Isle of Man Financial Services Authority (IOMFSA) is the regulatory authority, additional sectoral regulations strengthen enforcement across domains.

Sector-Specific Oversight

● Banking Sector: The banking sector is one of the most strictly regulated industries with regards to Anti-Money Laundering (AML) activities. Before they accept new customers, banks check risk factors such as domestic and international transactions.

● Gambling Industry: For gambling operators, it is important to regularly check the transactions and analyze if they meet the Know Your Customer (KYC) requirements. They focus on customers who conduct high wager transactions.

● Cryptocurrency Asset Service Providers (CASPs): Virtual Asset Service Providers (VASPs) encounter serious challenges regarding digital currencies. Here, CASP acts as a business that offers services related to the exchange of cryptocurrencies and safekeeping of digital assets.

What Are the Main AML Laws in the Isle of Man?

In the Isle of Man, various pieces of legislation are responsible for strengthening AML.

● Terrorism and Other Crimes (Financial Restrictions) Act 2014: This act restricts individuals and organizations connected to terrorism from having access to financial resources.

● AML/CFT Code of 2019: This code aims to assess risks, evaluate customer needs, and document obligations.

Which Businesses Are Subject to AML Obligations in the Isle of Man?

● Banks and Financial Institutions consist of commercial and investment banks as well as other financial distributors that control funds and conduct transactions.

● Trust and Company Service Providers (TCSPs) prioritize handling the establishment and management of companies.

● Casinos and Online Gambling Operators monitor physical and online gambling agencies dealing with large amounts of money.

● Virtual Asset Service Providers (VASPs) assist clients when they exchange or transfer money and they also protect virtual assets like cryptocurrencies (e.g. Bitcoin and Ethereum).

These businesses assess risk factors unique to their industries and take necessary actions to prevent illegal transactions.

What Are the AML Compliance Requirements in the Isle of Man?

Customer Due Diligence (CDD) consists of monitoring customer activity, detecting and reporting suspicious behavior. The process of identifying relevant documentation includes:

● Obligatory identification and verification based on customers and owners’ reliable sources such as passports, national IDs, or utility bills

● Risk assessment required to determine the appropriate level of due diligence (Standard, Simplified, or Enhanced)

● Sanctions lists reported by governmental and international agencies

Enhanced Due Diligence (EDD) is the evaluation of additional documentation such as source of funds or wealth checks. The risk assessment process is mandatory for:

● Politically Exposed Persons (PEPs)

● Non-face-to-face clients

● Clients from high-risk jurisdictions

● Unusually large money transactions

Know Your Customer (KYC) is an inseparable part of CDD that allows financial institutions to verify the credibility of clients. KYC procedures are used to:

● Investigate customer data and determine risk category

● Provide reports that include the nature and goals of business relationships

● Protect businesses from individuals and organizations that are involved in terrorist financing or money laundering

Suspicious Activity Reports (SARs)

● In the Isle of Man, financial institutions must document any suspicious activity or transaction, including the ones that are attempted but not completed.

● SARs must be filed with the Isle of Man Financial Intelligence Unit (FIU). Some of the reported activities are unexplained, large withdrawals, cash deposits, or international money transfers.

Record Keeping

● In accordance with the AML/CFT Act, financial institutions must keep records of their activities and transactions.

● Records regarding customer relationships are required to be kept minimum 5-year after completion. CDD documents, money exchanges and transactions, internal reports, and SARs are included.

Risk-Based Approach (RBA)

● Businesses must periodically conduct, review and update their Business Risk Assessment (BRA) and Customer Risk Assessment (CRA).

● AML controls must be adapted to the identified risks and the right measures should be implemented.

Does the Isle of Man Have a Beneficial Ownership Register?

The Isle of Man has a centralized register of beneficial owners under the Beneficial Ownership Act 2017. The data is not publicly accessible, but authorities and regulators can retrieve information to investigate financial crimes. Registered agents are required to collect and submit UBO data.

What Are the AML Obligations for Trusts and Foundations in the Isle of Man?

Settlors, beneficiaries, protectors, and other controlling persons must be identified and verified by trustees under AML/CFT Code rules. The Foundations Act 2011 maintains transparency for Isle of Man foundations and Enhanced Due Diligence (EDD) requirements are met to better control complex structures and cross-border risks.

Is the FATF Travel Rule Enforced for Crypto Transactions?

Even though the FATF Travel Rule has not yet been authorized by law, VASPs can control transaction records and perform CDD. Implementing the Travel Rule formally is currently under regulatory consultation and the IOMFSA supports the use of the FATF guidance.

Are e-Gaming Operators Subject to AML Laws in the Isle of Man?

Both physical and online gambling operators are monitored by the Gambling Supervision Commission. Requirements are as follows:

● Full customer identification (KYC)

● Reporting of Suspicious Activity Reports (SARs) to the FIU

● Risk-based internal AML programs

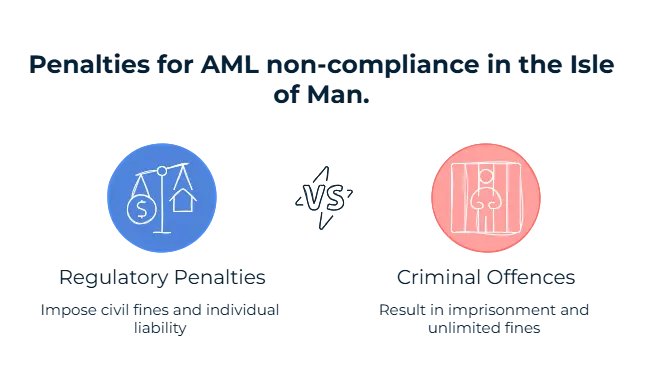

What Are the Penalties for AML Non-Compliance in the Isle of Man?

Regulatory Penalties:

● Under the Financial Services Act 2008, the Isle of Man Financial Services Authority (IOMFSA) imposes civil penalties of up to £400,000 for each breach.

● Individuals who are personally liable, such as directors, MLROs, or compliance officers, may be fined separately.

Criminal Offences under the Proceeds of Crime Act 2008 (POCA):

● If financial institutions do not report suspicious activity, this can result in up to 5 years of imprisonment and/or a fine.

● Assisting in money laundering knowingly leads to 14 years of imprisonment and an unlimited fine.

Additional Consequences:

● IOMFSA will demand license revocation or suspension.

● There will be public censure through enforcement notices.

● Overall, this will cause serious reputational damage that may consecutively limit access the to banking sector or international business relationships.

AML Regulations in the Isle of Man Banking Sector

The Isle of Man Financial Services Authority (IOMFSA) is responsible for the Isle of Man’s banking sector. IOMFSA puts in place strict AML requirements that align well with international standards.

Cryptocurrency and Virtual Assets

Although the Isle of Man has recently adopted crypto regulations, it is positioned as a regulated yet innovation-friendly jurisdiction. Virtual Asset Service Providers (VASPs) must register with the IOMFSA under the Designated Businesses (Registration and Oversight) Act 2015.

Payment Service Providers

Designated Businesses that are operating within the Isle of Man are overseen for AML compliance. They must carry out KYC procedures, verify beneficial ownership, and maintain transaction records.

Fintech Companies

If Fintech firms offer regulated activities such as lending, payments, and crowdfunding, they are subject to the same AML obligations in the Isle of Man just like traditional financial institutions. The IOMFSA offers guidelines for RegTech and FinTech innovation to promote compliance by design.

Is the Isle of Man on Any International AML Watchlists?

The Isle of Man is not on any FATF or EU AML watchlists or blacklists. However, the jurisdiction has been monitored by MONEYVAL, the Council of Europe’s anti-money laundering body.

According to its most recent reports in 2021, MONEYVAL acknowledged the Isle of Man’s progress as it implements a risk-based supervision framework that demonstrates beneficial ownership transparency. Although there were technical issues previously, the Isle of Man was not placed on the FATF grey list, and it still continues to actively engage in innovations to maintain global compliance standards.

What Are the Recent AML Developments or Updates in the Isle of Man?

● AML/CFT Code Updates: Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) Codes Updates are revised as of 2022. They introduce stricter compliance measures that improve the integrity of financial systems, and they make sure illicit activities are better prevented.

● FATF Recommendations: The Isle of Man regularly reviews its financial and regulatory framework to ensure alignment with the internationally recognized Financial Action Task Force (FATF) standards.

● MONEYVAL Reports: According to latest evaluations from MONEYVAL and the Council of Europe’s anti-money laundering body, the Isle of Man has proved to have made significant progress addressing previous recommendations.

How Can Sanction Scanner Help You?

Sanction Scanner provides solutions that will help your organization with compliance that aligns perfectly with global regulations and standards. With real-time sanctions, PEP (Politically Exposed Person), and adverse media screening utilized, risks are effectively minimized for businesses. Sanction Scanner’s interface offers a user-friendly experience, and it reduces the time needed for manual checks. As Sanction Scanner has customizable features, businesses can seamlessly adapt to changes with an up-to-date compliance framework.

FAQ's Blog Post

The primary legislation includes the Proceeds of Crime Act 2008 and the Anti-Money Laundering and Countering the Financing of Terrorism (AML/CFT) Code 2019.

The Isle of Man Financial Services Authority (IOMFSA) is the primary regulator for AML oversight across financial and certain non-financial sectors.

No. The Isle of Man is not currently on the FATF grey list and is considered broadly compliant with FATF recommendations through MONEYVAL assessments.

CDD requires verifying customer identity, understanding the nature of the business relationship, and identifying beneficial owners, with enhanced due diligence for high-risk cases.

Yes. Failure to comply with AML laws may result in criminal prosecution, regulatory sanctions, license revocation, or significant monetary fines.