Money laundering and the financing of illicit activities such as terrorism are becoming significant global threats affecting economic stability. To combat these activities, Qatar uses advanced anti-money laundering (AML) systems aligned with high standards such as those set by the Financial Action Task Force (FATF).

What are the AML Regulations in Qatar?

Law No. 20 of 2019 on Combating Money Laundering and Terrorism Financing is the primary AML legislation in Qatar. It follows FATF’s internationally recognized “40 Recommendations.” The law defines activities related to money laundering and terrorism financing, sets rules for companies and financial institutions, and it includes criminal penalties, fines, and jail time if these rules are violated.

Cabinet Decision No. 41 of 2019 explains which governmental agency implements anti-money laundering (AML) and Counter Financing of Terrorism (CFT) measures. Qatar Central Bank (QCB) AML/CFT Instructions were updated in 2022. These rules guide financial institutions licensed by the Qatar Central Bank. They cover;

How to check customer identities using Customer Due Diligence (CDD),

- How to monitor and report suspicious transactions,

- How to train employees on anti-money laundering rules.

- Guidance from the Qatar Financial Information Unit (QFIU): The QFIU supports compliance by providing Suspicious Transaction Report (STR) filing protocols and sector-specific risk indicators.

- Qatar follows up-to-date international standards and fights financial crimes effectively by following these rules.

Who Enforces AML Compliance in Qatar?

In Qatar, several authorities work together to strengthen the AML regulatory ecosystem. We have summarized them here for you:

- Qatar Financial Information Unit (QFIU): It works with the nation’s central Financial Intelligence Unit (FIU). The agency is responsible for detecting Suspicious Transaction Reports (STRs) and collaborating with international bodies to help stop money laundering.

- Qatar Central Bank (QCB): QCB is responsible for supervising banks and exchange houses. Under the guidance of the Qatar Central Bank, financial institutions follow AML/CFT rules to improve due diligence for high-risk accounts.

- Qatar Financial Centre Regulatory Authority (QFCRA): The QFCRA makes sure companies in the Qatar Financial Centre (QFC) follow anti-money laundering regulations.

- Qatar Financial Markets Authority (QFMA): QFMA’s main task is to ensure financial institutions trade by following AML rules.

- Ministry of Commerce and Industry (MOCI): The MOCI supervises Designated Non-Financial Businesses and Professions (DNFBPs) and it monitors high risk businesses including real estate brokers, dealers of precious metals and stones, gold and jewelry.

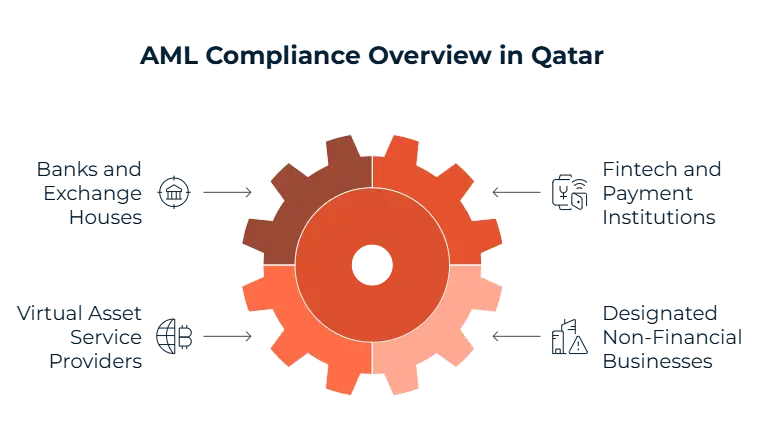

Who Must Comply with AML Regulations in Qatar?

- Banks and Exchange Houses must regularly check Customer Due Diligence (CDD) and monitor money transactions. Compliance with anti-money laundering (AML) and counter-terrorism financing (CTF) regulations is essential.

- Fintech and Payment Institutions must implement Electronic Know Your Customer (e-KYC) systems and verify customer identities. They regularly analyze Politically Exposed Persons (PEPs), people on sanctions lists, and negative media reports about specific clients.

- Virtual Asset Service Providers (VASPs) must follow the Financial Action Task Force (FATF) guidelines. These guidelines are for monitoring cryptocurrency activities and other virtual assets.

- Designated Non-Financial Businesses and Professions (DNFBPs): The non-financial businesses that face money laundering risks are as follows:

1. Real estate developers and brokers: During property transactions, they must conduct due diligence on clients.

2. Lawyers, accountants, and notaries are responsible for handling money and property. During that process, they verify clients, making sure that their profiles comply with AML/CTF regulations.

3. Dealers in luxury goods and precious metals are often involved in money laundering. Keeping records of their cash transactions and reporting suspicious activities are necessary.

When is Enhanced Due Diligence (EDD) Required?

Enhanced Due Diligence (EDD) is specifically applied when there is a higher risk for money laundering activities. Some of the circumstances that require EDD in Qatar include:

High-Risk Customers or Politically Exposed Persons (PEPs) are people with powerful and influential roles such as politicians or senior officials. These customers are generally from countries listed as high-risk by the Financial Action Task Force (FATF).

Non-Face-to-Face Onboarding is a remote and phone-based customer verification process that requires stronger verification measures.

Unusually Large Transactions that do not match the customer’s profile are significant signs of illicit activity.

Enhanced Due Diligence (EDD) includes checking customer identity, determining the source of cash, and monitoring transactions closely.

What Are the AML Rules for Banks, Fintechs, Payments, and Crypto in Qatar?

Banks

Banks in Qatar must implement internationally regulated Anti-Money Laundering (AML) standards.

- The Money Laundering Reporting Officer (MLRO) must check AML compliance and report risks.

- Politically Exposed Persons (PEPs) should be monitored by Enhanced Due Diligence (EDD) procedures.

- In case there are any suspicious transactions, it must be reported to the Qatar Financial Information Unit (QFIU).

Fintech & Payment Institutions

- Must follow the same strict AML/CFT obligations as traditional banks

- Must use Electronic Know Your Customer (e-KYC) to verify customer identities

- Must conduct daily checks on high-risk individuals such as Politically Exposed Persons (PEPs), people on sanctions lists and negative news

- Must help fintechs stay safe, follow Qatar’s AML/CFT rules, and build trust with customers.

Virtual Asset Service Providers (VASPs)

- As it is ruled by the Qatar Central Bank’s (QCB) in 2020, local investors are not allowed to trade cryptocurrencies in Qatar.

- Virtual Asset Service Providers (VASPs) serving Qatari customers must comply with strict AML regulations that align with the Financial Action Task Force (FATF) Virtual Asset Guidance.

- Any suspicious cryptocurrency-related activity must be reported immediately to the Suspicious Transaction Reporting (STR) system.

These regulations demonstrate Qatar’s commitment to maintaining a secure financial ecosystem by addressing the risks that are associated with virtual assets.

How Are Suspicious Transactions Reported in Qatar?

Financial institutions in Qatar are legally obligated to report any suspicious activity to the Qatar Financial Information Unit (QFIU). Key details include:

Reporting Authority: The QFIU processes all Suspicious Transaction Reportings (STRs).

Timeline: After suspicious activity is identified, it must be reported within 24 hours.

Submission Platform: Suspicious Transaction Reporting must be sent to the Financial Information Unit (FIU) electronically.

Record Retention: All documents, including Know Your Customer (KYC) records and STR data, must be kept for at least five years.

What Are the Penalties for AML Non-Compliance in Qatar?

If financial institutions do not comply with anti-money laundering rules, they can face serious consequences such as:

- Administrative Fines can go up to QAR 1 million per violation.

- Criminal Sanctions go up to 10 years of jail time..

- License Suspensions can happen if the violation is really serious.

- Public Censure may be issued so that everyone knows about the illicit activity.

Major Money Laundering Cases in Qatar

| Case | Key Individuals/Entities | Allegations | Outcome |

| Former Finance Minister | Ali Sherif al-Emadi | Money laundering, bribery, abuse of power | 20 years prison, QAR 61 billion fine (~$16.7B) |

| Royal Family Member | Sheikh Nawaf bin Jassim bin Jabor Al Thani | Public fund misuse | 6 years prison, QAR 825 million fine |

| Hamad Medical Corporation (HMC) Scandal | 16 defendants (incl. 4 HMC employees) | Bribery, laundering | 5–15 years prison, QAR 729 million in total fines |

| Ashghal (Public Works Authority) Case | 8 defendants incl. senior Ashghal official | Bribery, contract manipulation, laundering | Criminal court proceedings ongoing |

| Expat Money Laundering Convictions | 2 expatriates | Laundering via local accounts | 2 years prison, QAR 20,000 (~$5,500) fine each |

| Loan Diversion to India | Indian nationals using Qatar-based loans | Cross-border laundering | Charged by Indian ED, ~Rs 61 crore traced from Qatar banks |

Is Qatar on Any AML Watchlists?

FATF Status: Qatar is not currently on the Financial Action Task Force (FATF) grey list or blacklist. Qatar follows international AML (Anti-Money Laundering) and CFT (Counter-Terrorism Financing) standards.

MENAFATF: Qatar is regularly evaluated by the Middle East and North Africa Financial Action Task Force (MENAFATF). These reviews check how well Qatar follows international AML/CFT standards and offer advice on how to improve financial systems.

EU AML Lists: Qatar was previously flagged by the European Union for its weak AML protections. But now, Qatar is not currently on the EU’s high-risk list as recent improvements have effectively prevented financial crime risks.

What AML Developments Should Stakeholders Expect?

2025 AML Guidelines is introduced by the Qatar Central Bank (QCB) for banks and Payment Service Providers (PSPs).

Revised Compliance Manuals are being updated and the instructions will be shared with the Qatar Financial Centre Regulatory Authority (QFCRA).

MENAFATF Evaluation is Qatar’s next mutual evaluation review scheduled for Q3 2025.

These measures demonstrate Qatar’s commitment to maintaining effective AML/CFT controls.

How Sanction Scanner Supports AML Compliance in Qatar?

Implementing an effective AML strategy can be complex, but Sanction Scanner provides an end-to-end solution tailored to Qatar’s AML regime. Our professional services include:

- Real-time sanctions and Politically Exposed Persons (PEP) screening aligned with Financial Action Task Force (FATF) standards,

- Monitoring negative news globally to catch risks early,

- Easy connection with Qatar Financial Information Unit (QFIU) systems to file Suspicious Transaction Reports (STRs),

- Arabic-language compliance supports local teams.

FAQ's Blog Post

Cryptocurrency trading is currently restricted. Local companies are not allowed to offer crypto services. But Qatar is considering a safe testing (a regulatory sandbox) for Virtual Asset Service Providers (VAPs) in the future.

The primary anti-money laundering legislation in Qatar is Law No. (20) of 2019 on Combating Money Laundering and Terrorism Financing, aligned with FATF standards.

The Qatar Financial Information Unit (QFIU) is the key body responsible for AML enforcement and analysis of suspicious transactions. Other key regulators include the Qatar Central Bank (QCB) and Qatar Financial Markets Authority (QFMA).

Qatari businesses must implement customer due diligence (CDD), conduct risk assessments, report suspicious transactions to QFIU, and establish internal AML/CFT policies and training programs.

Yes, Know Your Customer (KYC) procedures are mandatory for all financial institutions and designated non-financial businesses. These include verifying identity, monitoring transactions, and maintaining updated customer records.

Penalties may include fines, imprisonment (up to 20 years), suspension of licenses, and public disclosure. For example, high-profile offenders have faced fines exceeding QAR 60 billion.

Cryptocurrency trading is currently restricted. Local companies are not allowed to offer crypto services. But Qatar is considering a safe testing (a regulatory sandbox) for Virtual Asset Service Providers (VAPs) in the future.