SWIFT (Society for Worldwide Interbank Financial Telecommunications) is a global messaging network that is widely used by financial institutions to send and receive money transfer orders. It is a cooperative society owned by member financial institutions and has offices worldwide. The SWIFT network assigns a unique code of eight or 11 characters to each financial institution, which is alternately called a bank identification code (BIC), SWIFT code, SWIFT ID, or ISO 9362 code. The code helps banks and money transfer services determine where to send money on a global scale. In addition to its core functions, SWIFT also plays a pivotal role in safeguarding the integrity of financial transactions through essential processes like AML name screening. By incorporating robust compliance measures, SWIFT ensures that each transaction is subject to rigorous scrutiny, further reinforcing its status as a trusted partner in the world of international finance. Since its inception in 1973, SWIFT has continuously evolved, and as of 2018, nearly half of the high-value cross-border payments worldwide have relied on the SWIFT network for their secure and efficient processing.

What is SWIFT?

SWIFT is a vast messaging network used by financial institutions such as banks to send and receive money transfer orders. It works through a standard code system, which assigns a unique code to each financial institution. The code is comprised of eight or 11 characters and is assigned according to specific rules. The code helps banks and money transfer services determine where to send money on a global scale. Since the SWIFT code is a national code, a bank on one side of the world can find the right bank on the other side of the world. However, bank transfers using the SWIFT system usually pass through 1-3 intermediary banks, each of which may charge a fee. As a result, international transaction fees might be higher than local transactions.

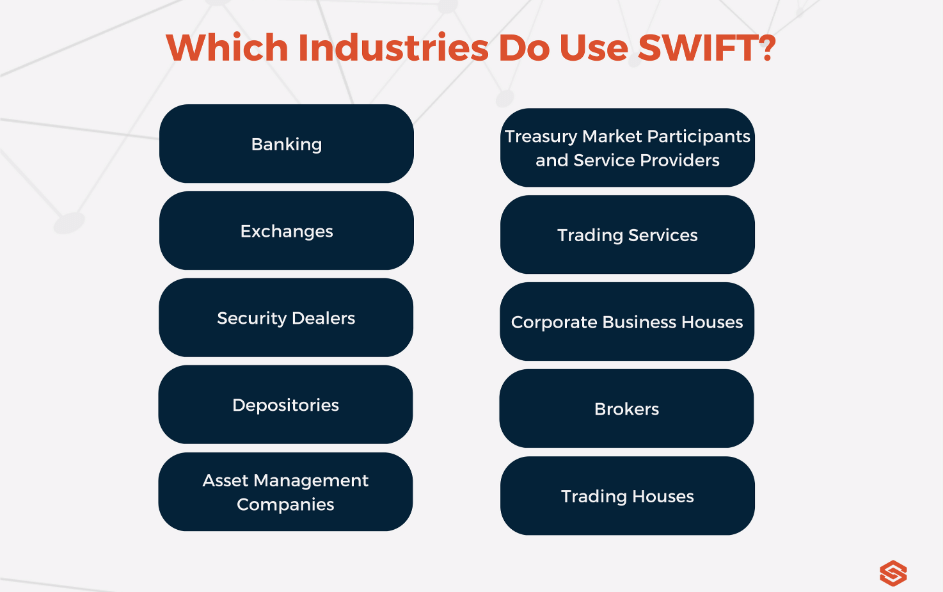

Although SWIFT was only used for treasury transactions when it was first established, it has gradually developed and serves many sectors today. These sectors include treasury market participants and service providers, banks, exchanges, trading services, securities dealers, corporate business houses, asset management companies, depositories, brokerage institutes and trading houses, foreign exchange, and money brokers.

How Does Swift Work?

SWIFT is a vast messaging network used by financial institutions such as banks to send and receive money transfer orders. SWIFT works through a standard code system. It assigns a unique code of eight or 11 characters to each financial institution. The code is alternately called bank identification code (BIC), SWIFT code, SWIFT ID, or ISO 9362 code. The codes are assigned according to the rules below.

- The first four characters: institute code

- The next two characters: country code

- The next two characters: city code

- The last three characters: optional branch code

Customers who transfer money using international lines must use a SWIFT / BIC code since banks and money transfer services determine where to send money on a global scale using SWIFT. Since the SWIFT / BIC code is a national code, a bank on one side of the world can find the right bank on the other side of the world. Bank transfers using the SWIFT system usually pass through 1-3 intermediary banks, each of which may charge a fee. As a result, international transaction fees might be higher than local transactions.

Which Industries Use SWIFT?

In today's globalized economy, the ability to transfer funds and settle financial transactions across borders is essential. For decades, the financial industry has relied on a secure messaging system, SWIFT, to facilitate this process. Used by banks, corporations, and government agencies around the world, SWIFT has become an indispensable tool for conducting international commerce. In this context, understanding the role and importance of SWIFT is essential for anyone involved in the global financial system.

The following industries typically use SWIFT:

SWIFT in International Financial Transactions

SWIFT works through a standardized code system that assigns a unique code to each financial institution. When a bank initiates a financial transaction, it sends a message through the SWIFT network to the recipient bank, which uses the SWIFT code to identify the correct account. The transaction is then processed and settled through correspondent accounts owned by each bank.

SWIFT messages are sent in a standardized format, which includes information about the sender, recipient, and transaction amount. The messages are encrypted and transmitted securely through the SWIFT network, which has multiple layers of security to protect against fraud and cyber-attacks.

In the context of SWIFT, transaction screening is the process of reviewing financial transactions to identify potential risks, including money laundering, terrorist financing, and other financial crimes. SWIFT transaction screening is critical to detect and prevent illegal financial activities.

Financial institutions use various tools and techniques, including watchlists, sanctions lists, and adverse media databases, for transaction screening to identify suspicious activities and ensure strict compliance with AML and CFT regulations, including AML name screening.

Innovation and improvement are needed in the field of SWIFT transaction screening as Financial crimes continue to evolve, including potential areas for innovation and improvement. One potential area for improvement is the use of artificial intelligence and machine learning (ML) to improve SWIFT transaction screening capabilities. Artificial intelligence and machine learning can analyze large volumes of data and identify patterns that may be indicative of suspicious activity.

Another area for improvement is the integration of blockchain technology into the SWIFT network. Blockchain has the potential to increase transparency and reduce the risk of fraud by creating an immutable ledger of financial transactions.

Sanction Scanner Transaction Screening Service

Sanction Scanner's Transaction Screening Service includes SWIFT transaction formats, allowing businesses to implement robust AML name screening, Sanctions, PEP, and Adverse media controls for their customers in the money transfer and payment transactions they mediate, reducing financial crime risks. All control processes take place automatically in seconds with API integration. Sanction Scanner's Anti-Money Laundering database consists of 3000+ Sanctions, PEPs, Adverse Media, and Watchlist data updated every 15 minutes from more than two hundred countries. Sanction and PEP Screening are always in real-time. Businesses can reduce their AML risks and money laundering regulations with AML Transaction Screening.