Reporting fraud is crucial to maintaining trust and integrity within businesses and communities. It helps prevent further damage and holds perpetrators of fraudulent activities such as money laundering and terrorist financing accountable. Not reporting fraud can lead to continued losses, legal penalties, and damage to reputation.

What is Fraud?

Fraud involves deceit or trickery for financial or personal gain. It manifests in various forms, such as embezzlement, identity theft, and false claims. Understanding the basics of fraud is essential to recognize and report it effectively. Fraud can occur in numerous sectors including banking, insurance, and healthcare, and often involves complex schemes designed to deceive victims and exploit their trust.

Why Reporting Fraud is Crucial?

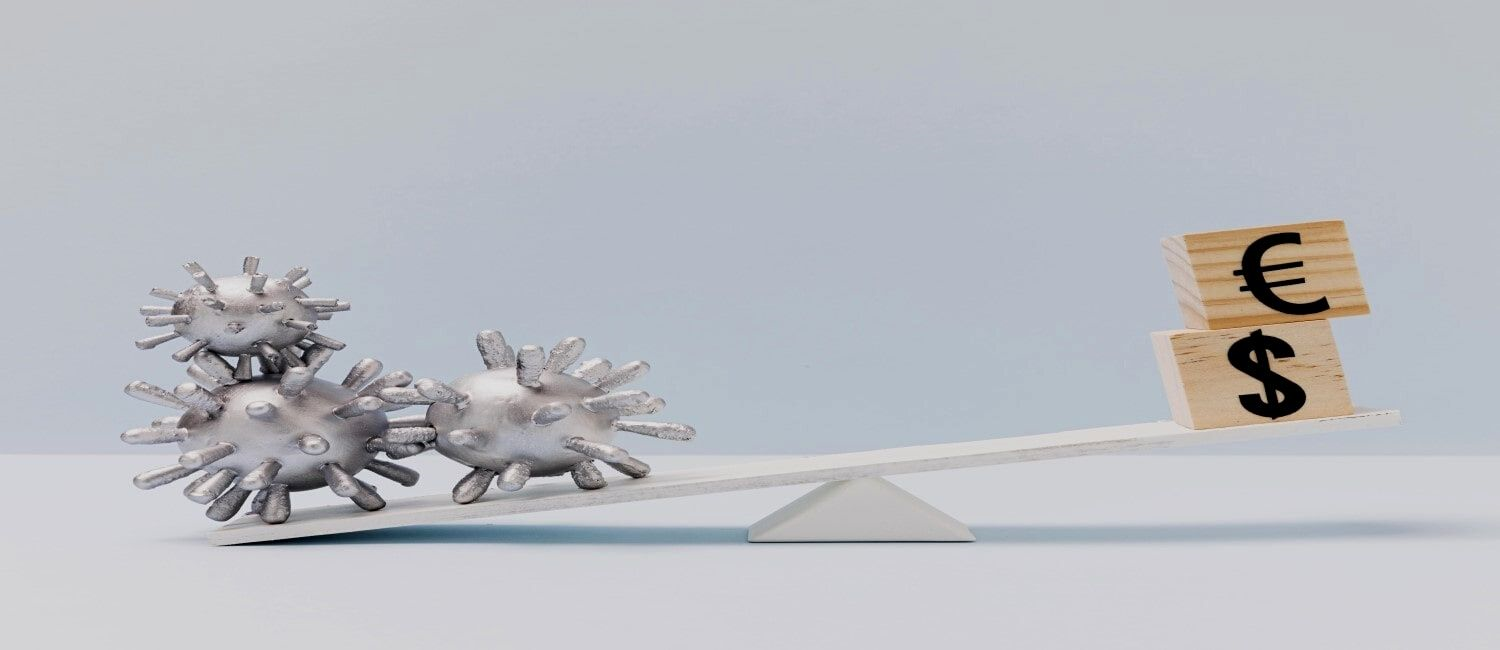

Fraud can result in significant financial losses, harm to reputation, and legal consequences for both businesses and individuals. Businesses may face bankruptcy, while individuals may suffer from credit damage and emotional distress.

Legal and Ethical Obligations to Report Fraud

Reporting fraud is a legal requirement in many jurisdictions and an ethical duty to prevent further harm. Companies are often mandated by law to report fraud to regulatory authorities, and employees must uphold ethical standards. Failure to report can result in legal penalties and loss of professional credibility.

Benefits of Reporting Fraud

Reporting fraud can help prevent further damage, provide legal protection, and contribute to a safer and more trustworthy environment. It also deters potential fraudsters, encourages a culture of honesty, and can lead to the recovery of stolen assets. By reporting fraud, individuals, and organizations contribute to the broader fight against financial crime and help maintain the integrity of markets and institutions.

Preparing to Report Fraud

Without solid evidence, it can be difficult to prove the occurrence of fraud and hold the responsible parties accountable. There are three kinds of solid evidence against fraud:

- Documentation: Gather all relevant documents that can substantiate your claim, such as emails, receipts, and transaction records.

- Witness Statements: Obtain statements from individuals who witnessed the fraudulent activity or have relevant information. These statements should be detailed and signed.

- Digital Evidence: Collect digital evidence such as screenshots and logs that can provide additional support for your report. Ensure this evidence is stored securely.

How to Report Fraud for Businesses

Businesses should have internal mechanisms for reporting fraud, such as notifying supervisors or compliance officers. These mechanisms should be well-publicized and easily accessible. There are certain strategies to ensure these mechanisms:

- Report the fraud to your immediate supervisor or the company’s compliance officer. Provide all collected evidence and a detailed account of the fraudulent activity. Compliance officers can initiate internal investigations and take appropriate actions.

- Utilize any internal hotlines or reporting systems available within your organization. These systems often allow for anonymous reporting. Anonymous reporting can encourage more employees to come forward without fear of retaliation.

- Consider external options for reporting fraud, such as regulatory bodies and law enforcement agencies. External reporting may be necessary if internal mechanisms are compromised or ineffective.

- Report the fraud to relevant regulatory bodies like the U.S. Securities and Exchange Commission (SEC) or the Financial Conduct Authority (FCA). These agencies have the authority to investigate and prosecute fraud cases. Regulatory bodies can impose sanctions, fines, and other penalties to deter fraudulent activities.

- Contact local or federal law enforcement agencies to report the fraud. Law enforcement can provide protection and take legal action against fraudsters. Engaging law enforcement ensures that criminal charges are pursued where applicable.

- Use third-party services that specialize in fraud reporting and investigation. These services can offer anonymity and professional expertise in handling fraud cases.

How to Report Fraud for Individuals

There are certain key points to report fraud for individuals:

- Reporting to financial institutions: Notify your bank or credit card company about the fraudulent activity. They can freeze accounts, reverse fraudulent transactions, and conduct their own investigations. Financial institutions have dedicated fraud departments that can assist in protecting your assets and restoring your financial integrity.

- Contacting consumer protection agencies: Report the fraud to consumer protection agencies like the Federal Trade Commission (FTC) or the Better Business Bureau (BBB). These agencies provide resources and support for fraud victims. Consumer protection agencies can offer advice, and mediation services, and take enforcement actions against fraudulent businesses.

- Reporting to local law enforcement: File a report with your local law enforcement agency. Law enforcement can help investigate the fraud and take legal action against perpetrators. Providing detailed information to law enforcement can expedite the investigation process and increase the likelihood of resolving the case.

- Using online fraud reporting platforms: Utilize online platforms designed for reporting fraud. These platforms often provide step-by-step guidance and the option to remain anonymous. Online reporting tools can streamline the reporting process and ensure that your case is directed to the appropriate authorities.

What Happens After You Report Fraud?

Each step of a fraud investigation is crucial in building a strong case. Investigations may involve multiple stages, such as:

- Initial assessment: The initial assessment involves evaluating the validity and seriousness of the report. This step determines whether the case warrants further investigation. Initial assessments may include preliminary interviews and a review of submitted evidence.

- Detailed investigation: A thorough investigation is conducted to gather more evidence and determine the extent of the fraud. This may involve interviews, audits, and forensic analysis. Detailed investigations are critical to uncovering the full scope of the fraud and identifying all involved parties.

- Possible outcomes: Possible outcomes include legal action against the perpetrators and recovery of lost funds. In some cases, preventive measures are implemented to avoid future fraud. Outcomes may also include disciplinary actions, policy changes, and restitution to victims.

- Your role during the investigation: Your cooperation is crucial during the investigation. Provide additional information and stay informed about the progress. Your involvement can significantly impact the outcome.

- Providing additional information: Be prepared to offer more details if requested by the investigators. Timely and accurate information can expedite the investigation process. Providing comprehensive information can help close any gaps in the evidence and support a robust case.

- Staying informed about the progress: Keep in touch with the investigating authorities to stay updated on the case. Regular updates can provide reassurance and help you prepare for any legal proceedings. Staying informed helps you understand the timeline and potential next steps in the investigation.

Tips for Effective Fraud Reporting

To ensure the efficiency of your fraud reports, consider the following:

- Be clear and concise in your report: Clearly describe the fraudulent activity and provide specific details. Avoid ambiguity and ensure your report is easy to understand.

- Provide as much detail as possible: Include all relevant information to strengthen your report. Detailed reports are more likely to be taken seriously and acted upon.

- Follow up on your report: Regularly follow up to ensure your report is being investigated. Persistence can demonstrate the seriousness of your report and keep the investigation on track.

- Keep records of all communications: Maintain a record of all communications related to your report. This includes emails, phone calls, and meetings. Detailed records can be useful if you need to reference past communications.

Sanction Scanner's Fraud Detection Tool

Sanction Scanner offers a robust fraud detection tool that helps businesses identify and report fraudulent activities. Its comprehensive features ensure that businesses can efficiently detect, report, and prevent fraud. The tool provides real-time monitoring, detailed reporting, and user-friendly interfaces, making it an essential resource for fraud prevention. By integrating Sanction Scanner into their operations, businesses can enhance their fraud detection capabilities, reduce risks, and maintain compliance with regulatory requirements.

To get one step ahead of fraudulent activities, contact us or request a demo today.