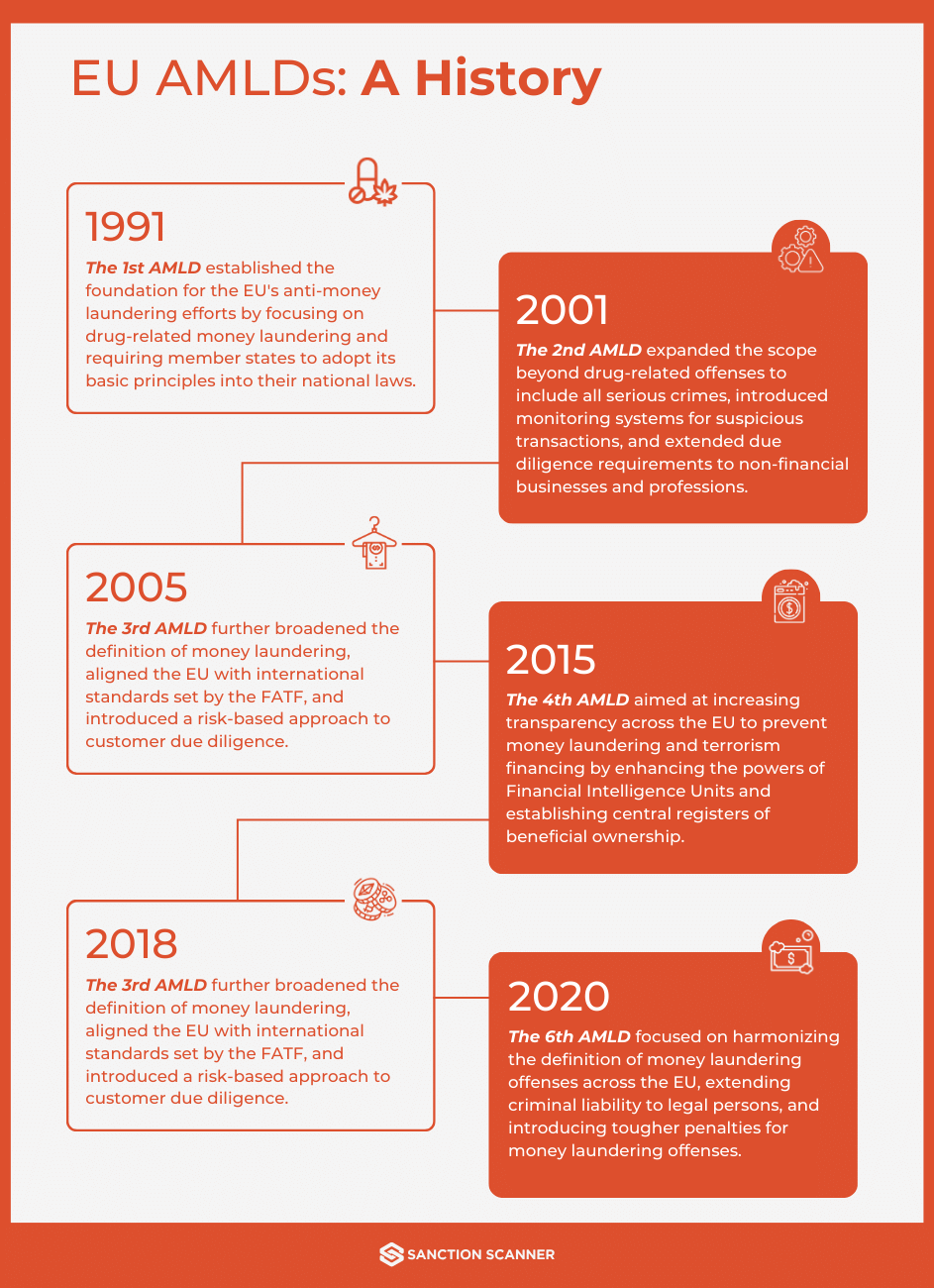

In a decisive move to fortify the European Union's arsenal against money laundering and terrorist financing, the Council of the EU adopted the Sixth Anti-Money Laundering (AML) Directive (6AMLD) in October 2018. The directive became effective starting on December 3, 2020, building upon the foundation laid by the Fourth Anti-Money Laundering Directive (4AMLD) and its subsequent amendments through the Fifth Anti-Money Laundering Directive (5AMLD), introduces a robust framework of criminal law provisions.

The Scope of 6AMLD

The proposed directive mandates EU member states to incorporate harmonized definitions of money laundering offenses, encompassing aiding, abetting, inciting, and attempted offenses, into their criminal legislation (Articles 3 and 4). With a focus on accountability, it sets a maximum imprisonment term of four years for persons involved in such offenses, complemented by potential additional sanctions (Article 5).

Furthermore, the 6AMLD places legal persons under the purview of criminal liability, subjecting them to fines and sanctions, including exclusion from public aid and judicial winding-up (Articles 7 and 8). The directive also addresses contemporary challenges posed by virtual currencies and outlines aggravating circumstances applicable to criminal organizations or offenses tied to specific professional activities (Article 6). Aiming for enhanced collaboration among EU member states, the directive establishes uniform provisions for investigative tools (Article 11) and jurisdiction determination rules (Article 10). EU member states are allotted 24 months from the publication in the Official Journal of the EU to transpose the directive into their national laws, signaling a unified effort to combat money laundering across the region.

Recent Amendments to 6AMLD

The 6AMLD introduced crucial amendments necessitating national transposition, matters related to national supervisors, and Financial Intelligence Units (FIUs) in member states, acknowledging the need for a tailored approach in certain provisions.

Parliament's endorsement of the Commission's plan to overhaul the AML/CFT legislative structure was showcased through a resolution on July 10, 2020, which has set the stage for comprehensive changes. The proposal, assigned to ECON and LIBE committees, led to a report published on May 23, 2022. The report advocates for more stringent requirements, emphasizing the verification of data and technological advancements and proposing amendments to enhance the functioning of FIUs.

The subsequent acceptance of the report by LIBE and ECON on June 2, 2022, highlights a pivotal step toward evolving AML/CFT regulations, with a particular emphasis on beneficial ownership registers and improved financial information exchange.

How 6AMLD Improves Upon Previous AML Directives for Robust Compliance

The 6AMLD was built upon the foundation laid by its predecessors. One key enhancement lies in the expanded definition of the money laundering offense, encompassing aiding, abetting, inciting, and attempted offenses. The 6AMLD does not merely broaden the definition; it also extends the scope of AML regulations to cover a more comprehensive range of entities and transactions.

Furthermore, the directive systemizes sanctions on both individuals and corporations, introducing a more consistent and stringent approach to penalizing those involved in money laundering activities. Clear penalties for money laundering offenses are established, creating a transparent and robust system to deter potential wrongdoers.

Additionally, the 6AMLD emphasizes the imperative of greater cooperation among EU member states, setting uniform provisions regarding investigative tools and jurisdiction determination. The directive also mandates the integration of technological procedures, reflecting a forward-looking approach to combating money laundering by leveraging advancements in data analytics and surveillance technologies.

Expanded the Definition of the Money Laundering Offense

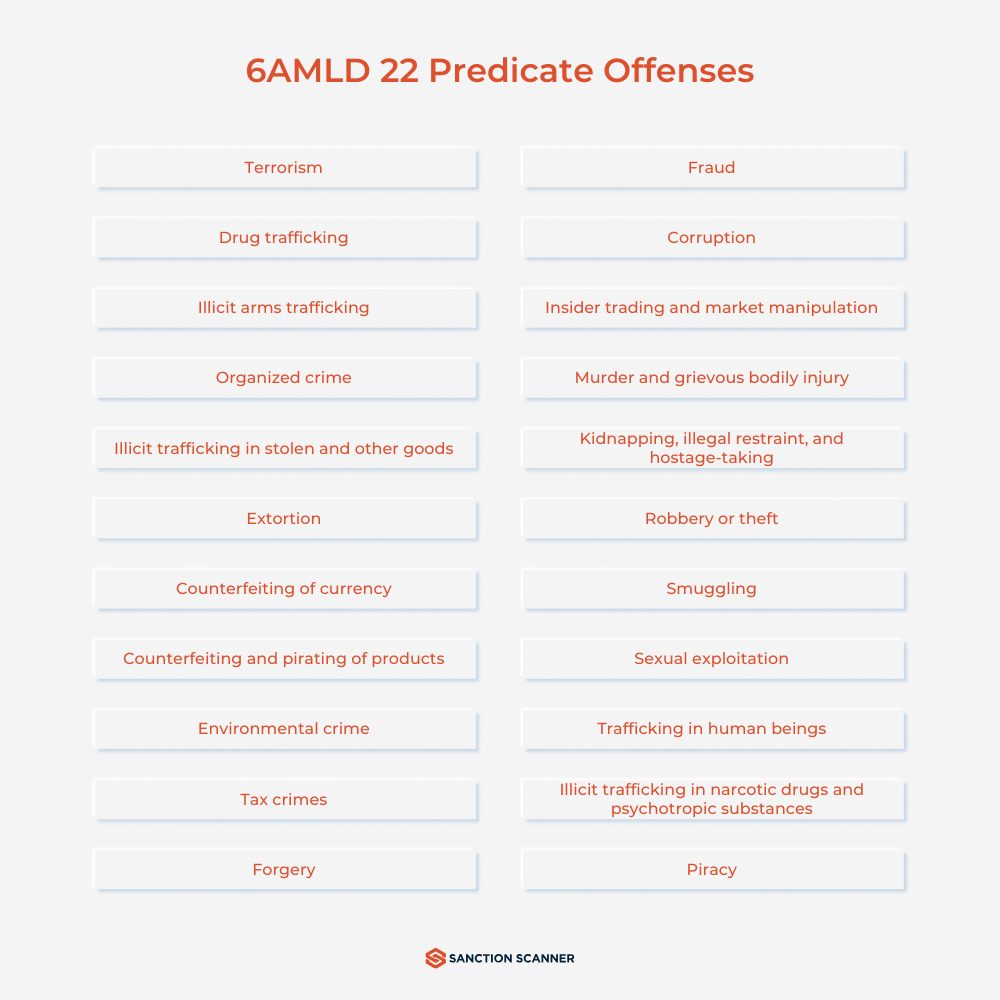

The directive identified 22 predicate offenses that can be associated with money laundering, offering a comprehensive list of criminal activities generating proceeds susceptible to laundering. These predicate offenses encompass a wide range of activities, including terrorism, drug trafficking, organized crime, corruption, cybercrime, and human trafficking, among others. The 6AMLD recognizes the interconnectedness of these offenses with money laundering, aiming to enhance the detection, prevention, and investigation of such illicit financial activities.

The importance of predicate offenses lies in their direct link to the money laundering cycle, where illegal proceeds from criminal activities are introduced into the financial system, subjected to layering to obscure their origin, and eventually reintegrated into the economy as seemingly legitimate funds. By identifying and addressing these predicate offenses, the 6AMLD disrupts the flow of illegal funds and strengthens efforts to trace and prevent money laundering activities associated with these criminal behaviors. The directive provides a foundation for financial institutions and authorities to focus their scrutiny on activities tied to these predicate offenses, reinforcing the EU's commitment to combatting money laundering effectively.

Extended the Scope of AML Regulations

The 6AMLD goes beyond mere enhancements by significantly extending the scope of AML regulations within the EU. The directive introduces stringent measures, such as restricting large cash payments beyond €10,000 and enhancing scrutiny on crypto transactions, making anonymity in crypto-asset transactions more challenging. Notably, the entire crypto sector falls under the purview of the new AML rules, compelling all crypto-asset service providers (CASPs) to conduct due diligence on their customers, especially for transactions of €1,000 or more.

The extended scope of AML regulations encompasses third-party financing intermediaries, individuals trading in precious metals, stones, and cultural goods, as well as jewelers, horologists, and goldsmiths. The directive also emphasizes transparency in beneficial ownership rules, clarifying that beneficial ownership is based on ownership and control, with specific guidance on multi-layered ownership structures. By harmonizing and clarifying these rules, the directive aims to facilitate the identification and verification of beneficial owners across different entities, including non-EU entities. The commitment to broader transparency extends to ensuring access to beneficial ownership registers for those with a legitimate interest, including journalists and civil society organizations dedicated to combating money laundering and terrorist financing.

Systemized Sanctions on Individuals and Corporations

One notable aspect of the directive is the imposition of targeted sanctions on obliged entities, including financial institutions and crypto-asset service providers. Enhanced due diligence (EDD) measures are mandated for cross-border correspondent relationships involving crypto-asset service providers, ensuring thorough scrutiny of transactions. Credit and financial institutions are required to undertake EDD when handling business relationships with high-net-worth individuals managing substantial assets, with the failure to do so considered an aggravating factor in the sanctioning regime.

The systematic integration of sanctions within the 6AMLD framework reflects a commitment to tightening regulatory controls and creating a robust restraint against money laundering and terrorist financing activities.

Clarified the Penalties for Money Laundering

The 6AMLD brought greater clarity to the penalties associated with money laundering within the EU, aiming to establish a more transparent and consistent approach to deter financial crimes. The directive strives to enhance the effectiveness of AML measures by ensuring that the penalties for money laundering offenses are well-defined and proportionate.

Under 6AMLD, the clarity in penalties extends to both individuals and corporations involved in money laundering activities. Stricter rules are introduced to harmonize and exhaustively define the sanctions applicable to offenders throughout the EU. This includes addressing large cash payments beyond €10,000, making it more difficult for criminals to launder illicit funds through smurfing techniques.

Ensured Greater Cooperation

The 6AMLD places a strong emphasis on ensuring greater cooperation among member states in the fight against money laundering and terrorist financing. The directive recognizes the transnational nature of financial crimes and the necessity of collaborative efforts to effectively combat illicit activities. By fostering enhanced cooperation, 6AMLD seeks to create a more unified and interconnected approach to addressing money laundering challenges across the EU.

To achieve this goal, 6AMLD introduces uniform provisions regarding investigative tools and rules for determining jurisdiction when offenses fall within the jurisdiction of more than one member state. This streamlined approach aims to facilitate seamless cooperation among EU member states in sharing information, conducting joint investigations, and addressing cross-border financial crimes. The directive underscores the importance of a coordinated response to money laundering, acknowledging that a collective effort is essential to staying ahead of evolving threats and ensuring the integrity of the EU's financial system.

Made Technological Procedures Mandatory

The 6AMLD underscores a forward-looking approach by making technological procedures mandatory to enhance the effectiveness of AML measures within the EU. The directive recognizes the transformative potential of technology in combating financial crimes and seeks to leverage advancements to strengthen regulatory compliance.

Regtech (regulatory technology) companies play a pivotal role in this technological shift. These firms specialize in developing solutions that use advanced technologies, such as artificial intelligence (AI), machine learning (ML), and data analytics, to automate regulatory compliance processes.

In the context of 6AMLD, regtech companies offer innovative tools to financial institutions and other obliged entities, enabling them to conduct more robust customer due diligence (CDD), monitor transactions for suspicious activities, and ensure compliance with the directive's provisions. The mandatory adoption of technological procedures represents a proactive step toward harnessing the potential of regtech solutions to improve the efficiency and accuracy of AML processes, reinforcing the EU's commitment to staying ahead of evolving financial threats.

Leveraging Sanction Scanner for 6AMLD Compliance

Sanction Scanner is a leading designer of cutting-edge AML compliance software, earning its well-deserved place among the prestigious Regtech100 companies. Renowned for its innovative solutions, Sanction Scanner empowers businesses to comply with AML regulations seamlessly, with a particular focus on compliance with the 6AMLD within the EU.

Sanction Scanner's suite of tools is strategically designed to address the stringent requirements of the 6AMLD. Leveraging advanced technologies such as AI and ML, the software provides robust CDD capabilities, ensuring thorough scrutiny of individuals and entities involved in financial transactions.

Moreover, its transaction monitoring tools enable businesses to effectively identify and flag suspicious activities, aligning with 6AMLD's mandate for enhanced scrutiny. To learn more about Sanction Scanner's commitment to act as a trusted partner for businesses striving for full AML compliance under 6AMLD and beyond, contact us or request a demo today.