Among all financial crimes, embezzlement sticks out as it requires some thing unique crimes don’t take delivery of as actual with. Unlike robbery or money laundering, where the perpetrator takes some thing they have been by no means alleged to get right of entry to, embezzlement entails a person who changed into legally depended on with cash or property and intentionally misuses it. According to us, this makes it sense even greater non-public and damaging, in particular for sufferers like small businesses or charities.

What is Embezzlement?

Embezzlement refers to the intentional misappropriation of money, funds, or property that has been entrusted to someone, often in a fiduciary or professional capacity. This is regularly seen in places of work or monetary roles in which people have ordinary get admission to to cash or assets however then exploit that get entry to for personal benefit.

How Does Embezzlement Work?

Embezzlement is not regularly a one-off act, it’s commonly a way concerning systematic manipulation and cover-up techniques.

Position of Trust: The individual is placed in a function in which they have got prison get right of entry to to business enterprise or purchaser belongings accountants, directors, or perhaps volunteers in small agencies.

Misappropriation: They take or misuse those property for themselves with the useful resource of the usage of shifting cash to their non-public money owed or using corporate property for private costs.

Concealment: To cowl their tracks embezzlers frequently clinical doctor records, create faux documents, or manipulate accounting systems. We assume this residue of deceit makes the crime even greater insidious.

Discovery: Eventually, someone notices discrepancies—both via audits, whistleblowers, or sincerely by way of catching purple flags. But through then, the harm would possibly already be large.

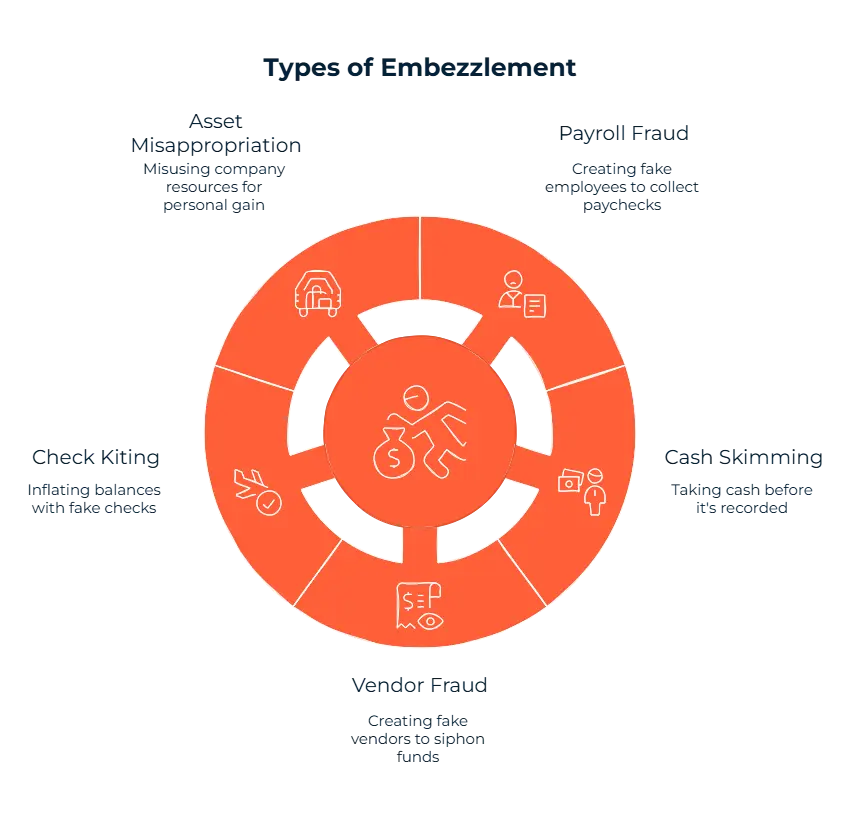

What Are the Types of Embezzlement?

1. Payroll Fraud

This takes place while personnel exercise the payroll machine to siphon off extra money.

Example: A supervisor creates faux employees ("ghost people") and collects their paychecks over months or years.

2. Cash Skimming

A sneaky however not unusual form taking cash in advance than it’s formally recorded.

Example: A cashier takes cash from a purchaser but does now not ring up the sale, maintaining the cash for themselves.

3. Vendor Fraud

Here, personnel may also create fake vendors or collaborate with real ones to siphon agency funds.

Example: An money owed group member sets up a shell company and problems fake payments to it.

4. Check Kiting

This entails shifting cash among financial institution money owed the usage of faux or insufficient exams to artificially inflate balances.

Example: Writing a take a look at from an empty account and depositing it into some other to temporarily cowl up robbery.

5. Asset Misappropriation

This can involve bodily gadgets or misuse of resources like credit cards or vehicles.

Example: An employee makes use of the company card to e book a private vacation however logs it as a commercial enterprise fee.

According to our view, these schemes aren't only criminal—they also replicate how inner manage failures open the door for long-term abuse.

What Are the Examples of Embezzlement?

• A nonprofit treasurer makes use of charity budget to finance costly holidays.

• An employee writes fake tests from a industrial corporation organisation enterprise account and deposits them in our opinion.

• A supervisor gives faux personnel to payroll and pockets the salaries.

According to us, what makes embezzlement especially dangerous is that it regularly flies underneath the radar for years, inflicting silent however great harm.

Difference Between Theft and Embezzlement

There are exact red lines between theft and embezzlement. We can categorize these in 4 topics.

| Feature | Embezzlement | Theft |

| Relationship | Involves a trusted role | No prior trust or access |

| Nature | Breach of trust | Direct and unauthorized taking |

| Settings | Often workplaces or official roles | Any environment |

| Method | Concealed, long-term deception | May be opportunistic and immediate |

Embezzlement vs Fraud: What’s the Difference?

Although both involve deception and monetary loss, embezzlement is a sort of fraud with unique characteristics.

| Feature | Embezzlement | Fraud |

| Trust Required | Yes | Not always |

| Access to Assets | Legal at first | Often obtained through deception |

| Examples | Employee misusing company funds | Insurance fraud, phishing scams, fake investments |

Embezzlement vs Money Laundering: Key Differences

| Aspect | Embezzlement | Money Laundering |

| Definition | Theft of funds by a trusted person | Hiding the origin of illicit money |

| Purpose | Personal gain from misused entrusted assets | Making dirty money appear legal |

| Source | Legitimate organizations or employers | Criminal activities (e.g. drugs, fraud) |

| Crime Type | Abuse of trust | Financial crime |

| Process | Direct appropriation | Placement → Layering → Integration |

| Complexity | Usually simple and direct | Often complex and multilayered |

| Traceability | Easier to trace | Designed to avoid detection |

Top 5 Largest Embezzlement Cases in History

| Case | Amount Stolen | Highlights |

| Rita Crundwell (Dixon, IL) | $53 million | Longest-running city fraud in U.S. history |

| Bernie Madoff | ~$65 billion | Massive Ponzi scheme, also involved embezzling client funds |

| Dennis Kozlowski (Tyco) | $600 million | Misused corporate funds for personal luxuries |

| KPMG Scandal | $457 million+ | Large-scale accounting scandal with embezzlement components |

These examples show how even depended on experts can manipulate structures for astronomical personal advantage.

Top Industries Most Vulnerable to Embezzlement

- Financial Services and Banking

- Healthcare and Medical Institutions

- Nonprofit and Charity Organizations

- Government and Public Sector

- Education Institutions

- Retail and Hospitality

- Legal and Accounting Companies

- Real Estate Sector

- Religious Institutions

What Are the Legal Consequences of Embezzlement?

| Factor | Consequences |

| Criminal Charges | Felony or misdemeanor depending on the scale and jurisdiction |

| Restitution | Courts may order the repayment of stolen funds |

| Fines | Can range from thousands to millions in penalties |

| Prison Time | Sentences can vary from a few months to decades |

In important cases, federal legal guidelines may also observe, in particular if financial institution fraud, tax evasion, or wire fraud is concerned.

Red Flags of Possible Workplace Embezzlement

- Gaps or inconsistencies in monetary records.

- Employees abruptly showing wealth without rationalization.

- Refusal to delegate monetary obligations or proportion get entry to.

- Some activities are same as in the white collar crime.

- Missing invoices or altered monetary documentation.

- Customer or seller court cases about abnormal bills.

We think agencies that ignore those signs and symptoms regularly come to be discovering the crime a ways too overdue.

How to Prevent Workplace Embezzlement? How May Sanction Scanner Help Your Business?

Regular Audits: Independent audits help catch irregularities early and sell a culture of economic transparency. This will help possible money laundering acts.

KYC Check: Should be put in place in order to control all individuals in the company & system.

Seperation of Duties: Split monetary roles in order that no person character controls all steps in a transaction.

Mandatory Vacations: Requiring personnel to take leave disrupts long-walking schemes and allows others to review their paintings.

Hiring Practices: Screening applicants, especially for economic positions, reduces the hazard of bringing in people with a shady records.

Advanced Monitoring Tools: Use monitoring software that tracks and flags suspicious transactions in actual time will act as anti-money laundering service. In our opinion, era is one of the maximum underused tools in fraud prevention—automated signals can capture what human eyes leave out.

Embezzlement is extra than only a financial crime—it’s a breach of accept as true with which could erode the rules of an organization. While it often begins with possibility and temptation, it’s the lack of preventive measures that we could it flourish. According to our experts, focus, transparency, and the braveness to analyze red flags are key to safeguarding your industrial corporation or group from this silent predator.

FAQ's Blog Post

Yes, in many cases. The scale and method of the crime often determine whether it’s classified as a felony or misdemeanor.

Nonprofits, healthcare, and small agencies are particularly inclined due to confined oversight or negative inner controls. In our view, any organization without strong assessments is a capacity target.

Embezzlement is often identified through irregularities in financial records, missing funds, unauthorized transactions, or audit discrepancies. Red flags like lifestyle changes, altered documents, or lack of oversight can also prompt internal investigations or external audits.

Yes, embezzlement is a criminal offense that can lead to jail or prison time. The severity of the punishment depends on the amount stolen and local laws. In many countries, small-scale embezzlement may result in up to one year in jail.

Embezzling is the act of dishonestly taking money or property that you were trusted to manage or control, typically in a job or official position. It’s a form of financial fraud.

Embezzlement is the theft of funds by someone trusted to manage them, while corruption involves abusing power for personal gain — including bribery, favoritism, or embezzlement itself.