Anti-Money Laundering (AML) and Know Your Customer (KYC) practices have become increasingly important for insurance companies due to the increasing financial crime risks in the insurance sector. For example, a former Allianz fund manager pleaded guilty over a meltdown that caused an estimated $7 billion of investor losses last year. According to Reuters, he faced up to 10 years in prison and agreed to give up $17.5 million, including the bonuses that were inflated by his fraud.

In order to avoid cases like this, one must give the utmost importance to verifying identities, detecting and reporting suspicious activities. So, let’s delve deeper into the details of AML and KYC for Insurance Companies and what you can do about it.

What Are AML and KYC Regulations in the Insurance Industry?

Some of the most prominent regulations are FATF (Financial Action Task Force) recommendations, the EU’s 6AMLD, the U.S. Bank Secrecy Act and Singapore’s MAS. In these directives, it is possible to see the role of insurers, reinsurers and brokers. These regulations mainly impose Customer Due Diligence (CDD), Suspicious Activity Reporting (SAR), PEP and Sanctions Screening and ongoing monitoring.

Why Is AML Compliance Important for Insurance Companies?

Some insurance products such as life insurance, annuities and investment-linked ones, can attract criminals a lot. If these fraudsters succeed, the concerned company can face severe repercussions which include heavy fines, damage to brand reputation, loss of customer trust or even the revocation of its license.

Which Insurance Products Are Most Vulnerable to Money Laundering?

We have already mentioned some insurance products that attract fraudsters and now, we are going to add a few more. Life insurance, Unit-Linked Insurance Plans, Single-Premium Annuities, Early Surrender Policies and Cross-Border Contracts are some of the most vulnerable ones. However, life insurances and ULIPs are the most risky ones because these may allow large and opaque fund movements.

What Are the Key AML/KYC Obligations for Insurance Firms?

In fact, they don’t differ a lot from other financial institutions. First, you must conduct Customer Due Diligence during onboarding and Enhanced Due Diligence for high-risk customers to know who you are dealing with. We will detail these in the next section if you are unfamiliar with these. If a suspicious case arises, you must immediately file a SAR/STR. Last but not least, you should keep the relevant documentation for future audits and trials.

How Does Customer Due Diligence (CDD) Work in Insurance?

In insurance, CDD doesn’t work much differently than the other sectors. First, you must collect the customer’s official documents such as passport, ID and utility bills. This is done to ensure whether the identity matches or not. Then, assess the source of funds and wealth of the customer to see if there is any risk of money laundering. After you collect these details, you must assign them correct risk levels based on several metrics such as type of product, jurisdiction, transaction patterns and their profile. Now that all of these are over, you must continuously monitor their actions and reassess their risk scores if necessary.

What Is Enhanced Due Diligence (EDD) for High-Risk Insurance Clients?

Now, let’s see what you should do if a customer turns out to be high-risk. These high-risk categories often consist of Politically Exposed Persons (PEPs), offshore clients and Complex Ownership Structures or Ultimate Beneficial Owners (UBOs). For these clients, you must require more detailed information, such as their proof of income, source of wealth, details of their business ownership or corporate structure. When you finish the previous step, you must get senior management approval because policy acceptance often requires sign-off from senior management or compliance officers. After you have handled all of these, you must conduct continuous monitoring for regular updates.

How Should Insurance Companies Monitor Transactions?

Setting a rule-based alert system can go a long way in securing your business because these can generate alerts in real-time for immediate review. There are red flags that may arise as well, such as early surrender of policies, multiple high-value policies and third-party payments. We will detail these even more in the next section.

What Are Common Red Flags in Insurance-Related Money Laundering?

Let’s start with overfunded policy. If the premiums exceed what you think is reasonable based on your customer’s income, then this may indicate a major red flag. Moreover, if you notice sudden or multiple changes in policy beneficiaries, this may indicate an attempt to obscure ownership. In addition to this, pay attention to offshore policyholders. Offshore customers are often linked with being high-risk, since they may be coming from high-risk jurisdictions or secrecy jurisdictions. Lastly we must mention ghost premiums, which means a client paying through third parties or unusual channels and having no clear economic rationale.

How Does KYC Differ in Insurance Compared to Banking?

Let’s start with the differences in their focus. Insurance often deals with policyholders and beneficiaries; while in banking, the focus shifts to account holders, signatories and transaction parties. Also, the frequency of the updates in insurance is much lower compared to the banking sector. We must also mention that the banking sector’s responsibility in monitoring is much higher.

Who Regulates AML/KYC Compliance in the Insurance Sector?

There are several regional regulators in the insurance sector. It would take too much space if we wanted to list them all. So, let’s give a few noteworthy examples. In the U.S., FinCEN and NAIC are the key organizations when it comes to insurance sector. In Europe, there are two that we cannot possibly overlook: EIOPA and FIUs. In the U.K., we again see two regulators: FCA and PRA. The list goes on with MAS in Singapore, AUSTRAC in Australia, FINTRAC in Canada…

What Happens If Insurance Companies Fail to Comply?

Unfortunately, there isn’t a single repercussion, which makes it harder for insurance companies to recover from them. As you may be expecting, investigations/audits and hefty fines that come with these are some of the notable repercussions. Moreover, there is a high chance of reputation loss as well, which can indirectly result in economic loss.

Let’s give a example to better illustrate the importance of compliance in the insurance sector. According to Reuters, Singapore’s central bank imposed fines collectively worth $2.83 million on lenders Citibank, DBS and OCBC and insurer Swiss Life. This was due to breaching requirements on anti-money laundering and countering terrorism financing.

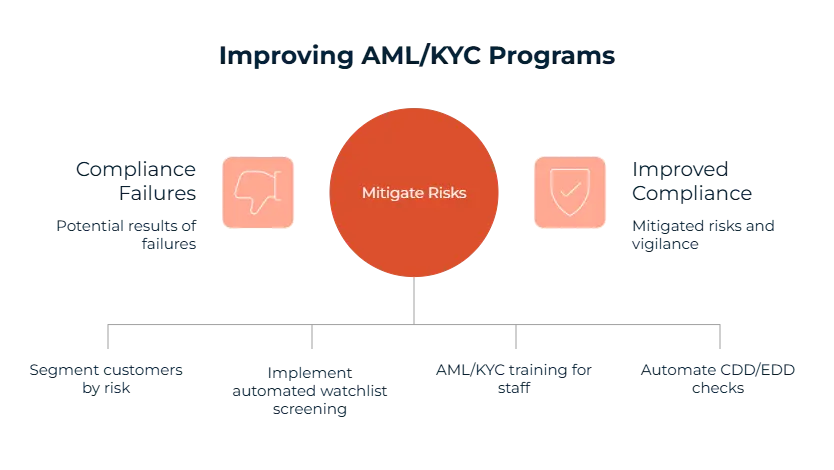

How Can Insurance Companies Improve Their AML/KYC Programs?

Now, you may have decided to double down on improving your AML/KYC program after having seen the potential results of compliance failures. Luckily, there are several things you can do to mitigate these risks.

First, you must adopt a risk-based approach. Customers segmented by their risk level is a good way to allocate your resources and time. Furthermore, you are probably now aware of how important it is to stay vigilant throughout your relationship with the customer. Thus, implementing automated watchlist screening against global sanctions and PEP databases could serve you well. With these real-time updates, systems can detect new high-risk individuals/entities and flag suspicious activity immediately.

Tools can facilitate your compliance processes to a certain extent, however you must not neglect the role of manpower for a fool-proof solution. This is why we strongly recommend regular AML/KYC training for all staff involved in policy sales, underwriting and compliance. Lastly, having a particular workflow automation can be extremely useful. This consists of automated CDD/EDD checks, alert generation and escalation processes; audit trails for regulators and internal review; and integrating AML/KYC systems with policy administration platforms.

What Is the Role of Technology in AML Compliance for Insurers?

There are numerous technologic tools for AML compliance that could come in handy for insurers. Let’s start with one of the most crucial tools for insurers: Real-time screening. These automated tools can instantly screen your policyholders, beneficiaries and transactions against sanctions, PEP, and adverse media lists. This way, you can reduce your manual workload and avoid delays.

In the recent years, the role of AI and ML has been becoming increasingly crucial for AML compliance, and the insurance sector is no exception. Machine learning models are better at identifying suspicious transaction patterns than rule-based systems. These models can detect red flags like early surrenders, ghost premiums or offshore payment routing. Another tool that you can take advantage of is end-to-end case tracking. These case management platforms allow insurers to log alerts, investigations and SAR filings in a single system, which also creates a complete audit trail. Lastly, we must mention the compliance dashboards. These provide a real-time overview of compliance health, such as alerts, high-risk clients, open investigations etc.

What Are the AML/KYC Requirements for Insurance Intermediaries and Brokers?

The most important requirement is undoubtedly the KYC. Since it is done before onboarding, it can help you avoid many issues down the road. So, you should verify customer identities of policyholders, beneficiaries and premium payers before selling or intermediating any policy. This requirement is followed by Suspicious Activity Reporting (SAR). You, as a intermediary, have a legal duty to monitor transactions and raise alerts. If a red flag appears, then you must immediately file SARs to relevant regulators and Financial Intelligence Units. Last but not least, insurance brokers are independently liable for AML/KYC breaches, which means regulators can impose fines, license suspension or criminal charges. So, this makes it a shared responsibility for both the insurer and the broker.

How Do Reinsurance and Cross-Border Insurance Impact AML Risks?

Let’s start with reinsurance. Since it often involves multiple layers of insurers and reinsurers, you will likely to have harder time identifying the ultimate beneficial owner (UBO) of funds. This opens the door for criminals, since its complexity can hide the true source of premiums or payouts. About cross-border insurance, there is a high likelihood that these will require compliance with different AML laws and sanctions regimes. This can create challenges in standardizing screening and monitoring because of the gaps between national regulations.

How Is KYC Performed for Beneficiaries in Life Insurance?

There are three main steps when it comes to KYC for Beneficiaries. First, you must apply KYC to beneficiaries when they claim benefits, in which you must require official ID, proof of address and relationship to the insured. After this step is over, AML/KYC teams must assess the beneficiary’s risk profile. This becomes even more important if they are a PEP, a foreign national from a high-risk jurisdiction and linked to adverse media or sanctions lists. After AML/KYC team’s check, if the KYC turns out to be incomplete or suspicious you can delay payout, file a SAR or escalate to compliance or regulators.

How Often Should KYC Be Updated for Insurance Customers?

In fact, the frequency depends on a lot of things. However, the risk-based review cycle is one of the most common ones you can encounter. For example, it may be 5 years for low-risk customers while yearly or trigger event for high-risk ones. Apart from these fixed cycles, KYC should be a process that must be refreshed when red-flags occur.

Best Practices in Insurance AML Compliance (2025)

It is true that you will need a lot of tools for the compliance and having all of these tools scattered around can be very inefficient. Thus, using a centralized AML Suite that consolidates KYC, transaction monitoring, sanctions screening and SAR filing into one platform can reduce duplication, ensure consistency and simplify audit reporting.

Another way that you can make things easier is connecting AML systems with policy administration platforms. This way, you can enable real-time monitoring of premiums, payouts and policy changes, thus facilitating risk scoring per policy or customer. Also, the real-time alerts can automatically flag suspicious activity such as early surrenders, overfunded policies and third-party premium payments in order to allow immediate investigation and escalation. While doing all of these, do not forget to check if you are properly complying with FATF standards and regional laws like 6AMLD.

How Sanction Scanner Supports Insurance Companies

Everything we’ve talked about may seem overwhelming, but there’s no need to worry. Here at Sanction Scanner, we help with name screening against more than 3,000 PEP lists and Sanctions, transaction monitoring, adverse media, audit trails, and easy-to-integrate compliance tools with your existing systems. You can contact us to find out more about what we offer.

FAQ's Blog Post

Insurance companies handle large sums and are vulnerable to money laundering, especially through life and investment-linked products.

Insurers must verify customer identity, assess source of funds, and screen against PEP and sanctions lists.

Life insurance, single premium policies, and investment-linked products are considered high-risk for laundering activities.

Insurers use transaction monitoring tools and red flag indicators to spot abnormal payments, claims, or early policy surrenders.

AML/CFT laws like FATF recommendations, EU AMLD, and local financial authority rules apply to insurers globally.

Insurers risk regulatory fines, license suspension, and reputational harm if they fail to comply with AML rules.

Sanction Scanner helps insurers verify customers, monitor transactions, and comply with KYC and reporting requirements.