In this blog post, we’ll talk about the crypto environment in Nigeria, regulations as of 2025, and many more details concerning firms operating or looking to operate in Nigeria.

Is Cryptocurrency Legal in Nigeria?

As of 2025, cryptocurrency isn’t illegal in Nigeria. Let’s clarify this statement. While not illegal, crypto is also not recognised as legal tender; so, it can’t be used instead of the Nigerian naira for official payments. But crypto is still used for peer-to-peer (P2P) trading and investment reasons. Nigeria ranked first globally in P2P crypto transaction volume. The CBN ban of 2021 shaped today’s environment immensely. In 2021, Nigerian banks were prohibited from allowing crypto transactions. Afterwards, in 2023, the restrictions were updated in a way that softened the pressure on banks. Banks were now allowed to provide accounts that are licensed to Virtual Asset Service Providers (VASPs). According to the local news, in March 2025, President Bola Ahmed Tinubu signed into law the Investments and Securities Act (ISA) 2025, officially recognising digital assets including cryptocurrencies as securities under Nigerian legislation. This is the latest update regarding bans Sanction Scanner experts can give our readers.

Cryptocurrency Regulations in Nigeria (2025)

The first regulatory body we’ll give details about is the Central Bank of Nigeria (CBN). This regulator is tasked with creating and maintaining monetary policies and banking regulations. It is also overseeing crypto activities to make sure it’s the same with Nigeria’s financial stability goals. The Securities and Exchange Commission (SEC) is our second regulatory body. They are overseeing securities exchanges, securities brokers and dealers, investment advisors, and mutual funds. The Nigerian Financial Intelligence Unit (NFIU) is there to watch over companies, making sure anti-money laundering (AML) and counter terrorism financing (CFT) compliance is reached.

What are the Key Rules?

Well, what regulations and rules do these regulatory bodies use when overseeing firms in Nigeria? The first is the requirement of registering with the Securities and Exchange Commission (SEC). This was put in place in 2022 so make sure companies are operating with the recognition of a legal body. Another rule to follow is about licensing. If you’re a VASP, your company should first acquire the needed licenses to operate; and keep up with the strict regulations set to reach AML and CFT compliance. One other rule to note is reporting every crypto transaction that is above ₦5 million for individuals or ₦10 million for companies. The process is completed using goAML and used to prevent illegal activities.

How are the Adoption Trends and Usage

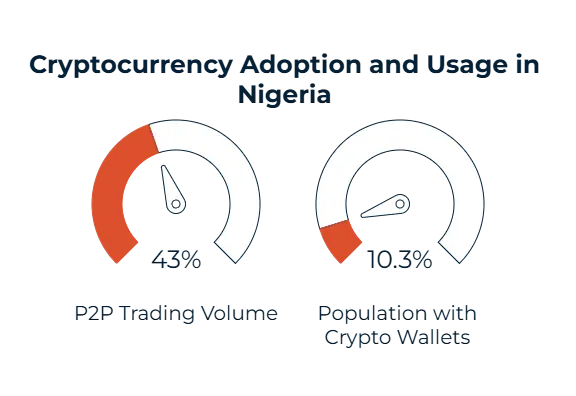

Despite the blurry lines drawn by Nigeria, cryptocurrency popularity continues to rise. Chainalysis reports Nigeria as one of the top three internationally for P2P trading volume, accounting for 43% of Sub-Saharan Africa total crypto transaction volume. More than 22 million users, equivalent to 10.3% of the population, are now involved with wallets. Our Sanction Scanner experts share that the crypto acceptence is higher within the younger generations, with wallet usage consisting mainly of 18 to 35 year old individuals. The most popular tokens in Nigeria are USDT, BTC, ETH, and BNB. There are several reasons for crypto adoption in Nigeria more than ever before. High inflation, limitations in traditional banking services and lack of trust, and the need for international remittances lead the list of reasons for the popularity.

Impact of Cryptocurrency on Banking in Nigeria

Nigeria processed approximately $59 billion in crypto transaction value. The sector is having its effects on industries like banking, and with crypto’s rising popularity, rightfully so. Support from banks is now being offered to licensed VASPs, the integration has started with the aim for a marriage of traditional finance and digital assets. The fintech sector is also benefitting from the rising popularity of crypto. Mobile banking platforms in Nigeria are now adopting crypto-friendly features to attract the mainly younger users. Transfers are also being done with crypto now that Nigerians are trusting this option as it is efficient and not costly for international payments. Our Sanction Scanner experts report that approximately 85% of Nigeria's crypto transactions are valued under $1 million, indicating a strong presence of retail and professional-sized transfers.

AML/KYC Compliance for Crypto Platforms

Crypto firms in Nigeria have to abide by strict AML/KYC regulations set forth by the country. Identity verification is done with Bank Verification Numbers (BVNs), National Identification Numbers (NINs) and facial recognition software to be extra sure of the details’ accurateness. Transaction monitoring, tracking of suspicious activities and reporting when needed, screening against sanctions people like PEPs is required for these companies. The SEC and NFIU requires regular reporting to create a safe environment for companies, regulatory bodies, and customers.

Central Bank Digital Currency (eNaira) vs Cryptocurrencies

Let’s talk more about the eNaira, Nigeria’s central bank digital currency. The eNaira is the legal tender in Nigeria which explains why cryptocurrency is not. According to sources of Reuters, Nigeria has filed a lawsuit seeking to compel Binance to pay $79.5 billion for economic losses it says were caused by its operations in the country and $2 billion in back taxes. The eNaira is fully centralised under the CBN and KYC is mandated for all, unlike cryptocurrency which is decentralised and its KYC requirement varies at different circumstances. Domestic transfers and government payments is mostly what the eNaira is used for; cryptocurrency is still the lead for remittances, savings, and trading purposes. Since cryptocurrency is older and more well-known, eNaira is unable to quite reach its popularity within Nigeria.

Nigeria's Role in the Global Crypto Ecosystem

We’ve talked about the nature of cryptocurrency in Nigeria, but what are the updates our readers might need about how Nigeria is affecting the overall global crypto system? The startups of Nigeria are tasked with leading the local innovation with companies like Bundle, Patricia, and Busha given as examples. Blockchain technology isn’t just for finance, areas like ID systems, voting, and supply chains benefit from implementing blockchain solutions. Web3 is there to decentralise data ownership on the internet, and Lagos is emerging in Nigeria in this area. Lagos acts as a development hub for new talents.

FAQ's Blog Post

Cryptocurrency is legal in Nigeria, but regulated under strict CBN and SEC guidelines.

The Central Bank of Nigeria (CBN) and the Securities and Exchange Commission (SEC) oversee crypto-related activities.

Crypto exchanges must register with the SEC and follow AML/CFT regulations to operate legally.

Nigeria is actively developing a licensing framework for VASPs and strengthening AML supervision.

Nigeria is working to implement FATF Travel Rule obligations for crypto transfers and exchanges.

Crypto gains are subject to capital gains tax under current Nigerian tax guidelines.

Sanction Scanner supports Nigerian crypto firms with real-time screening, risk scoring, and full AML/KYC compliance tools.