Buy Now, Pay Later (BNPL) is an innovative financing solution which emerged in the global financial landscape and change the consumer’s approach to their purchasing decisions. Since BNPL offers individuals an opportunity to acquire products whenever they want to and defers payment through installments, its adoption is considerably rapid with consumer-friendly features and interest-fee payments in a variety of different sectors from e-commerce to fashion.

What Is Buy Now, Pay Later (BNPL)?

We can define BNPL as an installment based payment plan which offers consumers to make partial payments over a certain period instead of paying the full cost upfront. Commonly offered by fintech companies like Klarna, Afterpay, Affirm and Sezzle, BNPL is often interest free if payments are made within the agreed terms.

Retailers mainly use BNPL to encourage sales by reducing the immediate financial burden of the customers which can thereby increase conversion rates and average order values. Many industries like fashion, home hoods and travel is rapidly integrating BNPL into their checkout processes due to customers who enticed by the opportunity to spread their payments out over time.

How Does BNPL Work?

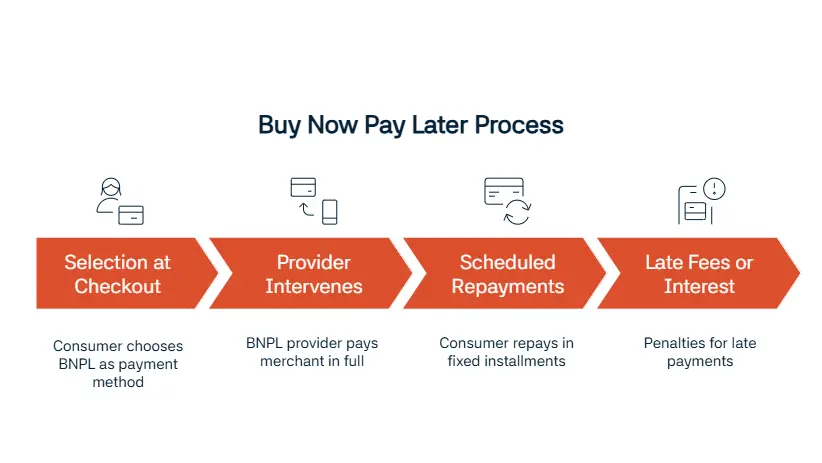

Involving multiple stakeholders and operating through the automation of transactions, here is how BNPL works:

1. Selection at Checkout

Consumers select BNPL as their preferred payment method while shopping online or in store. A shopper who buys a $200 electronic device can choose to divide their payments into four bi-weekly payments, each costing $50.

2. Provider Intervenes

After customers complete the purchase, a BNPL provider such as Klarna or Afterpay pays the full cost directly to the merchant of the item. Since the retailer receives immediate payment of the product, the risk of consumer default is eliminated.

3. Scheduled Repayments

The customer agrees to repay the amount through fixed installments often bi-weekly or monthly if it is also aligned with the provider’s schedule.

4. Late Fees or Interest

The BNPL may penalize the customers or charge interest if they fail to make their payments on time. Even though the terms can be different depending on the provider or jurisdiction, they are important for compliance and financial responsibility. BNPL reduces purchasing problems and speed up the revenue streams for merchants by simplifying payments.

Benefits of BNPL for Consumers and Merchants

BNPL has gained popularity in the global finance area because of its many advantages both for consumers and businesses. Here are its key benefits:

For Consumers:

Immediate Access to Products

Buy Now, Pay Later (BNPL) enables customers to acquire products immediately without paying the full amount upfront, makes higher priced items more accessible and rules out the need to wait until payday, giving a sense of financial flexibility to the consumers.

Interest-Free Payment Models

Many BNPL platforms offer interest free payment options provided that the payments are made on time. This enables consumers to spread out their purchases without any additional fees or interest.

Simplicity of Use

BNPL is a smooth payment method that is integrated into online and in-store shopping experiences with quick approvals and intuitive interfaces. Consumers can choose BNPL at the checkout without having to deal with complicated forms or delays.

For Merchants:

Enhanced Conversion Rates

BNPL options reduce the financial hesitations of the customers at checkouts by breaking payments into timely installments and help merchants to improve their sales with fewer abandoned cards and higher completed transactions.

Higher Average Order Value (AOV)

Higher average order values (AOV) for businesses can also be achieved since customers tend to spend more when they know they can break spread out the payments and therefore feel more comfortable choosing more pricey or extra products.

Customer Retention

BNPL offers flexible payment options and thus builds trust and loyalty among clients by making it easier for them to afford what they need, fostering better relationships and ultimately leads to long-term customer satisfaction. In our opinion, flexibility is an important factor that can distinguish a business from others in a competitive marketplace.

Buy Now, Pay Later Provider Comparison Table (2025)

Buy Now, Pay Later (BNPL) has become increasingly important in the modern purchasing experience that offers flexible payment options and boost conversions for the merchants. This table shows a detailed comparison of the BNPL platforms in 2025, their fees, credit checks and regions served.

| Provider | Regions Served | Installment Structure | Interest / Fees (for consumers) | Credit Check? | Merchant Fee Range | Integrated With |

| Klarna | Europe, US, Australia | Pay in 4, Pay Later (30 days), Financing (6–36 mo) | 0% if on time; interest on long-term financing | Soft credit check (Pay in 4); hard for financing | 2.9% – 5.9% +fixed fee | Shopify, WooCommerc e, Stripe, Wix, Magento |

| Afterpay | US, Australia, UK, NZ, Canada | 4 bi-weekly payments (6 weeks) | 0% if paid on time; late fees apply | Soft check; no impact | 4% – 6% | Shopify, BigCommerce, Squarespace, Adyen |

| Affirm | US, Canada, (expanding) | Monthly financing (3–36 months); Pay in 4 | Interest (0%–36% APR) or 0% promo options | Hard credit check (over $150) 2%– | 2% – 5.99% | Amazon, Walmart, Peloton, BigCommerce |

| Clearpay | UK (Afterpay brand) | 4 bi-weekly payments | 0% interest; late fees capped | Soft check only | 4% – 6% | Same as Afterpay |

| Sezzle | US, Canada, India | 4 payments over 6 weeks | 0% interest; reschedule fees possible | Soft check (no impact) | 3.5% – 6% | Shopify, WooCommerce, Magento |

| Zip | US, Australia, UK | Weekly or bi-weekly; custom plans | Flat $4–$6 monthly fee or interest on plans | Soft check; credit reporting in some cases | 2% – 4% | Shopify, Salesforce, Wix, major retailers |

| PayPal Pay Later | Global (select markets) | Pay in 4 (6 weeks); monthly financing | 0% for Pay in 4; APR up to 29.99% on credit | Soft check for Pay in 4; hard for PayPal Credit | 1.9% – 3.5% + $0.49 | Universal PayPal integrations |

Risks and Challenges Associated with BNPL

Besides having many advantages, BNPL also has risks and understanding them is essential for consumers, retailers and policymakers.

For Consumers

Overspending Risks

As BNPL services makes purchases more affordable, it may encourage impulsive buying and customers may experience financial strain they do not tack and manage their payments responsibly. It is always possible that a convenient payment option can spiral into debt if these small and manageable payments quickly add up.

Potential Late Fees

Missing the payment deadlines can result in late penalties and interest charges that accumulate rapidly and make the overall expense higher than the original price of the product.

Impact on Credit Score

Some BNPL platforms may report your payment activity to credit agencies which can affect your credit score negatively if there are any late or missed payments that potentially harm the credit rating.

For Merchants

Commissions to Providers

Businesses have to pay a commission to the BNPL providers which can range from 2% to 8% of the transaction value and wear out tight profit margins of small businesses. Thus, merchants must weigh benefits against the costs while offering BNPL options to the customers.

Regulatory Changes

Governments are now implementing strict regulations worldwide for BNPL services as they may face new requirements, administrative tasks or changes to the service structures which can impact the cost-effectiveness and viability of BNPL for some retailers and consumers.

How to Use BNPL Responsibly?

Consumers should adopt the following practice to fully benefit from BNPL offerings:

Budgeting Is Key

You should take a look at your budget and plan ahead to make sure that you can easily afford the repayments before committing to a BNPL purchase to avoid overspending and financial stress.

Read the Fine Print

It is really important to read and understand the terms and conditions of a BNPL purchase like fees, interest rates and repayment schedules to avoid unexpected costs and make informed decisions about your payments.

Track Payments

To be on top your financial responsibilities, you should keep track of your BNPL payments with reminders or automated payments since missing due dates can result in harsh penalties and affect your credit score. Staying organized is the key here to avoid unnecessary stress and money loss.

FAQ's Blog Post

BNPL is a payment method that allows consumers to split purchases into interest-free installments. It’s commonly used for online shopping.

You choose BNPL at checkout, get approved instantly, and pay in scheduled installments. Most providers don’t charge interest if paid on time.

Yes, most BNPL services offer interest-free plans. Late payments may incur fees or interest depending on the provider.

It can if the provider reports to credit bureaus. Missed payments may negatively impact your credit score.

Anyone over 18 with a valid ID and payment method can apply. Approval is subject to eligibility checks.

Missed payments can lead to fees, interest, and debt accumulation. It may encourage overspending for some users.

Regulation varies by country. Many regulators are introducing stricter rules to protect consumers.

Popular BNPL providers include Klarna, Afterpay, Affirm, and PayPal. Many retailers also partner directly with these services.