AI-Powered KYB: A New Era of Business Verification

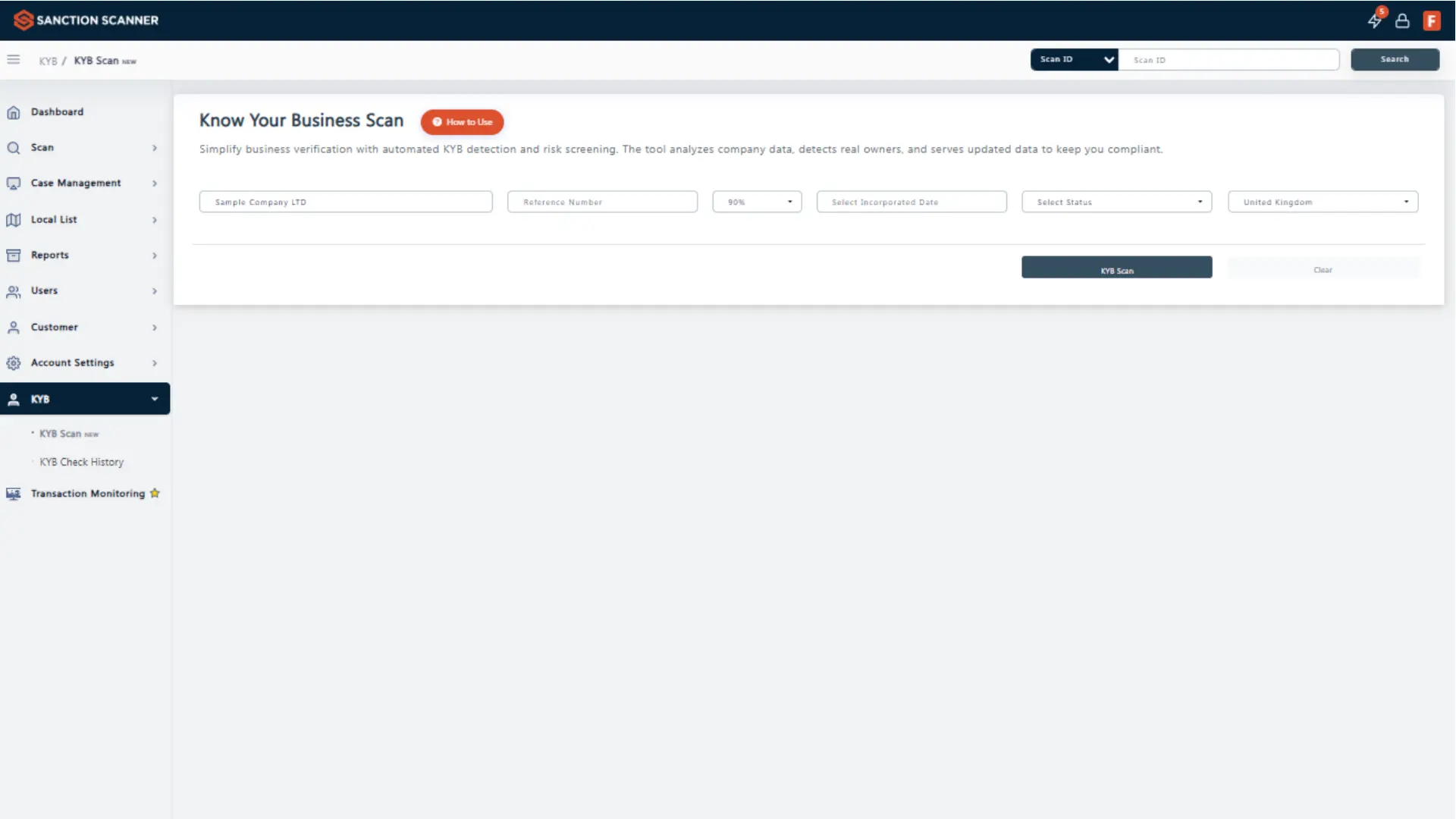

At Sanction Scanner, we’ve reimagined Know Your Business (KYB) processes to meet today’s growing regulatory demands and operational pressures. Our newly launched AI-powered KYB module introduces automation and explainability to one of the most time-consuming areas of compliance: verifying corporate entities and uncovering hidden ownership.

Why We Built It?

Nearly 70% of large-scale money laundering schemes involve legal entities as intermediaries (FATF), and 45% of shell companies in corruption cases intentionally mask their UBOs (Transparency International, 2024). Traditional KYB methods—spread across multiple tools and manual reviews—no longer meet the speed, accuracy, or auditability requirements of modern compliance.

Our KYB module changes that by using AI to streamline workflows, surface risk, and document decisions—at scale.

Key AI Features That Power the New KYB Experience

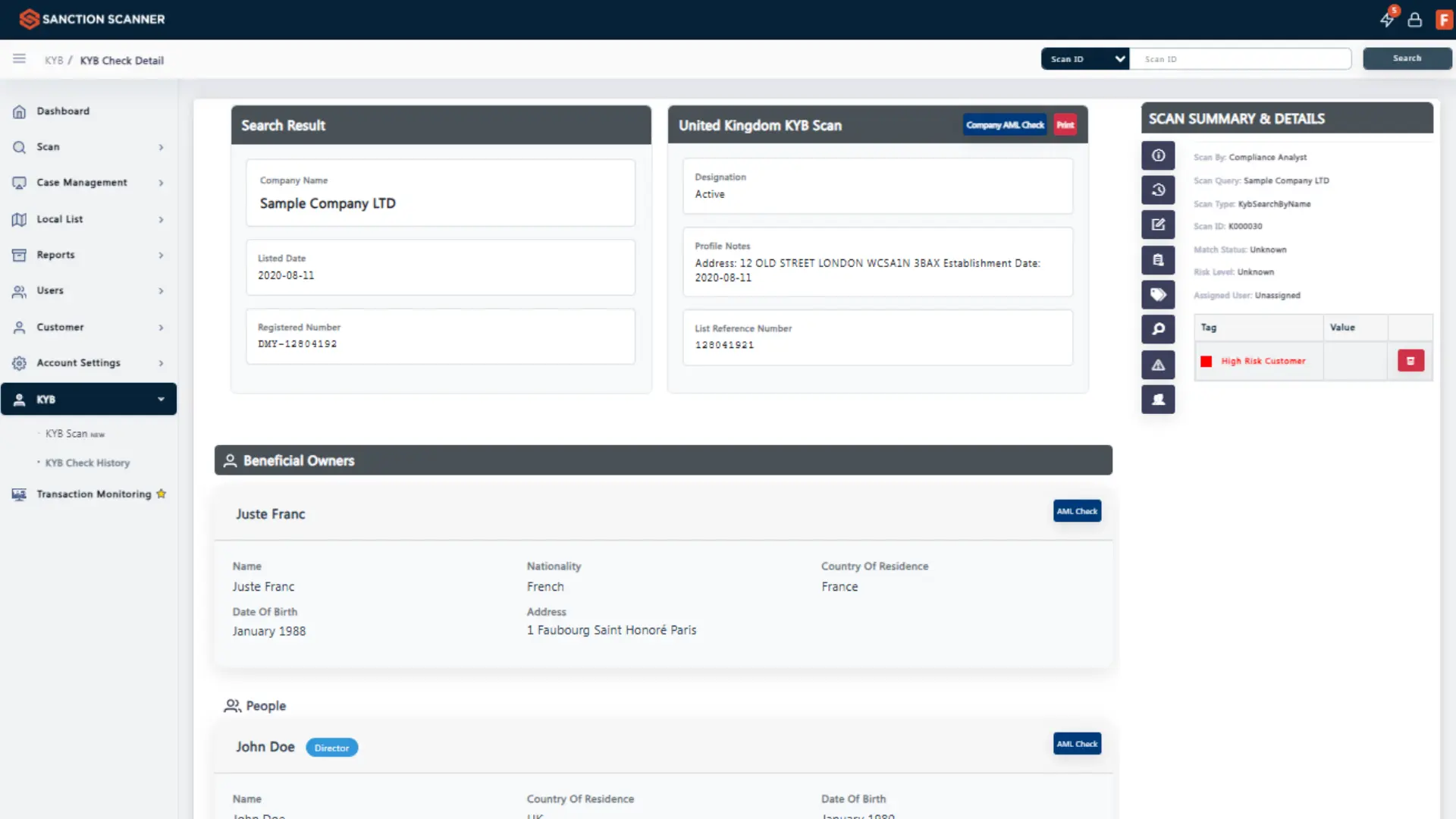

1. AI-Powered Ownership Mapping & UBO Discovery

Sanction Scanner’s AI automatically:

• Maps corporate hierarchies using data from 150+ global registries

• Flags Ultimate Beneficial Owners (UBOs), even in complex or nested ownership structures

• Assesses jurisdictional risk and watchlist exposure (PEPs, sanctions, adverse media)

This feature enables teams to shift from manual tree-building to instant UBO transparency—with a 56% increase in discovery rates, based on pilot programs.

2. Smart Entity Profiling & Case Notes

For each verified business, the system:

• Summarizes ownership structure, screening results, and risk exposure in a human-readable format

• Generates audit-ready notes for onboarding, memory, closure, or escalation

• Adapts to your team’s tone and compliance logic for consistent documentation

Instead of copying data into fragmented systems, analysts now receive AI-generated summaries that explain why a business passed or failed a check—ensuring clarity and traceability.

Results from Real-World Use

In our closed beta with banks and fintechs:

• Verification time dropped by 68%, from 22 minutes to 7

• UBO identification improved by 56%, from 61% to 95%

• Audit trail preparation time decreased by 64%

One partner said it best:

“What used to be a three-tool workflow is now handled in one place. The AI pinpoints UBOs and explains every match—we’ve never moved this fast with this much confidence.”

Designed for Regulatory Expectations

The KYB module complies with:

• FATF Recommendations

• The FinCEN Corporate Transparency Act (U.S.)

• EU AMLD UBO requirements

Each decision is backed by explainable AI, full audit logs, and analyst override control. This ensures transparency, not just automation.

Smarter KYB, Stronger Compliance

In a world of tightening regulations and rising enforcement, KYB is no longer just a check—it’s a risk decision. Sanction Scanner’s KYB module empowers compliance teams to:

• Detect risks earlier

• Handle onboarding faster

• Deliver defensible, auditable insights

Whether you're onboarding a supplier, investor, or customer, the goal is the same: know who you're doing business with—and why it matters.

Explore the KYB module today.